New Car Tax Deduction 2023 IRS Tax Tip 2023 49 April 12 2023 The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the tax credit Beginning January 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500

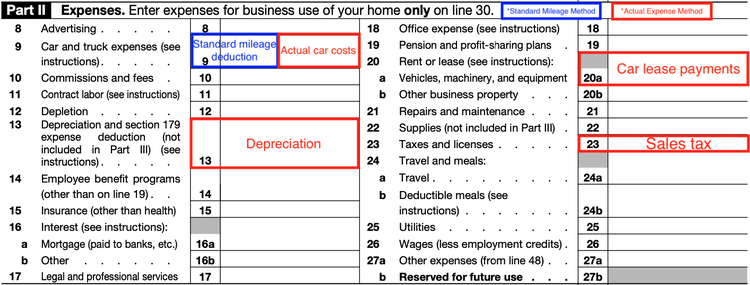

In 2022 you bought a new car and used it for personal purposes In 2023 you began to use it for business Changing its use to business use doesn t qualify the cost of your car for a section 179 deduction in 2023 However you can claim a depreciation deduction for the business use of the car starting in 2023 See Depreciation Deduction later The 2023 rules on company cars automotive accessories provide for a new tax exempt threshold raised from 850 to 1 200 Further information Decision of the Tax Administration for 2023 concerning valuation of fringe benefits Fringe benefits in taxation chapter 7 4 3 Accessories available in Finnish and Swedish added 10 Jan 2023

New Car Tax Deduction 2023

New Car Tax Deduction 2023

https://phantom-marca.unidadeditorial.es/adf8f9bc71d32817f02e07809214c006/resize/1200/f/jpg/assets/multimedia/imagenes/2023/03/24/16796726455124.jpg

Car Tax Deduction 2023 What Vehicles Qualify For Tax Deduction

https://phantom-marca.unidadeditorial.es/d5941c673abab248b74d3c2f64f50612/crop/71x0/1138x711/f/webp/assets/multimedia/imagenes/2023/02/19/16767981217503.png

United States Sales Taxes VAT GST 2023 Tax Rates And Deduction

https://www.mondaq.com/images/article_images/1294928a.jpg

The Inflation Reduction Act of 2022 IRA made several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 30D tax credit New Clean Vehicle Credit Beginning with tax year 2023 in addition to a new North America final assembly requirement the former 7 500 credit is broken into two new credits worth up to 3 750 each for qualifying buyers of new all electric cars

Rev Proc 2023 14 provides two major updates 1 limitations on depreciation deductions for owners of passenger automobiles placed in service in calendar year 2023 and 2 amounts that lessees must include in income for passenger automobiles first leased in 2023 For the 2023 tax year the IRS has set the depreciation limitations for passenger automobiles at 12 200 for the first tax year 19 500 for the second year 11 700 for the third year 6 960 for each year after that It s important to note that these limits are for vehicles used 100 for business purposes

Download New Car Tax Deduction 2023

More picture related to New Car Tax Deduction 2023

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

https://i.etsystatic.com/24598192/r/il/e3c7c0/3985544266/il_570xN.3985544266_82sm.jpg

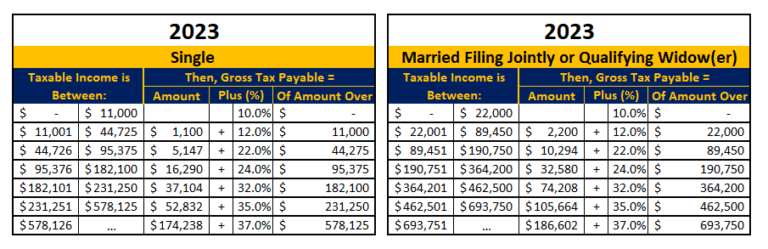

How Inflation May Reduce Your Tax Bill For 2023

https://moisandfitzgerald.b-cdn.net/wp-content/uploads/2023-Tax-Tables-side-by-side-768x249.png

Tax Worksheet For 2022

https://i.pinimg.com/originals/d1/cc/34/d1cc3440c2d9554d9b23652b32649ea1.jpg

For 2023 that rate is 0 655 65 cents per mile For 2024 it s set to increase to 0 67 67 cents For new and pre owned vehicles put into use in 2023 assuming the vehicle was used 100 for business The maximum first year depreciation write off is 12 200 plus up to an additional 8 000 in bonus depreciation

The minimum credit for vehicles placed in service from January 1 to April 17 2023 will be 3 751 The credit amount for vehicles placed in service after April 18 2023 will depend on whether Is there such a thing as a car purchase tax deduction While new cars aren t fully tax deductible you can write off some of the cost Learn how and what other car expenses you can deduct for a lower tax bill

How To Make Your Car A Tax Deduction YouTube

https://i.ytimg.com/vi/X-YJc2vswGk/maxresdefault.jpg

Car Lease Tax Deduction Calculator Have A Large Ejournal Lightbox

https://m.foolcdn.com/media/affiliates/images/Car_Tax_Deduction_-_01_-_Schedule_C_dtwP5ng.width-750.png

https://www.irs.gov/newsroom/heres-what-taxpayers...

IRS Tax Tip 2023 49 April 12 2023 The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the tax credit Beginning January 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500

https://www.irs.gov/publications/p463

In 2022 you bought a new car and used it for personal purposes In 2023 you began to use it for business Changing its use to business use doesn t qualify the cost of your car for a section 179 deduction in 2023 However you can claim a depreciation deduction for the business use of the car starting in 2023 See Depreciation Deduction later

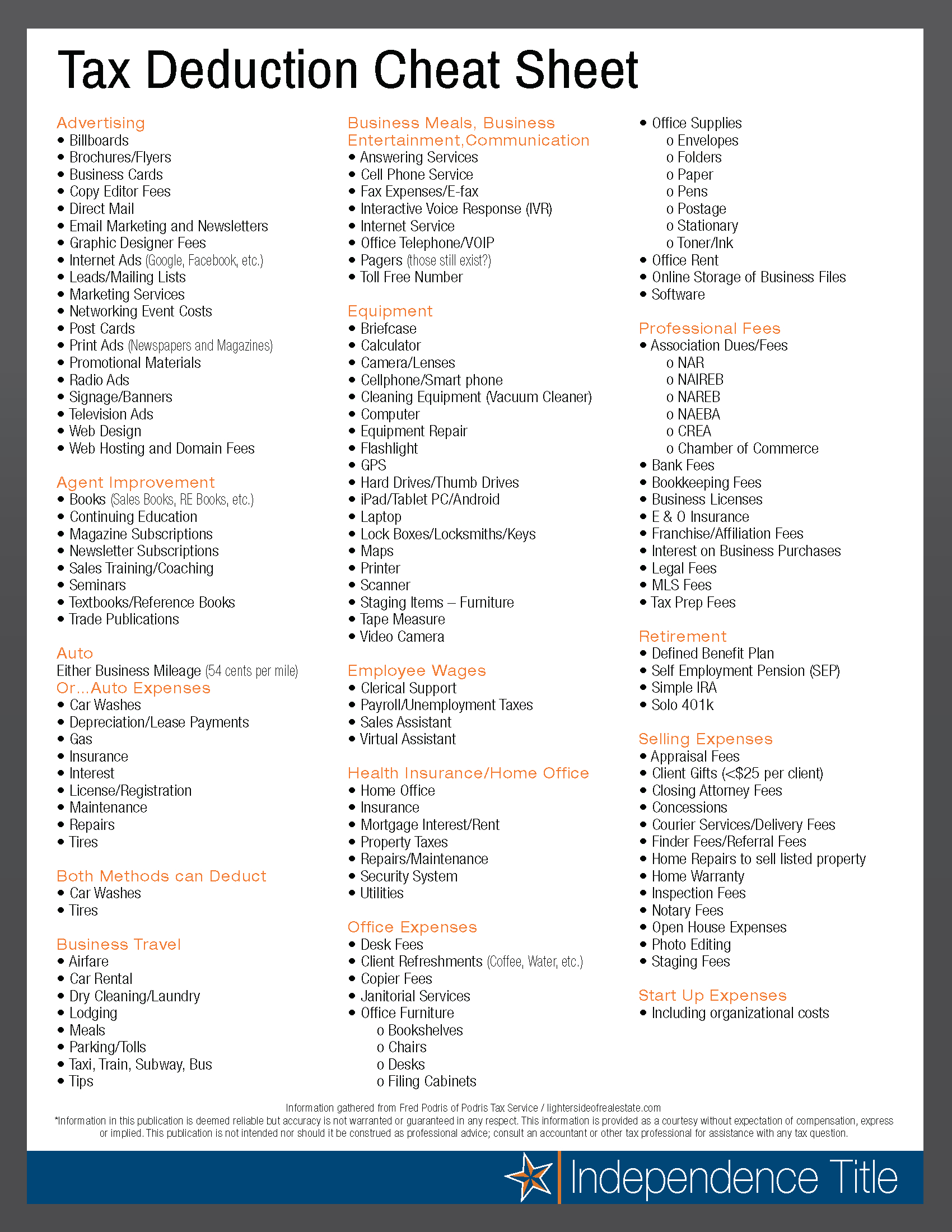

Real Estate Agent Tax Deductions Worksheet 2022

How To Make Your Car A Tax Deduction YouTube

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

IRS Announces 2022 Tax Rates Standard Deduction

Truck Expenses Worksheet Spreadsheet Template Printable Worksheets

Tax Deduction Everything You Should Know About TDS And VDS

Tax Deduction Everything You Should Know About TDS And VDS

Tax Deduction List 2024 Rena Krista

Nurse Tax Deduction Worksheet Fill Online Printable Fillable Blank

Donate Your Car And Benefit From A Tax Deduction Absbuzz

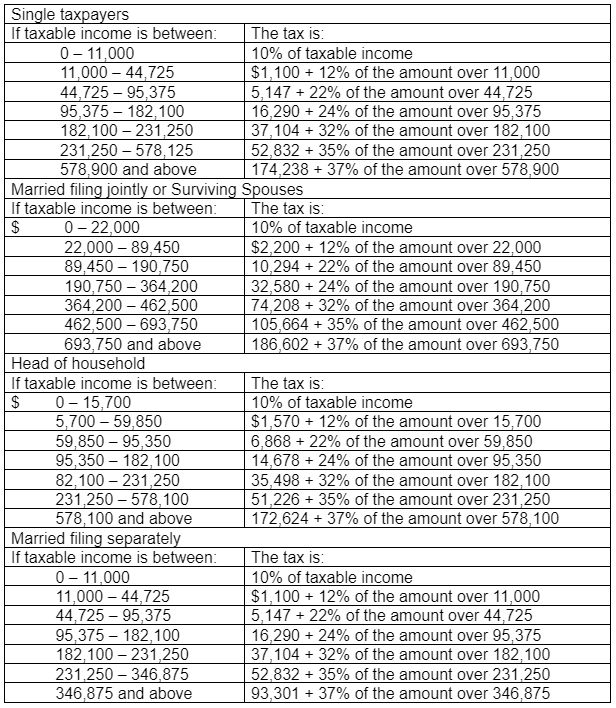

New Car Tax Deduction 2023 - Rev Proc 2023 14 provides two major updates 1 limitations on depreciation deductions for owners of passenger automobiles placed in service in calendar year 2023 and 2 amounts that lessees must include in income for passenger automobiles first leased in 2023