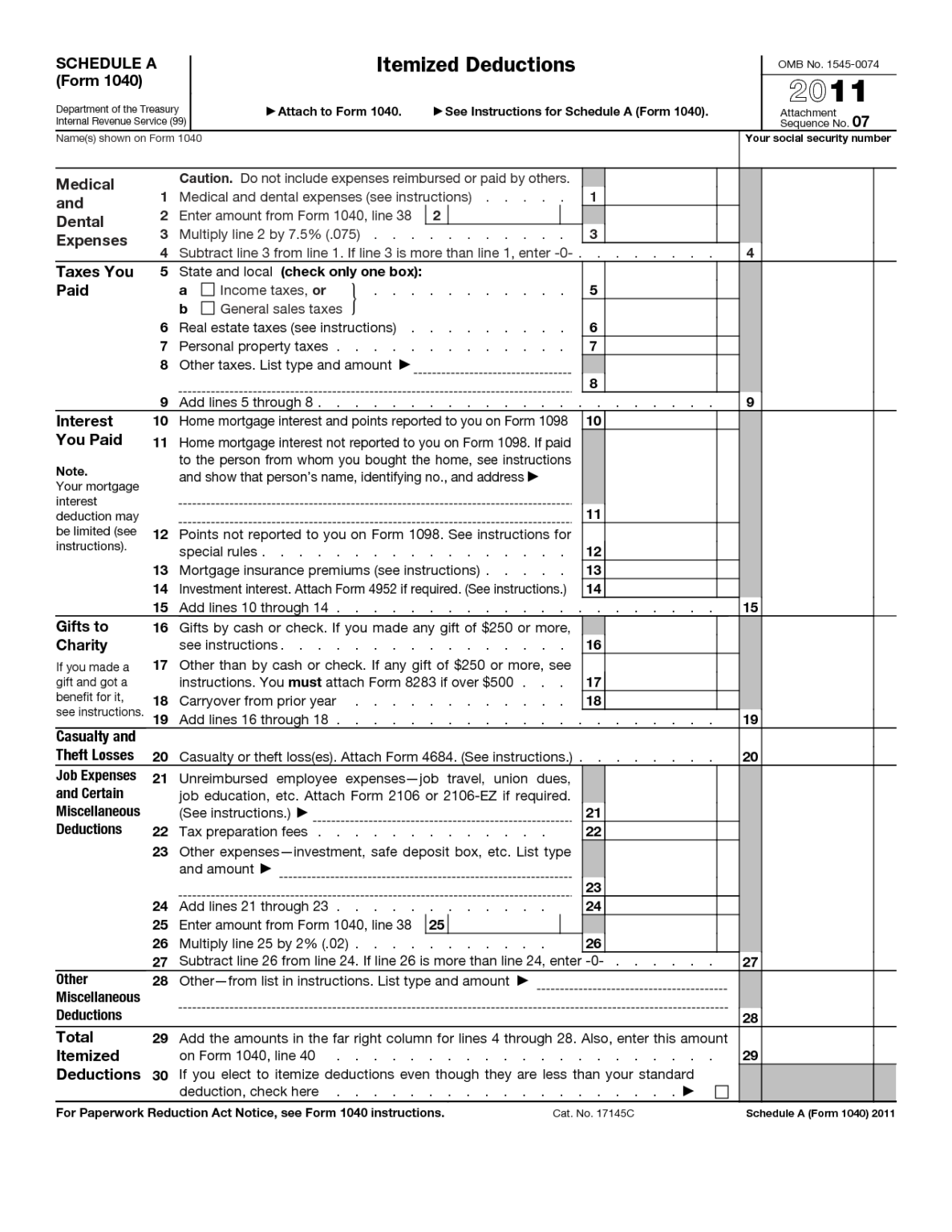

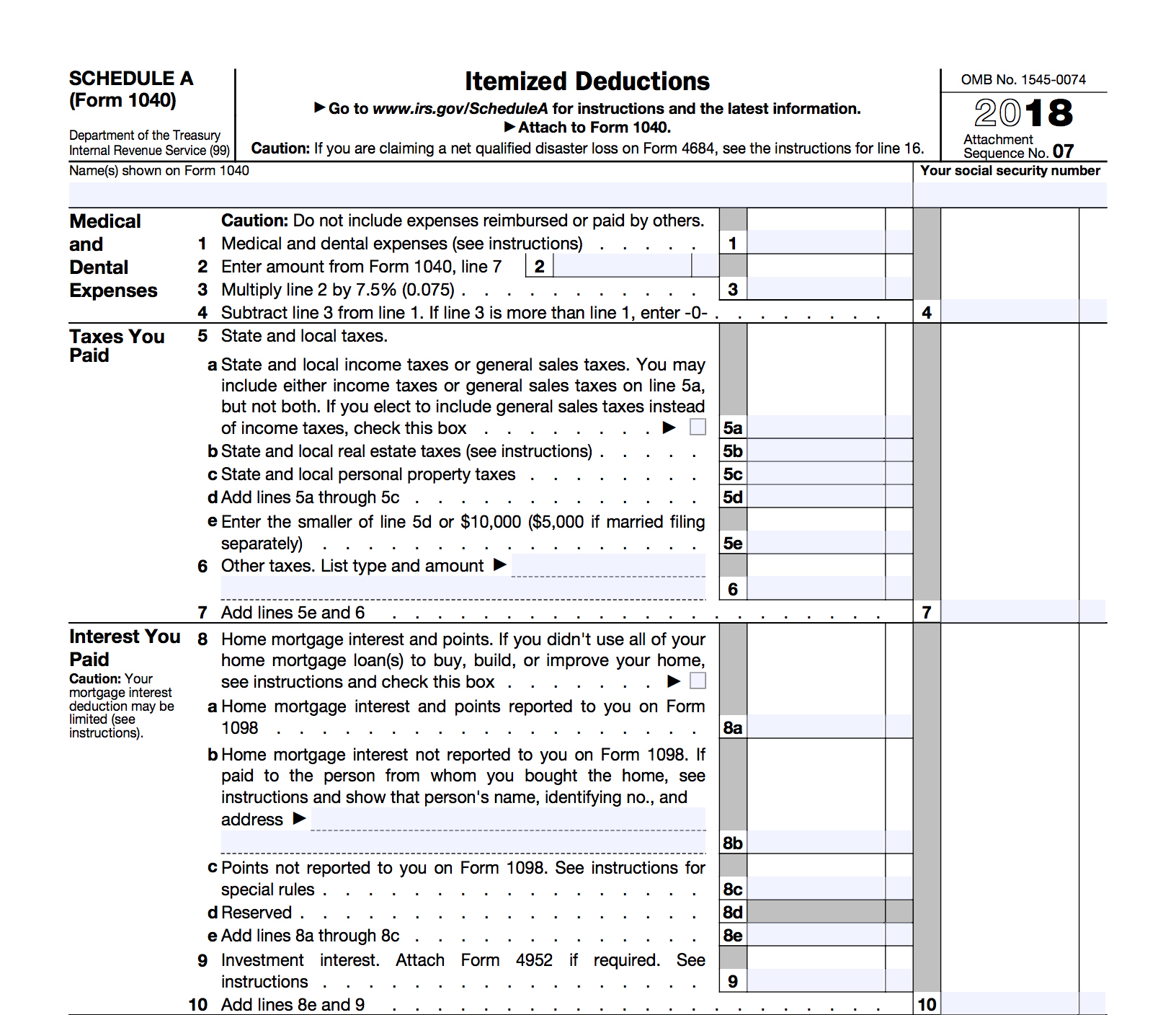

New Jersey Income Tax Medical Deductions New Jersey offers tax deductions and credits to reduce your tax liability including deductions for medical alimony and self employed health insurance expenses The

Threshold Requirement In order to claim a deduction for medical expenses in New Jersey they must exceed a certain threshold of your adjusted gross income AGI For federal Deductions Payments of alimony or for separate maintenance are deductible by the payer if reported as income by the payee Unreimbursed medical

New Jersey Income Tax Medical Deductions

New Jersey Income Tax Medical Deductions

https://njmoneyhelp.com/wp-content/uploads/2018/04/highway-3151762_1920.jpg

Printable Itemized Deductions Worksheet

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

Verw sten Gew hnliche Zur cktreten New Jersey Tax Free Verbrannt

https://www.njpp.org/wp-content/uploads/2017/09/NJ-income-tax-bracketsproposed-01.jpg

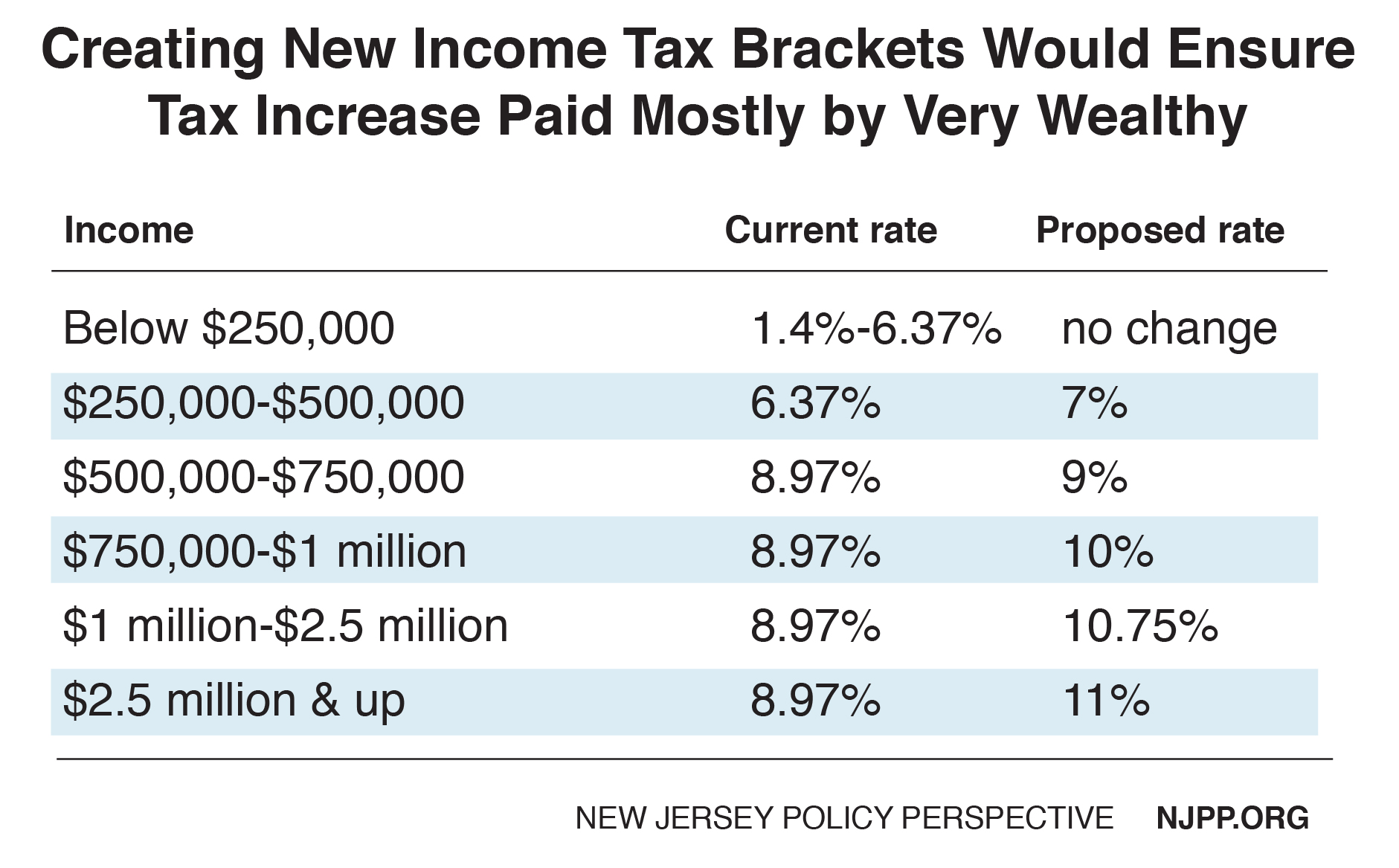

The Income tax rates and personal allowances in New Jersey are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and Medical expenses including medical insurance premiums are deductible on your federal tax return to the extent they exceed 7 5 of your adjusted gross income

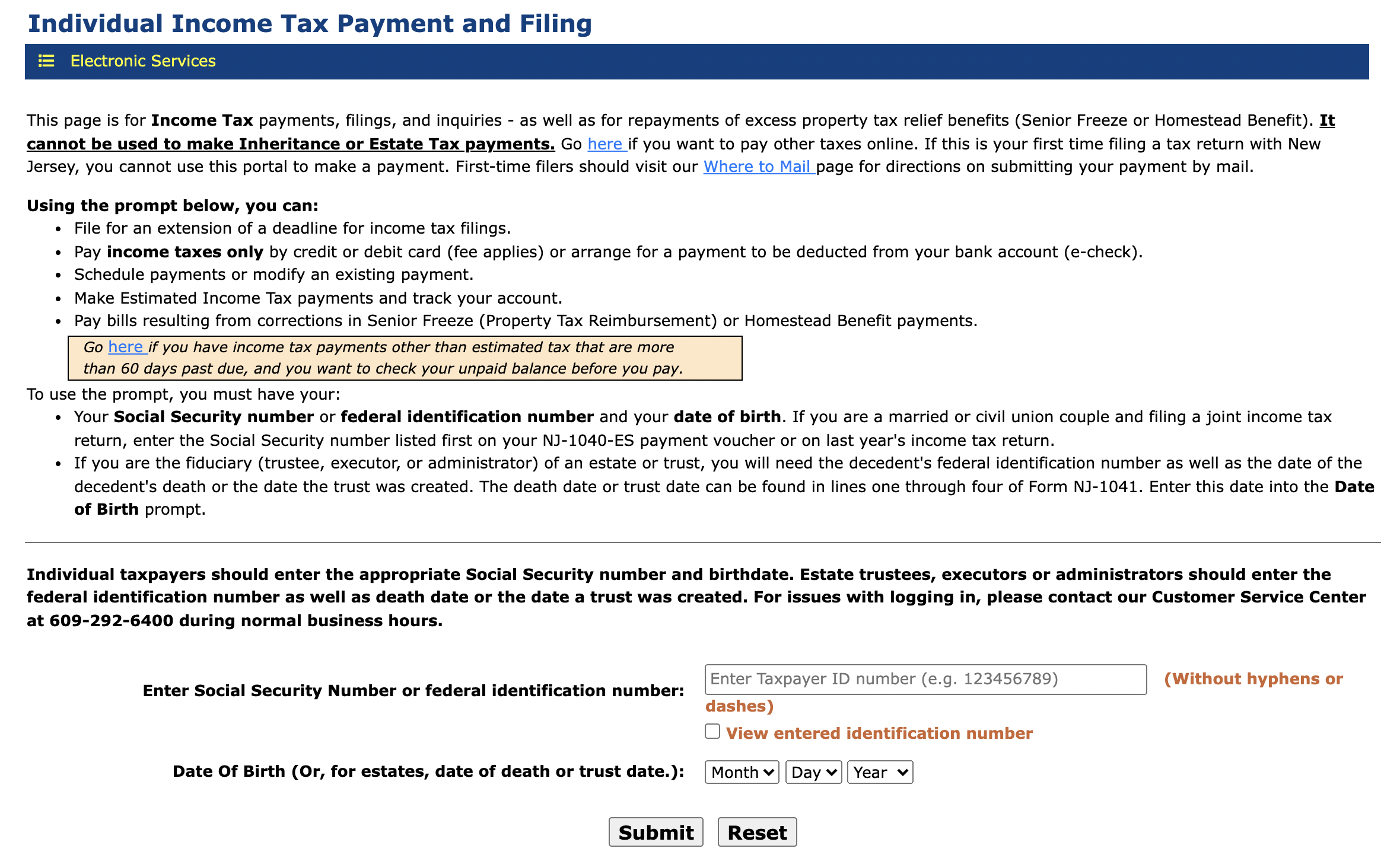

You are eligible for a New Jersey Earned Income Tax Credit or other credit and are due a refund If you are NOT required to file a return and you Are a homeowner or tenant It is usually easier to reach the NJ income threshold for the medical deduction of 2 compared to the federal income threshold of 7 5 Both retirees as well as employed individuals can benefit from this

Download New Jersey Income Tax Medical Deductions

More picture related to New Jersey Income Tax Medical Deductions

![]()

Income Tax Medical Deductions Can I Write Off My Medical Deductions

https://molentax.com/wp-content/uploads/2019/10/rawpixel-577480-unsplash.jpg

Paying State Income Tax In New Jersey Heard

https://support.joinheard.com/hc/article_attachments/4418239266967/Screen_Shot_2022-01-06_at_10.52.20_AM.png

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-6.jpg

Section 18 35 2 9 Medical expenses deduction a A taxpayer may deduct from gross income qualified medical expenses in excess of two percent of On your New Jersey tax return you can deduct medical expenses in excess of 2 of your New Jersey gross income If you entered any medical expenses in the

New Jersey allows you to deduct from your gross income certain medical expenses that you paid during the year for yourself your spouse or domestic partner and your dependents The medical deduction was on the chopping block for 2018 tax reform The final bill allows for medical expenses in excess of 7 5 percent of your adjusted gross income AGI to

Printable Itemized Deductions Worksheet

https://i0.wp.com/briefencounters.ca/wp-content/uploads/2018/11/clothing-donation-tax-deduction-worksheet-together-with-clothing-deduction-worksheet-fresh-calculating-sales-tax-worksheet-of-clothing-donation-tax-deduction-worksheet.jpg

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

https://1044form.com/wp-content/uploads/2020/08/8-best-images-of-tax-itemized-deduction-worksheet-irs-1187x1536.png

https://www.forbes.com/advisor/income-tax-calculator/new-jersey

New Jersey offers tax deductions and credits to reduce your tax liability including deductions for medical alimony and self employed health insurance expenses The

https://www.finsuranceguide.com/finance/tax...

Threshold Requirement In order to claim a deduction for medical expenses in New Jersey they must exceed a certain threshold of your adjusted gross income AGI For federal

1040 Deductions 2016 2021 Tax Forms 1040 Printable

Printable Itemized Deductions Worksheet

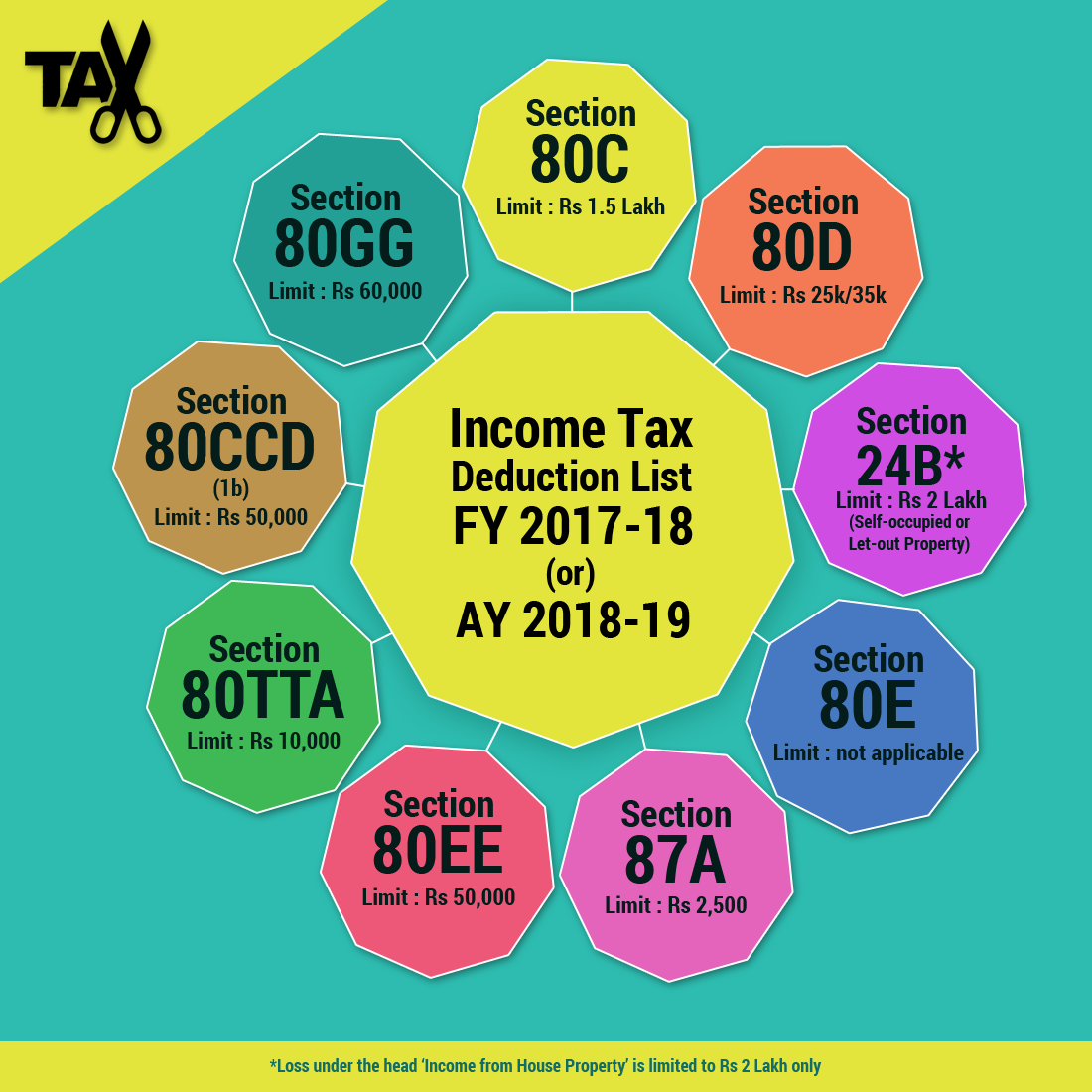

Income Tax Deductions For The FY 2019 20 ComparePolicy

Income Tax Calculator New Jersey DTAXC

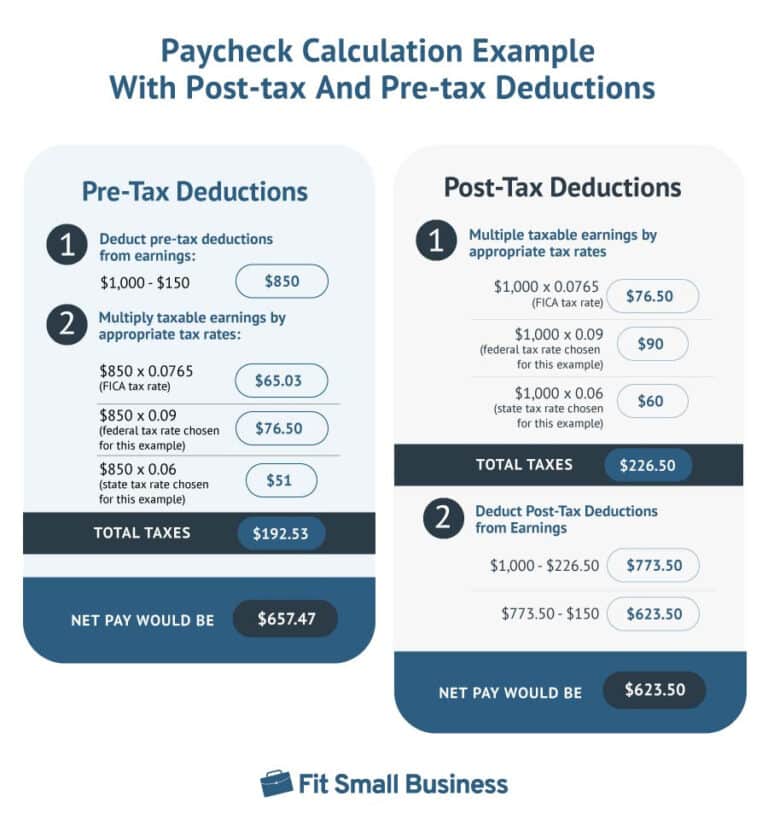

Pre tax Deductions Post tax Deductions An Ultimate Guide

New Jersey Income Tax Calculator 2023 2024

New Jersey Income Tax Calculator 2023 2024

Income Tax Brackets For 2021 And 2022 Publications National

Millions Of New Jerseyans Deduct Billions In State And Local Taxes Each

Bigger Deduction For Veterans Income Tax Becomes State Law

New Jersey Income Tax Medical Deductions - Estimate your New Jersey state tax burden with our income tax calculator Enter your annual income and filing details