Nebraska Sales Tax Rate 2024 Nebraska Sales Tax 5 5 Average Sales Tax With Local 6 338 Nebraska has state sales tax of 5 5 and allows local governments to collect a local option sales tax of up

Per recent legislation LB 1317 Section 81 changes were made to the state sales and use tax rate for Good Life District GLD transactions Effective on July 1 Nebraska sales and use tax rates in 2024 range from 5 5 to 7 5 depending on location Use our calculator to determine your exact sales tax rate

Nebraska Sales Tax Rate 2024

Nebraska Sales Tax Rate 2024

https://files.taxfoundation.org/20220202142849/2022-sales-taxes-including-2022-sales-tax-rates-2022-state-and-local-sales-tax-rates-1200x1033.png

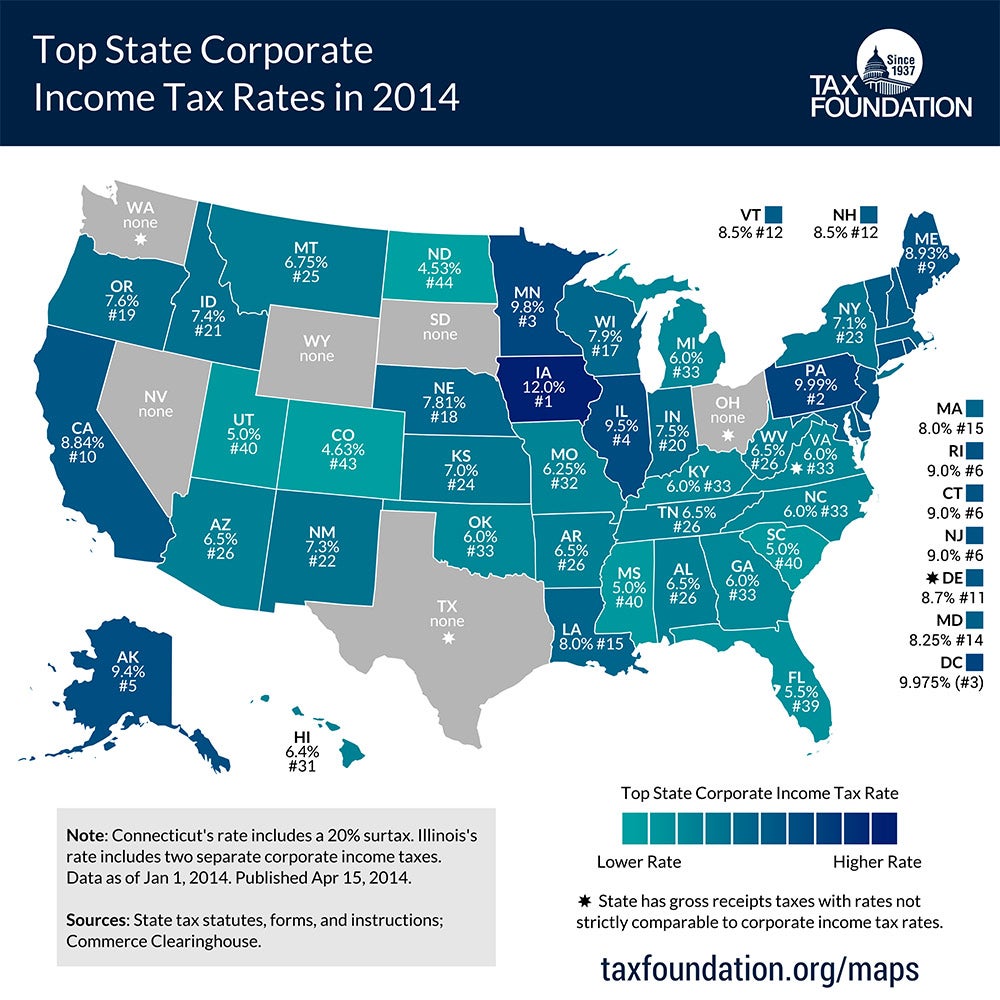

States With The Lowest Corporate Income Tax Rates Infographic

https://assets.entrepreneur.com/article/1398974418-states-lowest-corporate-income-tax-rates-infographic.jpg

Sales Tax Rate Is Not Correct

https://quickbooks.intuit.com/learn-support/image/serverpage/image-id/41398iB3311B03B61B9A7F?v=v2

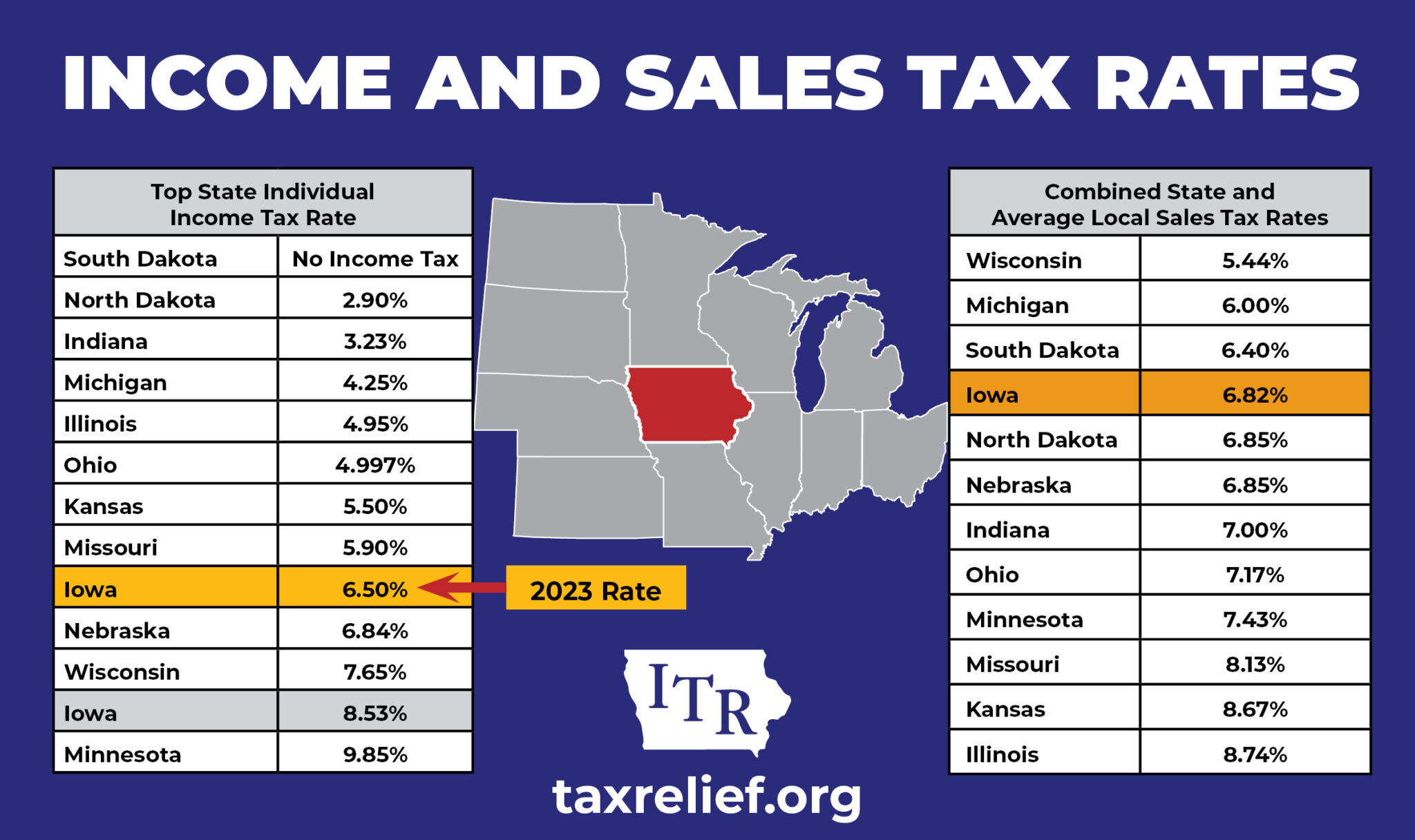

Local Sales and Use Tax Rates Effective April 1 2024 Dakota County imposes a tax rate of 0 5 See the County Sales and Use Tax Rate section at the end The Nebraska sales tax rate is 5 5 as of 2024 with some cities and counties adding a local sales tax on top of the NE state sales tax Exemptions to the Nebraska sales tax

The state sales tax rate in Nebraska is 5 5 but you can customize this table as needed to reflect your applicable local sales tax rate You can use this simple Nebraska sales tax calculator to determine the sales tax owed and total price including tax by entering the applicable sales tax rate and the purchase price

Download Nebraska Sales Tax Rate 2024

More picture related to Nebraska Sales Tax Rate 2024

2013 2023 2024 2025

https://d3fy651gv2fhd3.cloudfront.net/charts/[email protected]?s=ussalestax&v=202304061134V20230410&lang=all

Omaha Ne Sales Tax Calculator 2 Current Local Sales And Use Tax

https://i1.wp.com/www.dctreasurer.org/templates/dotcommadacountytemplate/img/background-slider/content-bg.jpg

Nebraska To Require More Online Retailers Collect Sales Tax Nebraska

https://nebraskapublicmedia.org/assets/images/Screenshot202018-07-272017.10.width-1200.png

State Nebraska s general sales tax rate is 5 5 Local Nebraska localities impose their own sales tax at rates ranging from 0 to 2 Local Sales and Use Tax The state sales tax rate in Nebraska is 5 5 but you can customize this table as needed to reflect your applicable local sales tax rate

Nebraska establishes economic nexus based on sales thresholds meaning you ll need to collect and remit sales tax if your business reaches a certain level of sales within the The Nebraska sales tax rate in 2023 is 5 5 to 7 This comprises a base rate of 5 5 plus mandatory local rates up to 2 Depending on the local sales tax

Nebraska Sales Tax Guide For Businesses

https://www.salestaxhelper.com/images/rt-nb.jpg

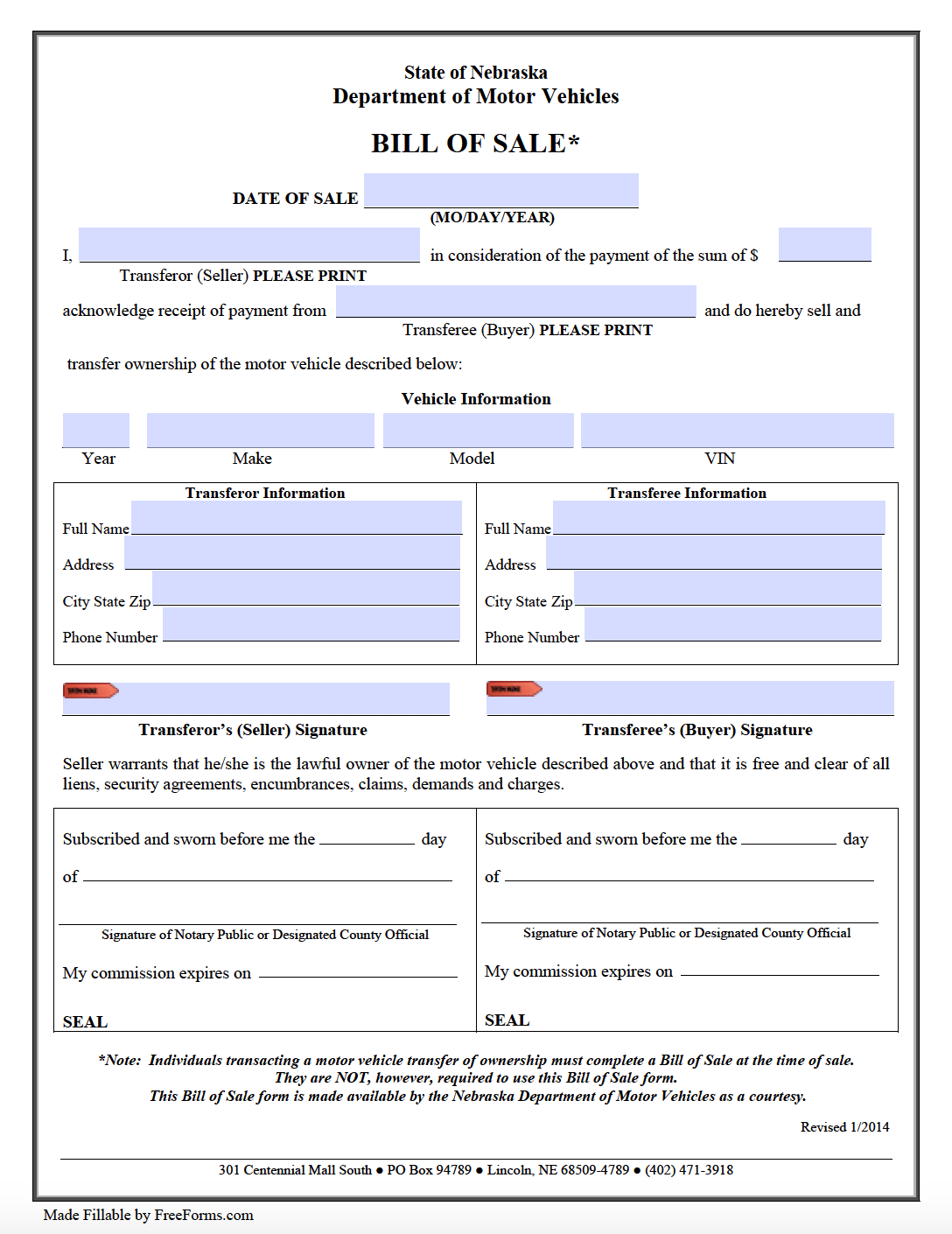

Free Printable Nebraska Bill Of Sale Printable Word Searches

https://freeforms.com/wp-content/uploads/2018/09/Nebraska-Motor-Vehicle-Bill-of-Sale-Form.png

https://www.salestaxhandbook.com/nebraska/rates

Nebraska Sales Tax 5 5 Average Sales Tax With Local 6 338 Nebraska has state sales tax of 5 5 and allows local governments to collect a local option sales tax of up

https://revenue.nebraska.gov/businesses/sales-and-use-tax

Per recent legislation LB 1317 Section 81 changes were made to the state sales and use tax rate for Good Life District GLD transactions Effective on July 1

California 9 Sales Tax Chart Printable Total Up Your Items Purchase

Nebraska Sales Tax Guide For Businesses

2023 Federal Tax Brackets 2023

Making Cents Why Nebraska Should Modernize The Sales Tax Pt 1

Omaha Nebraska Sales Tax Rate 2020 Jann Ocasio

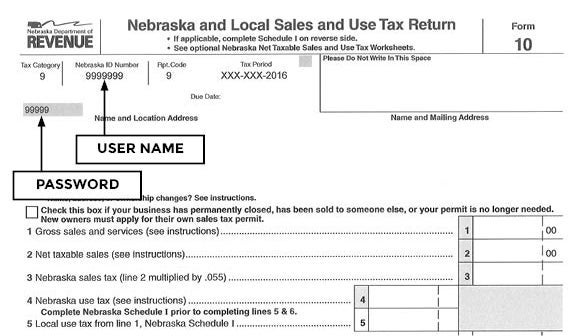

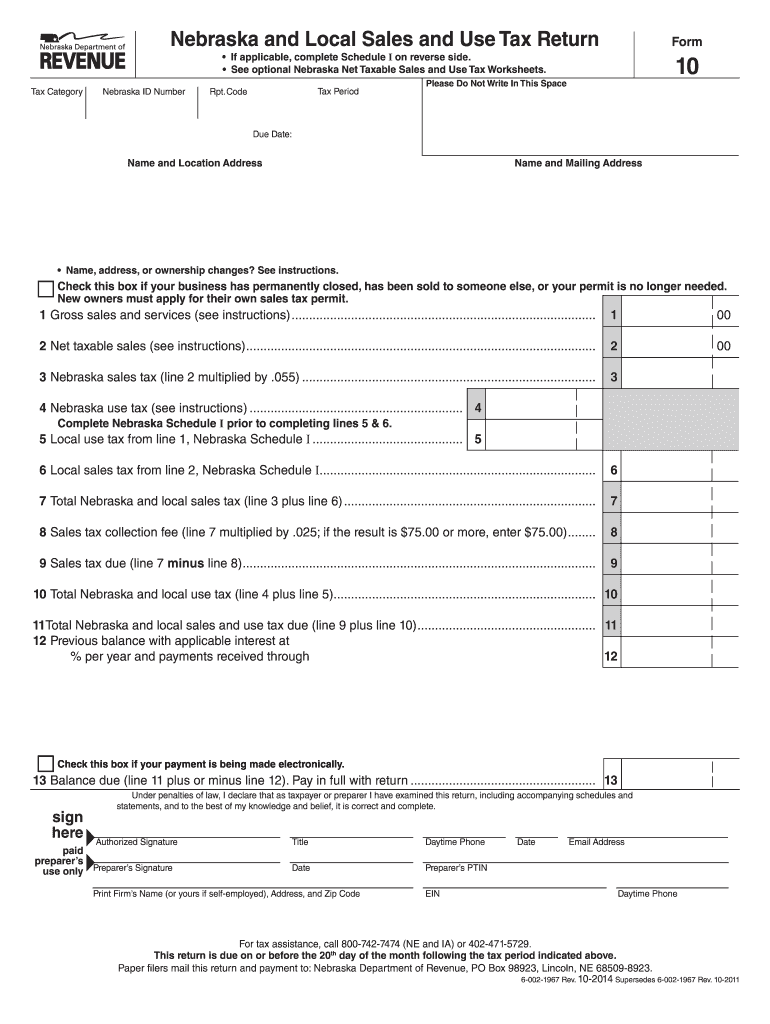

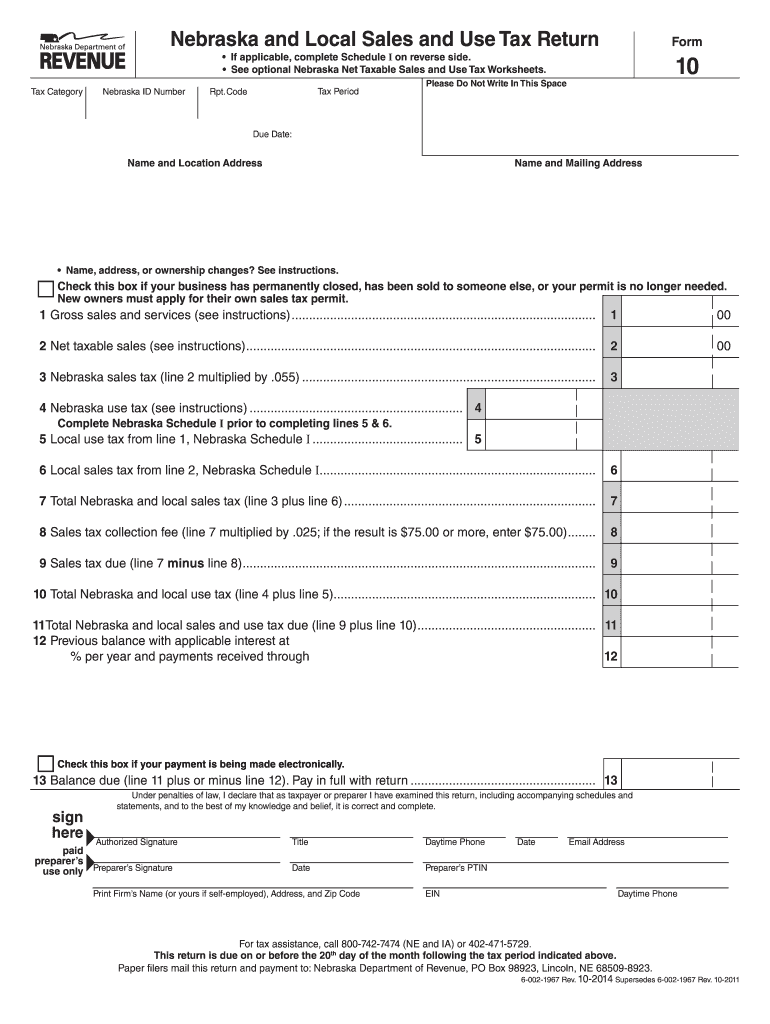

Nebraska And Local Sales And Use Tax Form 10 Fill Out And Sign

Nebraska And Local Sales And Use Tax Form 10 Fill Out And Sign

7 25 Sales Tax Chart Printable Printable Word Searches

2023 Tax Brackets The Best Income To Live A Great Life

Free Nebraska Motor Vehicle Bill Of Sale Form Legal Templates

Nebraska Sales Tax Rate 2024 - Local Sales and Use Tax Rates Effective April 1 2024 Dakota County imposes a tax rate of 0 5 See the County Sales and Use Tax Rate section at the end