New Energy Rebate 2024 Energy Efficient Home Improvement Credit If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Four states California Hawaii New Mexico and New York are the first to submit funding applications for the U S Department of Energy s DOE Home Energy Rebates program a historic 8 8 billion investment to lower costs for American families through energy efficiency and electrification thanks to President Biden s Inflation Reduction Act The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

New Energy Rebate 2024

New Energy Rebate 2024

https://solarninjas.energy/wp-content/uploads/2020/08/Rebate-rs-scaled-2560x1280.jpg

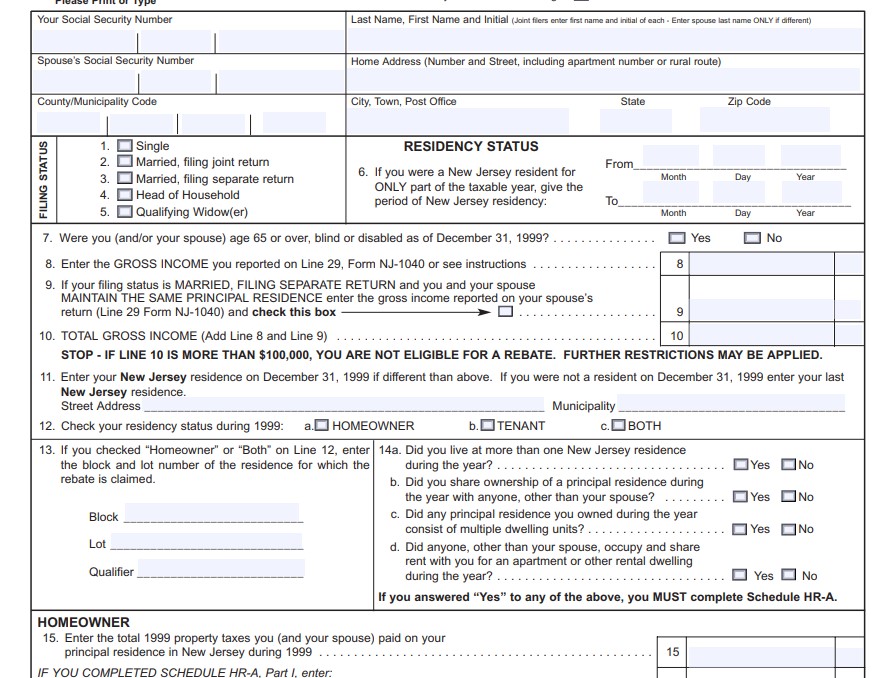

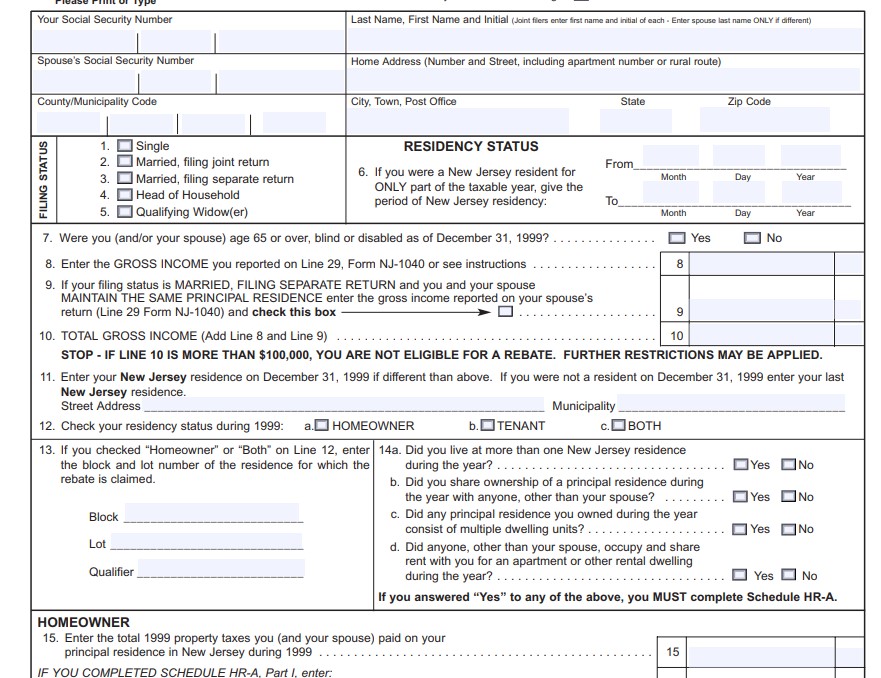

New Jersey Renters Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-Jersey-Renters-Rebate-2023.jpg

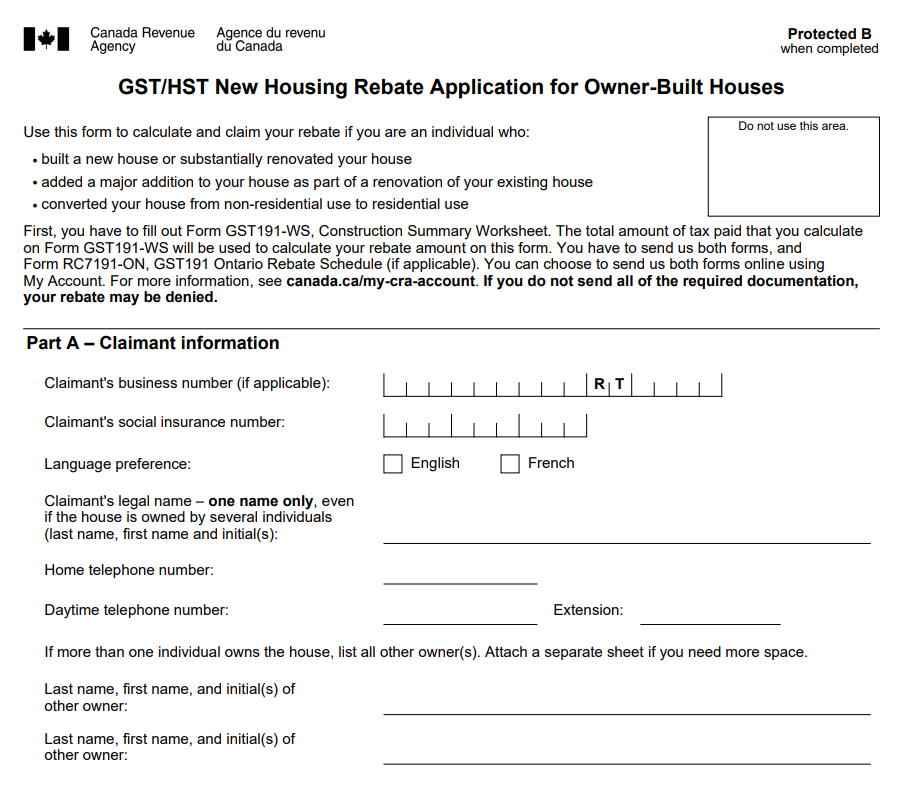

New Mexico Renters Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-Mexico-Renters-Rebate-2023.jpg

The law provides 391 billion nationwide to support clean energy and address climate change including 8 8 billion designated for the Home Efficiency Rebates HOMES Program and Home Electrification and Appliance Rebate HEEHRA Program The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings

Energy Efficiency and Electrification Rebates for 2024 Update Per the latest guidance from the US Department of Energy the home electrification rebates listed below are expected to be available in some areas in the second half of 2024 and available in most areas by early 2025 Home energy audits of a main home The maximum credit that can be claimed each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers

Download New Energy Rebate 2024

More picture related to New Energy Rebate 2024

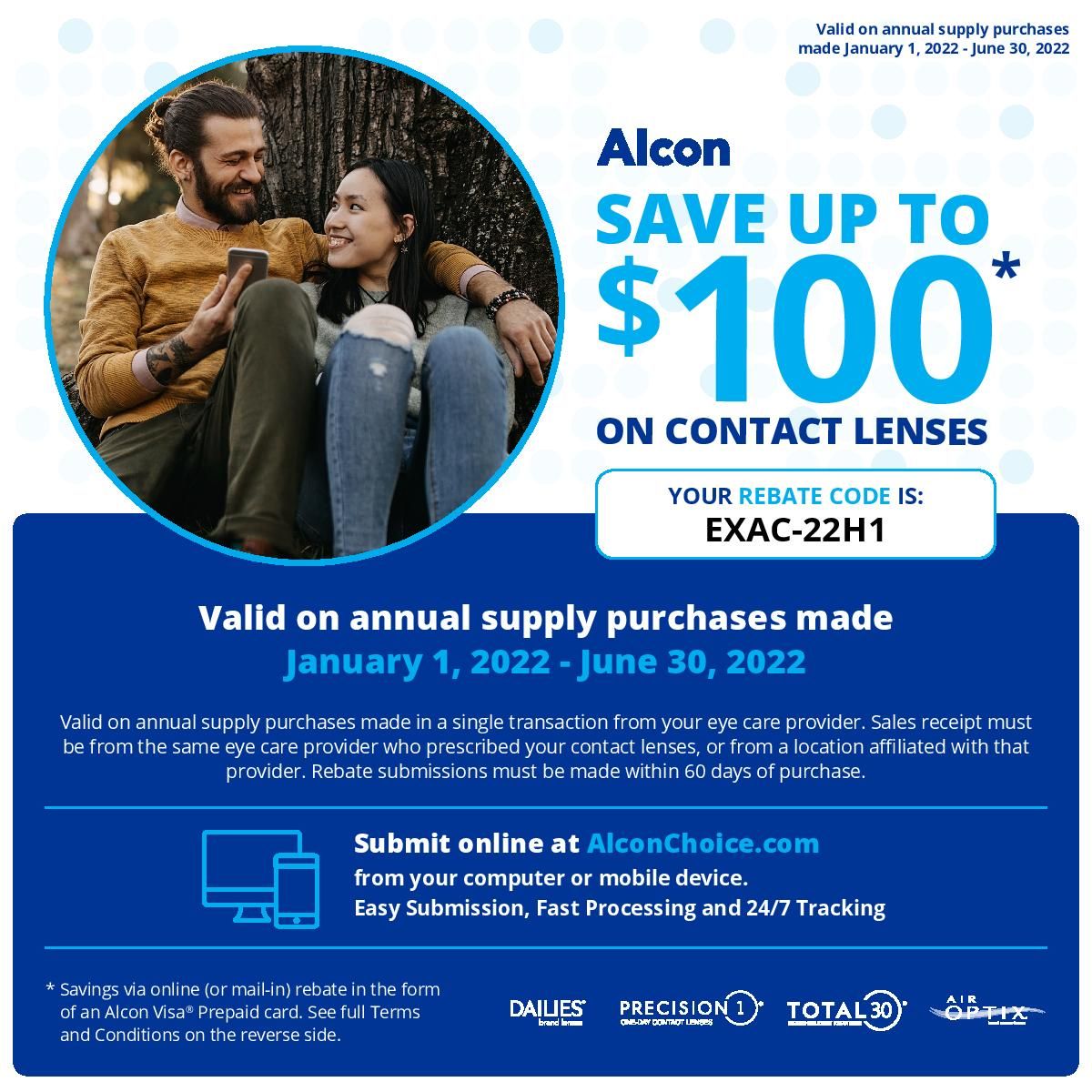

New Wearer Rebate Alcon New Wearers Can Save Up To 225 On Your Contact Lens Purchase

https://s3.amazonaws.com/VisionSource/Promos/alcon-2021-q4-upgrade1.jpg

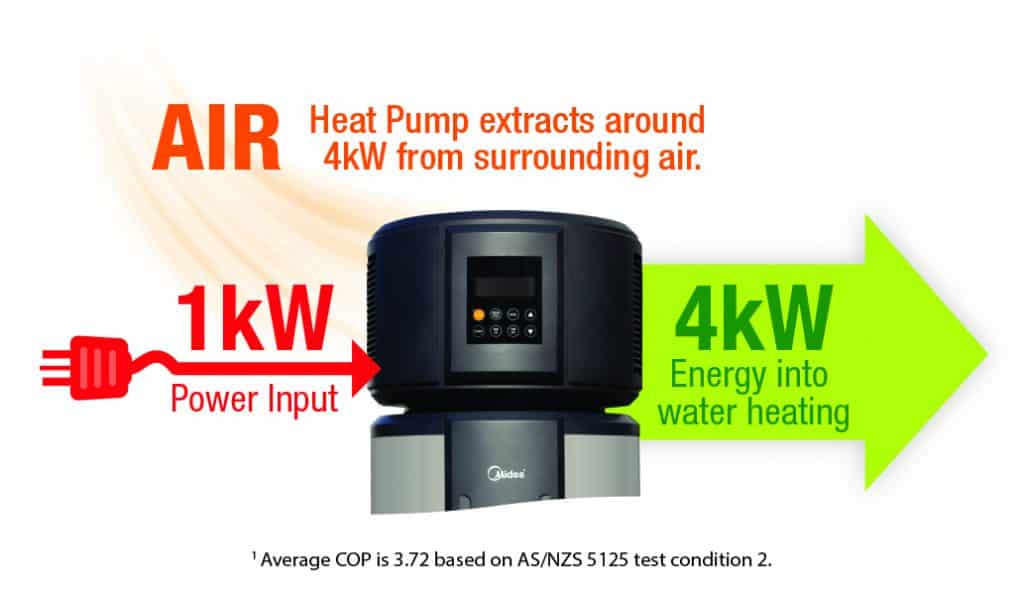

Hot Water Systems NSW Hot Water System Rebate 2022

https://www.efficientenergygroup.com.au/wp-content/uploads/2022/05/HeatPump-Energy_Multiplier-1024x599.jpg

Lensrebates Alcon Com

https://www.royacdn.com/unsafe/Site-88a5128c-aaae-4122-b1ad-472be343579c/rebate/2022_1H_Existing_Wearer_Rebate_page_001.jpg

Published January 25 2024 Written by CLEAResult We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and The program provides rebates based on the energy savings their upgraded home will achieve For instance homeowners that make changes that cut their energy usage by at least 35 can get up to

Many Inflation Reduction Act rebates on green technology such as heat pumps and induction stoves being installed in homes in this Riverside subdivision went into effect Jan 1 but homeowners What s new for 2024 instant rebate Starting in January EV buyers won t have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead

Set Up A Council Tax Direct Debit To Receive Energy Rebate Quickly Shropshire Council Newsroom

https://newsroom.shropshire.gov.uk/wp-content/uploads/energy-rebate-1024x576.jpg

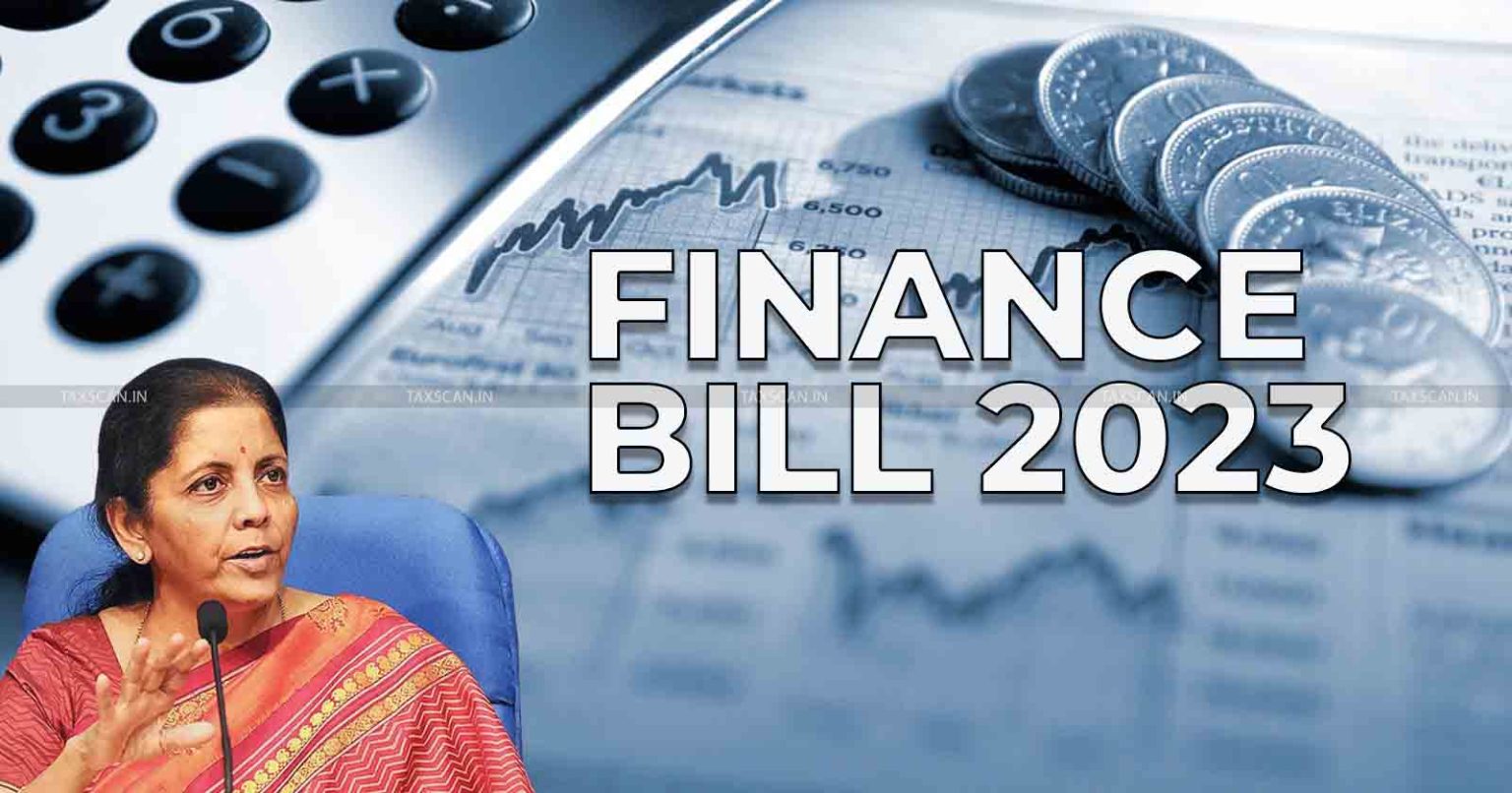

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And

https://www.gconnect.in/gc22/wp-content/uploads/2023/02/Finance-Bill-2023-1536x806.jpg

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

Energy Efficient Home Improvement Credit If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

https://www.energy.gov/scep/articles/first-group-states-apply-landmark-home-energy-rebates-funding-lower-energy-costs

Four states California Hawaii New Mexico and New York are the first to submit funding applications for the U S Department of Energy s DOE Home Energy Rebates program a historic 8 8 billion investment to lower costs for American families through energy efficiency and electrification thanks to President Biden s Inflation Reduction Act

Victoria s Solar Homes Rebate Maxing Out But Don t Panic

Set Up A Council Tax Direct Debit To Receive Energy Rebate Quickly Shropshire Council Newsroom

Save Up To 300 On Your Alcon Contact Lens Purchase

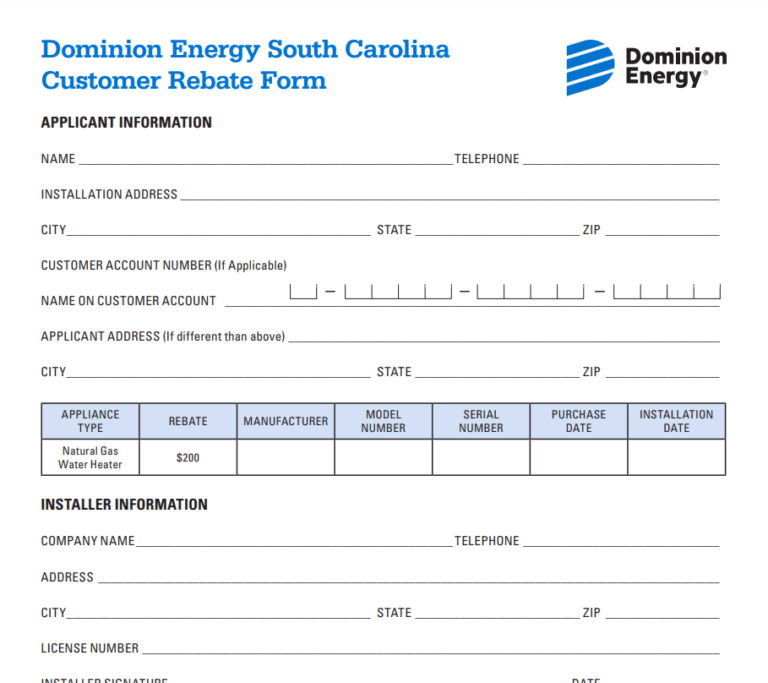

Dominion Rebate For New Furnace Printable Rebate Form

Dominion Rebate For New Furnace Printable Rebate Form

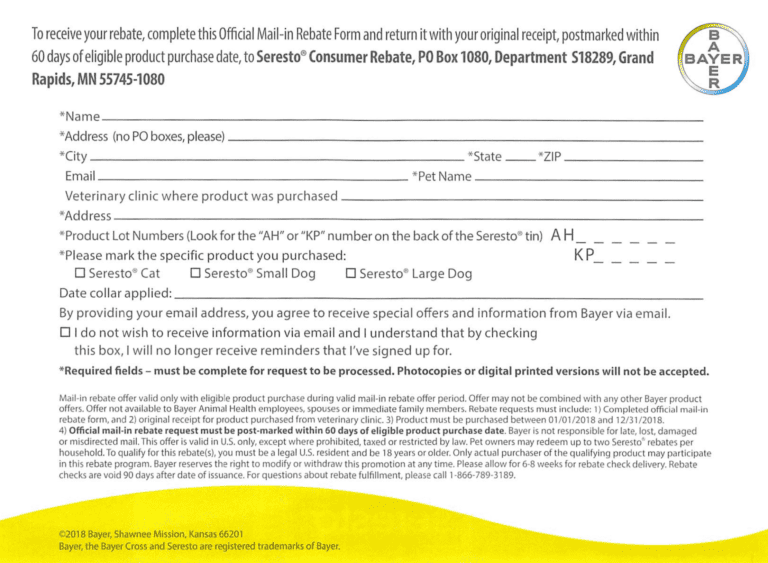

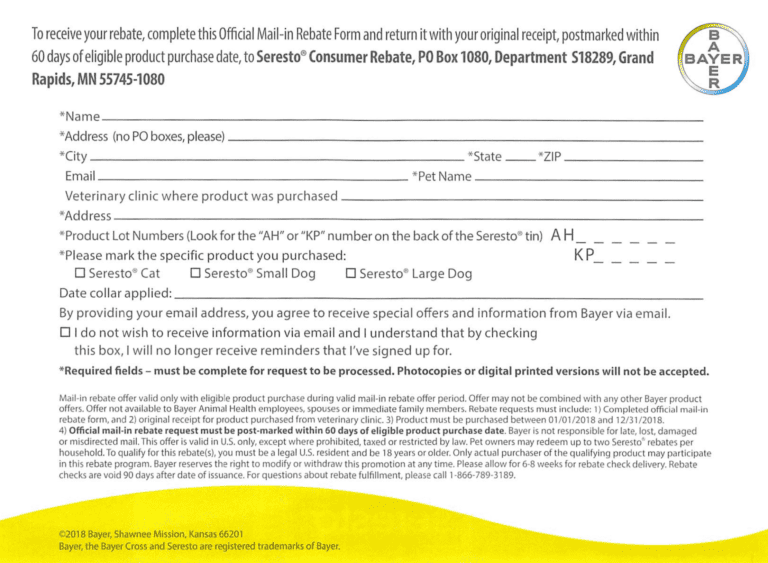

Seresto Rebate Form PrintableRebateForm

Seresto Rebate Form PrintableRebateForm

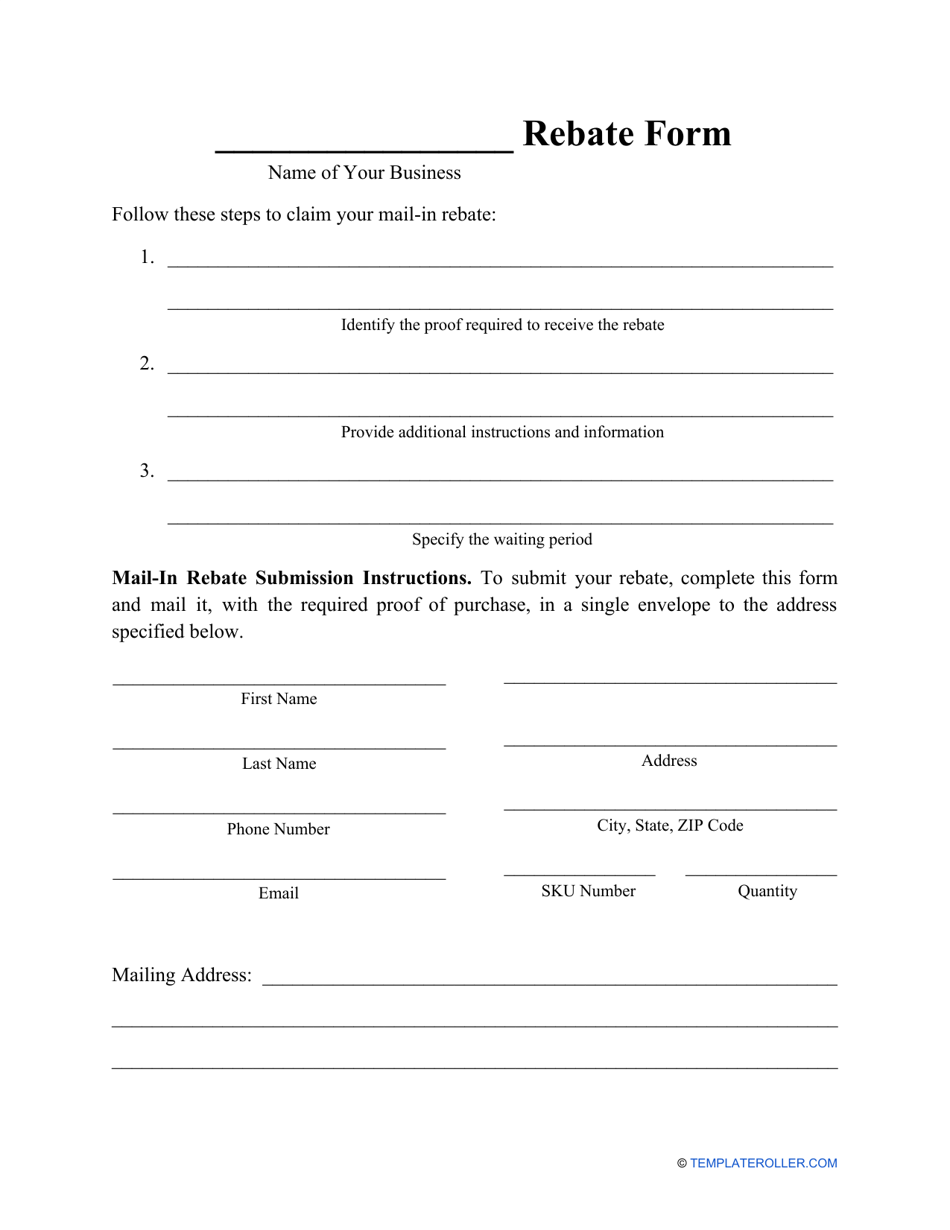

Conquista Midollo Coro Rebate Program Template Omettere Additivo Bobina

Mobil One Offical Rebate Printable Form Printable Forms Free Online

New Rebate Program To Improve Energy Savings For Ontarians BSG

New Energy Rebate 2024 - The law provides 391 billion nationwide to support clean energy and address climate change including 8 8 billion designated for the Home Efficiency Rebates HOMES Program and Home Electrification and Appliance Rebate HEEHRA Program