Nebraska Tax Return Extension Form 2023 Nebraska Individual Income Tax Return 01 2024 1040N Form 2023 Nebraska Schedules I II and III all three schedules are on one form I Nebraska Adjustments to Income for Nebraska Residents Nonresidents and Partial year Residents

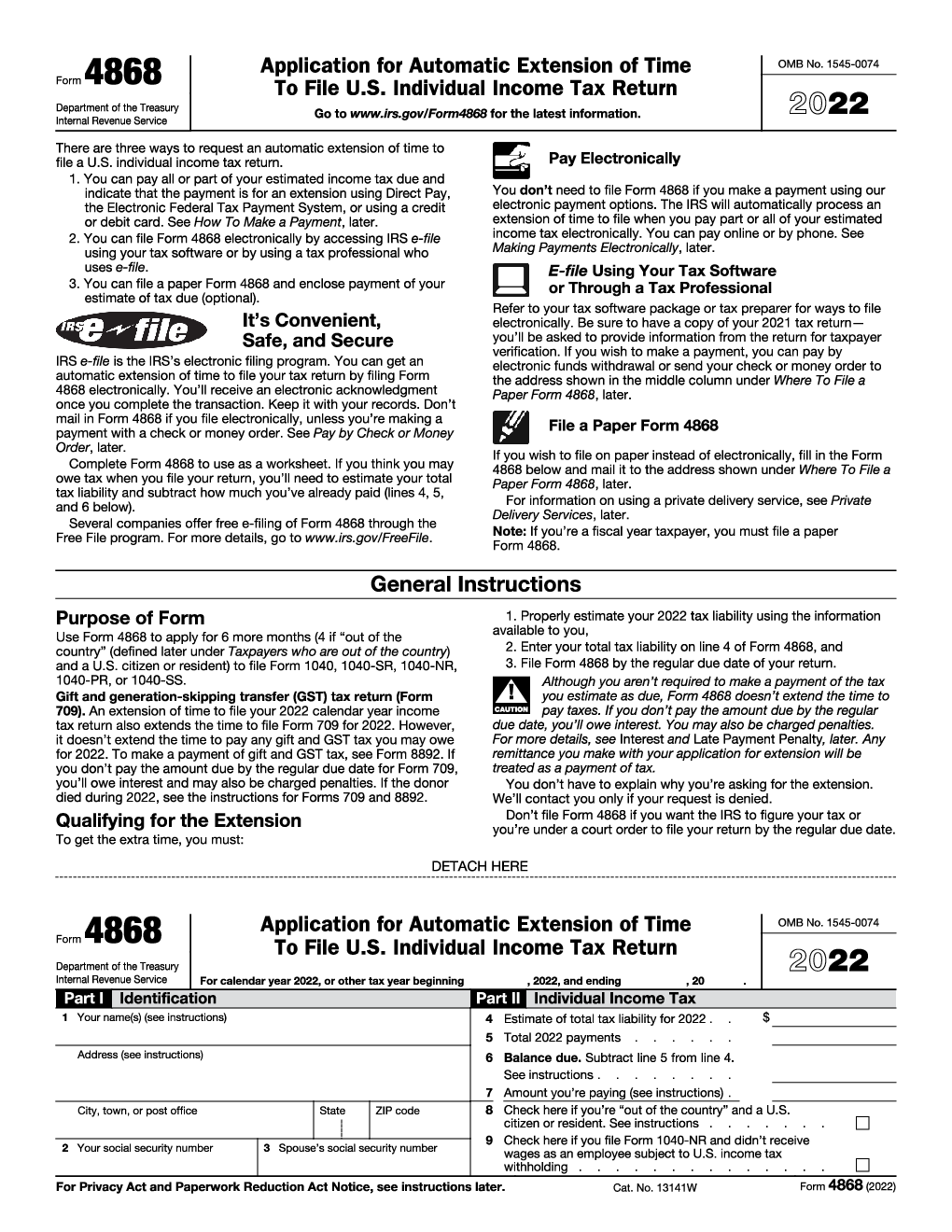

When you file your Nebraska income tax return if not e filing through a paid tax preparer you must Send a copy of the Application for Automatic Extension of Time to File Federal Form 4868 or Forms specific to the current tax year Property Assessment Forms for county officials homestead exemption car lines air carriers public service entities and railroads

Nebraska Tax Return Extension Form

Nebraska Tax Return Extension Form

https://www.taxslayer.com/blog/wp-content/uploads/2022/10/Filing-a-tax-extension-blog-main-scaled.jpg

How To File A FREE Tax Extension Form 4868 Complete Instructions

https://i.ytimg.com/vi/wBeAU2BKh2w/maxresdefault.jpg

How To File A Tax Extension ZenLedger

https://uploads-ssl.webflow.com/5f9a1900790900e2b7f25ba1/6254776336f3f437f693e6db_62547502a2486c6ddefbf6e3_personalTaxExtension.png

Unless you filed a timely Application for Automatic Extension of Time and filed the return prior to the expiration of that time the April 15 2024 deadline also applies to filing an amended return for the 2020 income tax year claiming a refund NebFile allows you to file a Form 1040N Schedule I and Schedule II with some limitations Use NebFile to e file your Nebraska resident income tax return for free and easily claim your property tax credit if applicable Nebraska Driver s License or State ID for e filing

Step 6 NEW THIS YEAR You must upload a complete copy of your federal return along with any supporting documentation to claim certain deductions and credits Step 7 File your tax return Your return has not been filed until you receive a reference number This form is not necessary if a federal extension has been filed and you are not making a payment or if the return is being e filed by a paid tax preparer See instructions below for additional information Please consider using the Nebraska Department of Revenue s DOR e pay program to make this payment It s fast secure and easy

Download Nebraska Tax Return Extension Form

More picture related to Nebraska Tax Return Extension Form

IRS Form 4868 Extension Printable 4868 Form 2023

https://irstax-forms.com/wp-content/uploads/2023/04/IRS-Form-4868-Extension-Printable1024_3.jpg

Nebraska Estimated Tax Form 2023 Printable Forms Free Online

https://www.incometaxpro.net/images/forms/2022/nebraska-tax-forms.png

Form 4868 For 2023 Printable Forms Free Online

https://www.incometaxpro.net/images/forms/2022/irs/form-4868.png

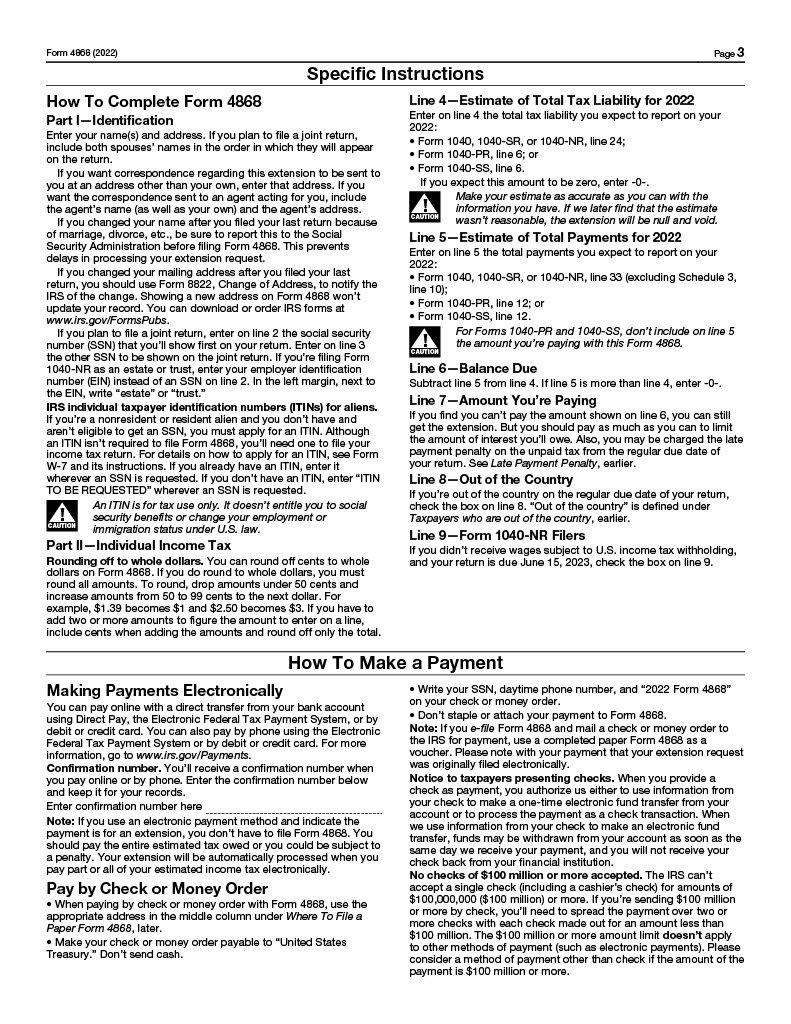

Use Form 4868N to file for an automatic 6 month extension in time to file your Nebraska income tax return We last updated the Nebraska Application for Extension of Time in January 2024 so this is the latest version of Form 4868N fully updated for tax year 2023 If you do not owe Nebraska income taxes or expect a tax refund by the tax deadline your accepted federal extension will be honored as a state extension and you do not have to mail in Form 4868N Owe Nebraska Taxes Option 1 Pay all or some of your Nebraska income taxes online via Nebraska s e pay

A six month extension may be obtained by Attaching a copy of a timely filed federal Form 4868 to the Nebraska return when filed To request a Nebraska tax extension use Form 4868N Nebraska Application for Automatic Extension of Time to File a Nebraska Individual Income Tax Return This form should also be used if you need to make a Nebraska extension payment

Tax Form For Seniors 2023 Printable Forms Free Online

https://www.southbendtribune.com/gcdn/presto/2023/02/01/NSBT/a3d2debe-ae3d-4823-b41f-65dd2a61395e-1040Form2022.jpg

Tax Deadline 2024 Extension Form Helli Emelyne

https://m.foolcdn.com/media/affiliates/images/Business_Tax_Extension_-_02_-_Form_7004_Part_O.width-750.png

https://revenue.nebraska.gov/about/forms/...

2023 Nebraska Individual Income Tax Return 01 2024 1040N Form 2023 Nebraska Schedules I II and III all three schedules are on one form I Nebraska Adjustments to Income for Nebraska Residents Nonresidents and Partial year Residents

https://revenue.nebraska.gov/sites/revenue...

When you file your Nebraska income tax return if not e filing through a paid tax preparer you must Send a copy of the Application for Automatic Extension of Time to File Federal Form 4868 or

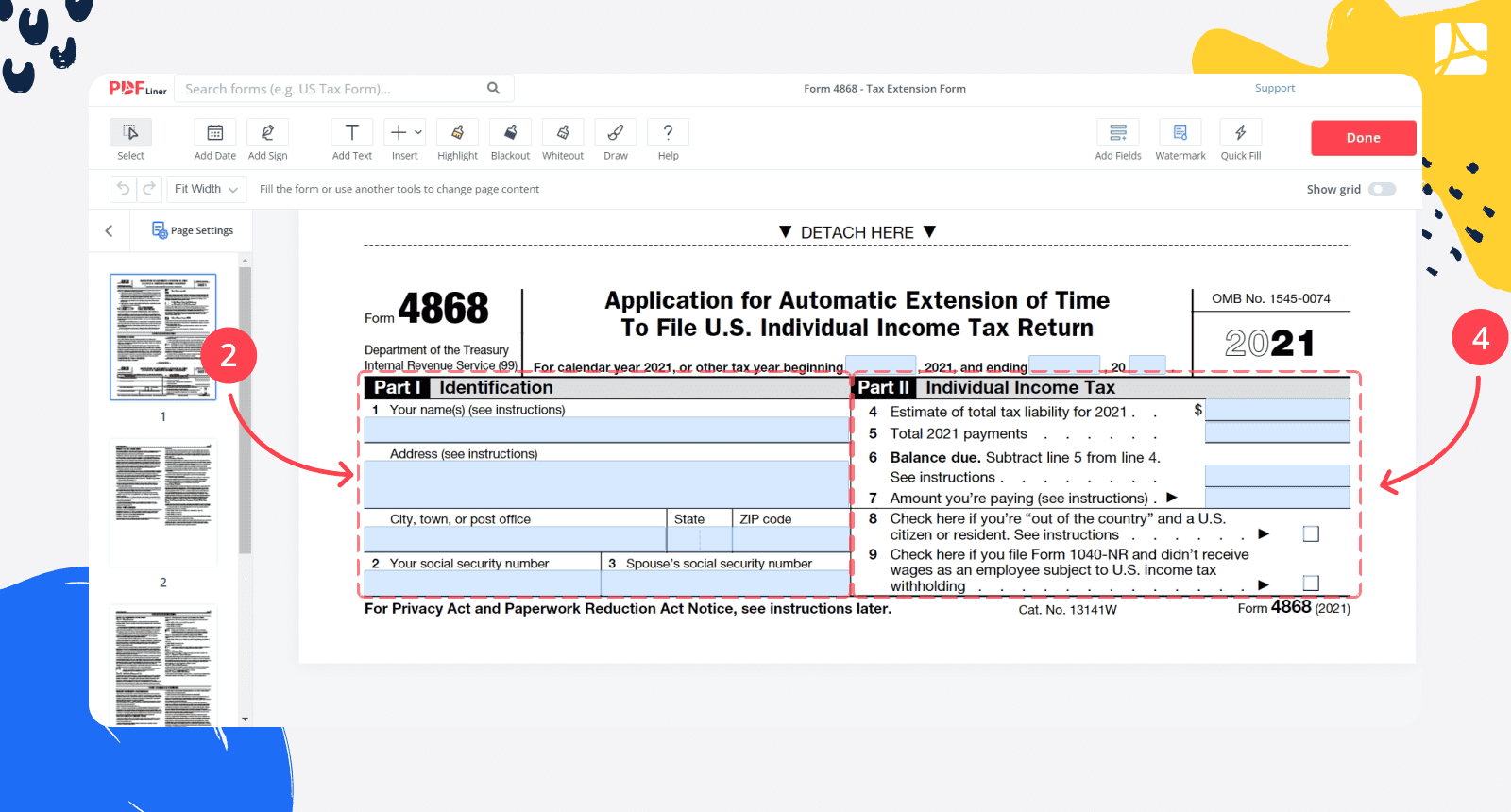

IRS Form 4868 2023 Application For Automatic Tax Extension PDFliner

Tax Form For Seniors 2023 Printable Forms Free Online

Nebraska State Income Tax Fill Out Sign Online DocHub

Nebraska Sales Tax Form Fill Out Printable PDF Forms Online

Are You Getting The Most Money Out Of Your Nebraska Tax Return This Year

Tax Extention Form 2023 Printable Forms Free Online

Tax Extention Form 2023 Printable Forms Free Online

IRS Form 4868 Application For Automatic Extension Of Time To File U S

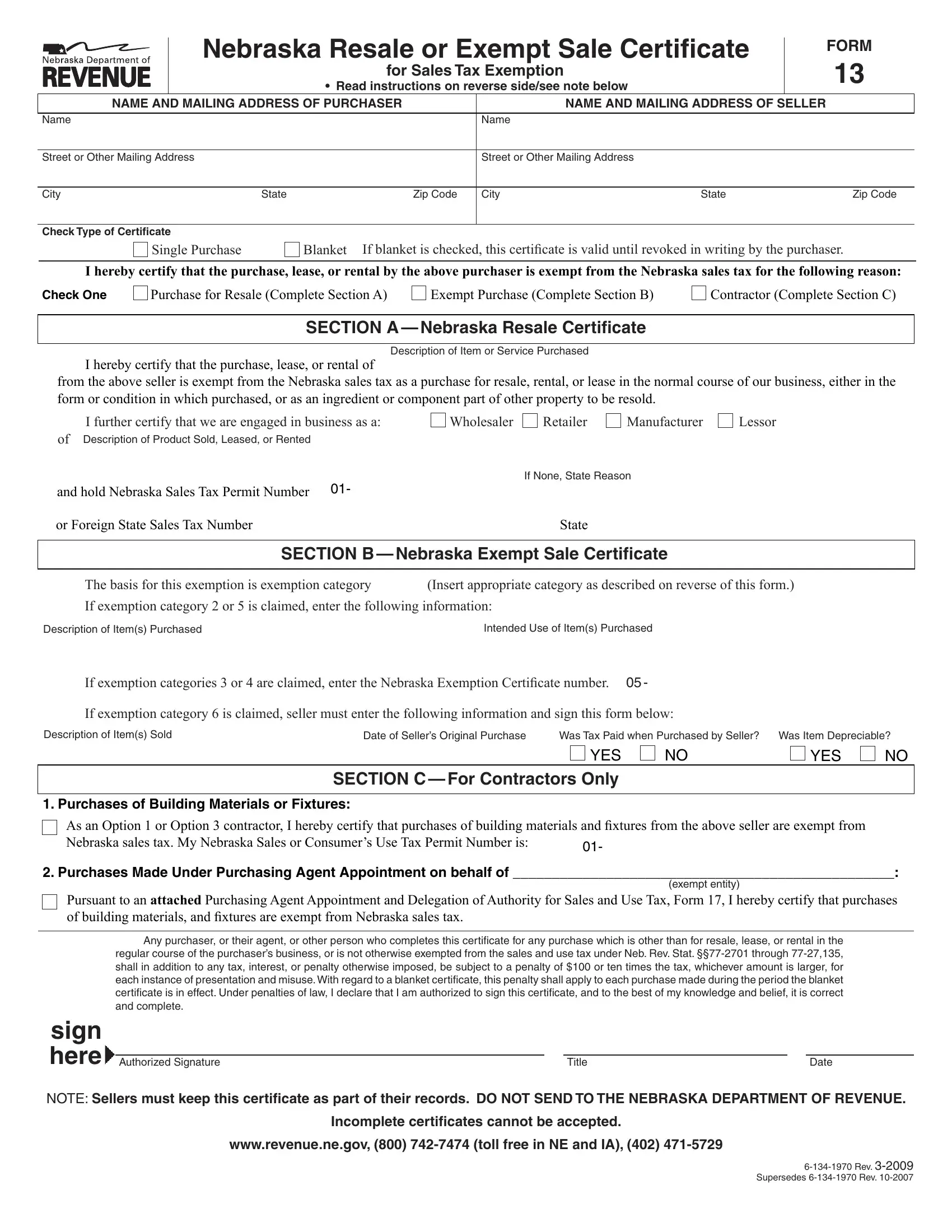

Form 13 Download Fillable PDF Or Fill Online Nebraska Resale Or Exempt

How Far Back Does The Irs Go To Collect Back Taxes Scared Portal Ajax

Nebraska Tax Return Extension Form - Check to see if you qualify and the due date of your return E file Your Extension Form for Free Individual tax filers regardless of income can use IRS Free File to electronically request an automatic tax filing extension Filing this form gives you until October 15 to file a return