New Jersey Mileage Reimbursement Law Mileage allowance in lieu of actual expenses of transportation is allowed for an employee traveling by personal automobile on official business at the rate authorized by the State Appropriations Act

STATE OF NEW JERSEY 220th LEGISLATURE PRE FILED FOR INTRODUCTION IN THE 2022 SESSION Sponsored by Senator SHIRLEY K TURNER District 15 Hunterdon and Mercer SYNOPSIS Sets States mileage reimbursement rate at IRS rate for business use of automobile CURRENT VERSION OF TEXT Introduced Pending Technical STATE OF NEW JERSEY 220th LEGISLATURE INTRODUCED MARCH 24 2022 Sponsored by Assemblyman JOHN F MCKEON District 27 Essex and Morris SYNOPSIS Encourages federal Internal Revenue Service to increase standard mileage reimbursement to alleviate economic hardship resulting from rising gas prices

New Jersey Mileage Reimbursement Law

New Jersey Mileage Reimbursement Law

https://gofar.b-cdn.net/wp-content/uploads/2020/02/gofar-mileage-reimbursement-law.jpg

Fichier Wetlands Cape May New Jersey jpg Wikip dia

http://upload.wikimedia.org/wikipedia/commons/d/de/Wetlands_Cape_May_New_Jersey.jpg

How To Get Your Mileage Reimbursement For Travel Expenses In Virginia

https://www.injuredworkerslawfirm.com/wp-content/uploads/2015/05/shutterstock_314822138.jpg

Created Date 7 5 2022 2 31 11 PM Mileage reimbursement for the use of a personal vehicle is not permitted when a State owned vehicle is available or when a State contracted rental car is more cost effective

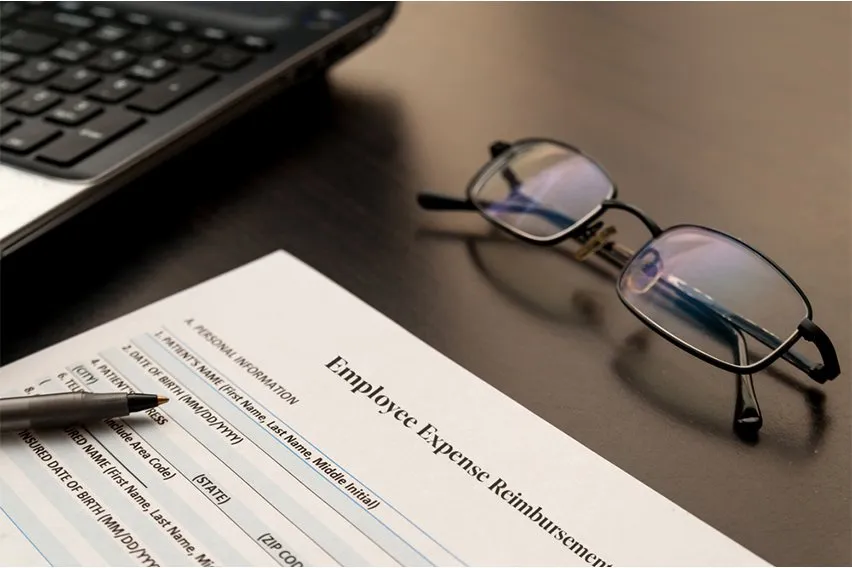

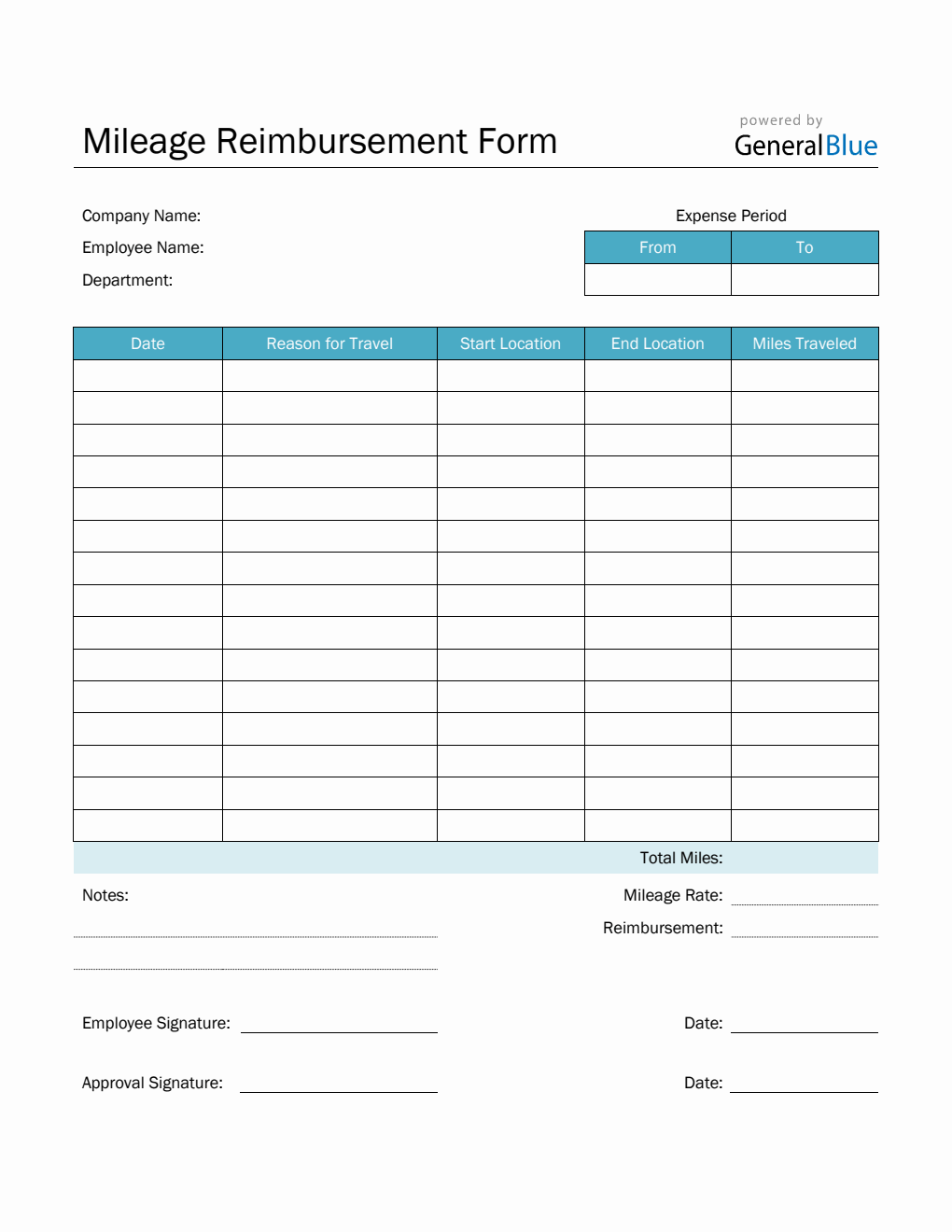

On December 17 2021 the IRS announced that beginning on January 1 2022 the standard mileage rates for the use of an automobile would be 58 5 cents per mile driven for business use 18 cents per mile driven for medical purposes or for moving purposes for qualified active duty members of the United States Armed Forces and 14 cents per mile In New Jersey there are no laws requiring private sector employers to reimburse employees for mileage However state employees receive a mileage reimbursement rate of 0 31 cents per mile when using personal vehicles for

Download New Jersey Mileage Reimbursement Law

More picture related to New Jersey Mileage Reimbursement Law

Manchester United Home Jersey 2022 23 Goaljerseys

https://cf.goaljerseys.cn/upload/ttmall/img/20220711/7a596dc299c8ca02608039bd95e505c1.png

What Expenses Does A Mileage Reimbursement Include

https://www.mburse.com/hubfs/pexels-photo-295826.jpeg

What Is The Law On Mileage Reimbursement MileIQ

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110f190fa53fca0fce2b71a_6108d7ac1189074b0a6efeb5_Mileage-Reimbursement-Law-1.jpeg

Under current law the State s mileage reimbursement rate is 0 18 cents per mile adjusted biannually to reflect changes in gasoline prices Annual appropriations acts have adjusted this mileage reimbursement rate Beginning on Jan 1 2022 the standard mileage rates for the use of a car also vans pickups or panel trucks will be 58 5 cents per mile driven for business use up 2 5 cents from the rate for 2021

28 27 Under current law the State s mileage reimbursement rate is 29 0 18 cents per mile adjusted biannually to reflect changes in 30 gasoline prices Annual appropriations acts have adjusted this 31 mileage reimbursement rate 32 This bill provides that the mileage reimbursement rate payable to As of Jan 1 the standard mileage rates for the use of a car van pickup or panel truck are 65 5 cents per mile driven for business use up 3 cents from the midyear increase setting the rate for the second half of 2022

Guide To Employee Mileage Reimbursement Law

https://www.freshbooks.com/wp-content/uploads/2022/01/employee-mileage-reimbursement-law.jpg

What Is Virginia s Mileage Reimbursement Law For Caregivers YouTube

https://i.ytimg.com/vi/ZeN8n8ai740/maxresdefault.jpg

https://www.nj.gov/infobank/circular/cir23-02-OMB.pdf

Mileage allowance in lieu of actual expenses of transportation is allowed for an employee traveling by personal automobile on official business at the rate authorized by the State Appropriations Act

https://pub.njleg.gov/bills/2022/S0500/262_I1.PDF

STATE OF NEW JERSEY 220th LEGISLATURE PRE FILED FOR INTRODUCTION IN THE 2022 SESSION Sponsored by Senator SHIRLEY K TURNER District 15 Hunterdon and Mercer SYNOPSIS Sets States mileage reimbursement rate at IRS rate for business use of automobile CURRENT VERSION OF TEXT Introduced Pending Technical

England Rugby Classic Stripe Rugby Jersey Womens

Guide To Employee Mileage Reimbursement Law

What Is Employee Expense Reimbursement Law How Does It Work

Mileage Reimbursement Form In PDF Basic

New Jersey Mileage Reimbursement Rate 2021 2021 Mileage Rate

Timeero Home Health Mileage Reimbursement And Tax Deduction Timeero

Timeero Home Health Mileage Reimbursement And Tax Deduction Timeero

New Jersey Mileage Reimbursement Rate 2021 2021 Mileage Rate

Free Mileage Reimbursement Form 2022 IRS Rates PDF Word EForms

Understanding Employee Mileage Reimbursement Law CLC Lodging

New Jersey Mileage Reimbursement Law - On December 17 2021 the IRS announced that beginning on January 1 2022 the standard mileage rates for the use of an automobile would be 58 5 cents per mile driven for business use 18 cents per mile driven for medical purposes or for moving purposes for qualified active duty members of the United States Armed Forces and 14 cents per mile