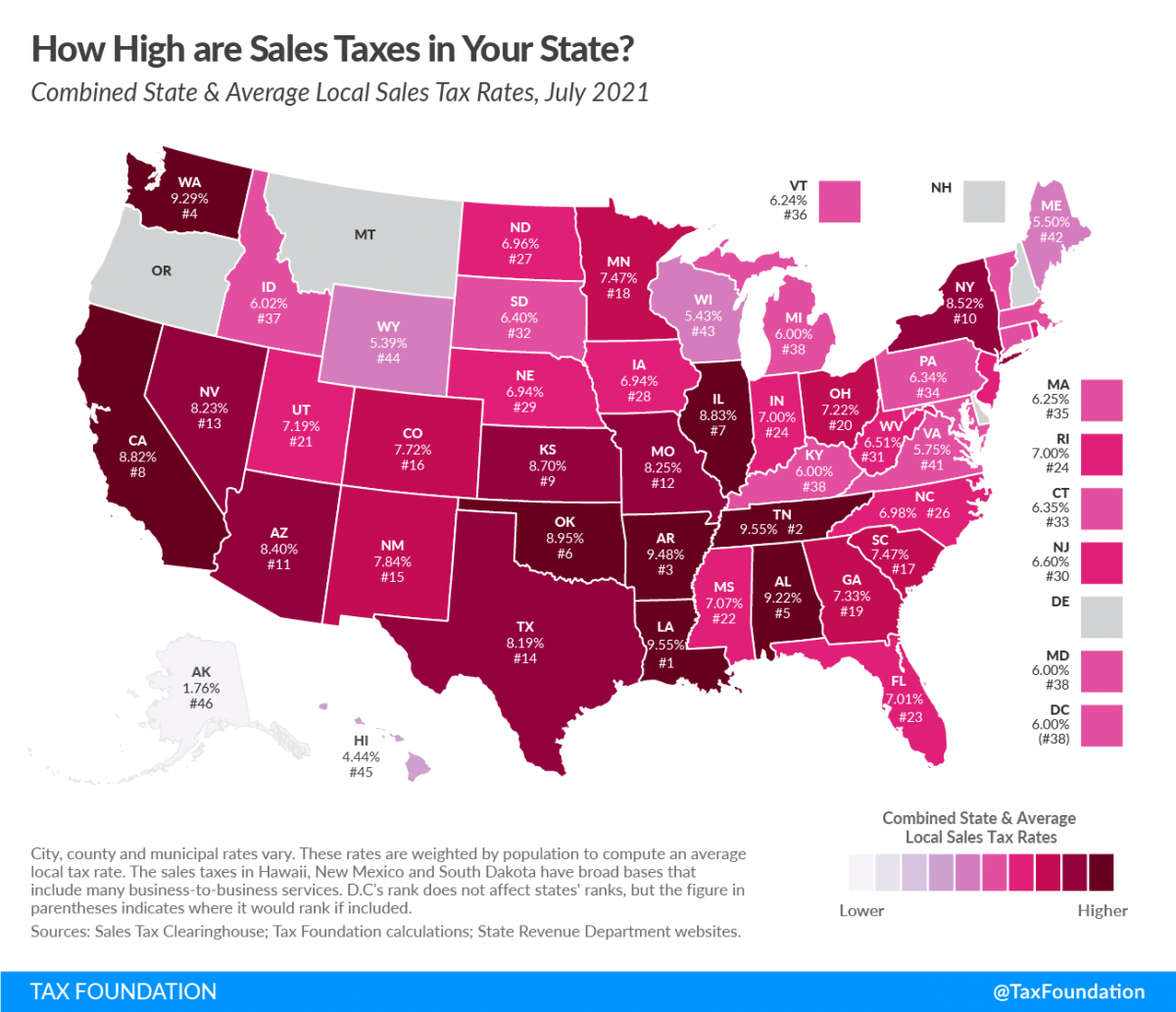

Nebraska Sales Tax Rates By City Nebraska Sales Tax 5 5 Average Sales Tax With Local 6 338 Nebraska has state sales tax of 5 5 and allows local governments to collect a local option sales tax of up

The state sales tax rate in Nebraska is 5 500 With local taxes the total sales tax rate is between 5 500 and 8 000 Nebraska has recent rate changes Thu Jul 01 2021 You can use this simple Nebraska sales tax calculator to determine the sales tax owed and total price including tax by entering the applicable sales tax rate and the purchase

Nebraska Sales Tax Rates By City

Nebraska Sales Tax Rates By City

https://files.taxfoundation.org/20210707180628/2021-sales-taxes-by-state-2021-sales-tax-rates-by-state-2021-state-and-local-sales-tax-rates-July-2021-1200x1033.png

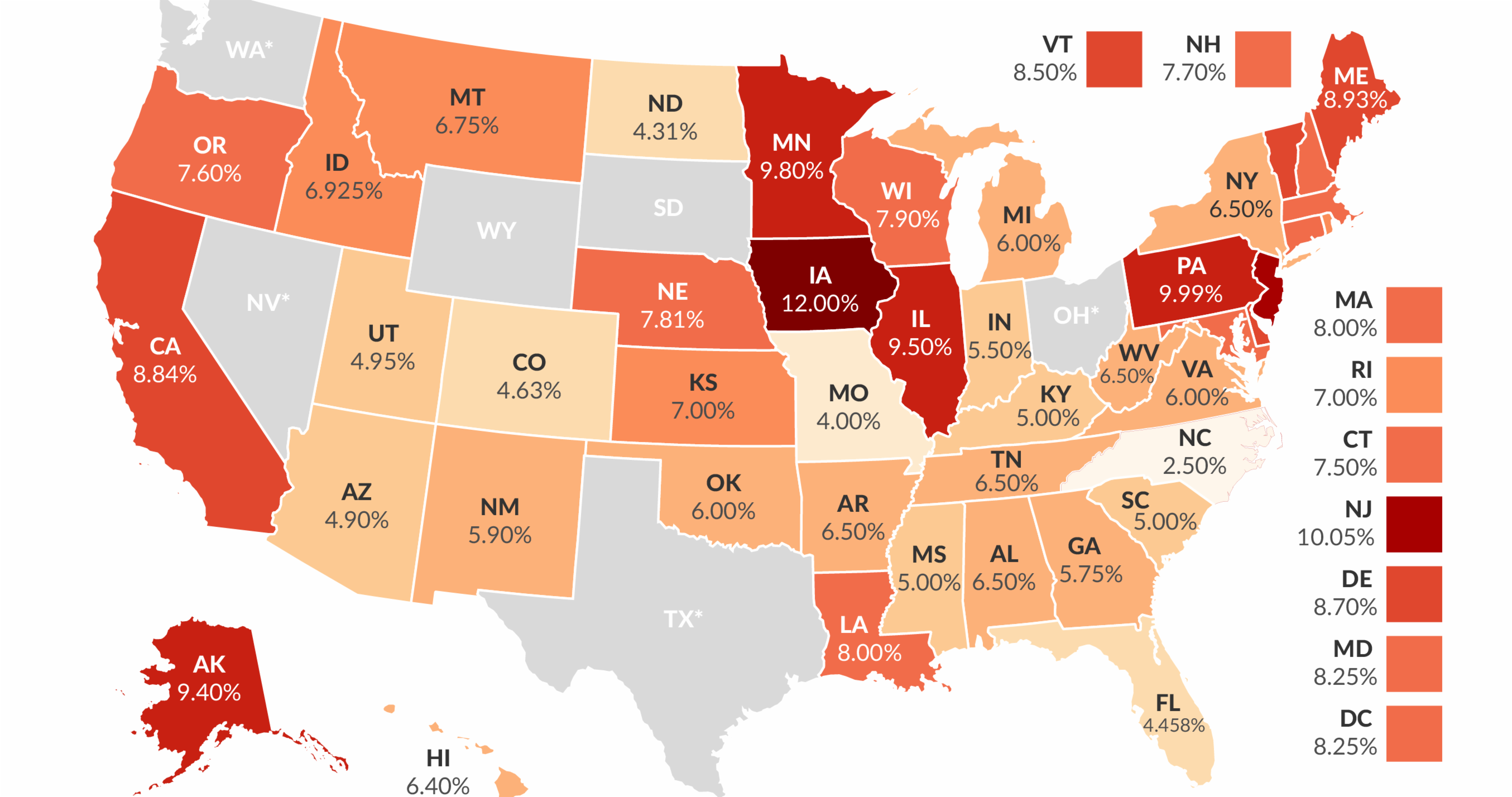

State Corporate Income Tax Rates And Brackets For 2020

https://files.taxfoundation.org/20200127173134/linkedin-In-Stream_Wide___2020-State-Corporate-Income-Tax-Rates-01.png

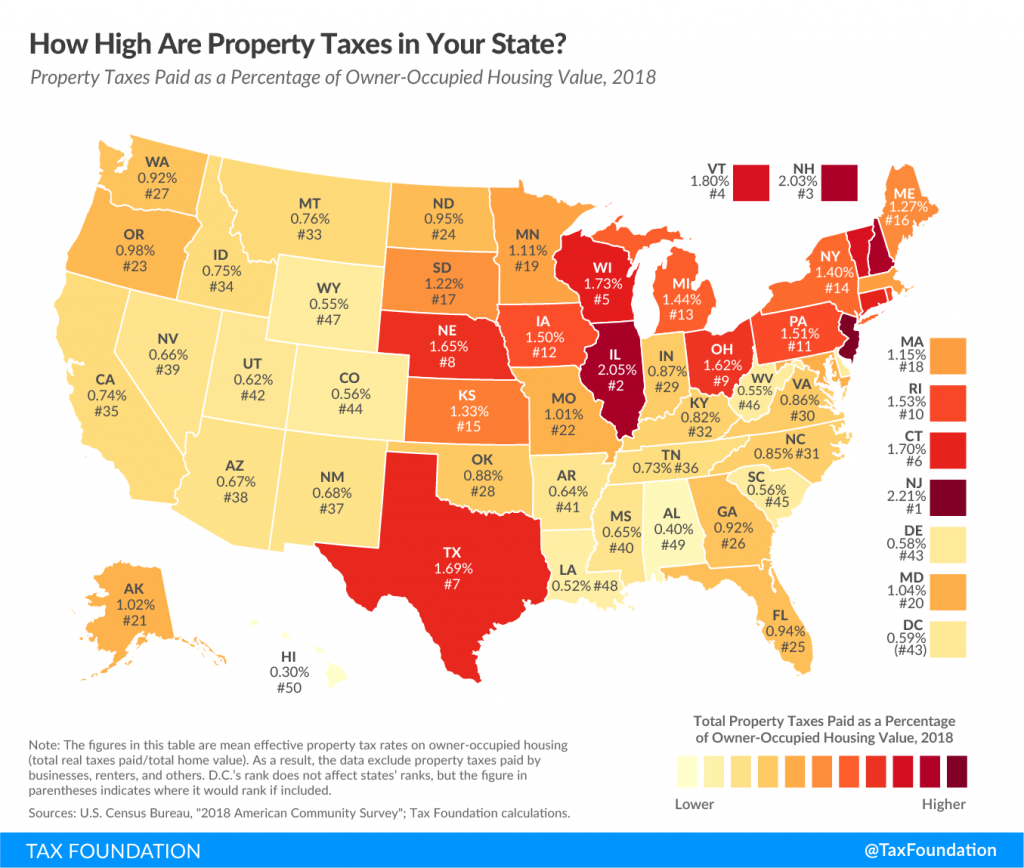

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information County City Lottery Keno Frequently Asked Questions Lottery Raffle News Local Sales and Use Tax Rates Effective July 1 2021 Dakota County and Gage County each impose a tax rate of 0 5 See the County Sales and Use Tax Rates section at the

Nebraska sales and use tax rates in 2024 range from 5 5 to 7 5 depending on location Use our calculator to determine your exact sales tax rate Our dataset includes all local sales tax jurisdictions in Nebraska at state county city and district levels The tax data is broken down by zip code and additional locality

Download Nebraska Sales Tax Rates By City

More picture related to Nebraska Sales Tax Rates By City

Nebraska Sales Tax Guide For Businesses

https://www.salestaxhelper.com/images/rt-nb.jpg

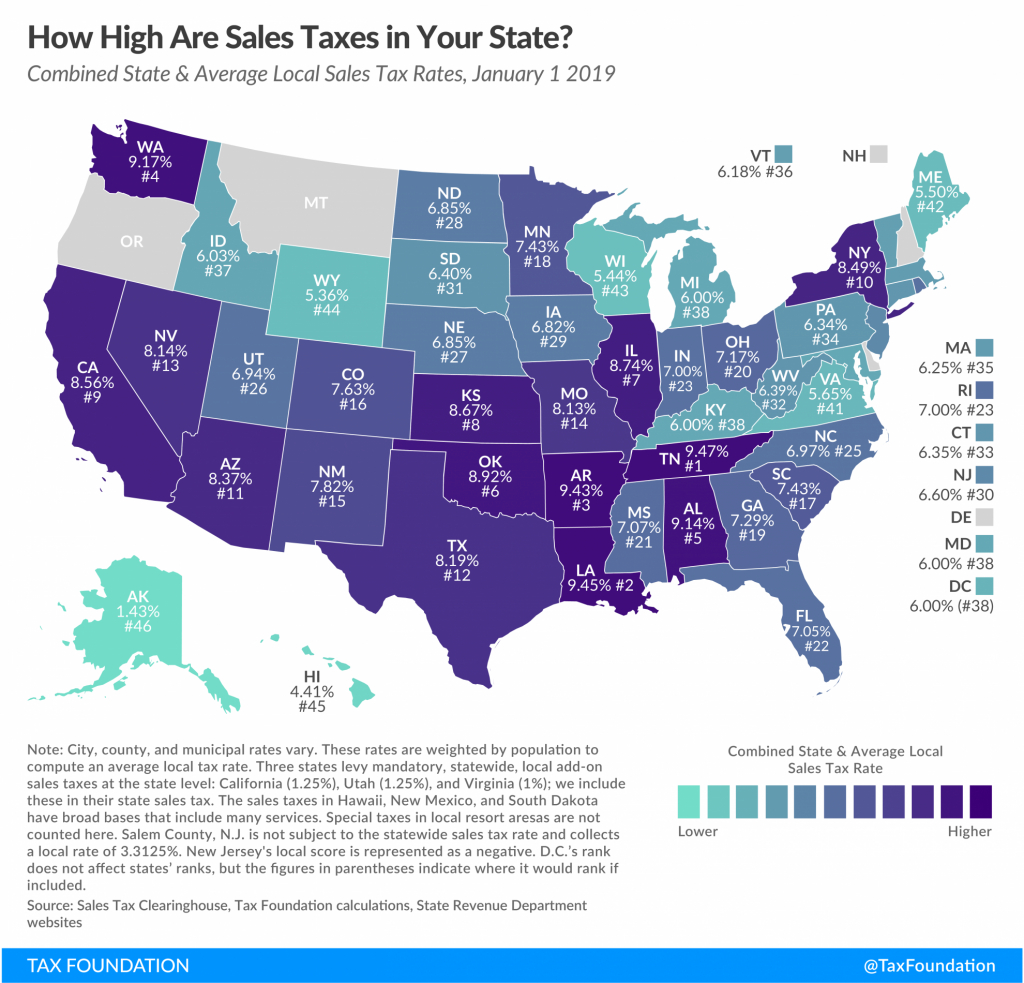

Sales Taxstate Are Grocery Items Taxable Texas Sales Tax Map

https://4printablemap.com/wp-content/uploads/2019/07/state-and-local-sales-tax-rates-2019-tax-foundation-texas-sales-tax-map.png

John Brown s Notes And Essays States With The Highest And Lowest Sales

https://1.bp.blogspot.com/-AA9uBiF3pqQ/Wr0HBrjvlcI/AAAAAAABy_A/_7JcvcvsEVoU24NY8-bpPjeyeuh1OvzIACLcBGAs/s1600/636468799183949256-103117-sales-tax-rates.png

The base state sales tax rate in Nebraska is 5 5 Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 5 5 to 7 5 Find your Nebraska The Nebraska sales tax rate is 5 5 as of 2024 with some cities and counties adding a local sales tax on top of the NE state sales tax Exemptions to the Nebraska sales tax

You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code The calculator will show you the total sales tax amount as well as The maximum local tax rate allowed by Nebraska law is 2 You can lookup Nebraska city and county sales tax rates here This page provides an overview of the sales tax rates

/dotdash-TheBalance-best-and-worst-states-for-property-taxes-3193328-final3-4972494b00d447d58e8943ad5b82913e.jpg)

South Dakota Sales Tax Rate On Vehicles Tax Preparation Classes

https://www.thebalance.com/thmb/5ZpesW3WBdkiwfGASIPwVtw0v1Y=/3000x1687/smart/filters:no_upscale()/dotdash-TheBalance-best-and-worst-states-for-property-taxes-3193328-final3-4972494b00d447d58e8943ad5b82913e.jpg

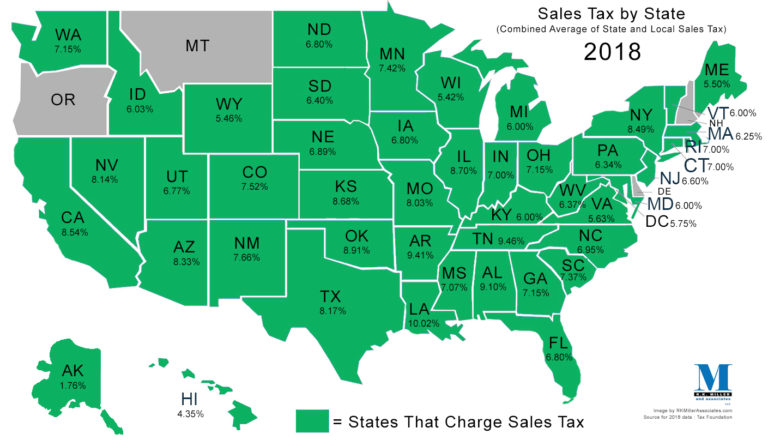

Sales Tax By State Here s How Much You re Really Paying Sales Tax

https://i.pinimg.com/originals/f6/99/3f/f6993f73fae9c87213464fd9ef538b8f.jpg

https://www.salestaxhandbook.com/nebraska/rates

Nebraska Sales Tax 5 5 Average Sales Tax With Local 6 338 Nebraska has state sales tax of 5 5 and allows local governments to collect a local option sales tax of up

https://www.sale-tax.com/Nebraska

The state sales tax rate in Nebraska is 5 500 With local taxes the total sales tax rate is between 5 500 and 8 000 Nebraska has recent rate changes Thu Jul 01 2021

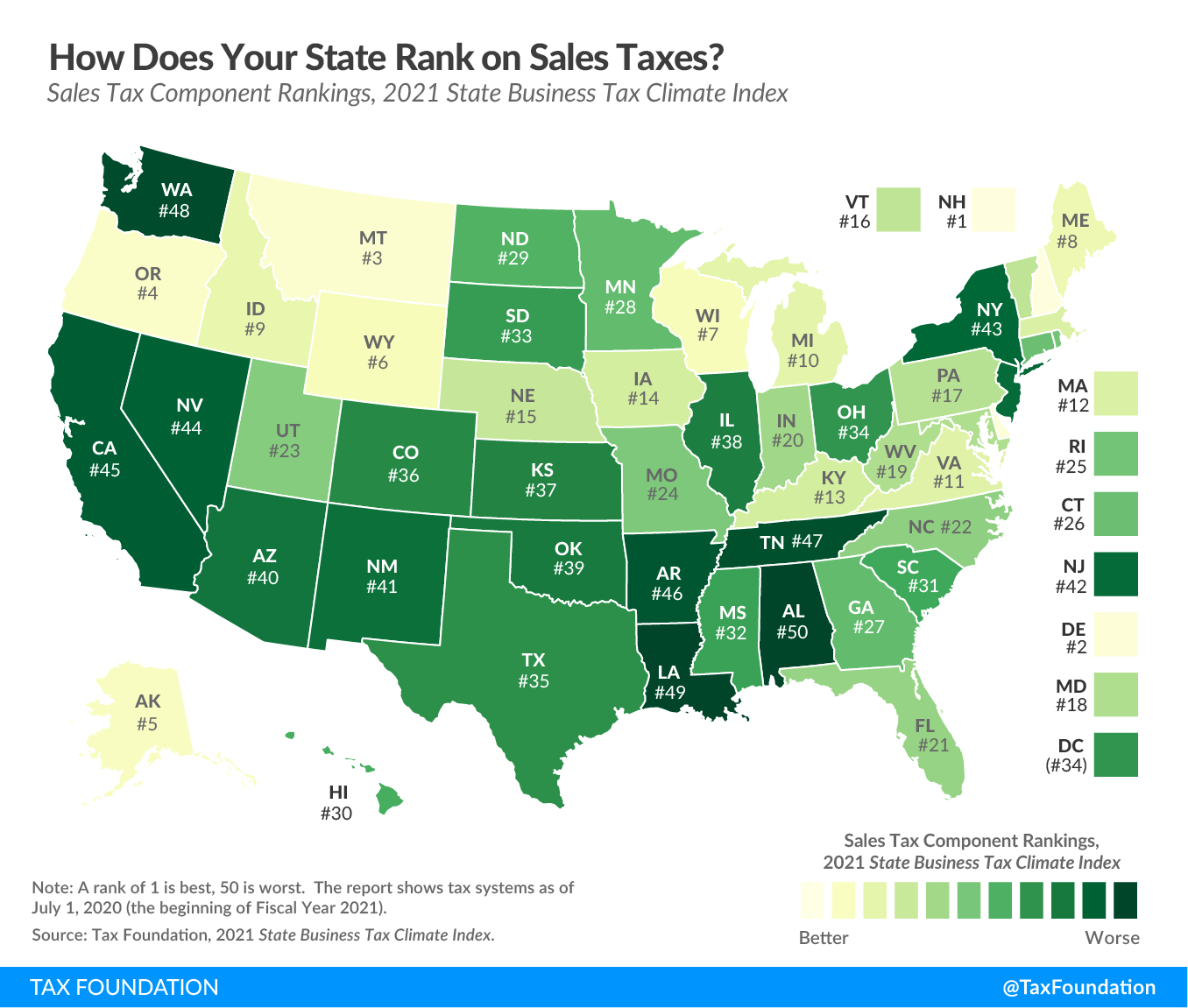

Best Worst State Sales Tax Codes Tax Foundation

/dotdash-TheBalance-best-and-worst-states-for-property-taxes-3193328-final3-4972494b00d447d58e8943ad5b82913e.jpg)

South Dakota Sales Tax Rate On Vehicles Tax Preparation Classes

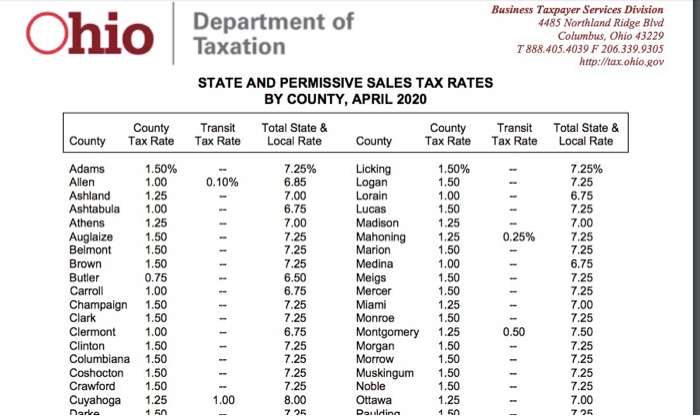

How Much Is Ohios Sales Tax Tax Walls

7 25 Sales Tax Chart Printable Printable Word Searches

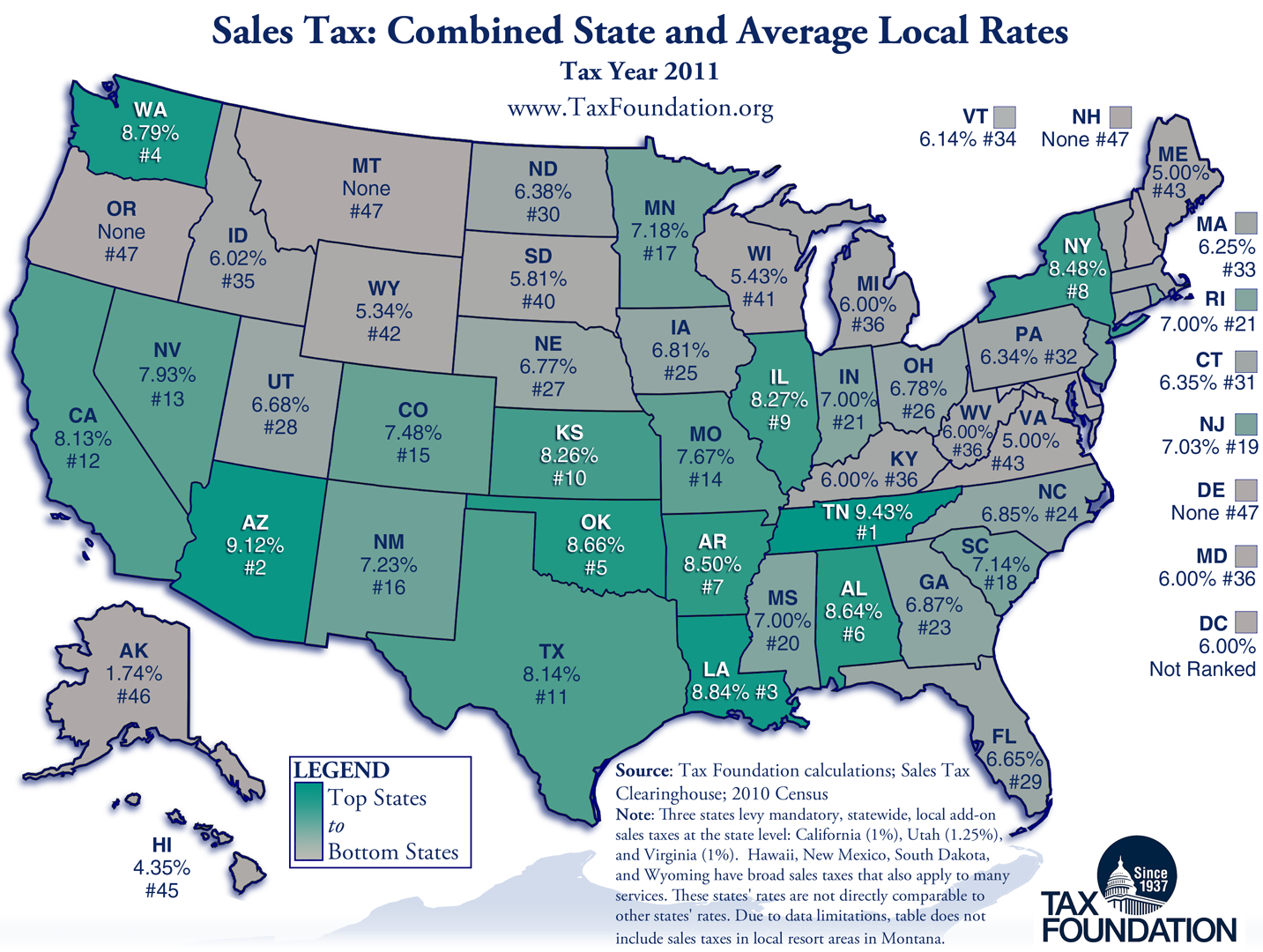

Ranking State And Local Sales Taxes Tax Foundation Texas Sales Tax

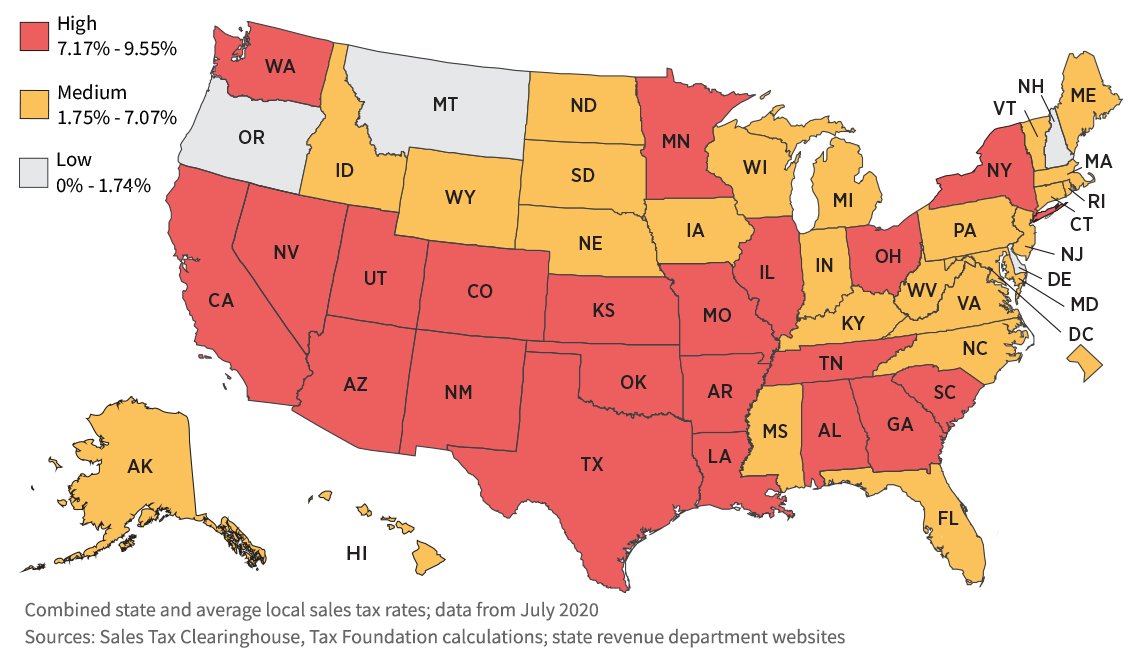

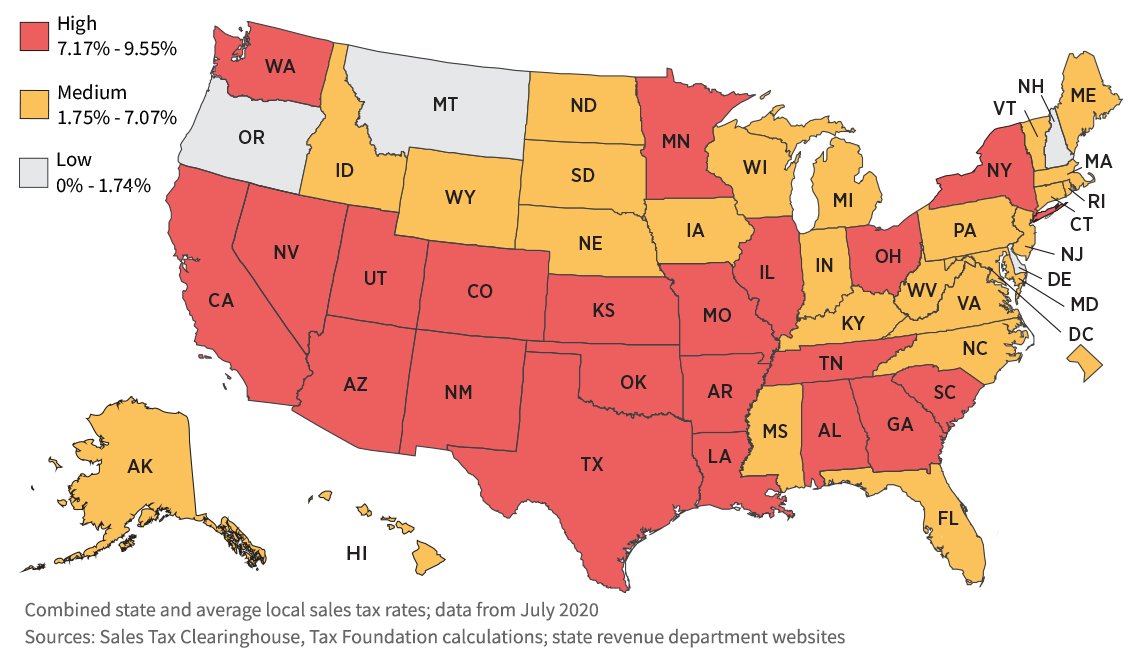

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Sales Tax Expert Consultants Sales Tax Rates By State State And Local

Sales Tax Rates By Province In Canada Retail Council Of Canada

Irs Tax Brackets 2023 Chart Printable Forms Free Online

Nebraska Sales Tax Rates By City - Nebraska City NE Sales Tax Rate The current total local sales tax rate in Nebraska City NE is 7 500 The December 2020 total local sales tax rate was also 7 500 Sales