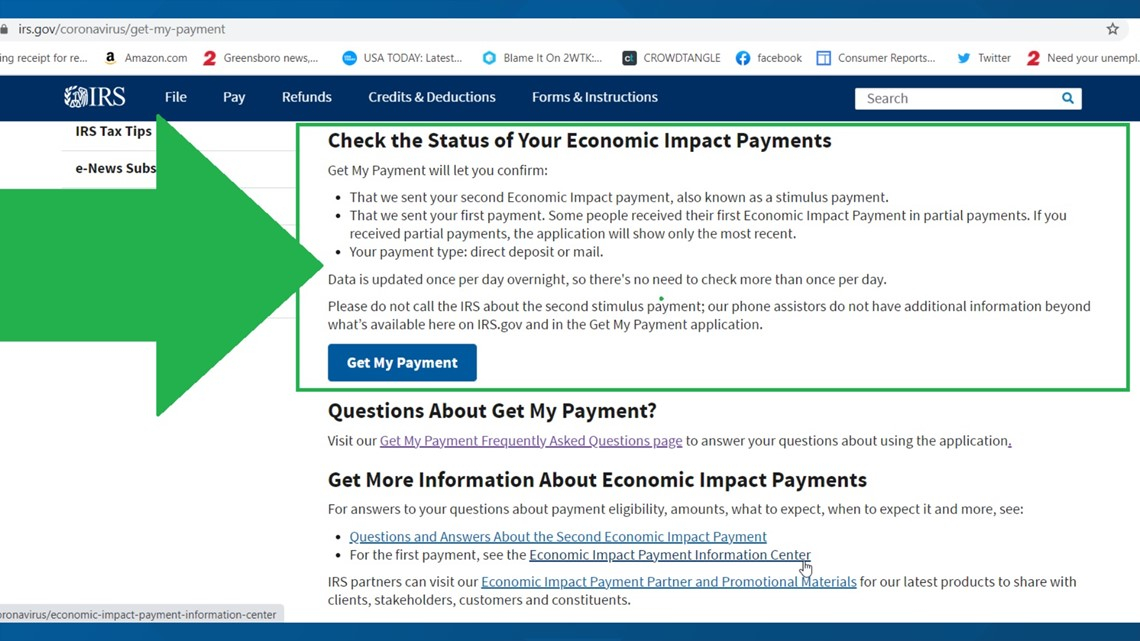

Nc Tax Rebate Status Web Check the status of your 2022 original income tax refund Refund amount different than what you expected Receive information about your amended return or prior year refund

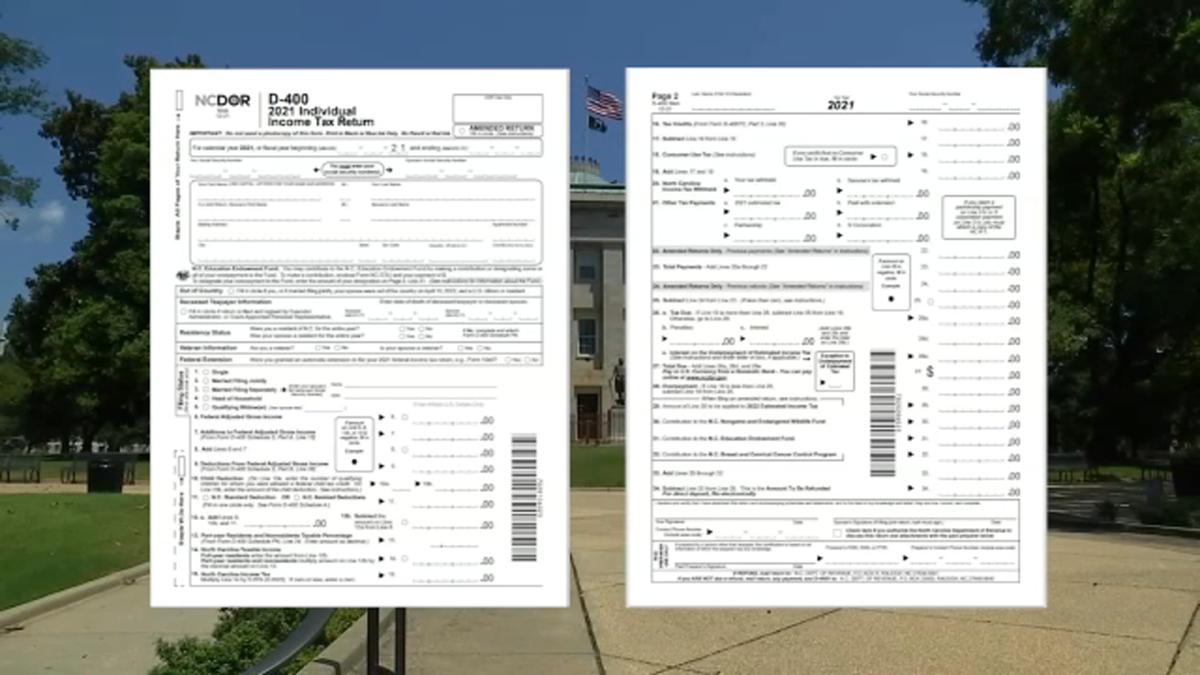

Web WHERE S MY REFUND File amp Pay Taxes amp Forms Received a Notice Web 5 avr 2022 nbsp 0183 32 Where is my North Carolina tax refund That s the question many ABC11 viewers are asking Troubleshooter Diane Wilson after filing their taxes weeks ago

Nc Tax Rebate Status

Nc Tax Rebate Status

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Tax-Rebate-2023-NC.jpg?fit=1400%2C774&ssl=1

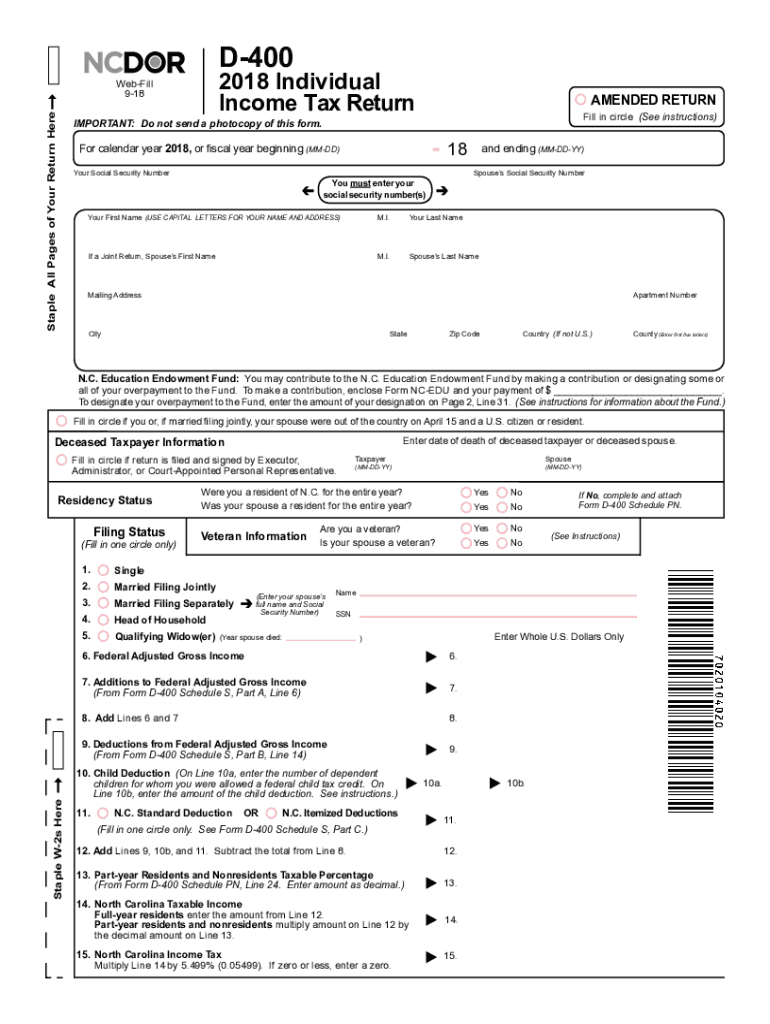

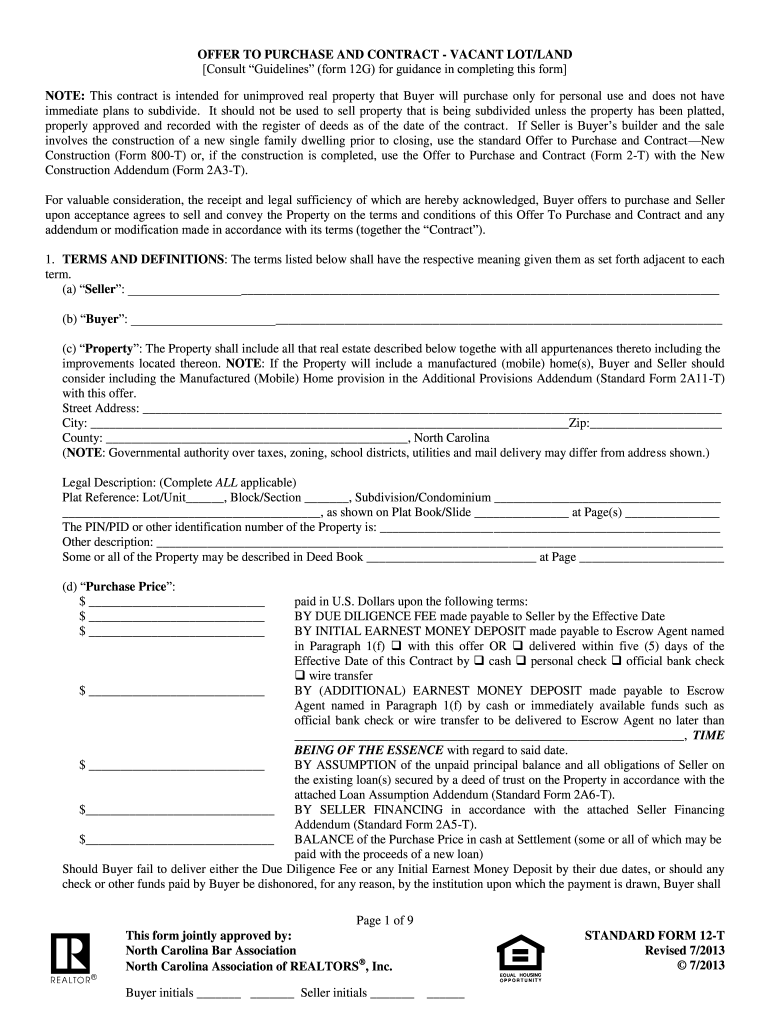

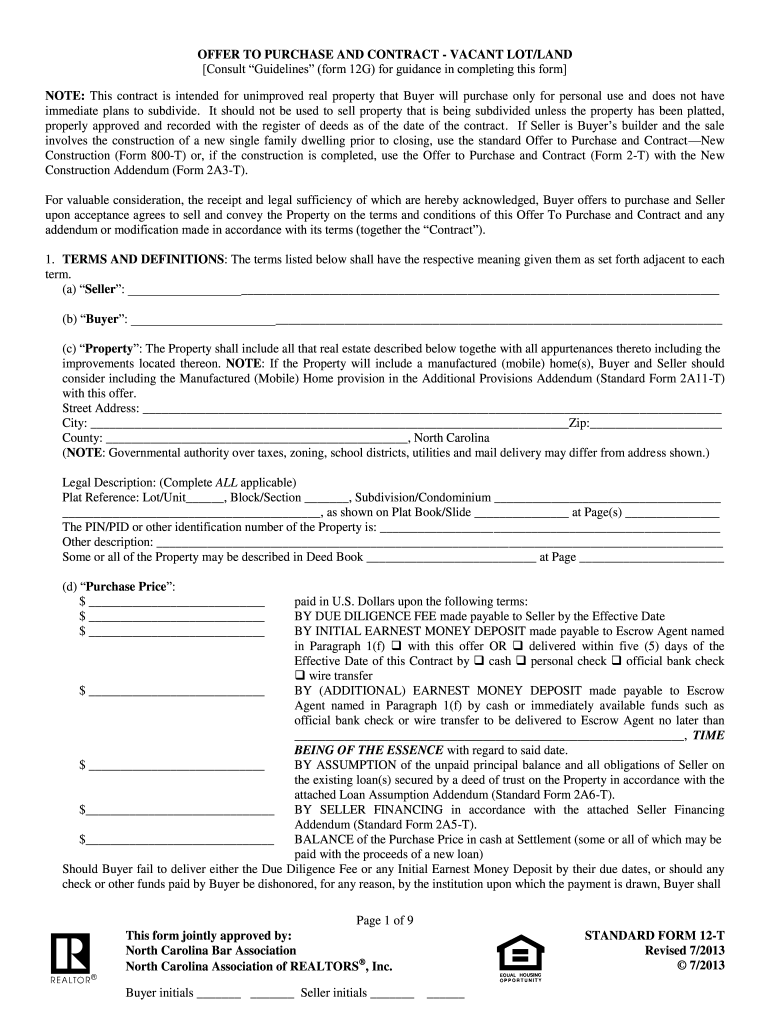

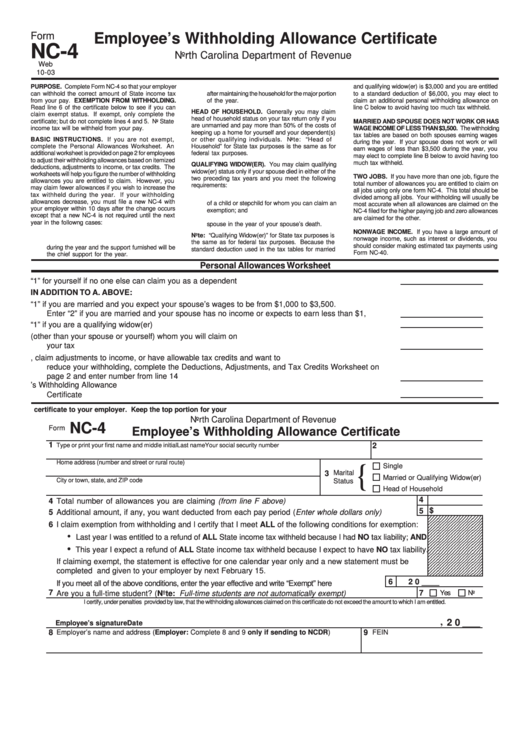

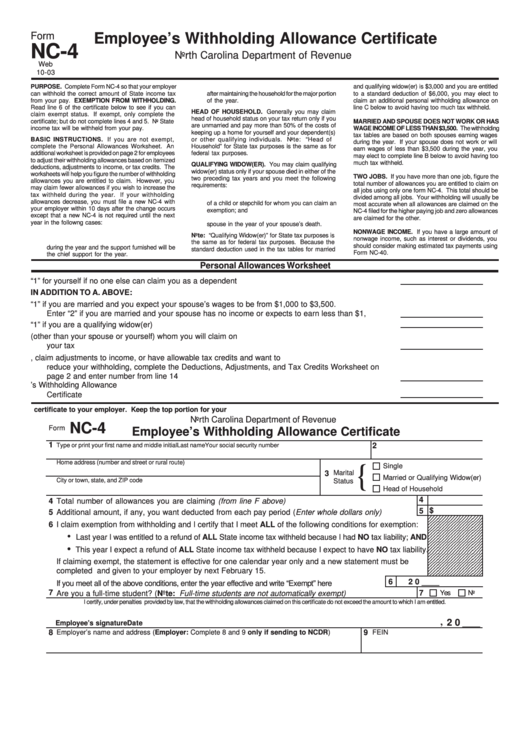

Printable Forms For Nc Tax Returns Printable Forms Free Online

https://www.pdffiller.com/preview/465/346/465346008/large.png

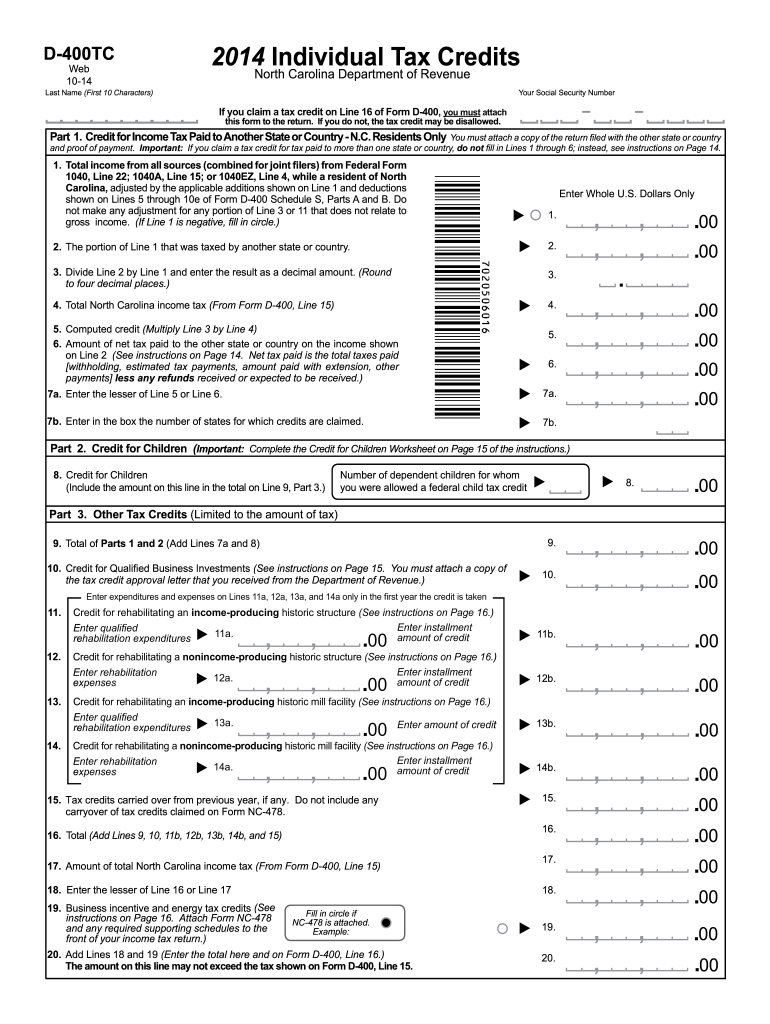

D 400Tc Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/6/962/6962831/large.png

Web 24 juil 2023 nbsp 0183 32 Starting January 1 2022 the state s flat individual income tax rate will be reduced from 5 25 to 4 99 percent The rate will be reduced further each year until it Web 11 mai 2022 nbsp 0183 32 In its most recent update the NCDOR said that s still the case most taxpayers will get their refunds by the end of the month The NCDOR said as of a few days ago it had issued roughly 1 1

Web 7 avr 2022 nbsp 0183 32 NCDOR officials told Stoogenke the agency started sending refunds out this week When you get your refund will depend on when you filed your taxes State officials Web General Tax Information State Tax Forms amp Instructions Apply for an Extension Pay Bill or Notice Order Tax Forms amp Instructions Collections amp Past Due Taxes Check Refund

Download Nc Tax Rebate Status

More picture related to Nc Tax Rebate Status

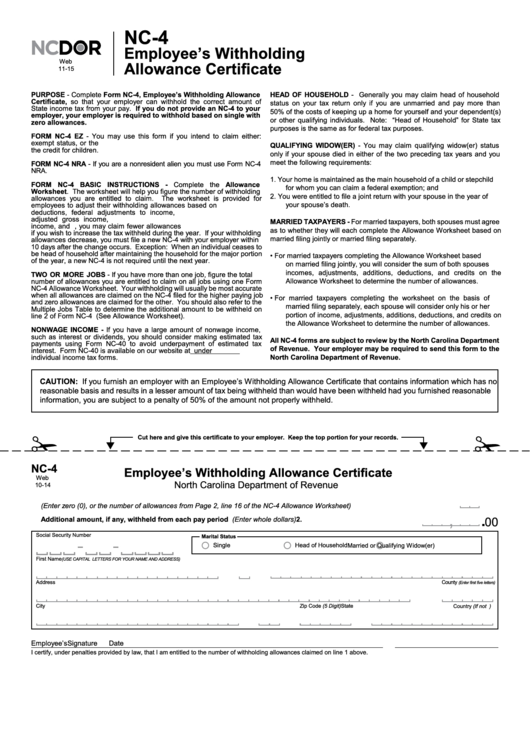

Form Nc 4 Employee S Withholding Allowance Certificate Nc 4p Free

https://data.formsbank.com/pdf_docs_html/97/971/97154/page_1_thumb_big.png

2022 Form NC DoR D 400TCFill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/625/21/625021510/large.png

Where Is My NC Tax Refund Delays Plague State Revenue Department

https://s.yimg.com/ny/api/res/1.2/5DoTW1OgLgfT22b9UsvgsQ--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD02NzU-/https://s.yimg.com/hd/cp-video-transcode/prod/2022-04/05/624cb457c1c1697228396100/624cb457c1c1697228396101_o_U_v2.png

Web Line 1 Form E 536R Correct Counties G S 105 164 4B determines which county the tax is attributed as a result of the sale 1 The tax is deemed paid in the county in which the Web 10 ao 251 t 2022 nbsp 0183 32 L awmakers in North Carolina have proposed a 200 per person tax rebate as a form of relief for high gas prices The proposal would use the state budget surplus

Web In cases where more than one county s sales and use tax has been paid Form E 536R Schedule of County Sales and Use Taxes for Claims for Refund must be attached to the Web The total State sales and use tax refund amount for both six month periods may not exceed 31 700 000 for the State s fiscal year and the total Food County amp Transit tax refund

Nc Form 12 T Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/104/100104666/large.png

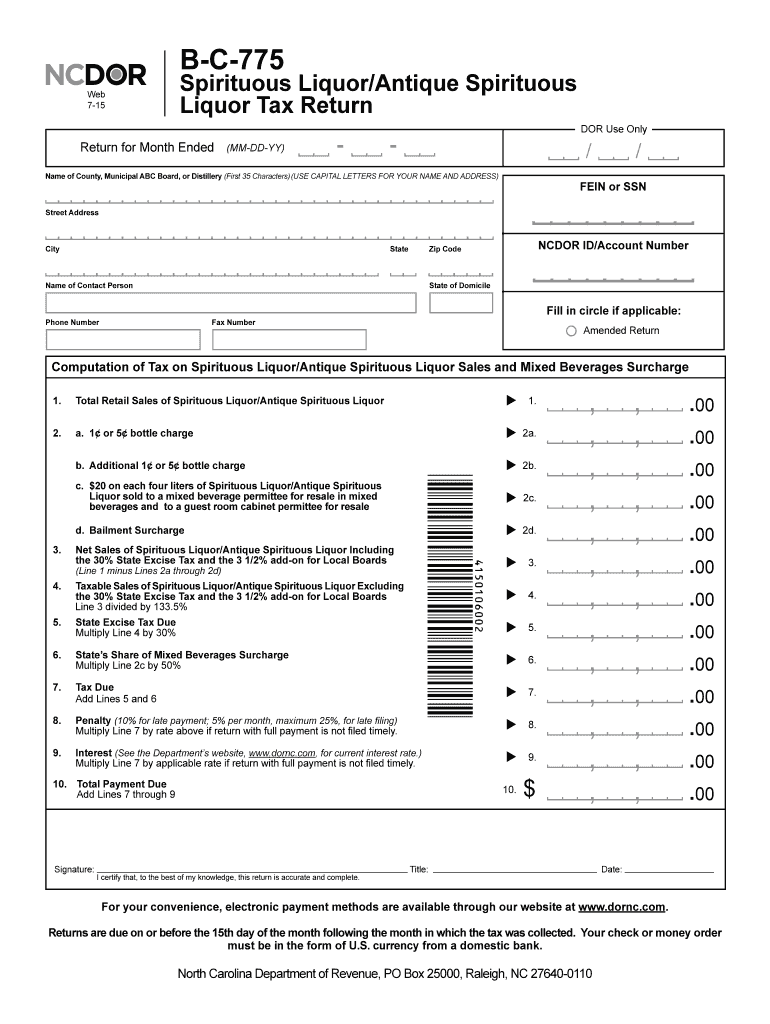

BC 775 North Carolina Department Of Revenue Fill Out And Sign

https://www.signnow.com/preview/6/966/6966337/large.png

https://eservices.dor.nc.gov/wheresmyrefund

Web Check the status of your 2022 original income tax refund Refund amount different than what you expected Receive information about your amended return or prior year refund

https://www.ncdor.gov/wheres-my-refund

Web WHERE S MY REFUND File amp Pay Taxes amp Forms Received a Notice

Martwick Encourages Residents To Check Their Tax Rebate Status

Nc Form 12 T Fill Out Sign Online DocHub

Press Releases

California Gas Tax Rebate Status Californiarebates Rebate2022

Nc Tax Allowance Worksheet Triply

Nc Tax Form Printable Printable Forms Free Online

Nc Tax Form Printable Printable Forms Free Online

Nc Tax Rebate Energy Efficient Heat Pump PumpRebate

Gigabyte Check Rebate Status RebateCheck

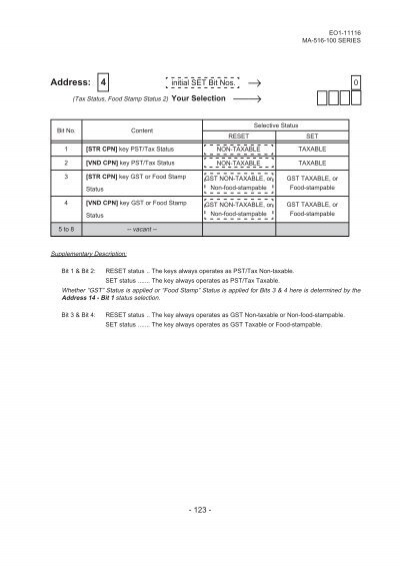

1 Key PST Tax Statu

Nc Tax Rebate Status - Web 11 mai 2022 nbsp 0183 32 In its most recent update the NCDOR said that s still the case most taxpayers will get their refunds by the end of the month The NCDOR said as of a few days ago it had issued roughly 1 1