Nebraska State Tax Rate The Income tax rates and personal allowances in Nebraska are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in the Nebraska Tax Calculator 2024

Today Nebraska s income tax rates range from 2 46 to 5 84 with a number of deductions and credits that lower the overall tax burden for many taxpayers On the other hand Nebraska s average effective property tax rate of 1 54 is one of the highest in the U S Nebraska s 2024 income tax ranges from 2 46 to 5 84 This page has the latest Nebraska brackets and tax rates plus a Nebraska income tax calculator Income tax tables and other tax information is sourced from the Nebraska Department of Revenue

Nebraska State Tax Rate

Nebraska State Tax Rate

https://creditkarma-cms.imgix.net/wp-content/uploads/2018/12/GettyImages-516250951-TXSTNE-e1545060127890.jpg

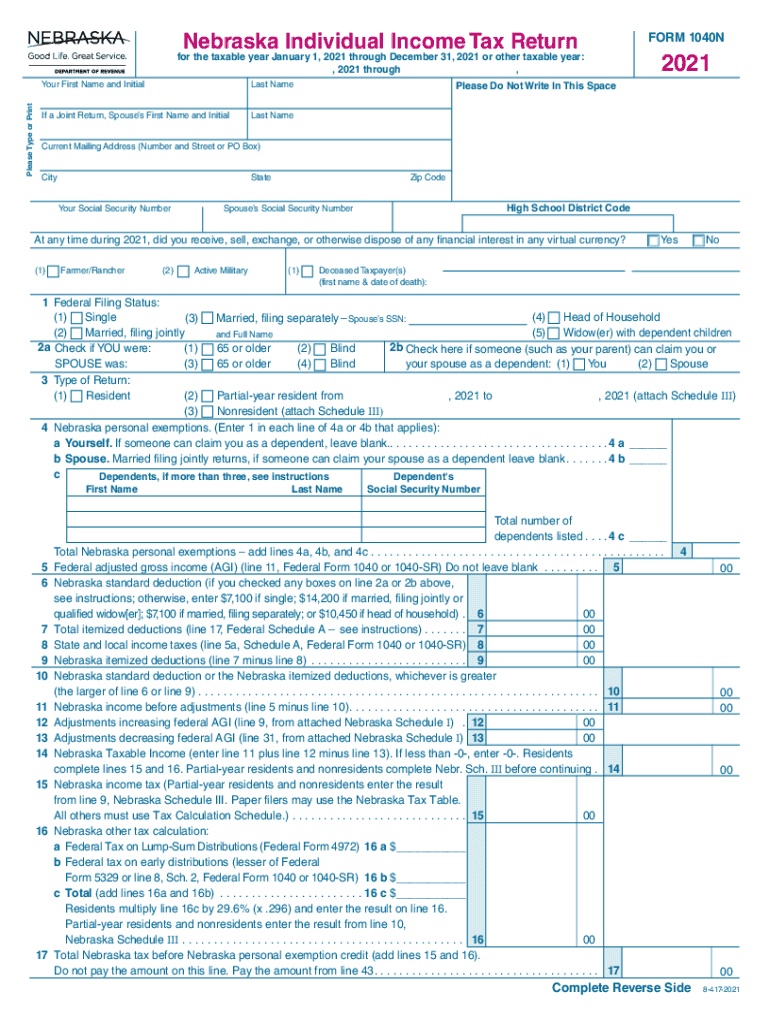

Nebraska State Tax Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/596/688/596688751/large.png

What Is Nebraska State Income Tax Rate LiveWell

https://livewell.com/wp-content/uploads/2023/10/what-is-nebraska-state-income-tax-rate-1698724978.jpg

Nebraska has a graduated corporate income tax with rates ranging from 5 58 percent to 5 84 percent Nebraska also has a 5 50 percent state sales tax rate and an average combined state and local sales tax rate of 6 97 percent Nebraska has a 1 44 percent effective property tax rate on owner occupied housing value Nebraska has an inheritance tax You can quickly estimate your Nebraska State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Nebraska and for quickly estimating your tax commitments in 2025

Nebraska Tax Brackets for Tax Year 2022 As you can see your income in Nebraska is taxed at different rates within the given tax brackets Any income over 33 180 Single or 66 360 Married Jointly would be taxed at the highest rate 6 84 Below we explain various Nebraska state taxes affecting retirement income such as sales tax inheritance tax and property taxes For information regarding taxes in other states see Retirement Taxes by State 5 5 Localities can add as much as 2 5 There is a sales tax and an annual tax on vehicles

Download Nebraska State Tax Rate

More picture related to Nebraska State Tax Rate

The Harms Of Retaliatory Tax And Trade Policies Tax Foundation

https://taxfoundation.org/wp-content/uploads/2024/01/AdobeStock_253977390-scaled.jpeg

State Taxes In Every US State And DC Ranked Lovemoney

https://loveincorporated.blob.core.windows.net/contentimages/largesize/4eb06d10-948b-48d1-8bbd-835678ec9dfe-6-taxes-people-pay-in-every-state-and-dc-ranked-nebraska.jpg

Nebraska Surety Bond Nebraska Bonding Company Absolute Surety

https://www.absolutesurety.com/wp-content/uploads/2021/05/nebraska.png

Review the latest income tax rates thresholds and personal allowances in Nebraska which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in Nebraska Nebraska Governor Jim Pillen signed into law LB 754 which gradually reduces the state s top personal income tax rates and collapses the tax brackets from four to three over four years starting in 2024

[desc-10] [desc-11]

Taxes And Spending In Nebraska

https://nebraskalegislature.gov/app_rev/charts/chart_statelocal_area.gif

Full Article News Business Nebraska

https://business.unl.edu/images/news/2022/220310-ft-ranking-DS.gif

https://ne-us.icalculator.com › income-tax-rates

The Income tax rates and personal allowances in Nebraska are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in the Nebraska Tax Calculator 2024

https://smartasset.com › taxes › nebraska-tax-calculator

Today Nebraska s income tax rates range from 2 46 to 5 84 with a number of deductions and credits that lower the overall tax burden for many taxpayers On the other hand Nebraska s average effective property tax rate of 1 54 is one of the highest in the U S

Nebraska State Income Tax Fill Out Sign Online DocHub

Taxes And Spending In Nebraska

California Legislators Propose 0 4 Wealth Tax Plus 16 8 Income Tax Rate

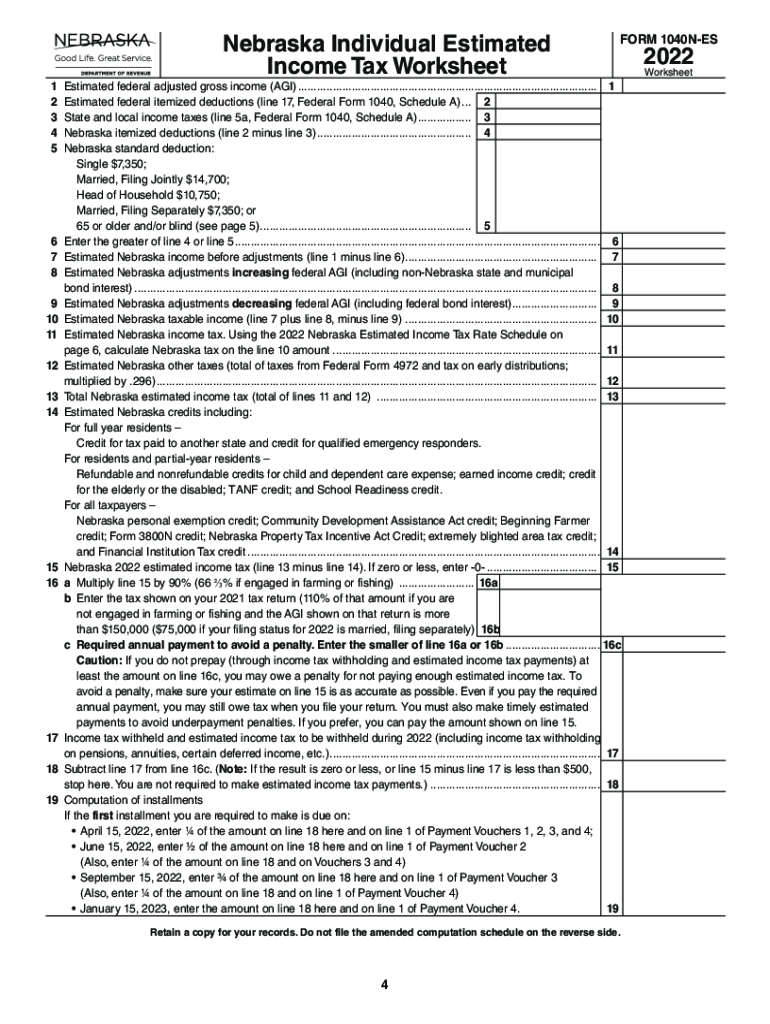

Nebraska Estimated Tax Form 2023 Printable Forms Free Online

House GOP Tax Plan Details Analysis Tax Foundation

US Payroll Tax Guide Puerto Rico

US Payroll Tax Guide Puerto Rico

Exploring Financial Havens The World s Lowest Tax Rate Countries

Montana Sales Tax Rate 2020 Say It One More Microblog Portrait Gallery

Proposed Bill Would Add New Income Tax Bracket In Nebraska

Nebraska State Tax Rate - [desc-13]