Nebraska Llc Tax Filing Requirements Your LLC must file tax returns with the IRS and the Nebraska Department of Revenue to pay your Nebraska income tax Check with your accountant to make sure

You will file monthly if your monthly income tax withholding exceeds 500 quarterly if your monthly income tax withholding does not exceed 500 and annually if your income tax Secretary of State Corporate Tax Filing Corporations Domestic and Foreign Limited Liability Partnerships and Limited Liability Companies are required to submit a tax

Nebraska Llc Tax Filing Requirements

Nebraska Llc Tax Filing Requirements

https://i.ytimg.com/vi/bMbv8hBg4G4/maxresdefault.jpg

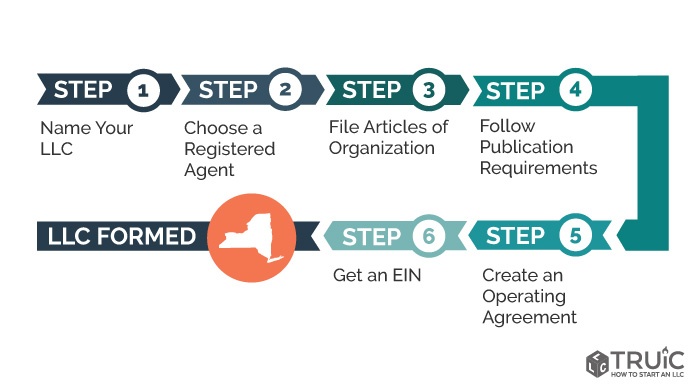

New York Single member Llc Tax Filing Requirement LLC Bible

https://llcbible.com/wp-content/uploads/2022/09/new-york-single-member-llc-tax-filing-requirement.jpg

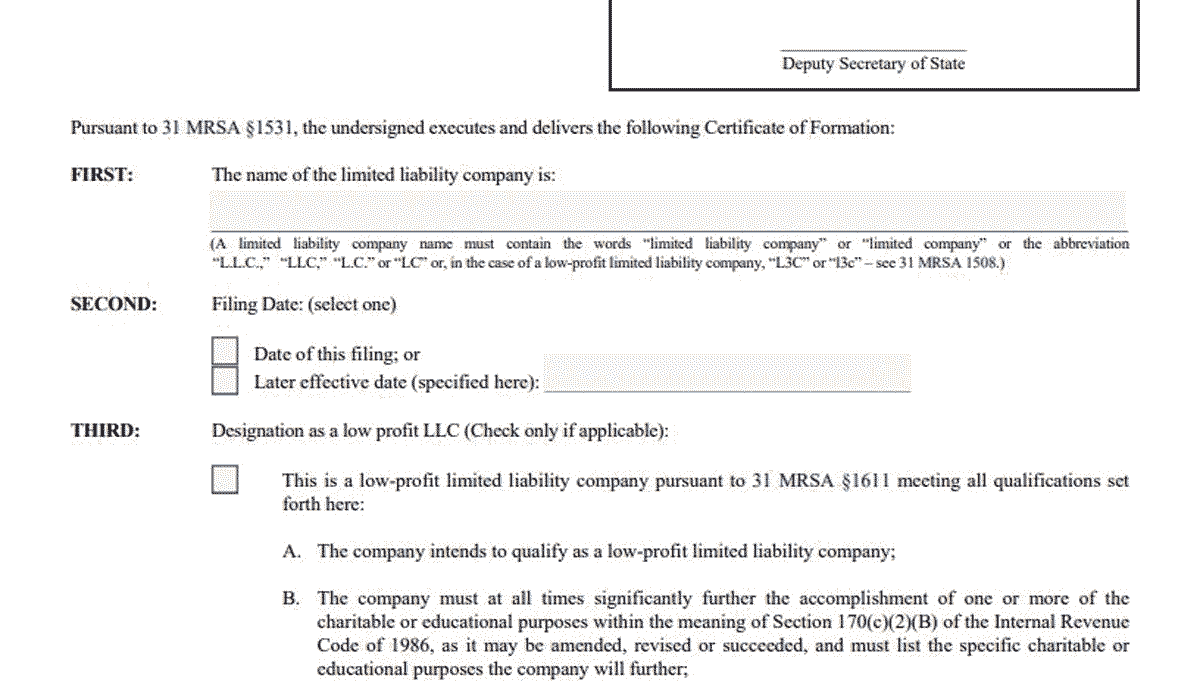

Maine Llc Tax Filing Requirements LLC Bible

https://llcbible.com/wp-content/uploads/2022/08/maine-llc-tax-filing-requirements-1200x700.png

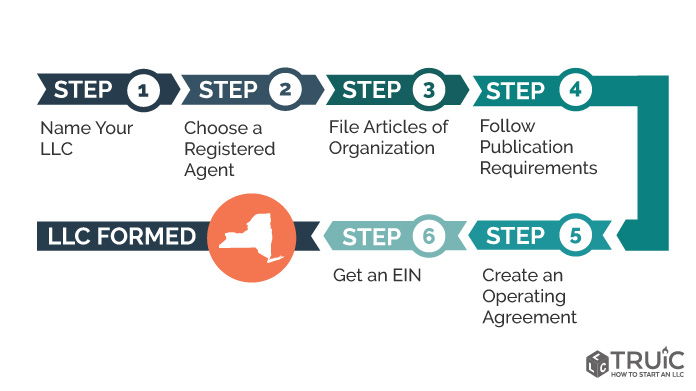

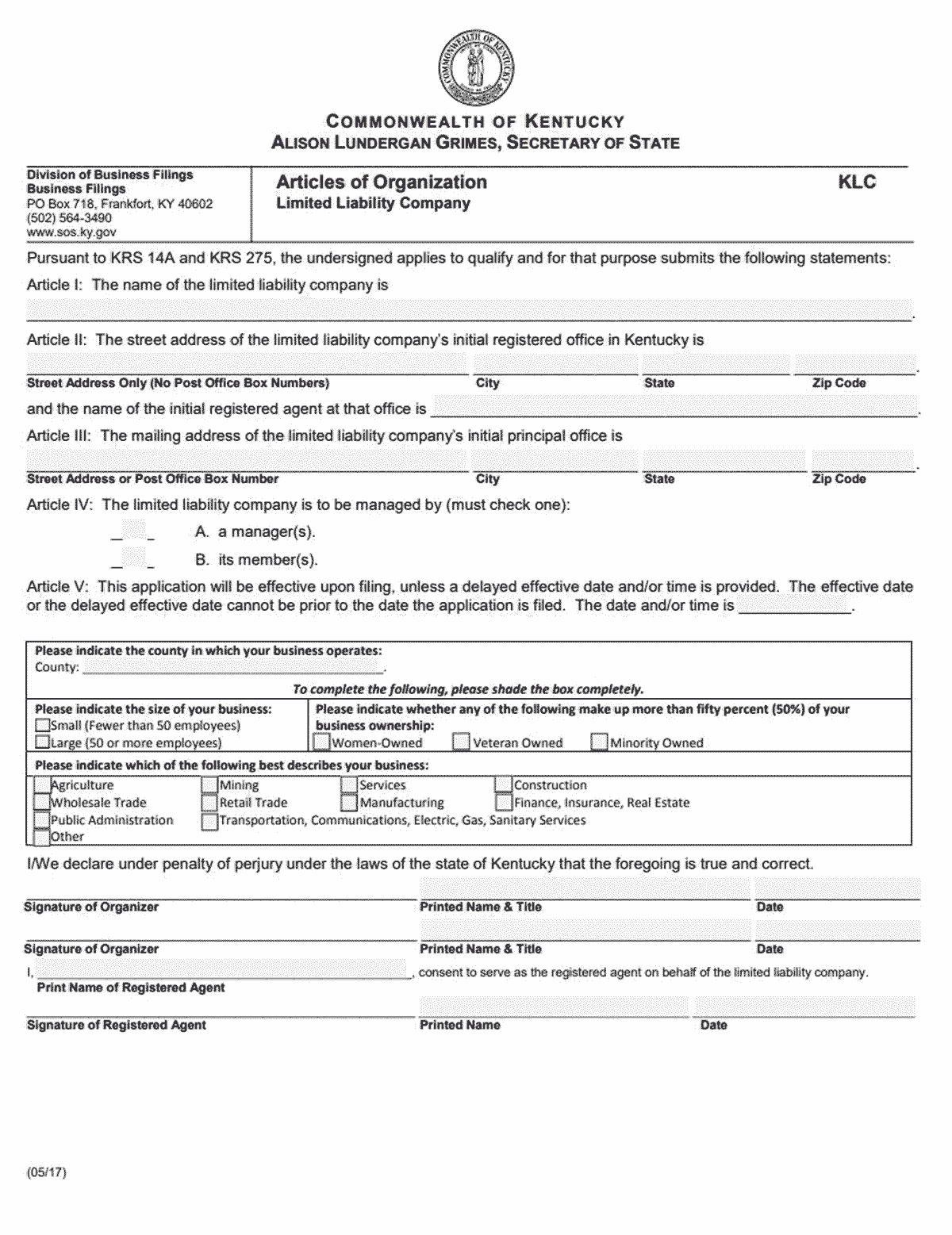

Nebraska LLC Tax Filing Obligations Keeping current on Nebraska LLC taxes is imperative Depending on your business s nature you might need to register for one or Learn how to set up an LLC in Nebraska with our helpful step by step guide We ll walk you through each step and highlight important considerations

There are different tax requirements to consider which are influenced by regulations at both the state and local levels In this article we provide a detailed breakdown of Nebraska LLC taxes as well as the Nebraska requires LLCs to file a biennial every two years report It is due between January 1 and April 1 of each odd numbered year The filing fee is 10 Taxes For

Download Nebraska Llc Tax Filing Requirements

More picture related to Nebraska Llc Tax Filing Requirements

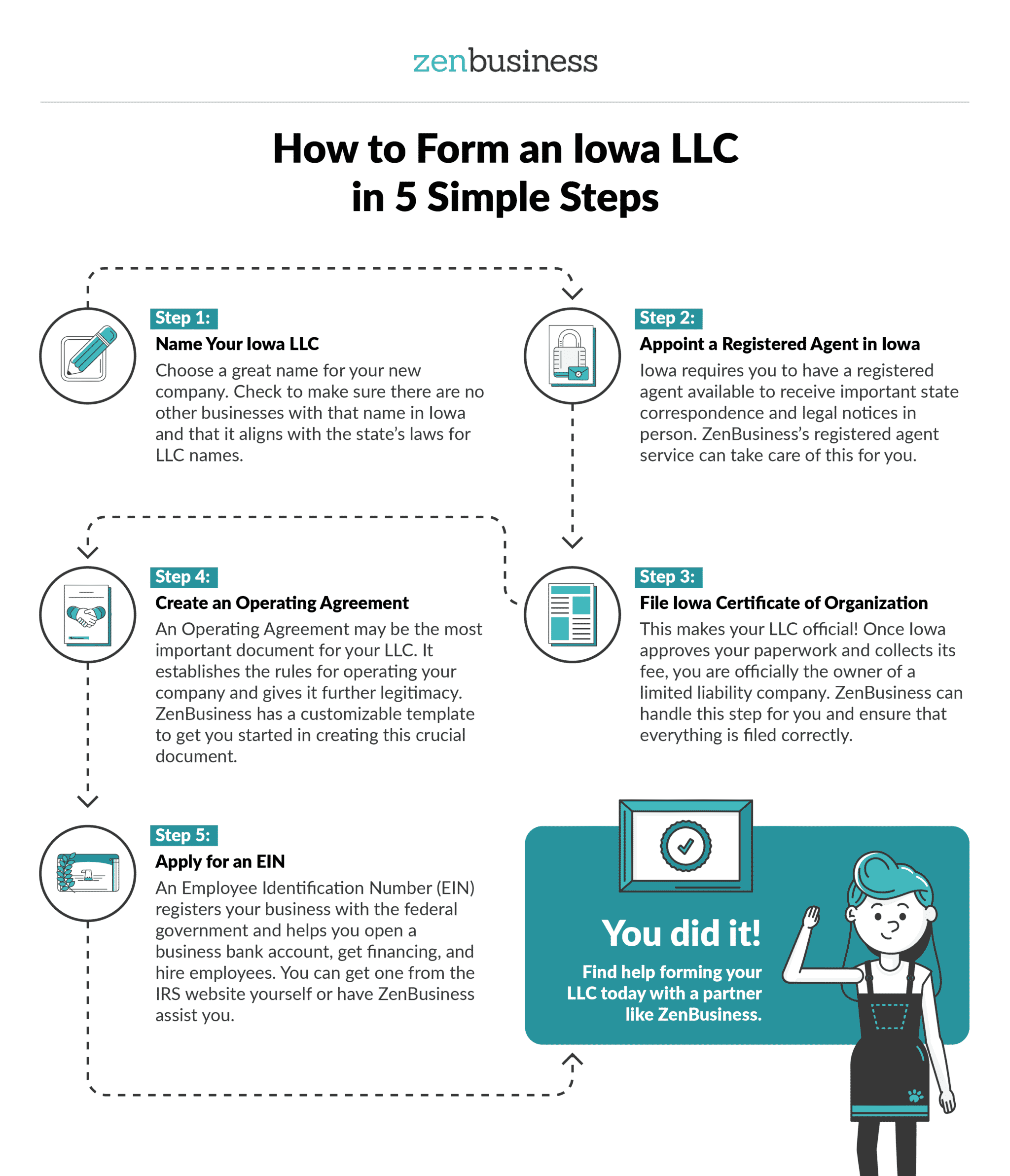

Iowa Llc Tax Filing Requirements LLC Bible

https://www.zenbusiness.com/wp-content/uploads/2020/11/iowa-llc.png

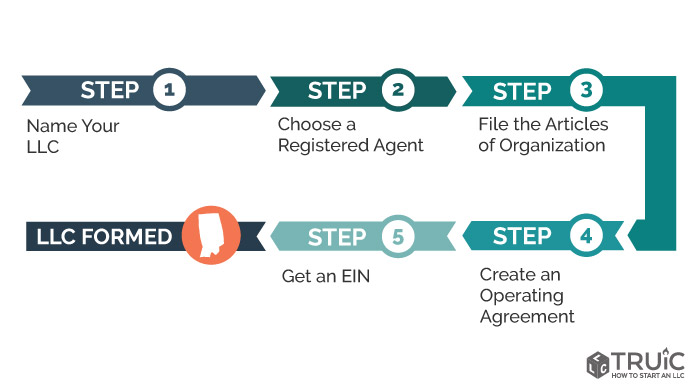

Indiana Llc Tax Filing Requirements LLC Bible

https://llcbible.com/wp-content/uploads/2022/08/indiana-llc-tax-filing-requirements.jpg

Tax Filing Requirements For Nonprofit Organizations Rocket Lawyer

https://www.rocketlawyer.com/binaries/content/gallery/guide-hero-images/US/tax-filing-requirements-for-nonprofit-organizations-1277386246.jpg

How to Start an LLC in Nebraska Nebraska offers many benefits to start a limited liability company LLC There are no franchise taxes nor sales tax and you To form an LLC in Nebraska you will need to pay a filing fee of 100 if you submit your LLC s Certificate of Organization online or 110 if you choose to file by

Most Nebraska LLCs will need to report their income to the Internal Revenue Service IRS each year using Form 1065 Partnership Return multi member LLCs or Here are the ongoing maintenance tasks and filing requirements for your Nebraska LLC Annual Franchise Tax All Nebraska LLCs are required to pay an

Michigan Llc Tax Return Filing Requirements LLC Bible

https://llcbible.com/posts/michigan-llc-tax-return-filing-requirements.png

Connecticut Llc Filing Requirements LLC Bible

https://llcbible.com/posts/connecticut-llc-filing-requirements.png

https://www.llcuniversity.com/nebraska-llc/taxes

Your LLC must file tax returns with the IRS and the Nebraska Department of Revenue to pay your Nebraska income tax Check with your accountant to make sure

https://revenue.nebraska.gov/businesses/starting-business-nebraska

You will file monthly if your monthly income tax withholding exceeds 500 quarterly if your monthly income tax withholding does not exceed 500 and annually if your income tax

What Tax Forms Do I Need To File For An LLC Tax Relief Center Llc

Michigan Llc Tax Return Filing Requirements LLC Bible

Maryland LLC Tax Filing Requirements SH Block Tax Services

Kentucky Llc Tax Filing Requirements LLC Bible

LLC Operating Agreement Maryland LLC Bible

Nebraska State Tax Things To Know Credit Karma

Nebraska State Tax Things To Know Credit Karma

Virginia LLC Tax Filing Requirements How LLCs Pay Their Taxes Tingen

Virginia LLC Tax Filing Requirements How LLCs Pay Their Taxes Tingen

I T Return Filing Interest Penalties On The Cards If Failed To File

Nebraska Llc Tax Filing Requirements - Learn how to set up an LLC in Nebraska with our helpful step by step guide We ll walk you through each step and highlight important considerations