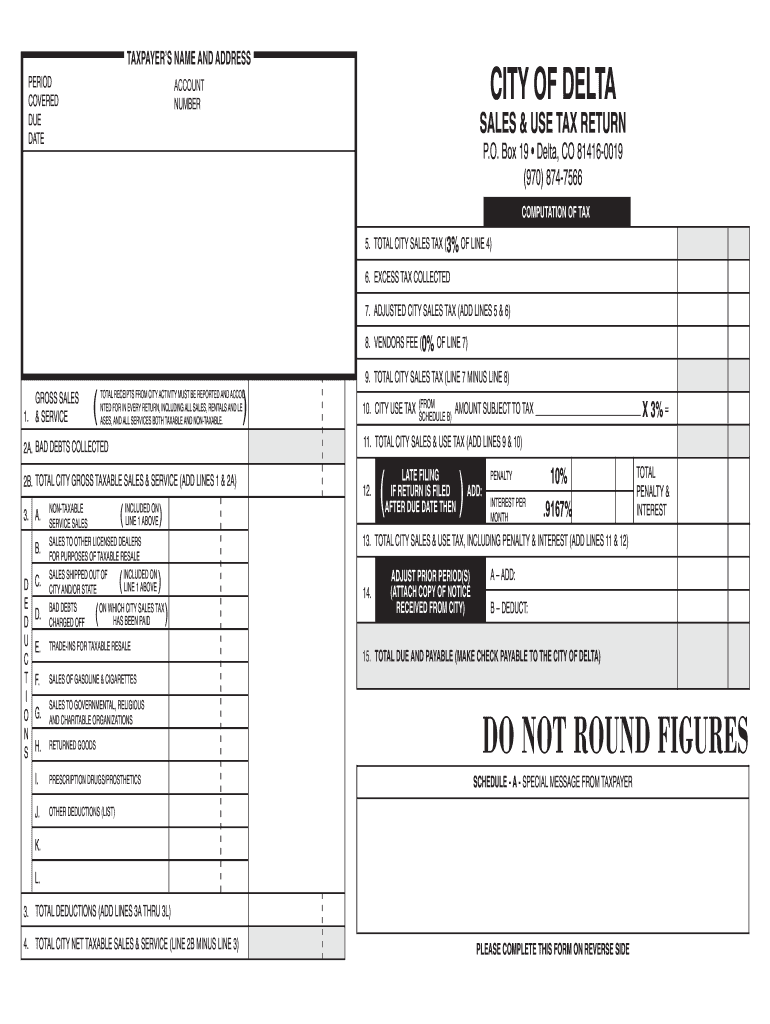

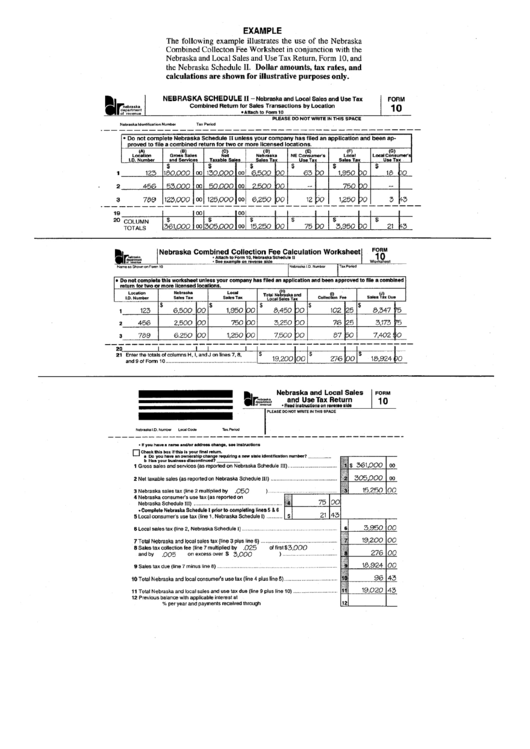

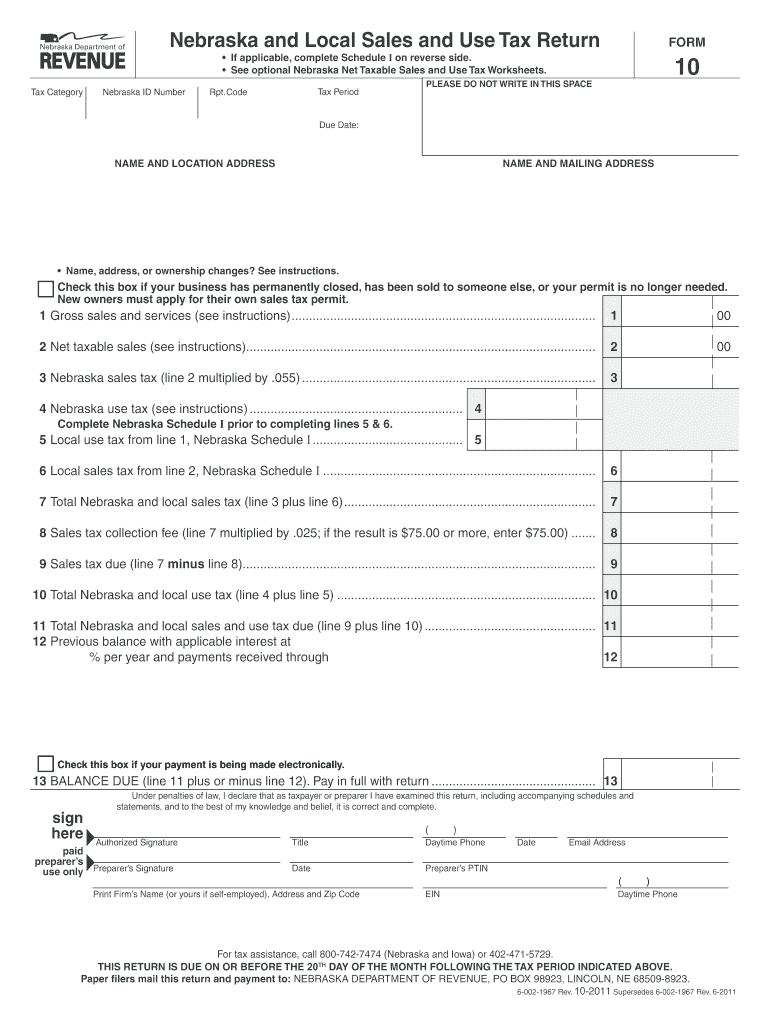

Nebraska Sales Tax Return Form 10 File Form 10 Form 10 and Schedules for Amended Returns and Prior Tax Periods Demonstration of Filing State and Local Sales and Use Taxes Form 10 Single

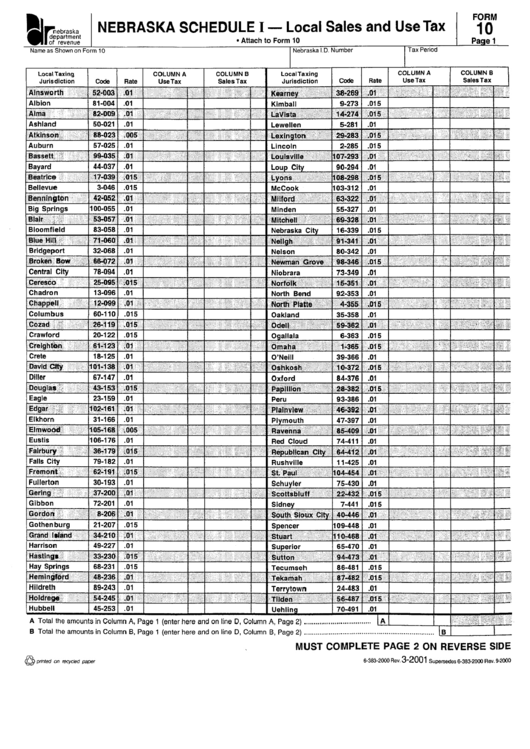

66 rows10 Form Nebraska and Local Sales and Use Tax Return with Schedule I Form 10 Worksheets Nebraska Net Taxable Sales and Use Tax Worksheets The online version of these worksheets expands for detailed information To see this information

Nebraska Sales Tax Return Form 10

Nebraska Sales Tax Return Form 10

https://www.pdffiller.com/preview/22/927/22927837/large.png

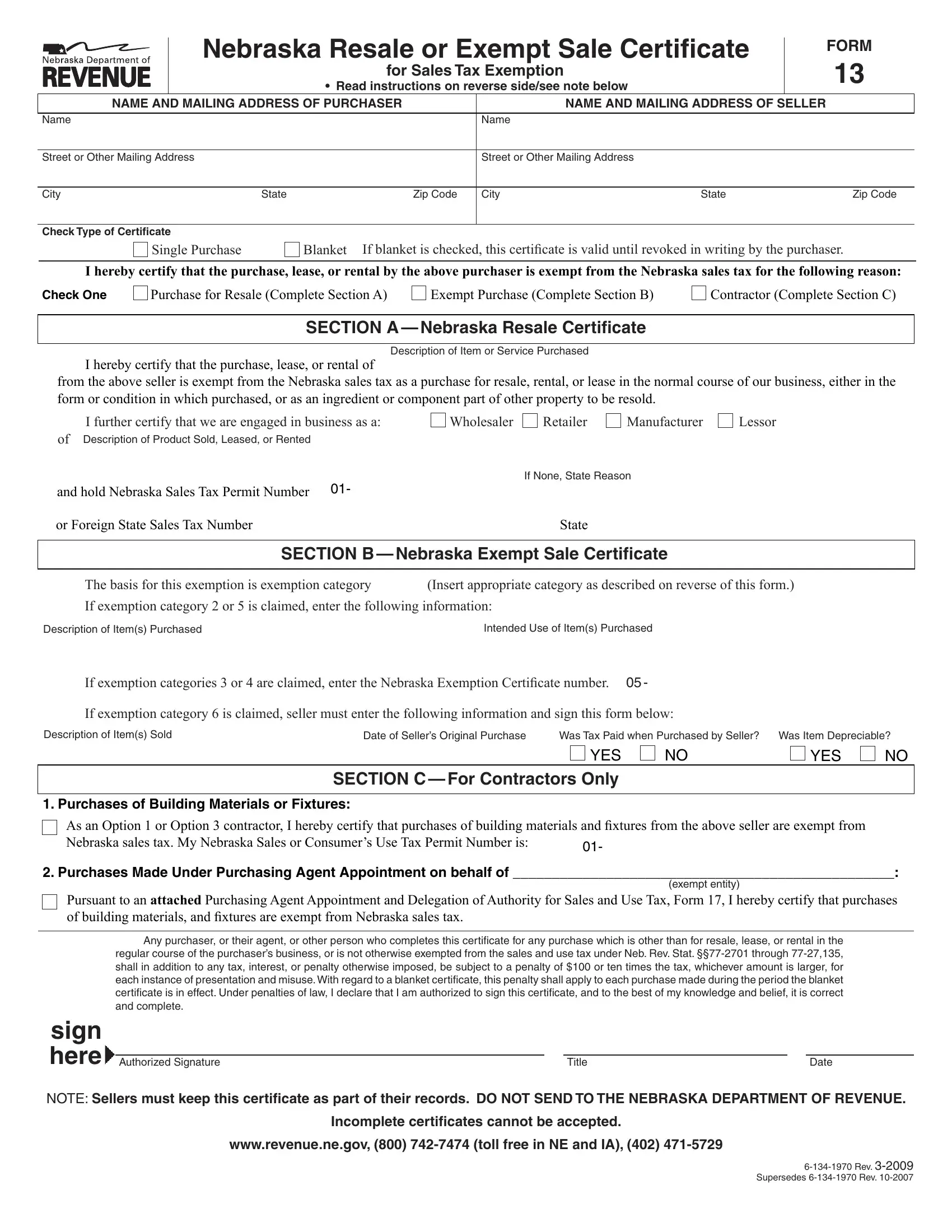

2020 2022 NE 7AG Formerly 13AG Fill Online Printable Fillable

https://www.pdffiller.com/preview/526/979/526979757/large.png

Form 10 Nebraska Schedule I Local Sales And Use Tax 2000

https://data.formsbank.com/pdf_docs_html/245/2453/245360/page_1_thumb_big.png

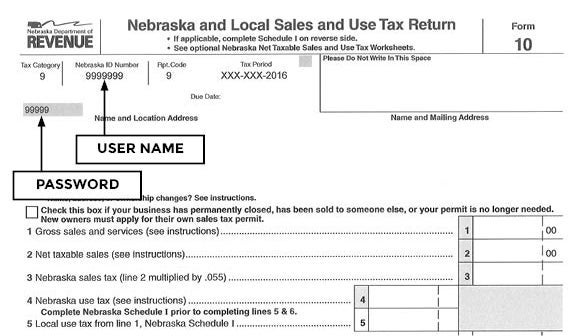

Name and Location Address FORM 10 Name address or ownership changes See instructions Check this box if your business has permanently closed has been sold to Every person including every MMP making taxable sales in Nebraska is a retailer and must hold a Nebraska Sales Tax Permit and must file a Nebraska and Local Sales and Use

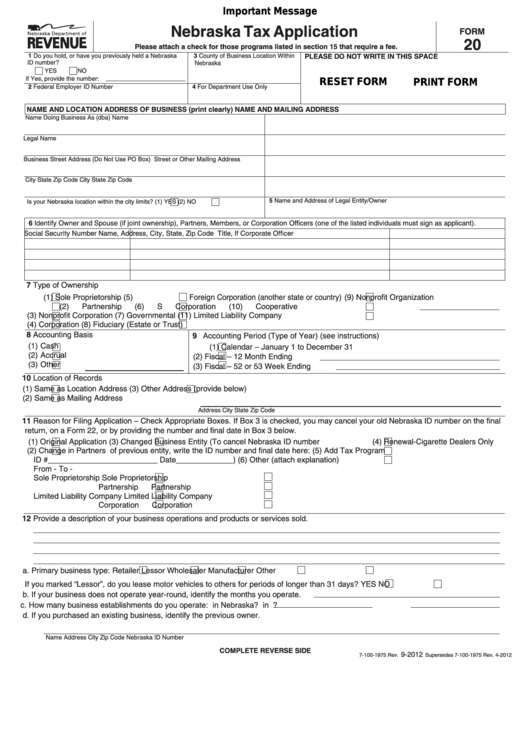

Form 10 with Schedule 4 2024 for tax period April 1 2024 and after Form 10 with Schedule 11 2023 for tax period January 1 2024 through March 31 2024 Amended Form 10 Nebraska and Local Sales and Use Tax Return Once you have submitted your Form 20 the state will begin sending you a Form 10 to file sales tax returns The

Download Nebraska Sales Tax Return Form 10

More picture related to Nebraska Sales Tax Return Form 10

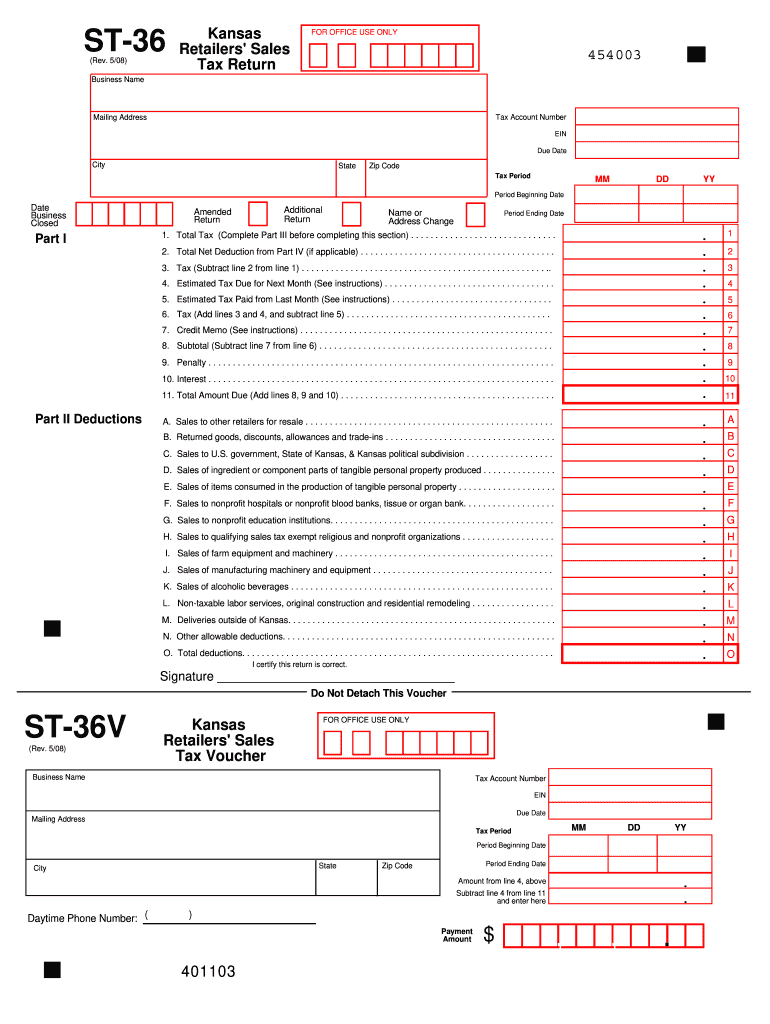

Kansas Retailers Sales Tax Return St 36 Fill And Sign Printable

https://www.pdffiller.com/preview/41/256/41256214/large.png

Form 10 Nebraska And Local Sales And Use Tax Return Example Printable

https://data.formsbank.com/pdf_docs_html/306/3065/306543/page_1_thumb_big.png

Nebraska Sales Tax Form Fill Out Printable PDF Forms Online

https://formspal.com/pdf-forms/other/nebraska-sales-tax/nebraska-sales-tax-preview.webp

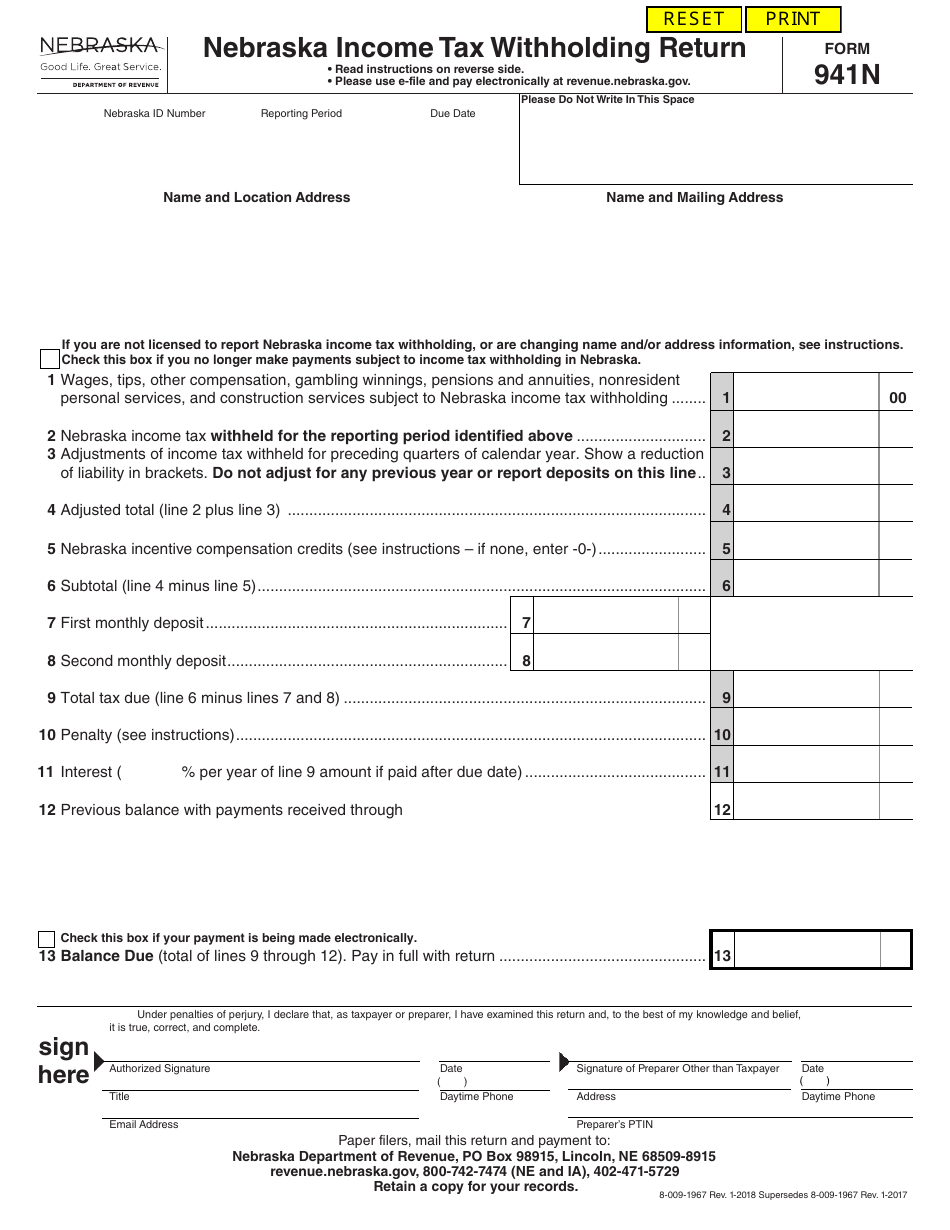

Nebraska supports electronic filing of sales tax returns which is often much faster than filing via mail As of 2013 all taxpayers who made payments of 9 000 or more in the Every person collecting Nebraska sales and use tax is required to hold a Nebraska sales and use tax permit and must file a Nebraska and Local Sales and Use Tax Return

Change to Sales Tax Collection Fees LB 984 Takes Effect October 1 2022 be sure to keep these changes in mind with your November filing of your October taxes The change is to NE Sales Tax Form 10 Due Date Name and Location Address Name address or ownership changes See instructions Check this box if your business has permanently closed has

Free Printable Nebraska Bill Of Sale Printable Word Searches

https://freeforms.com/wp-content/uploads/2018/09/Nebraska-Motor-Vehicle-Bill-of-Sale-Form.png

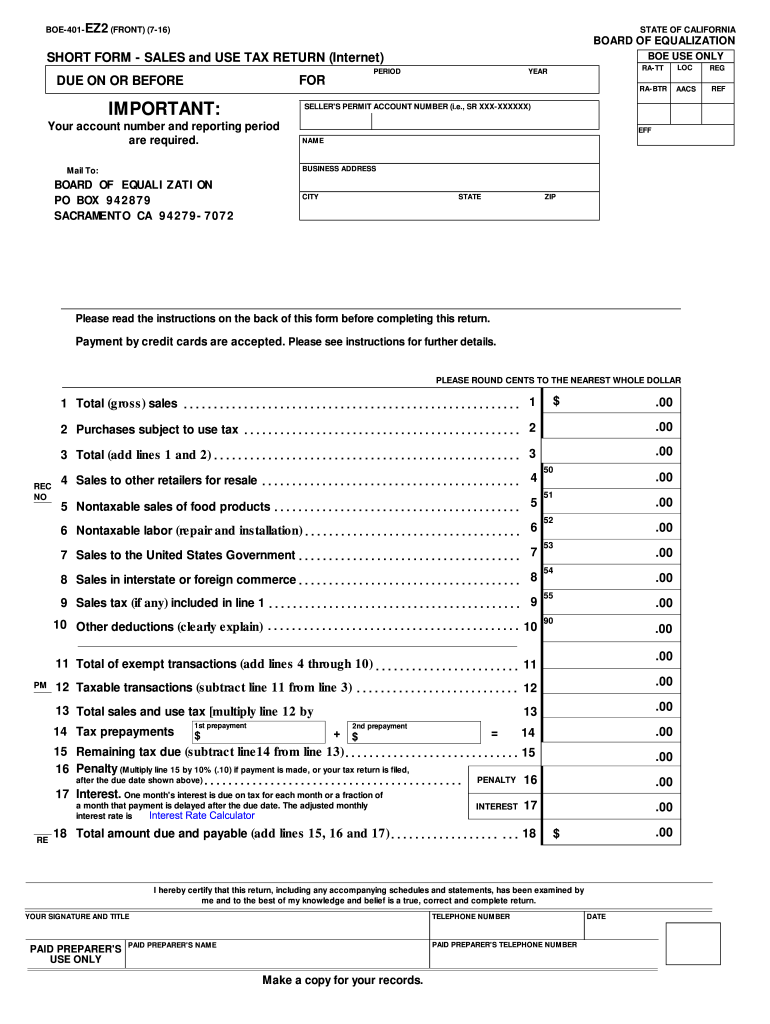

Ca Form Sales Tax Return Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/370/164/370164210/large.png

https://revenue.nebraska.gov/businesses/nebraska...

File Form 10 Form 10 and Schedules for Amended Returns and Prior Tax Periods Demonstration of Filing State and Local Sales and Use Taxes Form 10 Single

https://revenue.nebraska.gov/about/forms/sales-and-use-tax-forms

66 rows10 Form Nebraska and Local Sales and Use Tax Return with Schedule I

Fillable Form 20 Nebraska Tax Application Printable Pdf Download

Free Printable Nebraska Bill Of Sale Printable Word Searches

Form 941N Fill Out Sign Online And Download Fillable PDF Nebraska

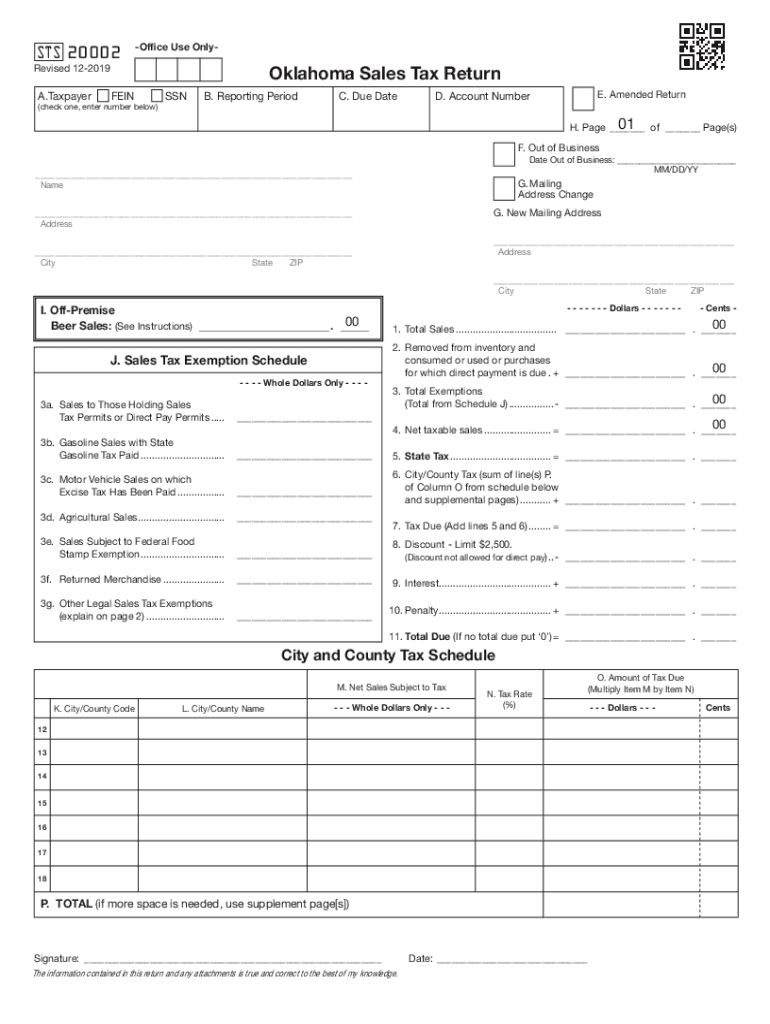

Oklahoma Sales Tax Fill Out Sign Online DocHub

Nebraska Sales Tax Form 10 Fill Out Sign Online DocHub

Tax Return Form Filing And Deadlines Stock Photography CartoonDealer

Tax Return Form Filing And Deadlines Stock Photography CartoonDealer

Omaha Nebraska Sales Tax Rate 2020 Jann Ocasio

Can Utah Afford To Lose State Income tax Revenue No But

Nebraska EIN Number LLC Bible

Nebraska Sales Tax Return Form 10 - Form 10 with Schedule 4 2024 for tax period April 1 2024 and after Form 10 with Schedule 11 2023 for tax period January 1 2024 through March 31 2024 Amended