Nevada Use Tax Exemptions Consumer Use Tax ensures that purchases made outside of Nevada do not unfairly compete with in state retailers who are required to collect sales tax Consumer Use Tax

There are exempted from the taxes imposed by this chapter the gross receipts from occasional sales of tangible personal property and the storage use or other Consumer use tax applies to property bought outside of Nevada without paying sales tax which is then used stored or consumed in Nevada This includes purchases made through mail order out of state retailers toll

Nevada Use Tax Exemptions

Nevada Use Tax Exemptions

https://i.ytimg.com/vi/afrTmeYMODw/maxresdefault.jpg

Which States Offer Disabled Veteran Property Tax Exemptions Military

https://www.military.net/wp-content/uploads/2023/09/state-property-tax-exemptions-veterans-1024x576.jpg

Income Tax ShareChat Photos And Videos

https://cdn.sharechat.com/2b0d0eef_1588734670621.jpeg

Some goods are exempt from sales tax under Nevada law Examples include most non prepared food items newspapers and some farming equipment We recommend What purchases are exempt from the Nevada sales tax While the Nevada sales tax of 4 6 applies to most transactions there are certain items that may be exempt from

The sales tax applies to every retail sale of tangible personal property in this State unless the sale is exempt from taxation pursuant to a statutory exemption or taxation of the Is there a Sales Use Tax exemptions for non profit organizations Yes but organizations are not automatically exempt by their Federal 501 c status Nevada Revised Statute

Download Nevada Use Tax Exemptions

More picture related to Nevada Use Tax Exemptions

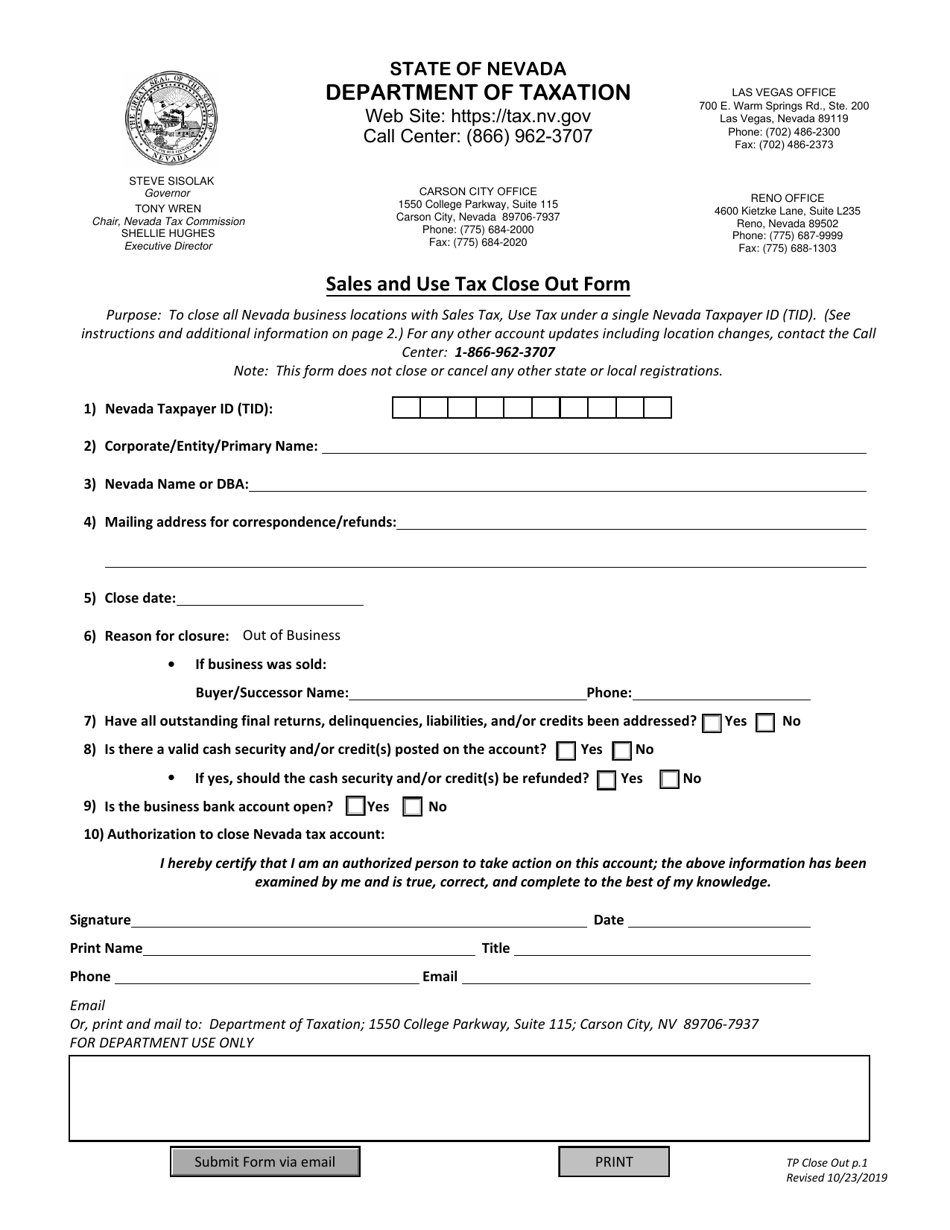

Nevada Sales And Use Tax Close Out Form Fill Out Sign Online And

https://data.templateroller.com/pdf_docs_html/2434/24349/2434926/sales-and-use-tax-close-out-form-nevada_print_big.png

Income Tax Exemptions For Investment In Target Companies MPG

https://mahanakornpartners.com/wp-content/uploads/2022/08/Tax-Exemptions-for-Gains-2048x1351.png

15 Essential Guidelines For 1031 Exchange Tax Exemptions Invest In

https://investinmultifamily.com/wp-content/uploads/2023/11/fb9b269e-999f-4ebd-bda0-a3e8717ed895.jpg

Learn everything you need to know about the sales and use tax rules in Nedava This guide covers what sales and use tax entails exemptions sale tax audits as well as Through social entre pre neurship we re lowering the cost of legal services and increasing citizen access Nevada Revised Statutes Chapter 372 Sales and Use

What is exempt from sales taxes in Nevada Many states have special sales tax rates that apply to the purchase of certain types of goods or fully exempt them from the sales tax This report has been designed to allow for a quick overview of Nevada s current tax expenditures It is organized alphabetically by tax type the taxes that expenditures are

50 State Survey Occasional Sales And Resale Exemptions To State Sales

https://pruvent.com/wp-content/uploads/2023/07/iStock-1387051600.jpg

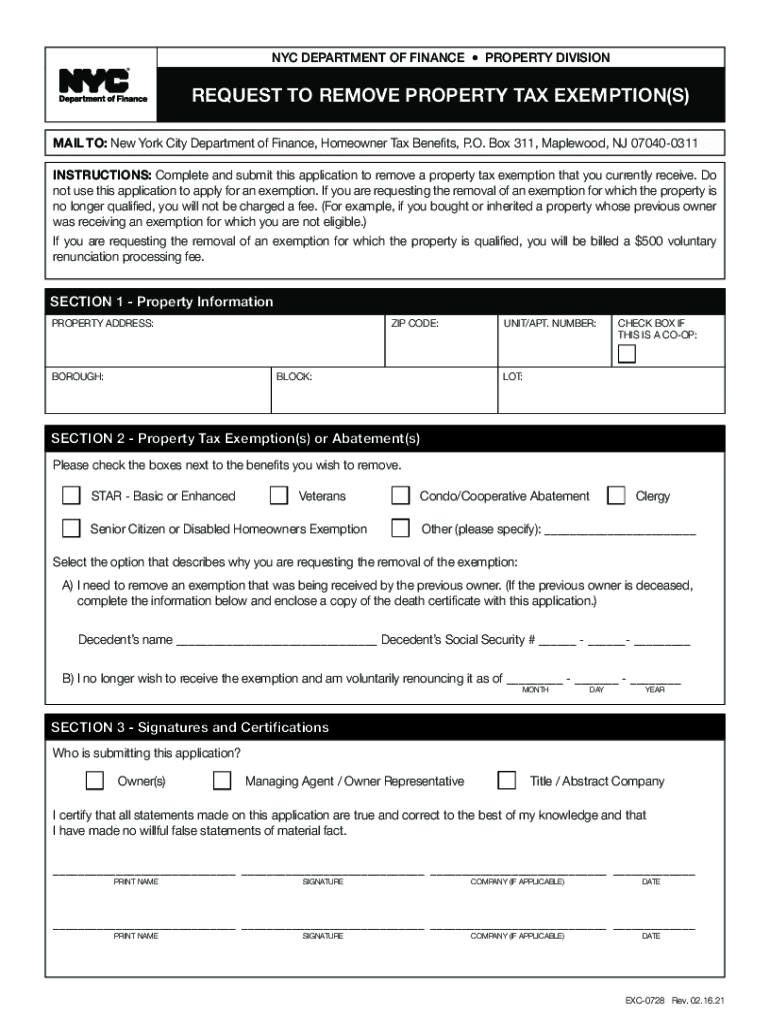

Request To Remove Property Tax Exemption Form Fill Out And Sign

https://www.signnow.com/preview/573/323/573323440/large.png

https://tax.nv.gov/tax-types/consumer-use-tax

Consumer Use Tax ensures that purchases made outside of Nevada do not unfairly compete with in state retailers who are required to collect sales tax Consumer Use Tax

https://www.leg.state.nv.us/NRS/NRS-372.html

There are exempted from the taxes imposed by this chapter the gross receipts from occasional sales of tangible personal property and the storage use or other

Understanding Tax Exemptions How Much Do You Qualify For When Selling

50 State Survey Occasional Sales And Resale Exemptions To State Sales

Top Tax Paying Companies

CALIFORNIA CODE PERMIT EXEMPTIONS pdf DocDroid

Can I File For Tax Exemptions Homestead Exemptions Online

Nevada Tax Rates 2024 Retirement Living

Nevada Tax Rates 2024 Retirement Living

Sales And Use Tax Verses Income Tax Or Business Tax Yaschica Coard

Tax Plus Madison MS

Why Tax Has Been Added To My Bill TradingView

Nevada Use Tax Exemptions - Property on Which Sales Tax Paid Is Exempt From Use Tax The storage use or other consumption in this state of property the gross receipts from the sale of which are