New Air Conditioner Tax Rebate Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Web 30 d 233 c 2022 nbsp 0183 32 Central Air Conditioners Tax Credit Information updated 12 30 2022 Subscribe to ENERGY STAR s Newsletter for updates on tax credits for energy Web 26 juil 2023 nbsp 0183 32 Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take

New Air Conditioner Tax Rebate

![]()

New Air Conditioner Tax Rebate

https://i0.wp.com/www.airrebate.net/wp-content/uploads/2022/10/dte-air-conditioner-rebate-tracker.png?fit=770%2C1024&ssl=1

New Air Conditioner Rebates AirRebate

https://i0.wp.com/www.airrebate.net/wp-content/uploads/2022/10/new-air-conditioner-rebates.jpg

Tax Rebate On Energy Efficient Air Conditioners AirRebate

https://i0.wp.com/www.airrebate.net/wp-content/uploads/2022/10/tax-rebate-on-energy-efficient-air-conditioners.jpeg?resize=1187%2C1536&ssl=1

Web 1 ao 251 t 2023 nbsp 0183 32 For qualifying central air conditioners installed in your primary residence between January 1 2023 and December 31 2032 you can claim a tax credit of 30 of Web 13 avr 2023 nbsp 0183 32 The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including

Web Basically you can get 10 off your air conditioner Further reading of this HVAC tax credit document explains that you can get 50 300 tax credits In specific cases you can Web Here are the highlights of ENERGY STAR certified equipment that is eligible for the tax credits Products That Qualify Central air conditioning 300 for air conditioners

Download New Air Conditioner Tax Rebate

More picture related to New Air Conditioner Tax Rebate

Rheem Air Conditioners Rebates AirRebate

https://i0.wp.com/www.airrebate.net/wp-content/uploads/2022/10/rheem-air-conditioners-rebates.jpg

High Efficiency Air Conditioner Rebates Rebates And Tax Credits

https://i0.wp.com/impressiveclimate.com/wp-content/uploads/2017/03/air-conditioner-rebates-Impressive-Climate-Control.jpg?fit=620%2C324&ssl=1

Con Edison Rebate For Split Air Conditioner Https Resource PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/con-edison-rebate-for-split-air-conditioner-https-resource-1.jpg?w=840&ssl=1

Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Web 4 mai 2023 nbsp 0183 32 IR 2023 97 May 4 2023 WASHINGTON The Internal Revenue Service reminds taxpayers that making certain energy efficient updates to their homes could

Web 13 f 233 vr 2023 nbsp 0183 32 For qualifying central air conditioners installed in your primary residence between January 1 2023 and December 31 2032 you can claim a tax credit of 30 of Web 3 janv 2023 nbsp 0183 32 The 2022 tax credit is not as robust but will credit 10 percent of the costs of installing qualified equipment and 100 percent of the costs associated with installing

Current Carrier Air Conditioner Rebates AirRebate

https://i0.wp.com/www.airrebate.net/wp-content/uploads/2022/10/current-carrier-air-conditioner-rebates.png?w=800&ssl=1

2022 Rebates And Tax Credits For Air Conditioner AirRebate

https://i0.wp.com/www.airrebate.net/wp-content/uploads/2022/10/2022-rebates-and-tax-credits-for-air-conditioner.jpg?fit=1280%2C720&ssl=1

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

https://www.energystar.gov/about/federal_tax_credits/central_air...

Web 30 d 233 c 2022 nbsp 0183 32 Central Air Conditioners Tax Credit Information updated 12 30 2022 Subscribe to ENERGY STAR s Newsletter for updates on tax credits for energy

Rebates For New Central Air Conditioners AirRebate

Current Carrier Air Conditioner Rebates AirRebate

Mass Save Rebates Air Conditioner 2020 Mass Save Rebates Tjs Radiant

American Standard Air Conditioner Rebates Griffith Heating Cooling

Solar Air Conditioner Tax Rebates 2022 AirRebate

The Homeowners Guide To Energy Tax Credits And Rebates Constellation

The Homeowners Guide To Energy Tax Credits And Rebates Constellation

Air Conditioner Tax Rebate 3 Tips To Help Repair Your Central Air

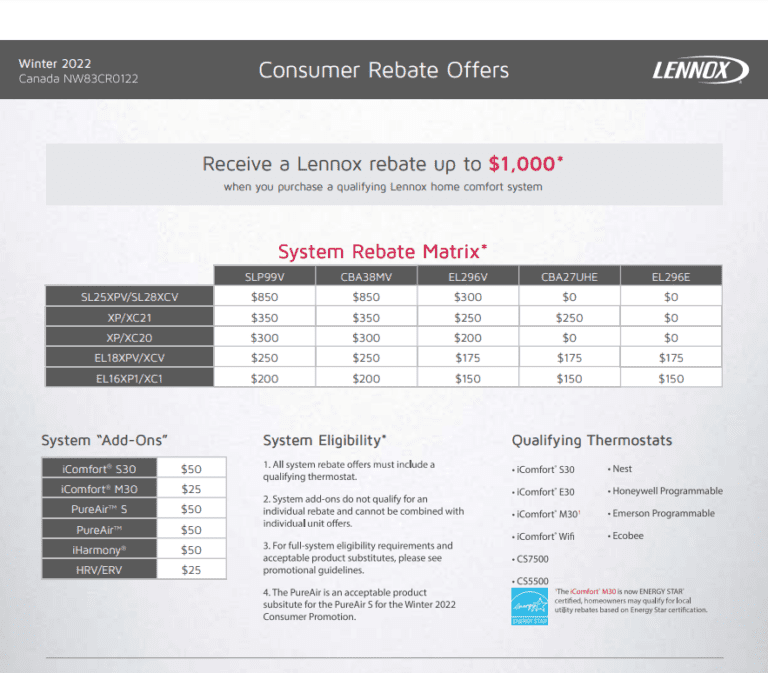

Rebate Lennox Air Conditioner Printable Rebate Form

York Air Conditioner Rebates AirRebate

New Air Conditioner Tax Rebate - Web 30 d 233 c 2022 nbsp 0183 32 Tax Credits for Homeowners Information updated 12 30 2022 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home