New Jersey Sales Tax Exempt Items In New Jersey certain items may be exempt from the sales tax to all consumers not just tax exempt purchasers Several examples of exemptions to the sales tax are most

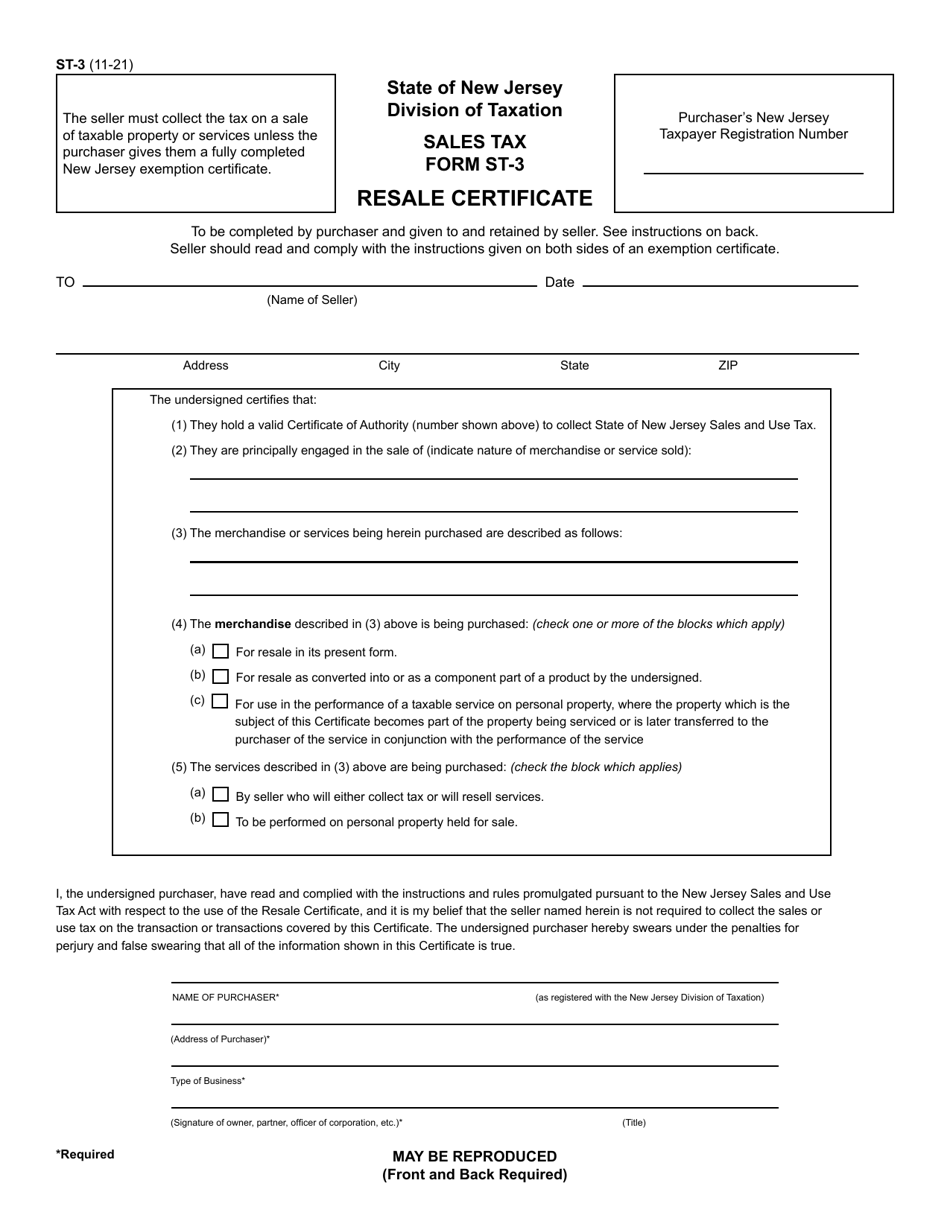

New Jersey assesses a 6 625 Sales Tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under New Jersey law Exempt items include most food sold as grocery items most clothing and footwear disposable paper products for household use prescription drugs and over the counter

New Jersey Sales Tax Exempt Items

New Jersey Sales Tax Exempt Items

https://msdtaxlaw.com/wp-content/uploads/2018/08/blog-image-jersey.jpg

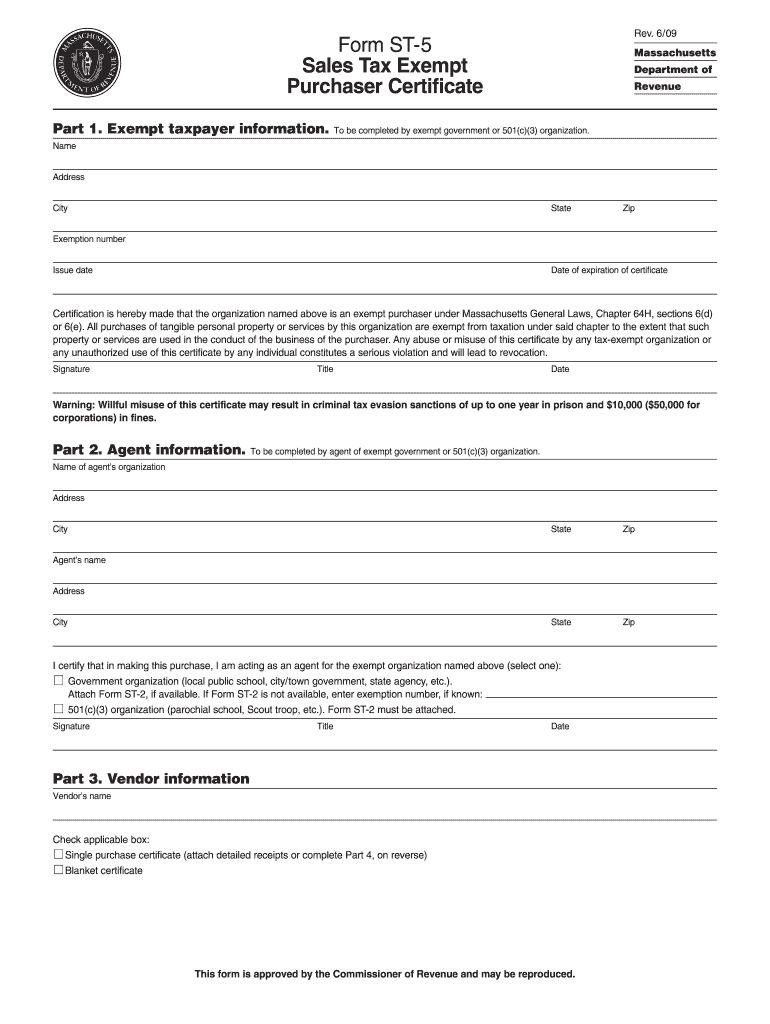

New Jersey Sales Tax Exempt Form Religious ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/form-for-new-jersey-sales-tax-exempt-st-5-tax-walls-9.png

Sales Tax In New Jersey What You Need To Know Lear Pannepacker LLP

https://lp-cpa.com/wp-content/uploads/2022/05/sales-tax-in-new-jersey.jpg

Some goods are exempt from sales tax under New Jersey law Examples include clothing and footwear most non prepared food items food stamps and medical supplies This page explains how to make tax free purchases in New Jersey and lists three New Jersey sales tax exemption forms available for download

New Jersey applies sales tax on the retail sale lease or rental of most goods and some services There are no additional local sales taxes in the state of New Jersey More Introduction This bulletin has been designed as a guide to New Jersey sales tax and the taxability of cer tain items and services sold at retail The lists of taxable and exempt

Download New Jersey Sales Tax Exempt Items

More picture related to New Jersey Sales Tax Exempt Items

New Jersey Sales Tax Tax Rate Guides Sales Tax USA

https://slash4.salestaxusa.com/wp-content/uploads/New-Jersey-Sales-Tax-600x450.jpg

New Jersey Sales Tax On Restaurants Sales Tax Helper

https://www.salestaxhelper.com/images/blog/Sales-Tax-on-Restaurants-Featured.jpg

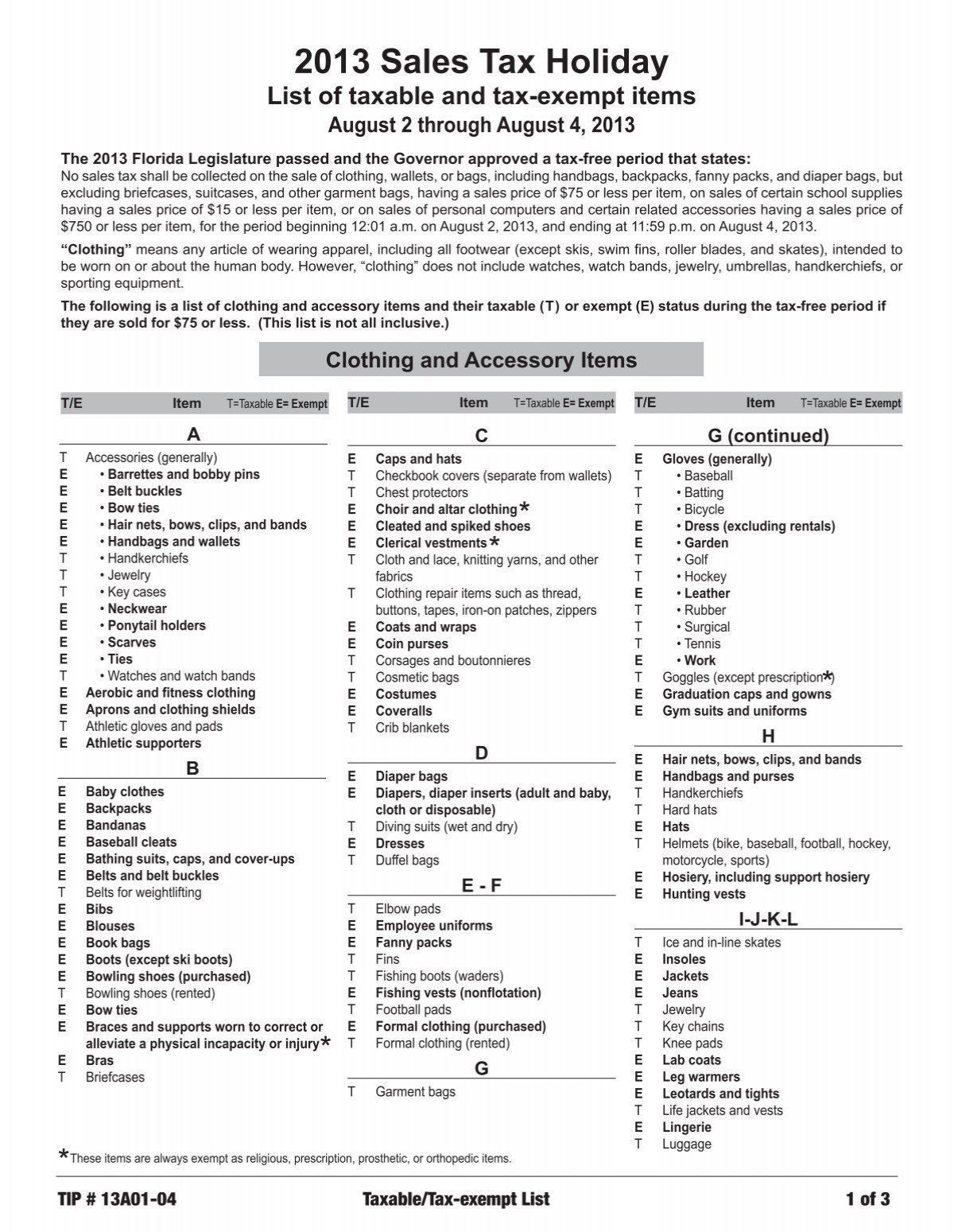

List Of Tax exempt And Taxable Items

https://www.yumpu.com/en/image/facebook/29575440.jpg

For most New Jersey Business owners New Jersey assesses a tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under What items are exempt from the sales tax in New Jersey New Jersey exempts several essential goods and services from its 6 625 sales tax to make basic

Clothing Most articles of clothing are exempt from sales tax Prescription Drugs Both prescription and many over the counter drugs are exempt Educational New Jersey has a lower state sales tax than 55 8 of states Items such as groceries household paper products medicine and clothes are exempt from all sales taxes

NJ School Supplies tax Holiday List Of What Would Be Tax Free

https://www.gannett-cdn.com/presto/2022/06/22/PNJM/4b15de31-e714-4650-9890-e104f8d95232-SALESTAXHOLIDAY0622A.jpg?crop=2399,1349,x0,y114&width=2399&height=1349&format=pjpg&auto=webp

Verw sten Gew hnliche Zur cktreten New Jersey Tax Free Verbrannt

https://www.njpp.org/wp-content/uploads/2017/09/NJ-income-tax-bracketsproposed-01.jpg

https://www.salestaxhandbook.com/new-jersey/sales...

In New Jersey certain items may be exempt from the sales tax to all consumers not just tax exempt purchasers Several examples of exemptions to the sales tax are most

https://www.nj.gov/.../businesses/sales…

New Jersey assesses a 6 625 Sales Tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under New Jersey law

Nj Tax Sale Certificate Toshia Lance

NJ School Supplies tax Holiday List Of What Would Be Tax Free

ShopKeep Tax Exempt Items YouTube

New Jersey Sales Tax Guide

New Jersey Sales Tax Holiday To Provide Buyers With Temporary Tax

Nj Sales Tax Exempt Form ExemptForm

Nj Sales Tax Exempt Form ExemptForm

New Jersey Sales Tax Sales Tax New Jersey NJ Sales Tax Rate

New Jersey Sales Tax Rates US ICalculator

New Jersey Sales Tax Exempt Items - Under New Jersey law some items are exempt from sales and use tax regardless of who buys them or how they are used such as most clothing food food ingredients and