Nevada State Tax Rate 31 rowsThe state sales tax rate in Nevada is 6 850 With local taxes

111 rows7 957 Nevada has state sales tax of 4 6 and allows local Learn how much tax you may pay in Nevada based on your income filing status and other factors Find out the state s sales tax property tax corporate income tax and estate tax

Nevada State Tax Rate

Nevada State Tax Rate

https://foreignusa.com/wp-content/uploads/nevada-income-tax-rate.png

Las Vegas Sales Tax Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/0/159/159985/large.png

Las Vegas Nevada State Sales Tax Rate 2019 Paul Smith

https://andyarthur.org/data/map_016397_large.png

Nevada has no state income tax but collects sales tax and property tax instead Use the free calculator to estimate your Federal and Nevada income taxes for 2024 This also includes an alphabetical list of Nevada cities and counties to help you determine the correct tax rate 8 375 Tax Rate Sheet For use in Clark County

Find the current sales tax rate for any address in Nevada using the lookup tool or the calculator Learn about the base state rate local rates exemptions and registration The Nevada state sales tax rate is 6 85 and the average NV sales tax after local surtaxes is 7 94 Groceries and prescription drugs are exempt from the Nevada sales tax

Download Nevada State Tax Rate

More picture related to Nevada State Tax Rate

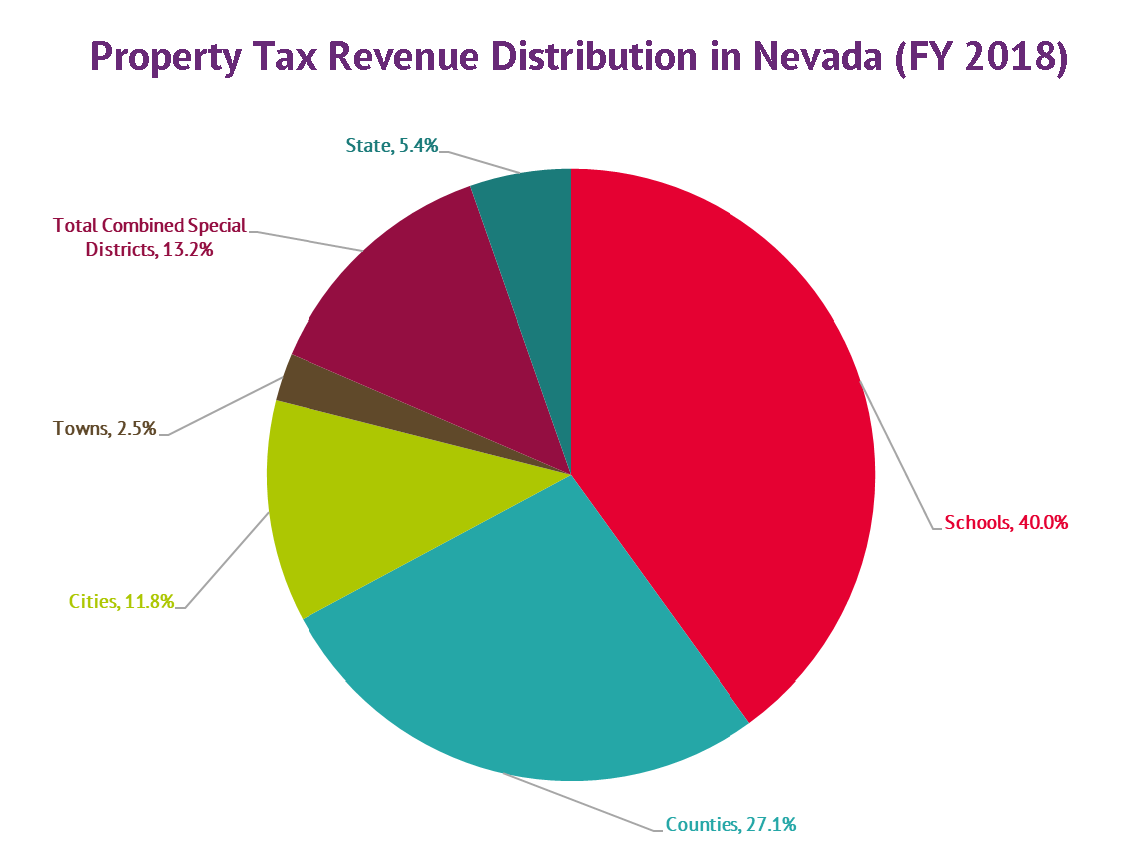

Property Taxes K 12 Financing In Nevada Guinn Center For Policy

https://guinncenter.org/wp-content/uploads/2019/02/fig2a.png

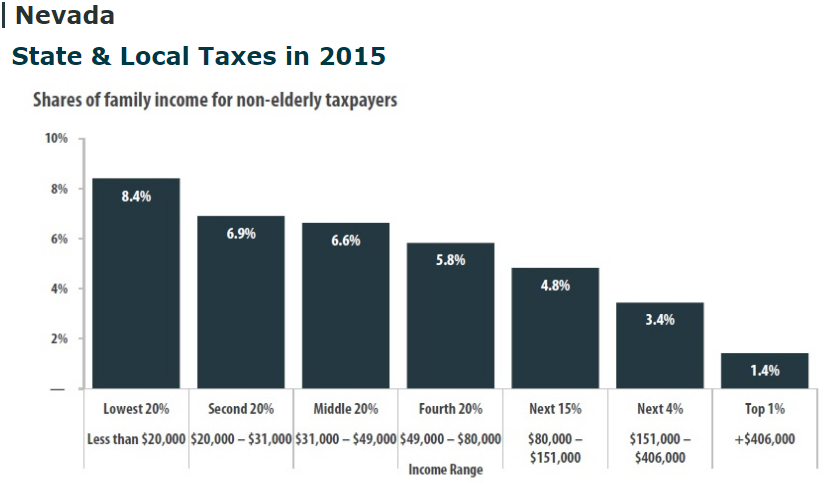

Nevada State And Local Taxes In 2015 Tax Credits For Workers And Families

https://www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2016/08/Capture-14.png

Property Taxes In Nevada Guinn Center For Policy Priorities

https://guinncenter.org/wp-content/uploads/2017/05/Slide1.jpg

Net amount 0 00 What is the sales tax rate in Nevada How much is sales tax in Nevada The base state sales tax rate in Nevada is 4 6 Local tax rates in Nevada range from Nevada first adopted a general state sales tax in 1955 and since that time the rate has risen to 4 6 percent On top of the state sales tax there may be one or more local sales

Nevada has a state sales tax rate of 6 85 Localities can add as much as 1 38 and the average combined rate is 8 23 according to the Tax Foundation Groceries Exempt Clothing Taxable Federal EITC in 2022 Federal Retirement Plan Thresholds in 2022 Alternate Tax Years Related Calculators 2022 FlexiTax Calculator 2022 Salary Calculator 2022 Income

New York State Taxes What You Need To Know Russell Investments

https://russellinvestments.com/-/media/images/us/blogs/images/kuharicny_july19_1.jpg?la=en&hash=EAFF36450E83624757D71C655AB69D67CECD684B

Tax Payment Which States Have No Income Tax Marca

https://phantom-marca.unidadeditorial.es/7f630bcfa3cc4f2b33db1ffa28dd66ab/resize/1200/f/jpg/assets/multimedia/imagenes/2023/02/05/16756118713316.jpg

https://www.sale-tax.com/Nevada

31 rowsThe state sales tax rate in Nevada is 6 850 With local taxes

https://www.salestaxhandbook.com/nevada/r…

111 rows7 957 Nevada has state sales tax of 4 6 and allows local

Nevada Income Tax Brackets 2024

New York State Taxes What You Need To Know Russell Investments

Nevada State Sales Tax Form 2020 Paul Smith

Sales Tax Rates In Nevada By County Semashow

Property Taxes In Nevada Guinn Center For Policy Priorities

Nevada Budget Overview 2019 2021 Guinn Center For Policy Priorities

Nevada Budget Overview 2019 2021 Guinn Center For Policy Priorities

Sales Tax By State 2023 Wisevoter

Las Vegas Nevada State Sales Tax Rate 2019 Paul Smith

State Individual Income Tax Rates Tax Policy Center

Nevada State Tax Rate - The Nevada state sales tax rate is 6 85 and the average NV sales tax after local surtaxes is 7 94 Groceries and prescription drugs are exempt from the Nevada sales tax