Nevada Sales Tax Exemption Certificate Expiration Certificate of Exemption Instructions Use this form to claim exemption from sales tax on purchases of otherwise taxable items The purchaser must complete all fields on the exemption certificate and provide the fully completed certificate to the

4 Purchaser s Type of business Circle the number that best describes your business 5 Reason for exemption Circle the letter that identifies the reason for the exemption Religious organization 6 I declare that the information on this certificate is correct and complete to the best of my knowledge and belief How long is my Nevada sales tax exemption certificate good for The exemption certificates are valid for five years Can I use a blanket resale exemption certificate in Nevada

Nevada Sales Tax Exemption Certificate Expiration

Nevada Sales Tax Exemption Certificate Expiration

https://i2.wp.com/prosecution2012.com/wp-content/uploads/2021/05/north-carolina-state-sales-tax-exemption-certificate.jpg

Wisconsin Sales And Use Tax Exemption Certificate Instructions

https://i2.wp.com/prosecution2012.com/wp-content/uploads/2021/05/wisconsin-sales-and-use-tax-exemption-certificate-instructions.jpg

Alabama Sales Tax Exemption Certificate Rules Prosecution2012

https://i2.wp.com/prosecution2012.com/wp-content/uploads/2021/04/alabama-sales-tax-exemption-certificate-rules.jpg

SSTGB Form F0003 Exemption Certificate Revised 5 10 2017 for use 1 1 2018 A Federal government qualify to claim exemption from tax in the state that would otherwise be due tax on this sale The seller may be required to Nevada has a unique definition for Exempt organizations and not all 501 c 3 organizations quality 3 Expiration dates and renewal procedures for sales tax exemption certificates vary by state by situation and in some cases by the type of certificate Some sales tax exemption certificates are intended to last as long as there s a business relationship between the buyer and the seller provided the information is accurate and

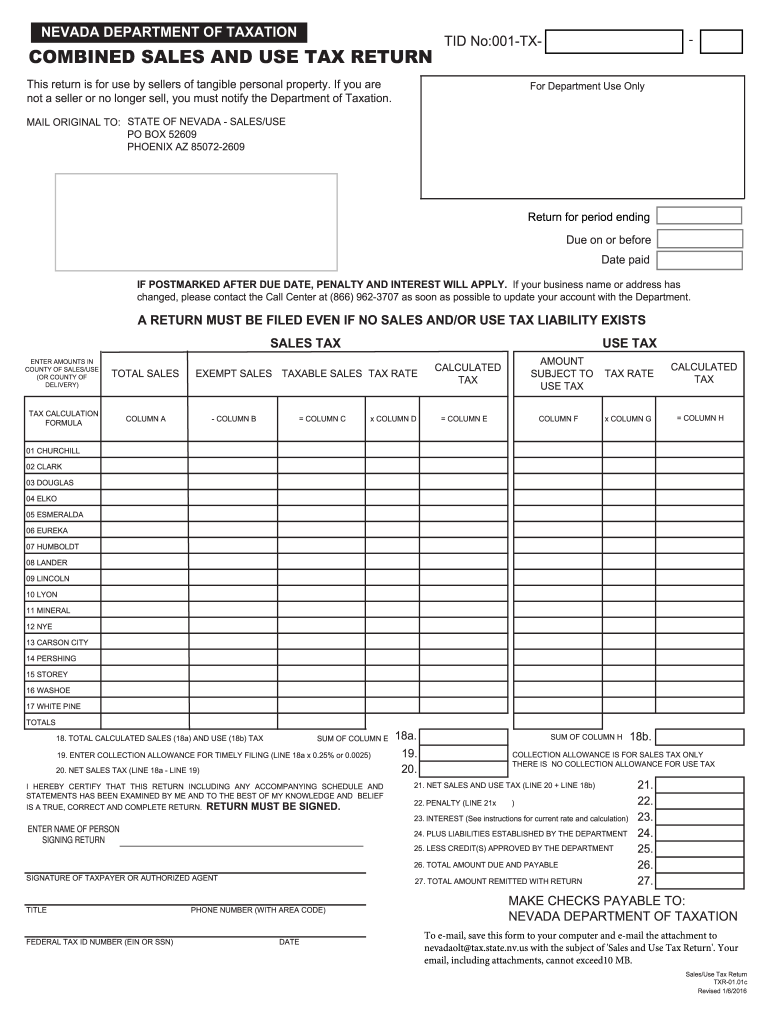

This Form includes the required information with instructions to cancel your account and refund any security deposit or credits to which you may be entitled For any other account updates including location changes contact the Call Center 1 866 962 3707 This is the standard monthly or quarterly Sales and Use Tax return used by retailers Effective January 1 2020 the Clark County sales and use tax rate increased to 8 375 This is an increase of 1 8 of 1 percent on the

Download Nevada Sales Tax Exemption Certificate Expiration

More picture related to Nevada Sales Tax Exemption Certificate Expiration

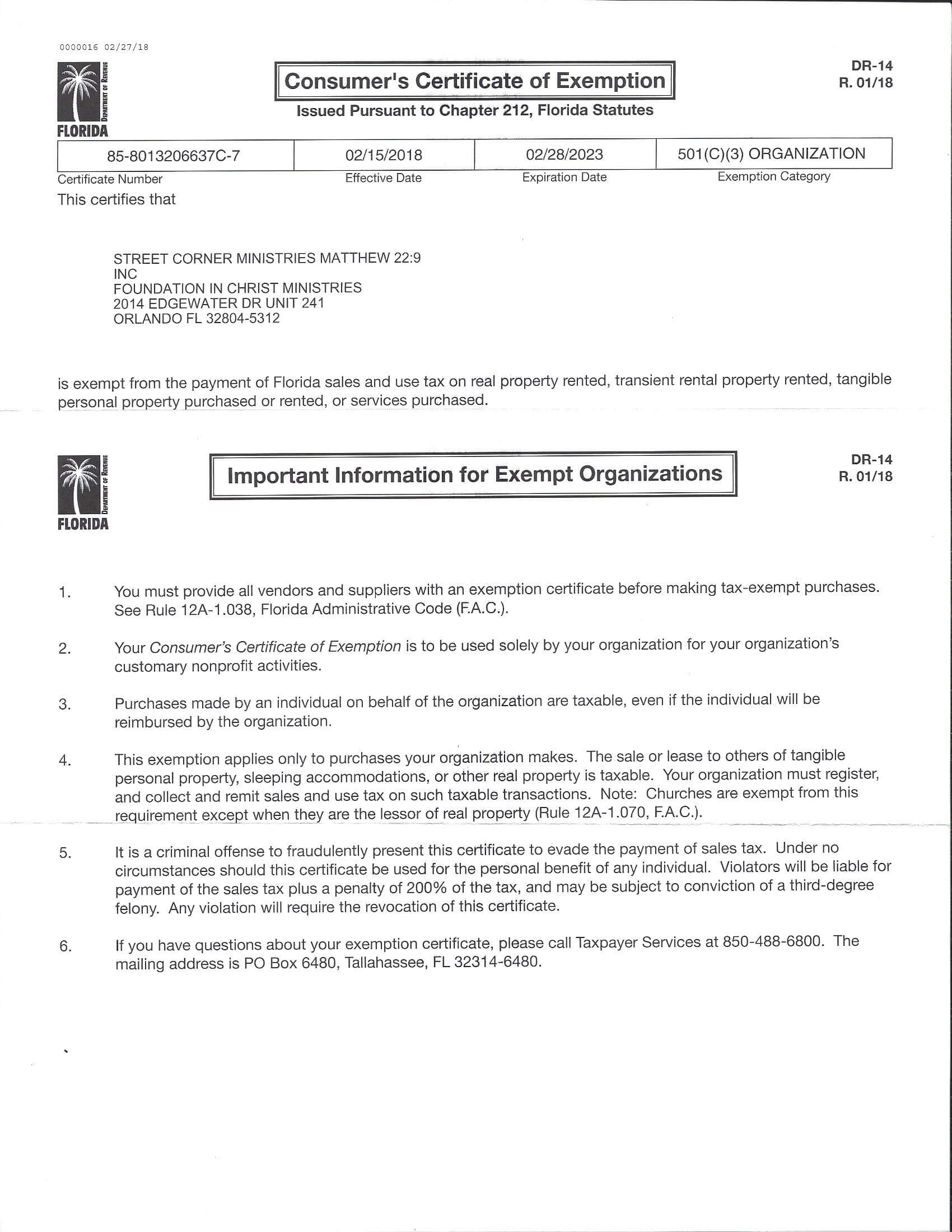

Florida Sales Tax Exemption Certificate Foundation In Christ Ministries

https://eoqsmt5wite.exactdn.com/wp-content/uploads/FL-Sales-Tax-Exemption-Certificate.jpg?strip=all&lossy=1&w=2560&ssl=1

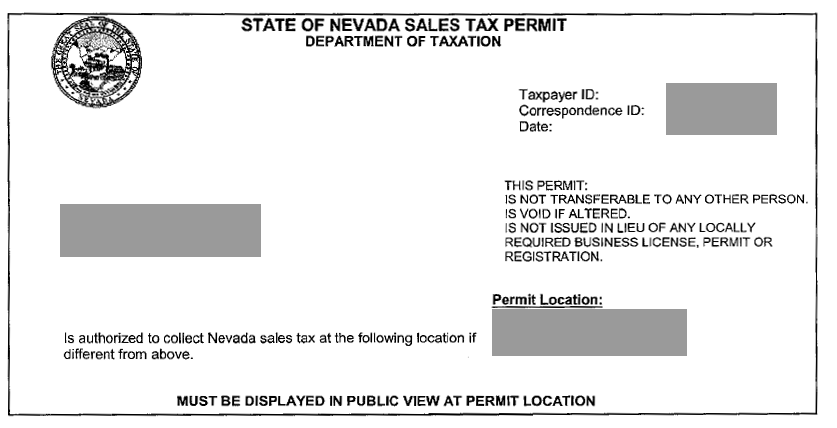

State Sales Tax State Sales Tax Permit

http://cdn.bstocksolutions.com/007550/images/certs/Nevada.png

State Of Nevada Cert Auth Dept Of Taxation

https://cdn.slidesharecdn.com/ss_thumbnails/stateofnevadacert-160228165611-thumbnail-4.jpg?cb=1456678614

Some customers are exempt from paying sales tax under Nevada law Examples include government agencies some nonprofit organizations and merchants purchasing goods for resale Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Nevada sales tax You can download a PDF of the Nevada Streamlined Sales Tax Certificate of Exemption Multistate Form SST MULTI on this page For other Nevada sales tax exemption certificates go here

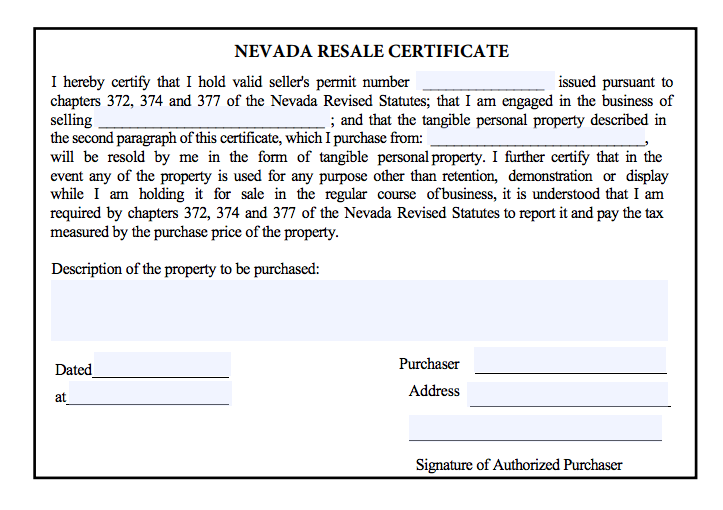

A Nevada resale certificate is a signed document that permits retailers and wholesalers to purchase items for resale without paying sales tax It also allows manufacturers to purchase raw ingredients or elements used to create a new product for sale without being subject to sales tax Gail Cole Dec 14 2023 Expiration dates for sales tax exemption certificates vary by state by situation and in some cases by the type of certificate Some sales tax exemption certificates are good for a year or two or four Other exemption certificates remain valid for as long as the information they contain is accurate and up to date

Illinois Tax Exempt Certificate Five Mile House

https://images.squarespace-cdn.com/content/v1/58cf3fa8e6f2e19aff948d4c/1593946918567-M3LZJC3J24BR72W9BKW6/Sales+Tax+Certificate.jpg?format=2500w

State Of Alabama Tax Exempt Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/alabama-state-sales-and-use-tax-certificate-of-exemption-form-ste-1-11.png

https://tax.nv.gov/uploadedFiles/taxnvgov/Content/...

Certificate of Exemption Instructions Use this form to claim exemption from sales tax on purchases of otherwise taxable items The purchaser must complete all fields on the exemption certificate and provide the fully completed certificate to the

https://tax.nv.gov/uploadedFiles/taxnvgov/Content/...

4 Purchaser s Type of business Circle the number that best describes your business 5 Reason for exemption Circle the letter that identifies the reason for the exemption Religious organization 6 I declare that the information on this certificate is correct and complete to the best of my knowledge and belief

Nevada State Withholding Tax Form WithholdingForm

Illinois Tax Exempt Certificate Five Mile House

Wisconsin Sales And Use Tax Exemption Certificate Fillable

Kansas Sales Tax Exemption Certificate Expiration

3372 2021 2024 Form Fill Out And Sign Printable PDF Template

Uniform Sales And Use Tax Certificate Multijurisdiction 2023 Fill Out

Uniform Sales And Use Tax Certificate Multijurisdiction 2023 Fill Out

Nevada Sales Tax Exemption Certificate Form ExemptForm

Save Time And Money On Sales Tax Exemption Certificate And Lattice

Verify Alabama Sales Tax Exemption Certificate Prosecution2012

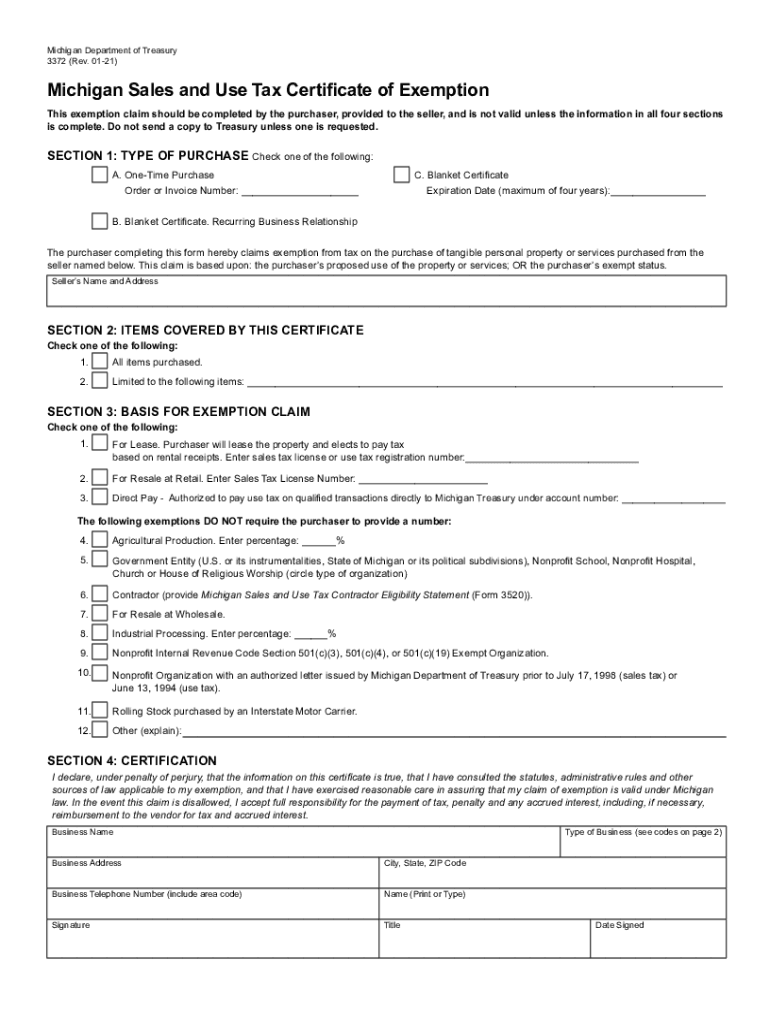

Nevada Sales Tax Exemption Certificate Expiration - Accepted exemption forms Sales tax resale and exemption certificate Form 3372 Donated motor vehicle exemption Form 4288 Data center exemption 5726 SST Certificate of Exemption Statute of limitations 4 years from the due date or filing date whichever is later