Nebraska Individual Income Tax Rate 2023 Web Use the following worksheet if your Nebraska taxable income is more than the maximum amount included in the 2023 Nebraska Tax Table The tax table shown above

Web 3 Aug 2023 nbsp 0183 32 2023 1362 Nebraska law gradually lowers personal income tax rates over four years starting in 2024 Nebraska Governor Jim Pillen signed into law LB 754 which Web 2023 Individual Income Tax Booklet with forms tables instructions and additional information 2023 Nebraska Tax Table 2023 Nebraska Public High School District

Nebraska Individual Income Tax Rate 2023

Nebraska Individual Income Tax Rate 2023

https://darrowwealthmanagement.com/wp-content/uploads/2022/10/2023-Income-Tax-Rates.png

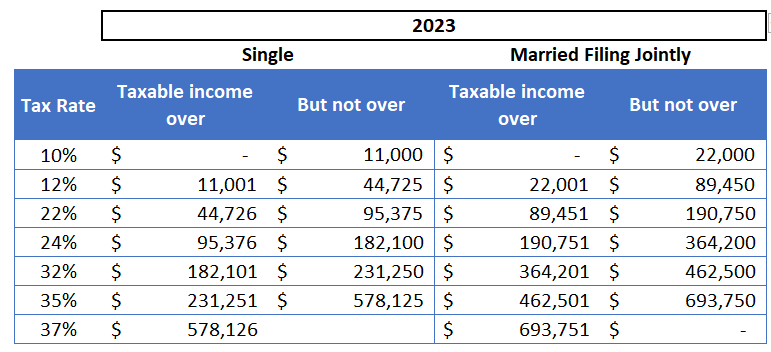

The 2023 Tax Brackets By Income Modern Husbands

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/e23b505f-ffa6-4e69-9c23-dde3138f86cc_2100x1500.png

Income Tax Rates 2023 To 2024 Winter PELAJARAN

http://assets.entrepreneur.com/article/1398974418-states-lowest-corporate-income-tax-rates-infographic.jpg

Web 2023 Nebraska Tax Tables with 2024 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator Compare your take home after t Web 2 100 of the income tax shown on the Nebraska return for the full 12 month preceding tax year if federal AGI was 150 000 or less or 3 110 the applicable federal

Web 25 Mai 2023 nbsp 0183 32 For tax year 2023 Nebraska taxes income at and above 37 130 for individuals and at and above 74 260 for married couples at its top income tax rate of 6 64 LB 754 will cut the top rate to 3 99 by Web Nebraska Income Tax Calculator 2022 2023 If you make 70 000 a year living in Nebraska you will be taxed 11 501 Your average tax rate is 11 67 and your marginal

Download Nebraska Individual Income Tax Rate 2023

More picture related to Nebraska Individual Income Tax Rate 2023

Nebraska Income Tax NE State Tax Calculator Community Tax

https://www.communitytax.com/wp-content/uploads/2021/03/Nebraska-Graphic-2.png

A Twenty First Century Tax Code For Nebraska Tax Foundation

https://files.taxfoundation.org/legacy/docs/PITmap.png

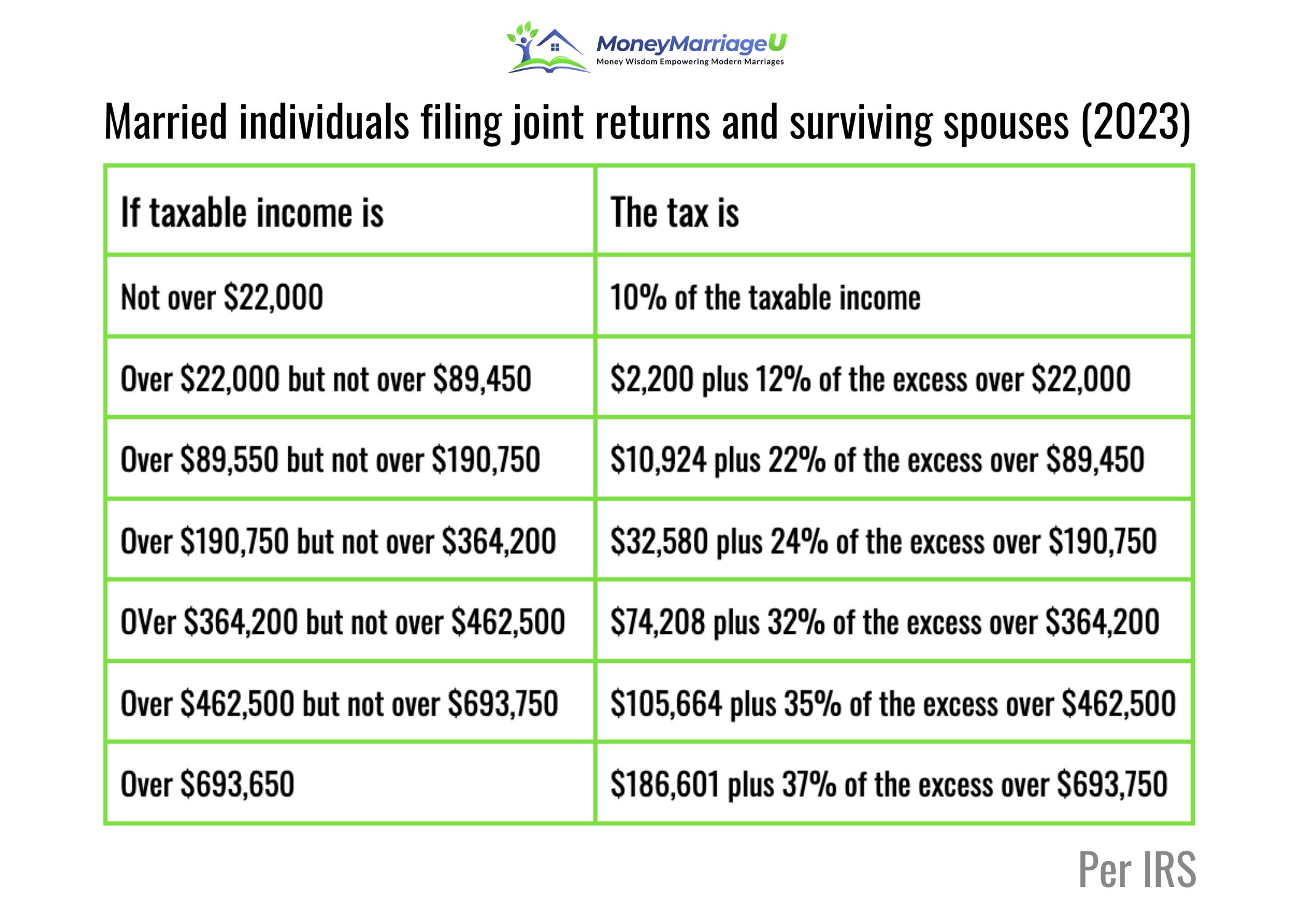

Federal Taxation Of Individuals In 2023 LBMC

https://www.lbmc.com/wp-content/uploads/2023/01/2023-federal-income-tax-brackets-for-individuals-and-trusts.png

Web Over 71 460 Over 52 980 Over 35 730 Effective for tax years beginning on or after January 1 2022 and before January 1 2023 the individual income tax brackets are as Web The top individual rate which is currently 6 84 and applies to taxable income of 29 000 or more for individuals filing separately or 58 000 or more if married filing jointly is

Web Individuals Filing Household 0 2 399 2 400 17 499 17 500 26 999 27 000 and Over Jointly 0 4 799 0 4 499 4 800 4 500 34 999 27 999 35 000 28 000 53 999 Web 13 Dez 2023 nbsp 0183 32 Nebraska state income tax rate table for the 2023 2024 filing season has four income tax brackets with NE tax rates of 2 46 3 51 5 01 and 6 64 for

2023 Income Tax Withholding Tables Example

https://www.patriotsoftware.com/wp-content/uploads/2022/12/2023-Publication-15-T-1-768x705.png

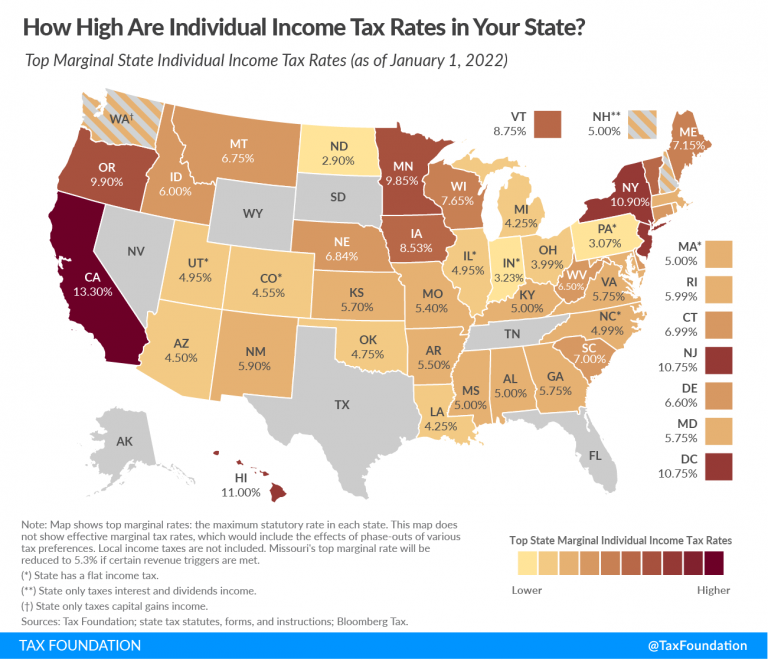

State Individual Income Tax Rates And Brackets Tax Foundation

https://files.taxfoundation.org/20220215111110/2022-state-income-tax-rates-and-brackets-2022-state-individual-income-tax-rates-and-brackets-See-income-taxes-by-state-flat-income-taxes-768x660.png

https://revenue.nebraska.gov/.../2023_Nebraska_Tax_…

Web Use the following worksheet if your Nebraska taxable income is more than the maximum amount included in the 2023 Nebraska Tax Table The tax table shown above

https://taxnews.ey.com/news/2023-1362-nebraska-law-gradually-lo…

Web 3 Aug 2023 nbsp 0183 32 2023 1362 Nebraska law gradually lowers personal income tax rates over four years starting in 2024 Nebraska Governor Jim Pillen signed into law LB 754 which

How Does Your State Structure Its Individual Income Tax Brackets

2023 Income Tax Withholding Tables Example

How To Calculate My 2023 Tax Rate Schedule PELAJARAN

Nebraska Estimated Tax Form 2023 Printable Forms Free Online

Your 2023 Tax Brackets Vs 2022 Tax Brackets Tax Brackets Income

2023 Federal Tax Rates Cra Printable Forms Free Online

2023 Federal Tax Rates Cra Printable Forms Free Online

How To Check The Status Of Your Nebraska Individual Income Tax Refund

New Federal Tax Brackets For 2023

Monday Map Top State Income Tax Rates Tax Foundation

Nebraska Individual Income Tax Rate 2023 - Web 2 100 of the income tax shown on the Nebraska return for the full 12 month preceding tax year if federal AGI was 150 000 or less or 3 110 the applicable federal