Nebraska Property Tax Rebate Web Nebraska Property Tax Credits The Nebraska Department of Revenue DOR has created a GovDelivery subscription category called quot Nebraska Property Tax Credit quot

Web Nebraska provides refundable credits for both school district and community college property taxes paid Each credit is equal to a distinct percentage multiplied by either Web 28 janv 2022 nbsp 0183 32 January 28 2022 In the past Nebraska s main property tax relief program appeared automatically on your property tax bill While that program will continue to benefit from the income tax credit

Nebraska Property Tax Rebate

Nebraska Property Tax Rebate

https://printablerebateform.net/wp-content/uploads/2023/04/Nebraska-Tax-Rebate-2023-768x678.png

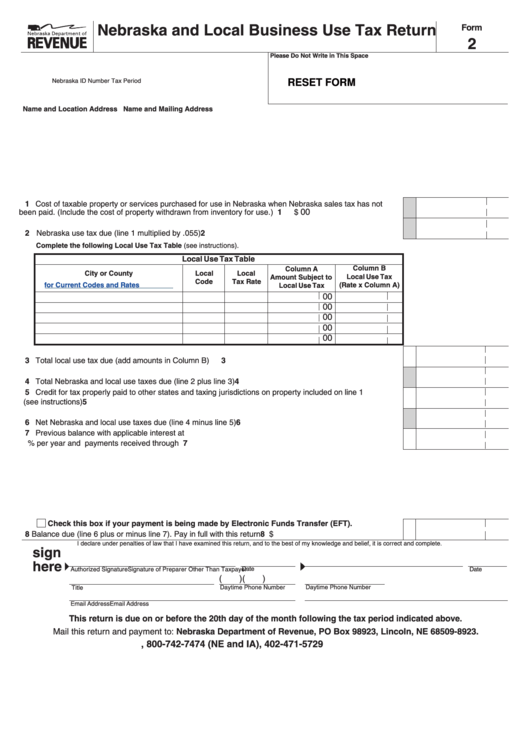

50 Million In Nebraska Property Tax Relief Goes Unclaimed Total May Rise

https://files.platteinstitute.org/uploads/2020/06/Figure-1-4.jpg

2020 2022 NE 7AG Formerly 13AG Fill Online Printable Fillable

https://www.pdffiller.com/preview/526/979/526979757/large.png

Web 15 sept 2022 nbsp 0183 32 For tax year 2022 the property tax credit rebate on taxes paid to K 12 public schools will grow from 25 percent to 30 percent Nebraska property taxpayers will also be eligible for a new 30 Web 25 mai 2023 nbsp 0183 32 LINCOLN Under the shadow of tightening state revenues the Nebraska Legislature gave final approval Thursday to a 6 4 billion tax relief package State lawmakers approved income tax cuts hikes in

Web 31 mars 2023 nbsp 0183 32 It would gradually increase the amount of state property tax credits given to landowners on their yearly property tax statements from the current 315 million to Web 15 sept 2022 nbsp 0183 32 The legislation will deliver 3 4 billion of tax relief to Nebraskans through tax year 2027 according to a news release from the governor s office When fully

Download Nebraska Property Tax Rebate

More picture related to Nebraska Property Tax Rebate

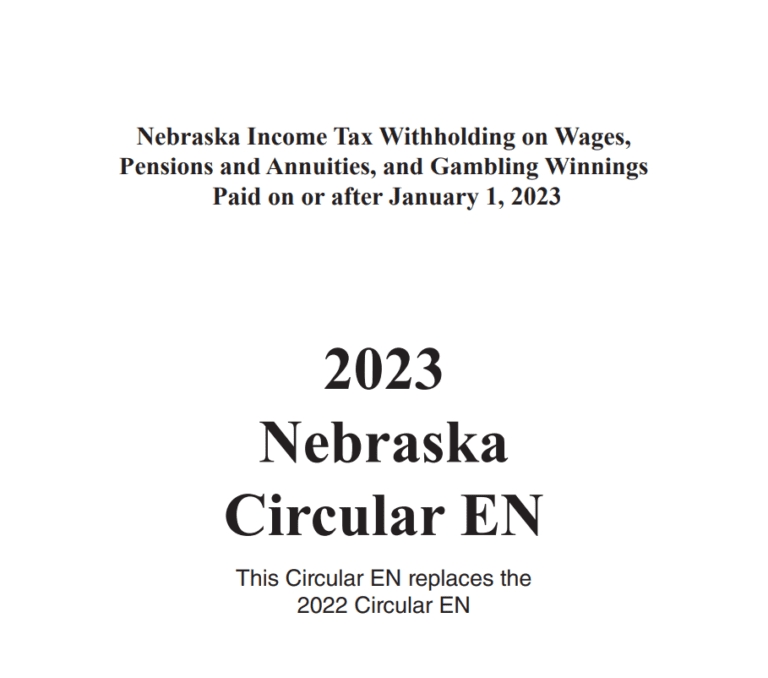

Nebraska Form 6 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/35/980/35980673/large.png

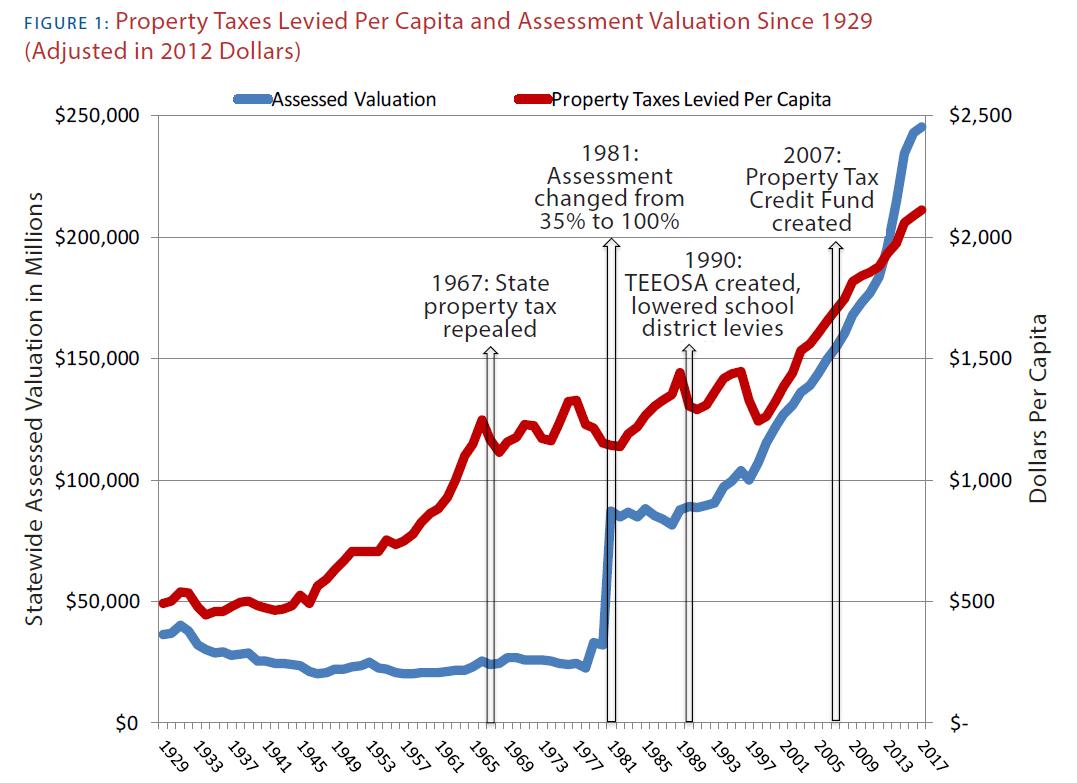

Fillable Form 2 Nebraska And Local Business Use Tax Return Printable

https://data.formsbank.com/pdf_docs_html/324/3249/324925/page_1_thumb_big.png

Nebraska Property Taxes And The 2019 Flood Agricultural Economics

https://agecon.unl.edu/cornhusker-economics/2019/june-5-2019-markets.jpg

Web The Nebraska Property Tax Incentive Act Credit Computation Form PTC is used to identify parcels and compute a tax credit for school district property tax paid Nebraska Web 24 juil 2023 nbsp 0183 32 August 13 2020 By Katherine Loughead On the last day of Nebraska s recently reconvened 2020 legislative session legislators today granted final approval to

Web Nebraska Higher Blend Tax Credit Act Nebraska Historic Tax Credit Nebraska Property Tax Credits New Markets Growth Investment Act Tax Credit NextGen for beginning Web 18 f 233 vr 2021 nbsp 0183 32 Published Feb 18 2021 at 6 35 AM PST OMAHA Neb AP Nebraska taxpayers who want to claim an income tax credit for some of the property taxes they

/cloudfront-us-east-1.images.arcpublishing.com/gray/F3LYHRTF5FFC7PKE5MNVQYLGPA.jpg)

You Could Qualify For Property Tax Rebates And Not Even Know It

https://gray-wmbf-prod.cdn.arcpublishing.com/resizer/f05Xb3OawRcrJN4ZdO4hjfC2u9Q=/980x0/smart/filters:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/gray/F3LYHRTF5FFC7PKE5MNVQYLGPA.jpg

2018 2022 Form NE RV 707 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/493/654/493654655/large.png

https://revenue.nebraska.gov/about/nebraska-property-tax-credit

Web Nebraska Property Tax Credits The Nebraska Department of Revenue DOR has created a GovDelivery subscription category called quot Nebraska Property Tax Credit quot

https://revenue.nebraska.gov/about/nebraska-property-tax-credit...

Web Nebraska provides refundable credits for both school district and community college property taxes paid Each credit is equal to a distinct percentage multiplied by either

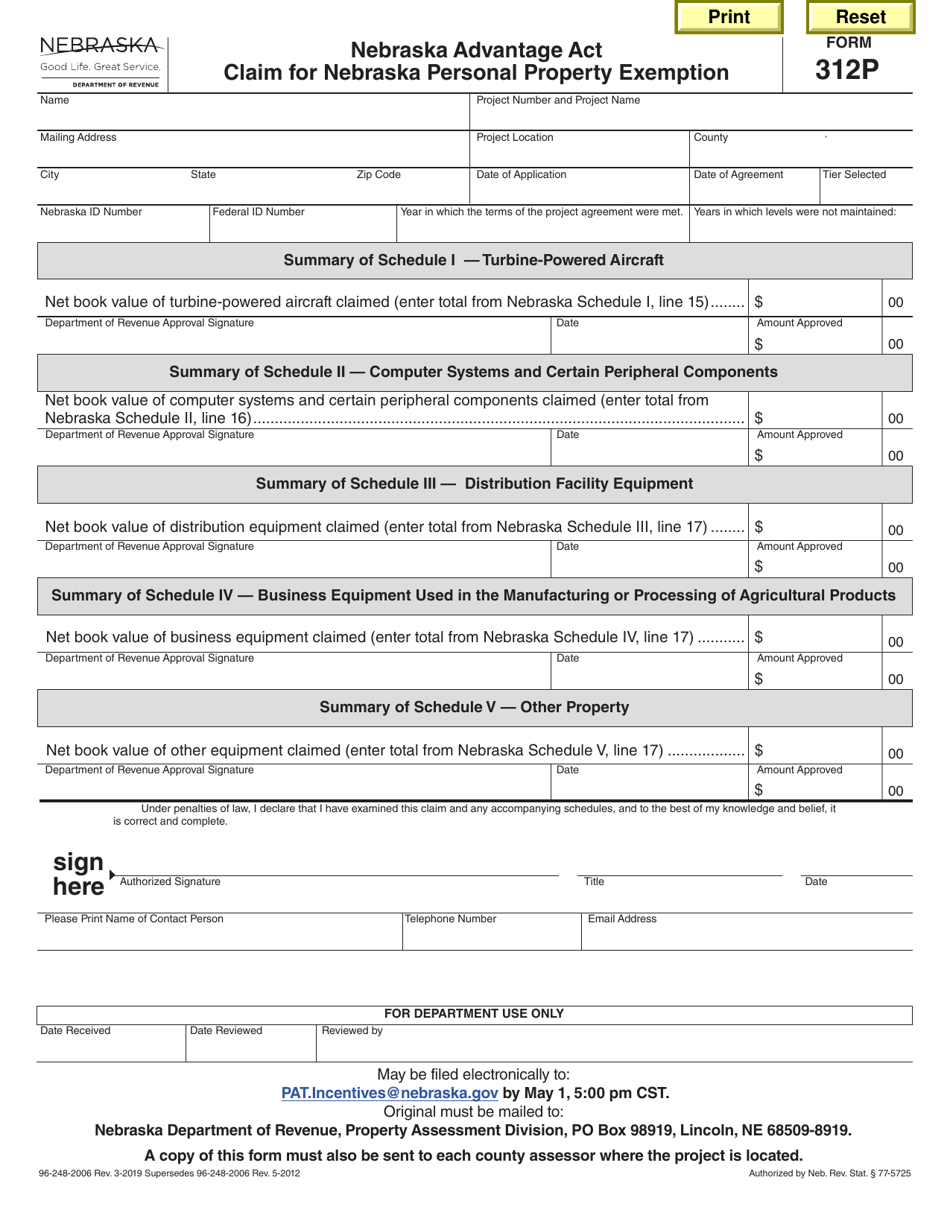

Form 312P Download Fillable PDF Or Fill Online Nebraska Advantage Act

/cloudfront-us-east-1.images.arcpublishing.com/gray/F3LYHRTF5FFC7PKE5MNVQYLGPA.jpg)

You Could Qualify For Property Tax Rebates And Not Even Know It

State Of Nebraska Local Sales And Use Tax Return Form 10 Fill Out

Older Disabled Residents Can File For Property Tax Rent Rebate Program

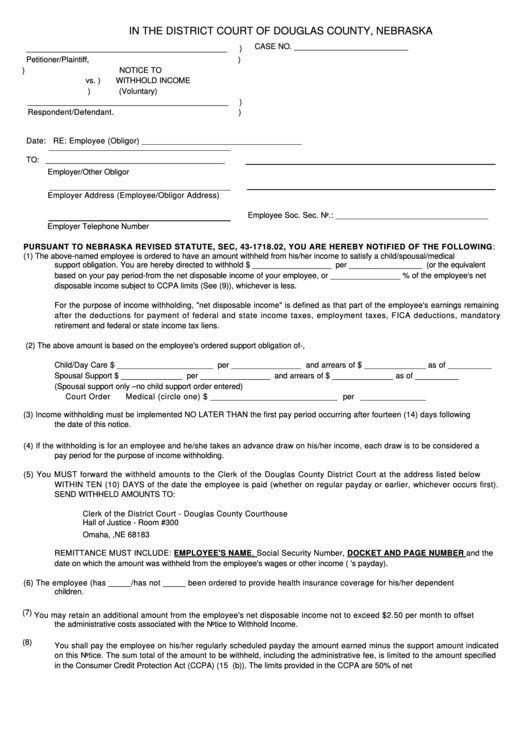

Fillable In The District Court Of Douglas County Nebraska Notice To

Notice Of Commencement Form Download Fillable PDF Templateroller

Notice Of Commencement Form Download Fillable PDF Templateroller

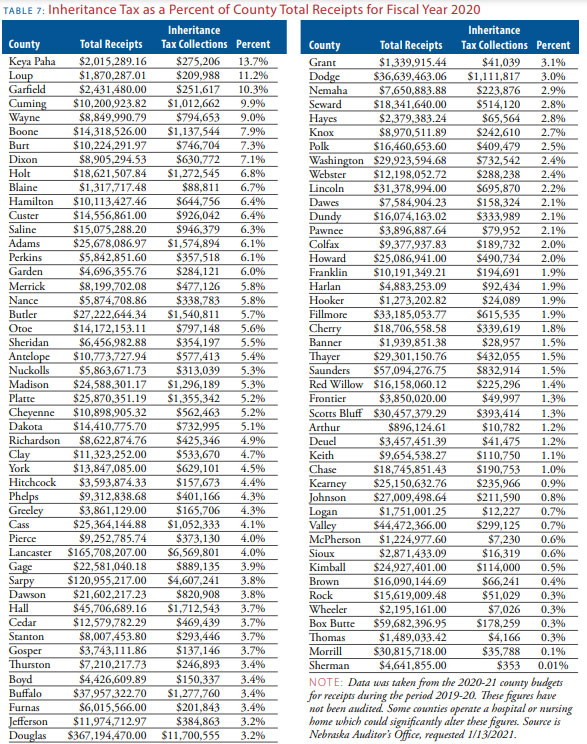

Nebraska Inheritance Tax Worksheet Printable Qualified Dividends And

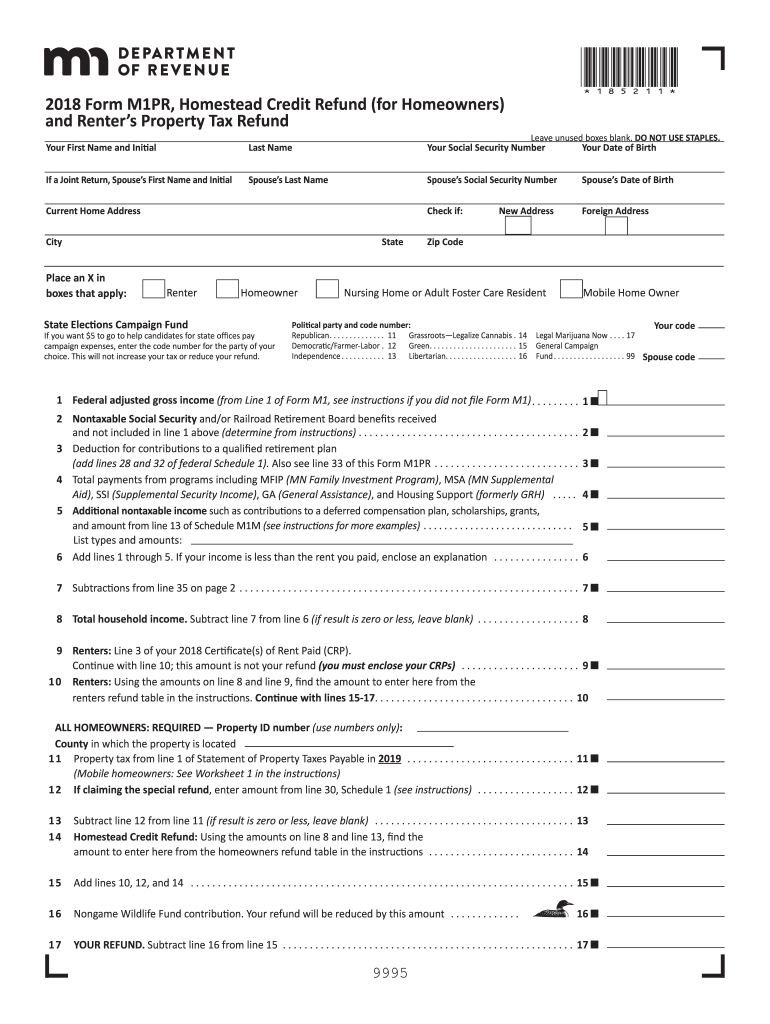

M1pr Form Fill Out Sign Online DocHub

43 Nebraska Inheritance Tax Worksheet Worksheet Live

Nebraska Property Tax Rebate - Web 31 mars 2023 nbsp 0183 32 It would gradually increase the amount of state property tax credits given to landowners on their yearly property tax statements from the current 315 million to