Nebraska S Corp Filing Requirements A small business corporation that has elected to file under Subchapter S of the Internal Revenue Code shall file Form 1120 SN for purposes of reporting net income of the S corporation and

What are Nebraska s filing requirements for S corporations partnerships and LLCs A Nebraska return must be filed by all S corporations partnerships and LLCs with income from Nebraska There are six basic steps to start an LLC and elect S corp status Step 1 Name Your LLC Step 2 Choose a Registered Agent Step 3 File the Certificate of Organization Step 4 Complete Publication Requirements Step

Nebraska S Corp Filing Requirements

Nebraska S Corp Filing Requirements

https://generisonline.com/wp-content/uploads/2022/04/Delaware-as-top-trend-for-the-incorporation.jpg

Nebraska CPA Requirements CpaCredits

https://cpacredits.com/wp-content/uploads/2022/01/nebraska-cpa-requirements.jpg

How To Start An S Corp In Nebraska Nebraska S Corp TRUiC

https://cdn.startupsavant.com/images/how-to-guides/s-corp/start-s-corp-ne.jpg

Follow these six steps to start a Nebraska LLC and elect Nebraska S corp designation Name Your Business Choose a Registered Agent File the Nebraska Certificate of Organization Complete Publication Requirements In this comprehensive guide we ll walk you through each step of forming an S corp in Nebraska from choosing your business name to obtaining necessary licenses and

To create S Corp in Nebraska you must follow the below guidelines that include forming a business name hiring a Registered Agent filing your Certificate of Organization To form an S Corporation in Nebraska it s essential to thoroughly research the specific requirements and regulations This includes understanding the eligibility criteria taxation and

Download Nebraska S Corp Filing Requirements

More picture related to Nebraska S Corp Filing Requirements

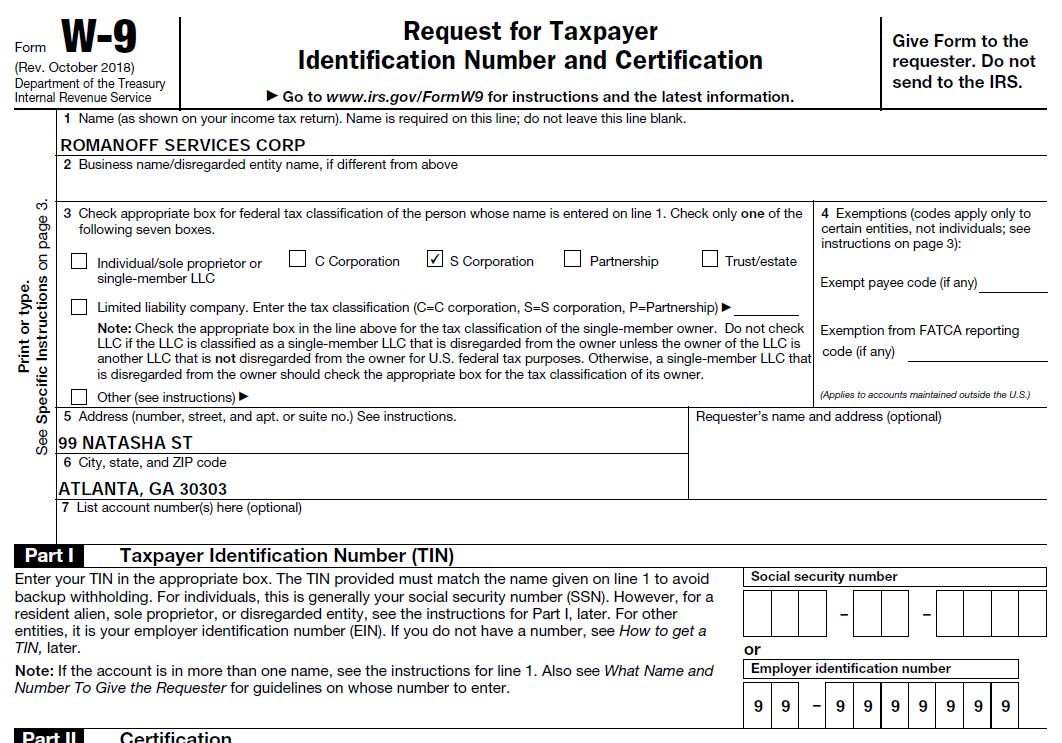

How To Guides Correctly Completing An IRS Form W 9 With Examples

https://emcelroycpa.com/wp-content/uploads/2021/12/W9_CORP_taxed_as_an_S_Corp.jpg

S Corp Filing Guide Block Advisors

https://www.blockadvisors.com/resource-center/wp-content/uploads/2023/06/S-Corp-Filing-Feature.jpg

Nebraska CPA Exam Requirements 2023 Detailed Breakdown

https://www.superfastcpa.com/wp-content/uploads/2022/06/Nebraska-CPA-Exam-Requirements-1024x576.png

Nebraska has no further S Corporation filing requirements It will recognize your S Corp election when the IRS accepts your election Before your LLC can complete Form 2553 1 Understand the Benefits of an S Corp Structure 2 Research the Requirements and Regulations in Nebraska 2 1 Learn about the specific requirements for forming an S Corp in Nebraska 2 2

In this comprehensive guide we will walk you through everything you need to know about starting a nebraska s corp From understanding the benefits of an S Corp to choosing a To start a Nebraska s corp in 2024 there are several steps you need to take From choosing a name and filing articles of incorporation to electing S corporation status with the

S Corp Filing Package Erin Armstrong Affiliate Marketing Training

https://i.pinimg.com/originals/bf/d1/75/bfd175426d49e05b1eca7dbbbbe3b8dd.png

S Corp Filing Package Erin Armstrong Successful Online Businesses

https://i.pinimg.com/originals/5f/67/a2/5f67a241d171c4cbca8956f239e2566a.png

https://revenue.nebraska.gov › about › legal-information › regulations

A small business corporation that has elected to file under Subchapter S of the Internal Revenue Code shall file Form 1120 SN for purposes of reporting net income of the S corporation and

https://revenue.nebraska.gov › about › frequently...

What are Nebraska s filing requirements for S corporations partnerships and LLCs A Nebraska return must be filed by all S corporations partnerships and LLCs with income from Nebraska

Nebraska S Corp How To Start An S Corp In Nebraska TRUiC

S Corp Filing Package Erin Armstrong Affiliate Marketing Training

Nebraska Physical Therapy Continuing Education Requirements

Initial S Corp Filing Steps Scribe

How To Start An S Corp In Nebraska Nebraska S Corp TRUiC

S Corp Filing Is Due But What Do You Know About S Corps

S Corp Filing Is Due But What Do You Know About S Corps

How An S Corp Filing Benefits Small Businesses Mycorporation

Annual S Corporation Filing Requirements For All 50 States

Pennsylvania Corporate Bylaws Northwest Registered Agent

Nebraska S Corp Filing Requirements - Nebraska requires corporations to file a biennial every two years report called the Occupation Tax Report and Payment It is due March 15 The amount due is calculated based on the