New Home Gst Rebate Alberta Web New Home GST Rebate Calculator The Federal government offers a GST rebate for new homes purchased as a primary residence The calculator below allows you to determine

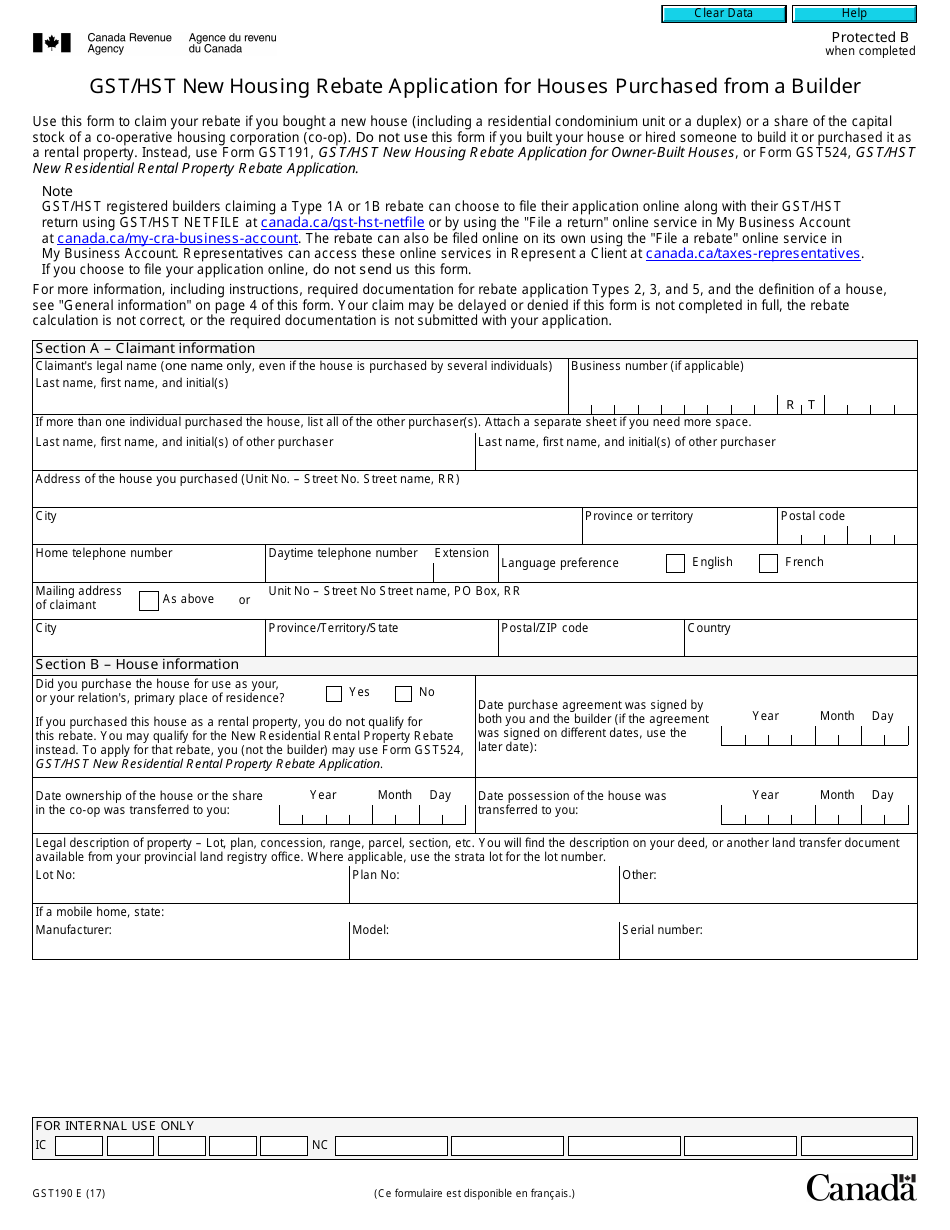

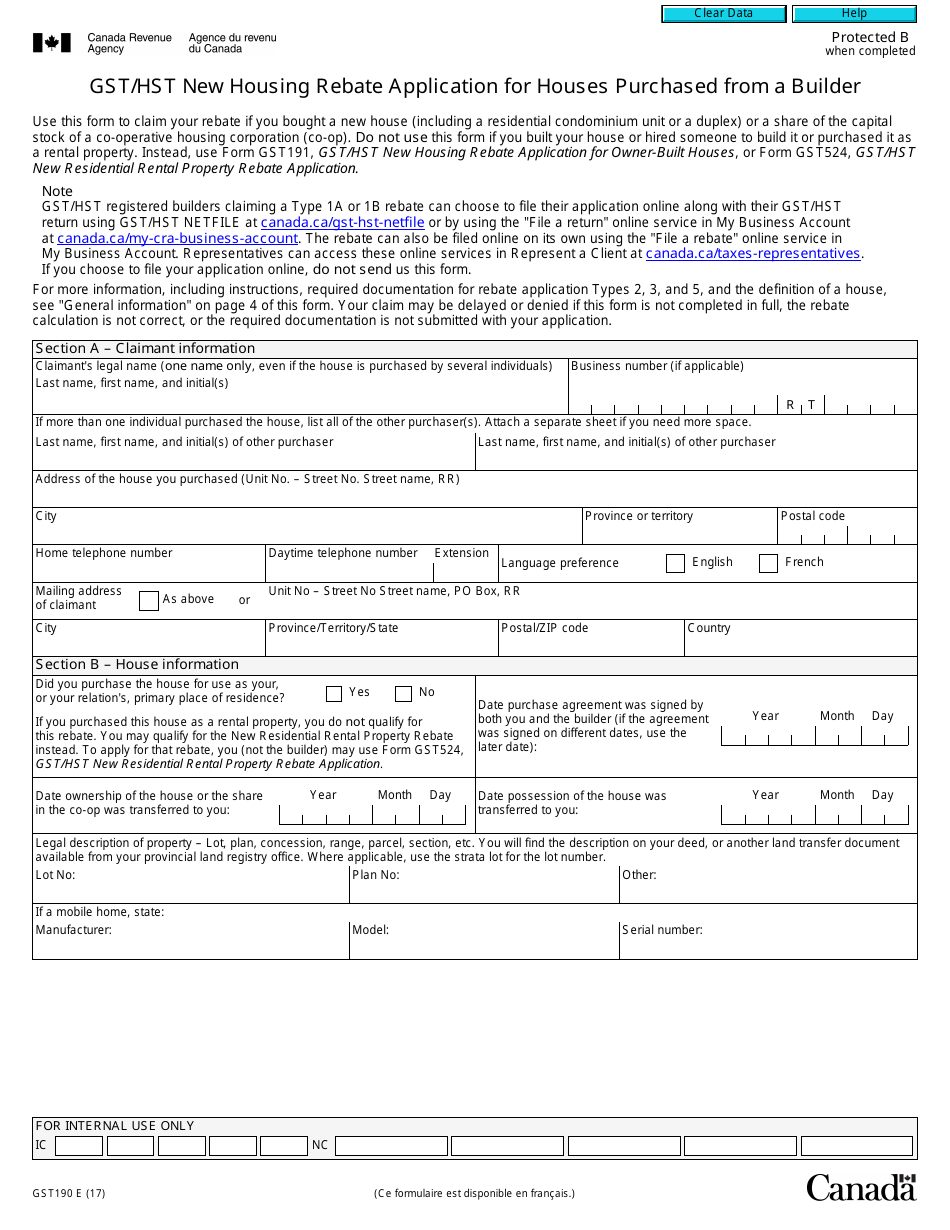

Web To be eligible for this rebate The home must be purchased as your primary residence If the home is purchased with the intent of using it as a rental property you are not eligible Web 5 juil 2022 nbsp 0183 32 GST190 GST HST New Housing Rebate Application for Houses Purchased from a Builder For best results download and open this form in Adobe Reader See

New Home Gst Rebate Alberta

New Home Gst Rebate Alberta

https://data.templateroller.com/pdf_docs_html/1867/18672/1867279/form-gst190-gst-hst-new-housing-rebate-application-for-houses-purchased-from-a-builder-canada_print_big.png

What Is The GST Rebate On Homes And How Does It Work TroiWest Builders

https://troiwestbuilders.com/wp-content/uploads/2021/10/04-DSC_0776.jpg

Gst Rebate Calculator Morrison Homes

https://d3290qmwypal8b.cloudfront.net/assets/_fullWidthBackground2x/New-Home-GST-Rebate-Calculator.jpg?mtime=20220105072621&focal=none&tmtime=20220105073512

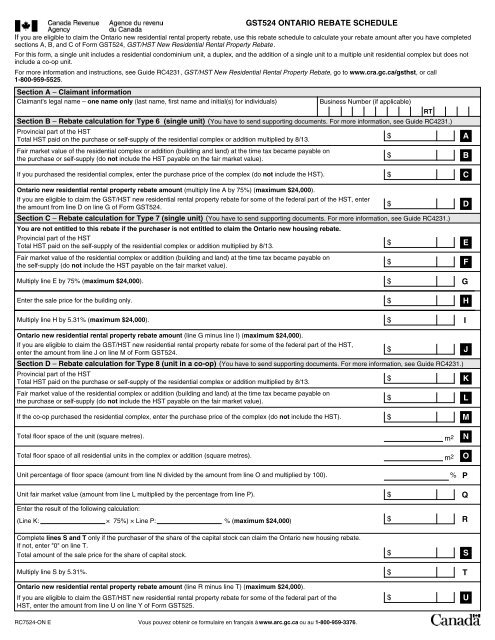

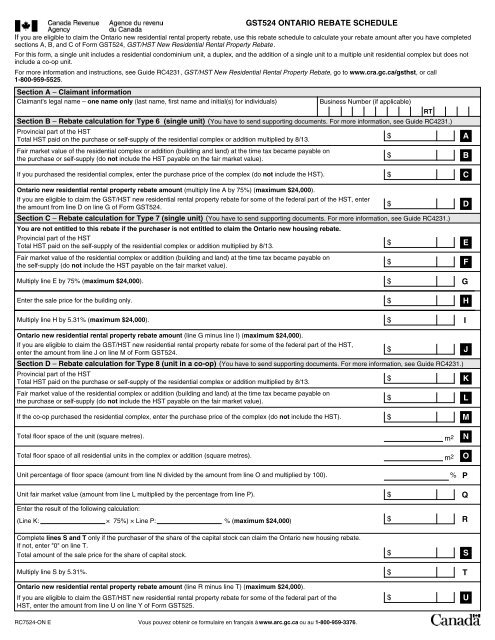

Web 26 oct 2022 nbsp 0183 32 Alberta New Housing Rebate The GST in Alberta and there is no provincial sales tax The amount of rebate you can receive for the GST Portion is 36 of the GST Web What is the HST GST New Housing Rebate November 2022 15 min read Key takeaways You could receive a maximum rebate of 6 300 You will need to make sure that you fit the criteria to be able to claim the new

Web Description The GST HST new housing rebate allows an individual to recover some of the GST or the federal part of the HST paid for a new or substantially renovated house that Web GST New Housing Rebate T he GST New Housing Rebate may allow you to recover some of the goods and services tax GST paid for a new or substantially renovated

Download New Home Gst Rebate Alberta

More picture related to New Home Gst Rebate Alberta

New Home HST GST Rebate By Nadene Milnes Issuu

https://image.isu.pub/130131143253-b171a3397fa948ceb10c5a961451c8bc/jpg/page_2.jpg

Most New Homes No Longer Qualify For The GST Rebate

https://media.licdn.com/dms/image/C4D12AQGaDK5Bf05Pyw/article-cover_image-shrink_600_2000/0/1520059245912?e=2147483647&v=beta&t=fLIBEMfTp1PbWRNcz57kHc3c9XpvkxYOJWhVicqRYw4

Rental Property GST Rebate For New Residential Homes Condo Millionaire

http://static1.squarespace.com/static/621d9692ec1be8680a5926c5/621e379deb4b915868e49b86/63a26b6cd673c5048b06d060/1672927175407/INSTAGRAM+-+Multiple+Pages.png?format=1500w

Web 13 nov 2021 nbsp 0183 32 Like the NRRP the GST HST New Housing Rebate is equal to the amount of tax paid multiplied by 36 to a maximum of 6300 When do you claim a New Web 11 mai 2020 nbsp 0183 32 First the new housing rebate equals 36 of the GST that all buyers need to pay when buying a new home in Canada This rebate is up to 6 300 and valid on homes with a fair market value of 350 000 or

Web GST HST new housing rebate Fortunately no matter where you live in Canada if your new home is priced below 450 000 before GST HST you may be eligible for a partial rebate Web This GST New Housing Rebate Calculator helps you find out how much goods and service tax GST you can recover for a new or substantially renovated home that has been

Guide Rc4231 Gst Hst New Residential Rental Property Rebate Property

https://img.yumpu.com/6665969/1/500x640/gst524-ontario-rebate-schedule-.jpg

GST HST New Housing Rebate And New Residential Rental Property Rebate

https://sqicpa.com/wp-content/uploads/2018/09/GST-HST-Rebate-1-e1537821386125.png

https://www.lincolnberg.com/financial-tools/gst-rebate-calculator

Web New Home GST Rebate Calculator The Federal government offers a GST rebate for new homes purchased as a primary residence The calculator below allows you to determine

https://www.howtobuyahome.ca/home-expenses/closing-costs/new-hom…

Web To be eligible for this rebate The home must be purchased as your primary residence If the home is purchased with the intent of using it as a rental property you are not eligible

How To Calculate Your New Home GST Rebate

Guide Rc4231 Gst Hst New Residential Rental Property Rebate Property

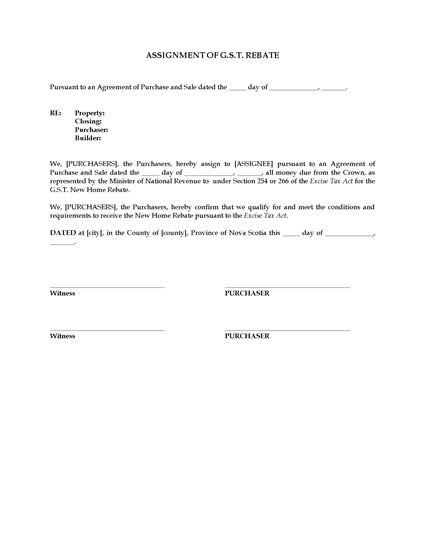

Canada Assignment Of GST New Home Rebate Legal Forms And Business

Gst Rebate Calculator Morrison Homes

How Do I Claim GST HST Housing Rebate RKB Accounting Tax Services

New Home GST Rebate Calculator Alquinn Homes

New Home GST Rebate Calculator Alquinn Homes

GST HST New Housing Rebate

GST On New Homes In BC Everything You Need To Know About The GST

Gst hst Rebate Other Property And Services PropertyRebate

New Home Gst Rebate Alberta - Web 20 avr 2015 nbsp 0183 32 In order to qualify for the GST HST New Housing Rebate the purchase price of the home must be less than four hundred fifty thousand 450 000 00 dollars before