Netherlands Tax Rebate Web A tax rebate is a reimbursement of taxes paid or owed to the government A number of expenses you incurred as a tax payer qualify as a tax rebate You can get it refunded by

Web If you have visited the Netherlands and done a lot of shopping you may be eligible for a tax VAT refund The tax refund partners at Schiphol will help you arrange this quickly and easily You can find out how below Web 30 juin 2023 nbsp 0183 32 Levy rebates Resident partial non resident and qualifying non resident taxpayers are entitled to so called levy rebates Except for the general levy rebate

Netherlands Tax Rebate

Netherlands Tax Rebate

https://lh3.googleusercontent.com/h127DHtpaAJcxG29v6ZNYZY2GnQ5gl-qKYK3ovi5TtS1g1r_WJgAZQS4J74Brg7MvX86QCPI36b478kf7B2Hp9YEQT1dojn7YiRnhfinaN8NfPb5AYBEs-IHoOXlpCD8k_o2w_j9R5aV7A82dLJu7EA1ekFyfmfGKyRvP4h1NozT3EKNLsT7ZXGU_Oa7exLgWslioeFSv5vSut7J1qUBHhz4UhBiv9-kTBc9l0PdPktiiXC5doyp3B2t9rQucMfy2Rpm1e05YNCpETMqIKX15tXJsilT2npkE4t4MwaGj6Lp-Vj2icm19-ELLgLx7zbDnMCxHN4GudnULi3hApenHDu4Y8LOUjrhVcfNXfaqFWlO_4iT4-jcJ-BLtvCBtZgW67eZbXMUcHvgwMIudFjdJ7tEiNRFLu2ziMmJM7-Y_fw9bI2v6JCDOnv1GoHZEPEdBQWRi-dSyM-QaxJE2iTD8RhJzxhP8I1y8MXc9I5TRrv5QLwmderAw-TbH6EnFDkkPCbur31XFHmULvFti1vgLChC4K0EzRrcMQft2aKl6r9iz6aCbSzyJwbmGCUuOtKg3SneAK5pEb55V2lqActsikC3Hq6U_DU0ey3HgYHTlOhxB9egIZhRsMh2k7GIpWSPNhAQ0oWPL1eyBQ4g36o7dgG1WpvnZS4GfzAchd38x34=w1149-h285-no

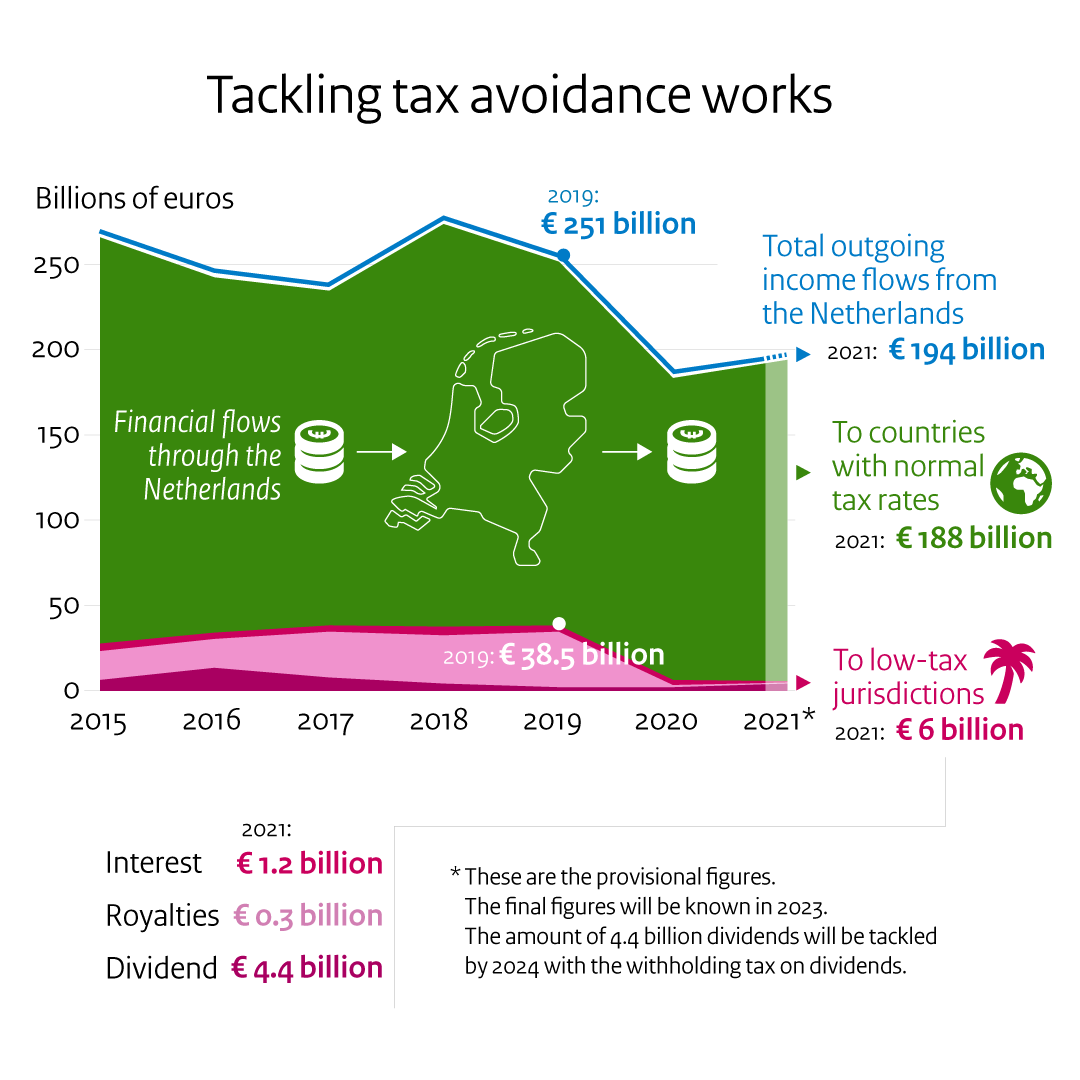

The Netherlands Tax Haven Infographic Tax Justice Network

https://taxjustice.net/wp-content/uploads/2020/07/Netherlands-Tax-Haven-Infographic-1.jpg

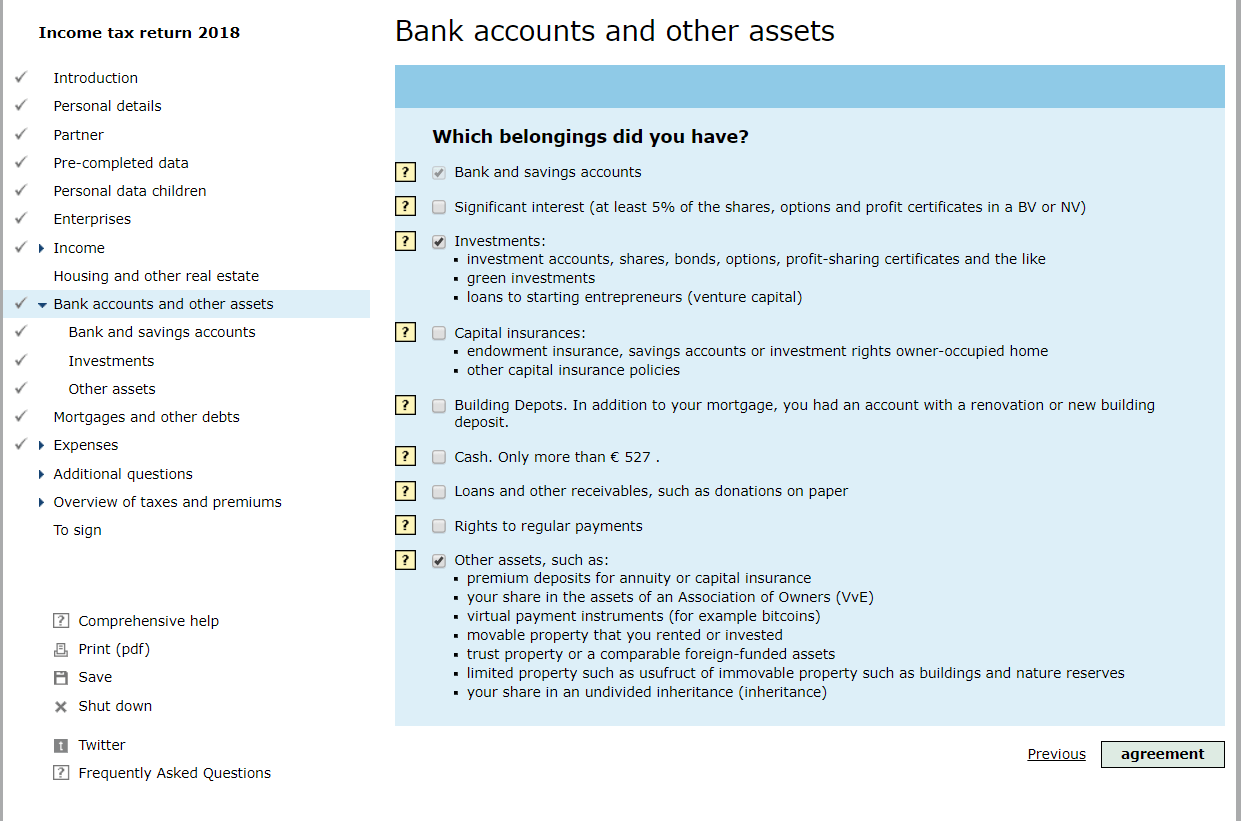

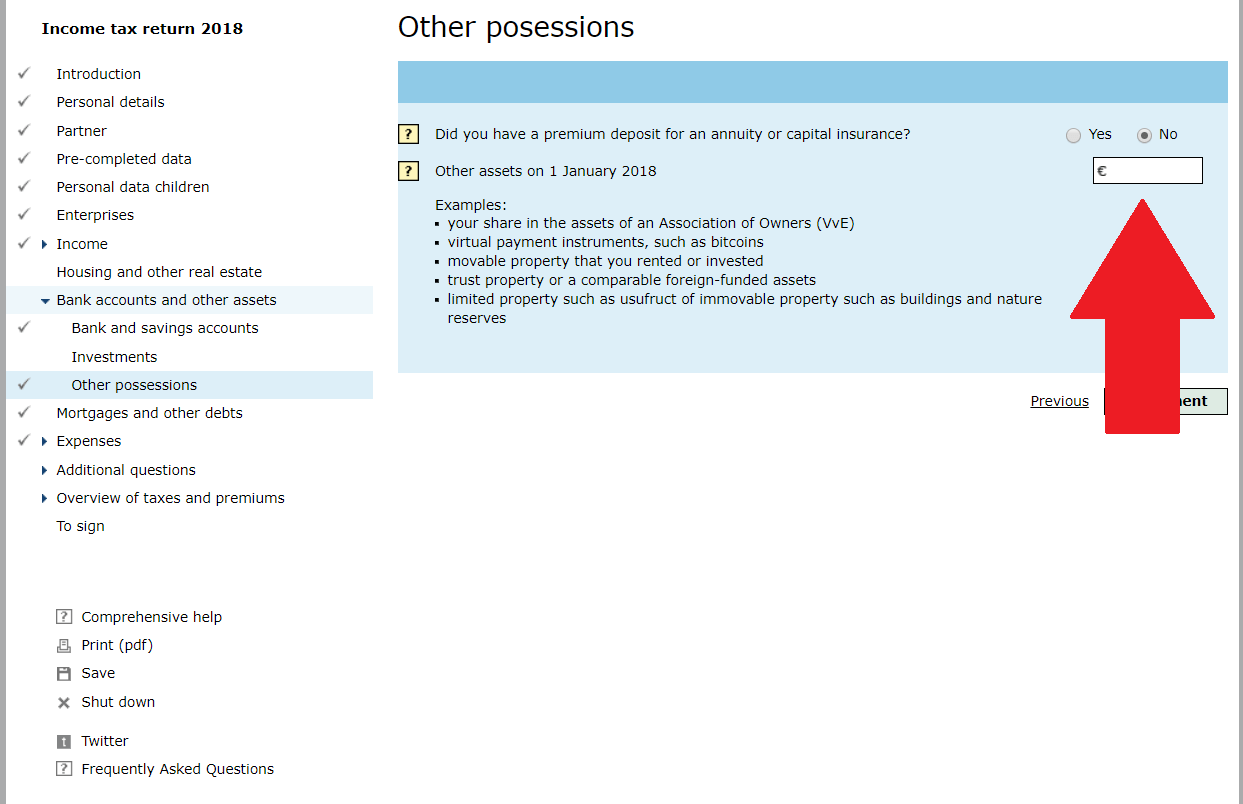

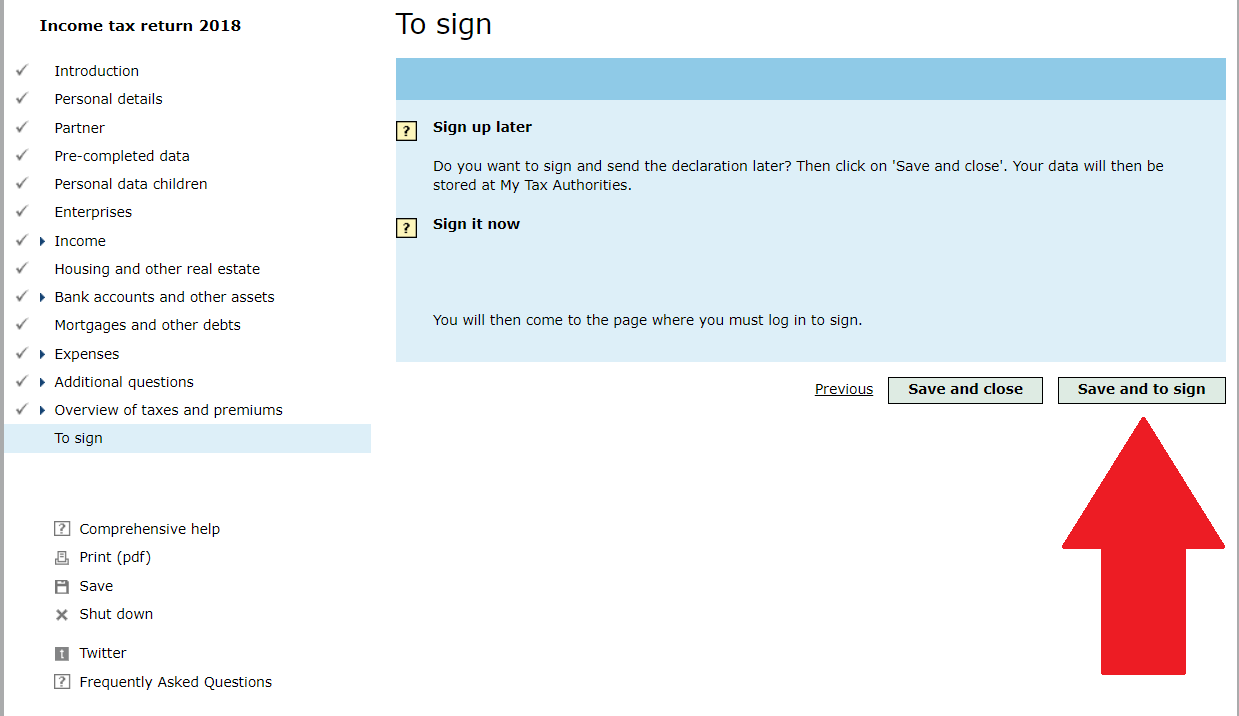

Netherlands File Your Tax Returns In 3 Steps MonkWealth

https://monkwealth.com/wp-content/uploads/2019/03/04-Assets.png

Web The income related combination tax credit is intended for parents living and working in the Netherlands who are caring for a child under 12 The amount of the credit is linked to Web If you are a resident taxpayer in the Netherlands you may receive not only the contribution component but also the amount of the reduction on income tax Check which situation

Web 14 juil 2023 nbsp 0183 32 For more information on sales tax in the Netherlands visit the Belastingdienst Can you get a refund on VAT Some tourists and visitors may be Web 3 ao 251 t 2023 nbsp 0183 32 What is the Dutch 30 ruling The 30 ruling is a Dutch tax exemption for employees who were hired abroad to work in the Netherlands If your situation meets various conditions your employer

Download Netherlands Tax Rebate

More picture related to Netherlands Tax Rebate

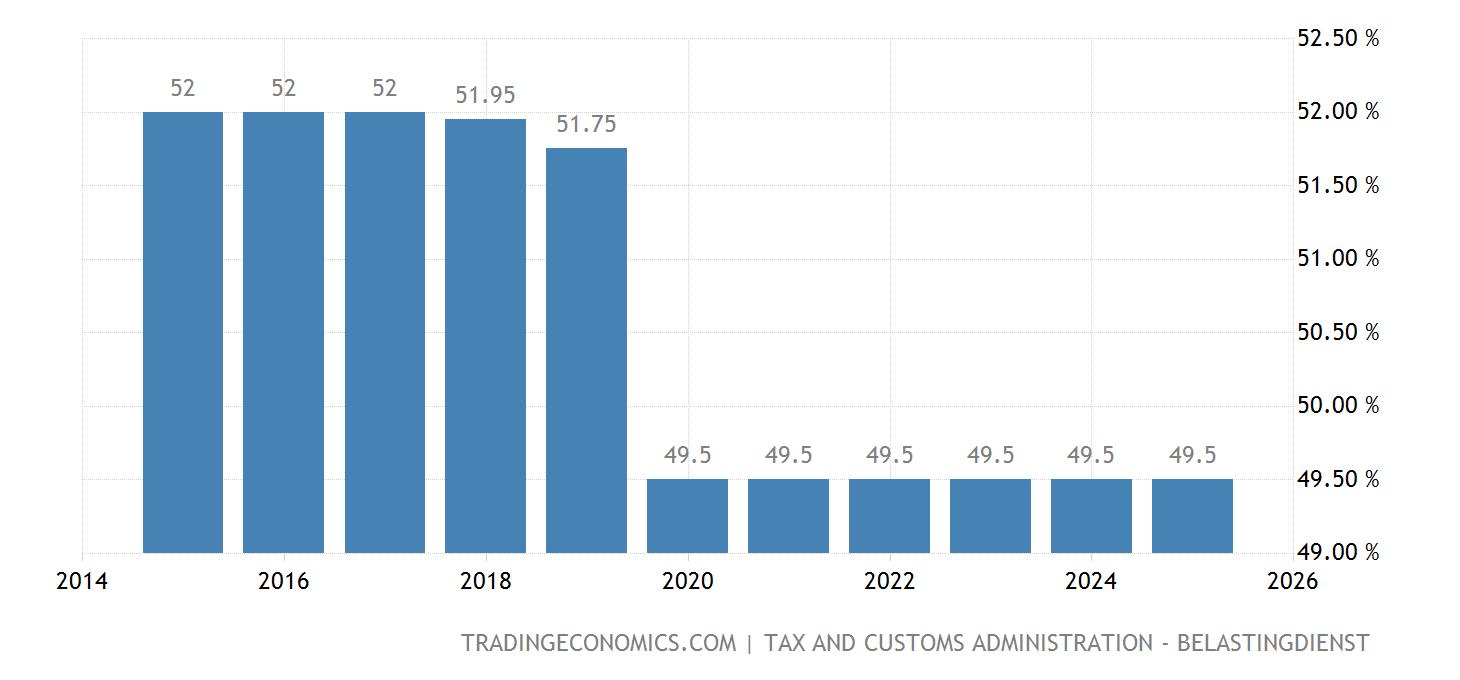

Netherlands Corporate Tax Rate 2022 Take profit

https://img.take-profit.org/graphs/indicators/corporate-tax-rate/corporate-tax-rate-netherlands.png

Netherlands Personal Income Tax Rate 2022 Data 2023 Forecast

https://d3fy651gv2fhd3.cloudfront.net/charts/[email protected]?s=nldirstax&v=202210240929V20220312

Netherlands File Your Tax Returns In 3 Steps MonkWealth

http://monkwealth.com/wp-content/uploads/2019/03/08-No-Box3-Tax.png

Web you have received income from the Netherlands over which you have paid an insufficient amount of tax or no tax at all The amount of tax payable is at least 45 If you think you Web 3 janv 2022 nbsp 0183 32 Apply for a tax credit getting paid to lowest earning partner If you live in the Netherlands and pay tax on your income you are entitled to a tax credit In some

Web Residents of third countries not being the Netherlands and not being circle of countries are not entitled to the tax part of the labor rebate Payroll administration and payroll tax Web Tax return Preventing tax evasion abroad by private individuals Expat tax break to be shortened News Documents If you live in the Netherlands or receive income from the

Netherlands Corporate Tax YouTube

https://i.ytimg.com/vi/W2ZNZsKH4rI/maxresdefault.jpg

Netherlands File Your Tax Returns In 3 Steps MonkWealth

https://monkwealth.com/wp-content/uploads/2019/03/07-Sign.png

https://www.blueumbrella.nl/faq/income-tax/tax-rebates

Web A tax rebate is a reimbursement of taxes paid or owed to the government A number of expenses you incurred as a tax payer qualify as a tax rebate You can get it refunded by

https://www.schiphol.nl/en/at-schiphol/service…

Web If you have visited the Netherlands and done a lot of shopping you may be eligible for a tax VAT refund The tax refund partners at Schiphol will help you arrange this quickly and easily You can find out how below

Tax Avoidance Via The Netherlands Significantly Reduced Thanks To

Netherlands Corporate Tax YouTube

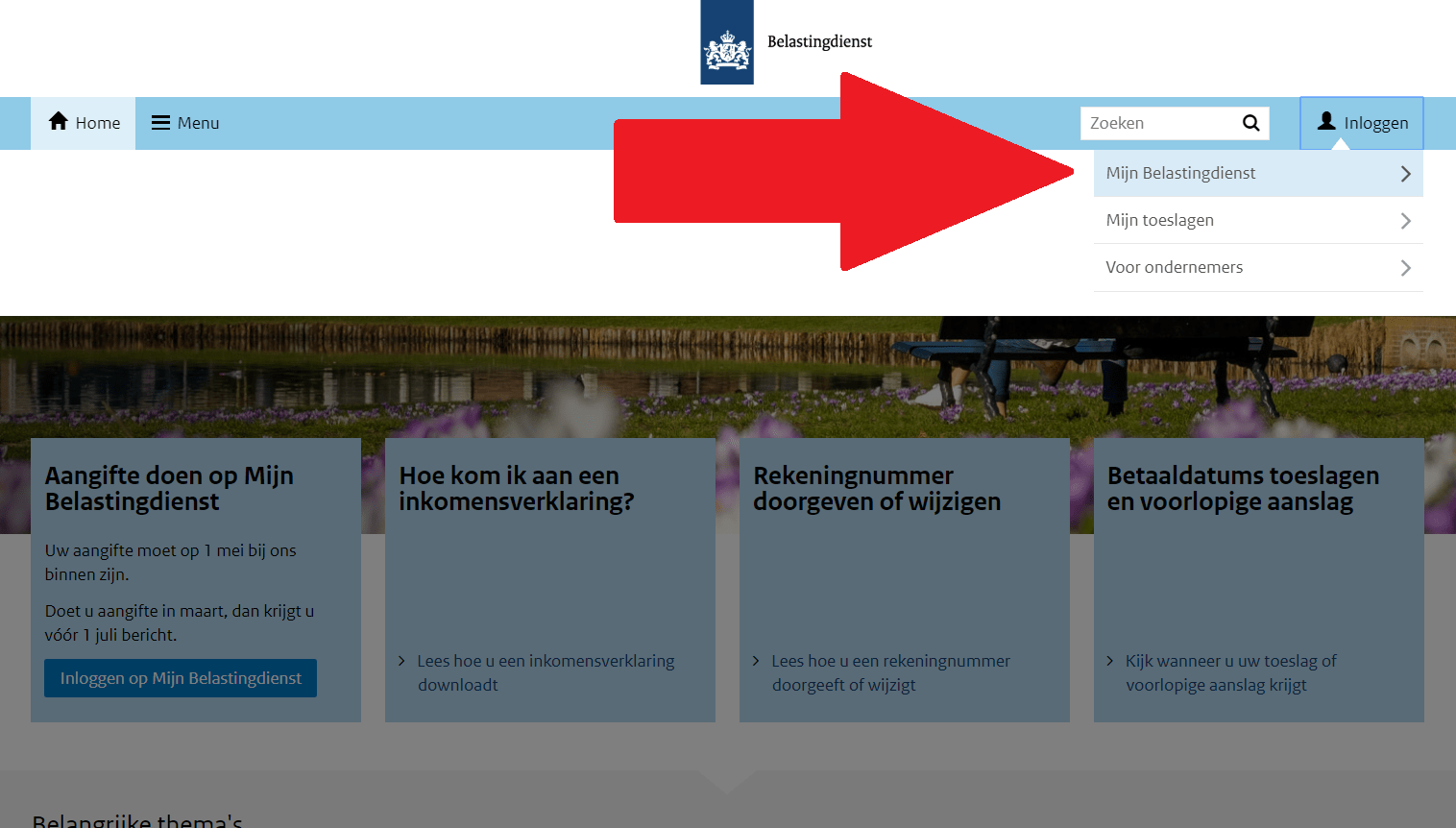

How To Apply Tax Refund In Netherlands As Expats Dutch Tax

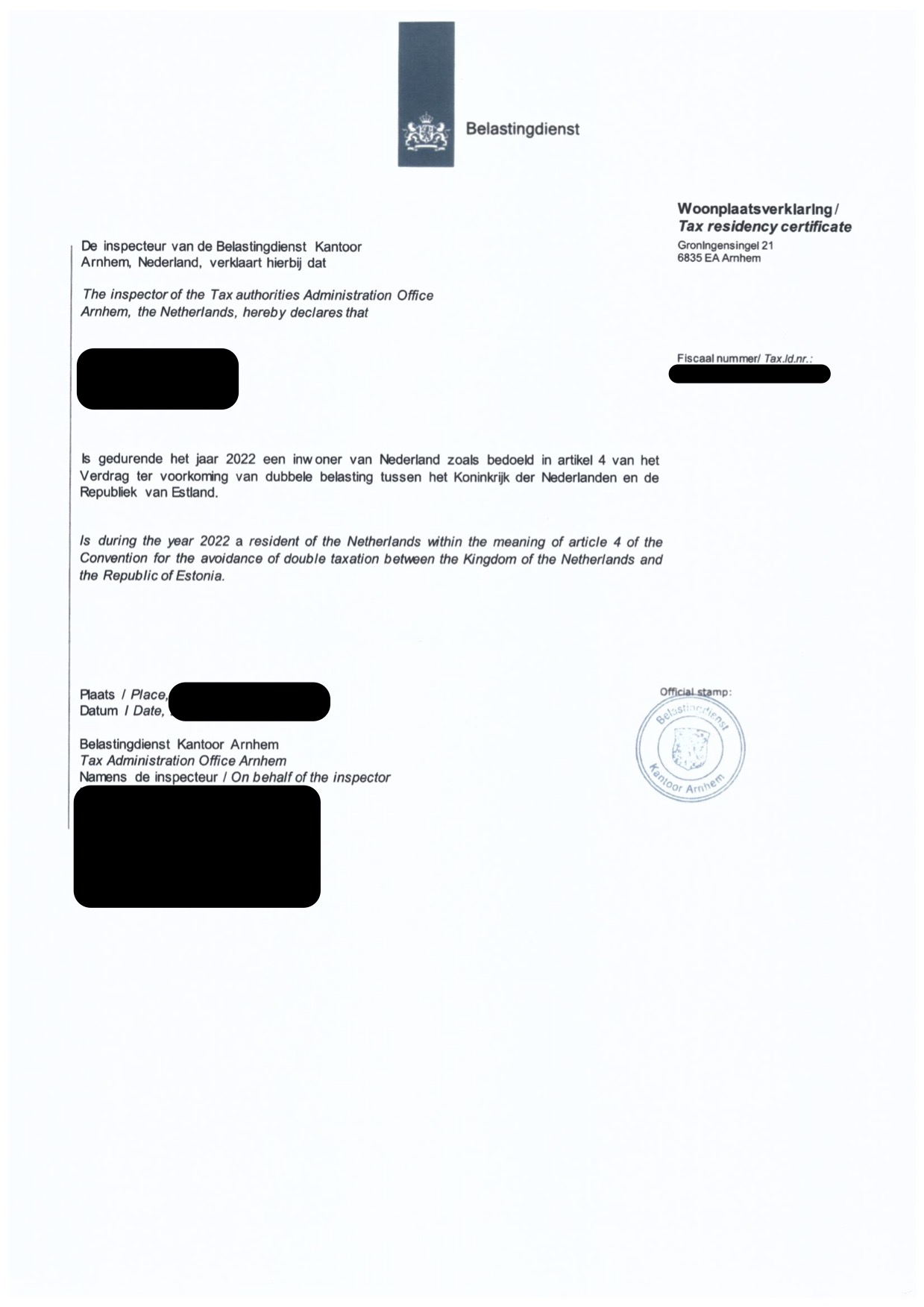

All You Should Know About Tax Residency Certificates Crowdestate

The Netherlands To Introduce Withholding Tax On Dividends Taxlinked

2007 Tax Rebate Tax Deduction Rebates

2007 Tax Rebate Tax Deduction Rebates

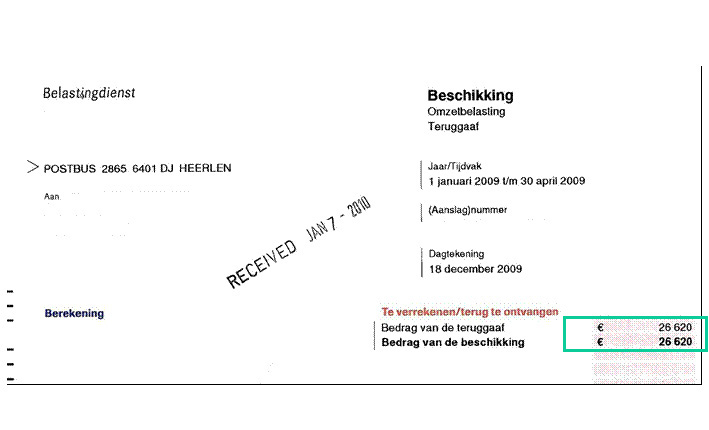

VAT Refund Samples INSATAX VAT Value Added Tax Refund Specialists

Netherlands File Your Tax Returns In 3 Steps MonkWealth

Netherlands Global Payroll Tax Information Guide Payslip

Netherlands Tax Rebate - Web 14 juil 2023 nbsp 0183 32 For more information on sales tax in the Netherlands visit the Belastingdienst Can you get a refund on VAT Some tourists and visitors may be