New Jersey Tax Free Clothing The Streamlined Sales and Use Tax Agreement affects the New Jersey Sales Tax treatment of certain products and services including but not limited to candy soft

Are Clothing subject to sales tax While New Jersey s sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales The current tax rate for the state is 6 625 and some items of clothing that are for human use are considered taxable including Fur clothing i e jackets vests

New Jersey Tax Free Clothing

New Jersey Tax Free Clothing

https://bestsavingscoupon.com/blog/wp-content/uploads/2022/07/960x0.jpg

New Jersey Tax Rate Notice Dunn Corporate Resources

https://dunncorp.com/blog/wp-content/uploads/2017/08/new-jersey.jpg

Verw sten Gew hnliche Zur cktreten New Jersey Tax Free Verbrannt

https://www.njpp.org/wp-content/uploads/2017/09/NJ-income-tax-bracketsproposed-01.jpg

Clothing is fully exempt in Minnesota New Jersey Pennsylvania New Jersey and Vermont In three states clothing up to a certain cap is exempt in Massachusetts the New Jersey The New Jersey tax on clothing is similar to Minnesota in that all items are exempt regardless of cost except for equipment accessories any type

The New Jersey Sales Tax Handbook provides everything you need to understand the New Jersey Sales Tax as a consumer or business owner including sales tax rates Section 18 24 6 3 Exempt sales of clothing and footwear a Receipts from retail sales of clothing are exempt from tax imposed under the Sales and Use Tax Act

Download New Jersey Tax Free Clothing

More picture related to New Jersey Tax Free Clothing

Nj Property Tax Relief Check 2021 Clair Blackwell

https://www.incometaxpro.net/images/forms/2021/new-jersey-tax-forms.png

Franklin New Jersey Tax Free Income Fund Summary Prospectus

https://s2.studylib.net/store/data/018467754_1-b0fa06b8ea1acef072f2a3c7ab16b909-768x994.png

New Jersey State Tax Form 2023 Printable Forms Free Online

https://www.incometaxpro.net/images/forms/2022/new-jersey-tax-forms.png

Both the sale and rental of adult costumes are subject to tax The definition of clothing in the new law does not make a distinction between children s and adult costumes From cap to shoes as long as they re not made of fur your clothing receipts are most likely free from a sales tax charge Items such as bathing suits belts coats and gloves are exempt

The New Jersey Division of Taxation offers a list of taxable and exempt clothing and footwear in its Sales Tax Guide along with some helpful tidbits For New Jersey Clothing is tax exempt but fur clothing clothing accessories or equipment sport or recreational equipment or protective equipment are taxable

New Jersey Tax Rebate 2023 Everything You Need To Know Printable

https://printablerebateform.net/wp-content/uploads/2023/04/New-Jersey-Tax-Rebate-2023-768x689.png

How To Fill Out A New Jersey Property Tax Reimbursement Form Property

https://i.pinimg.com/736x/aa/2c/cb/aa2ccb22e0d7089e51a599505f18b335.jpg

https://www.nj.gov/treasury/taxation/pdf/pubs/sales/su4.pdf

The Streamlined Sales and Use Tax Agreement affects the New Jersey Sales Tax treatment of certain products and services including but not limited to candy soft

https://www.salestaxhandbook.com/new-jersey/sales...

Are Clothing subject to sales tax While New Jersey s sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales

Jersey Changes Tax Policy

New Jersey Tax Rebate 2023 Everything You Need To Know Printable

LOVE YOUR MONEY New Jersey On Path To Tying For Highest Corporate Tax

New Jersey Corporate Tax Breaks Cost Taxpayers Billions WNYC New

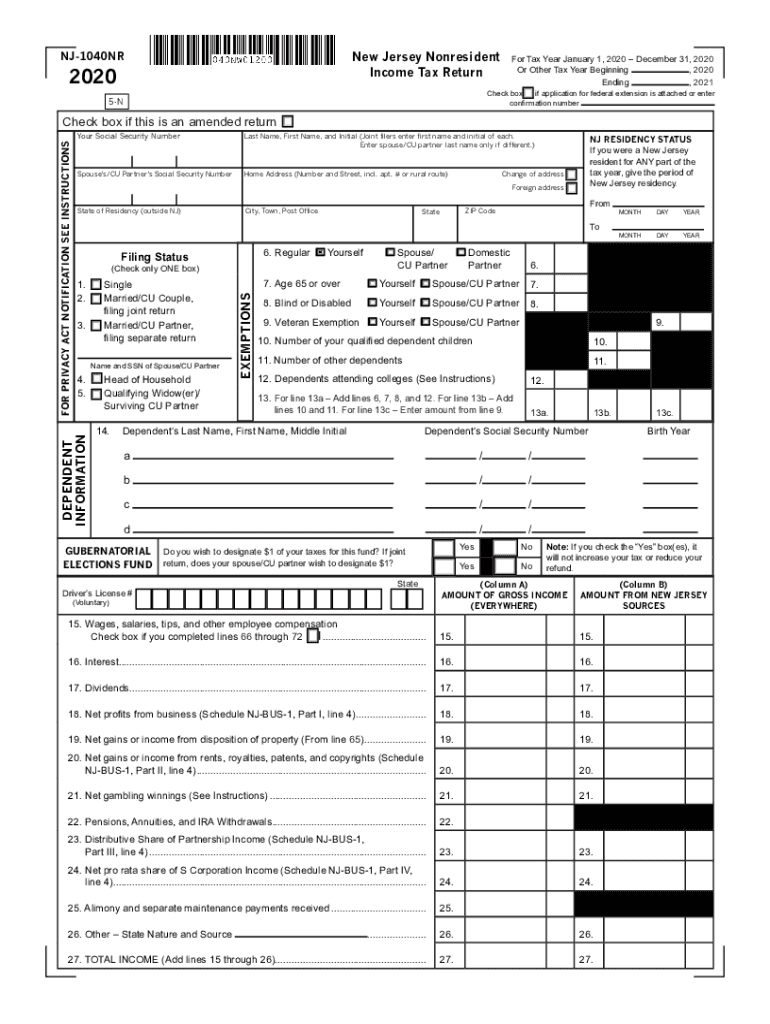

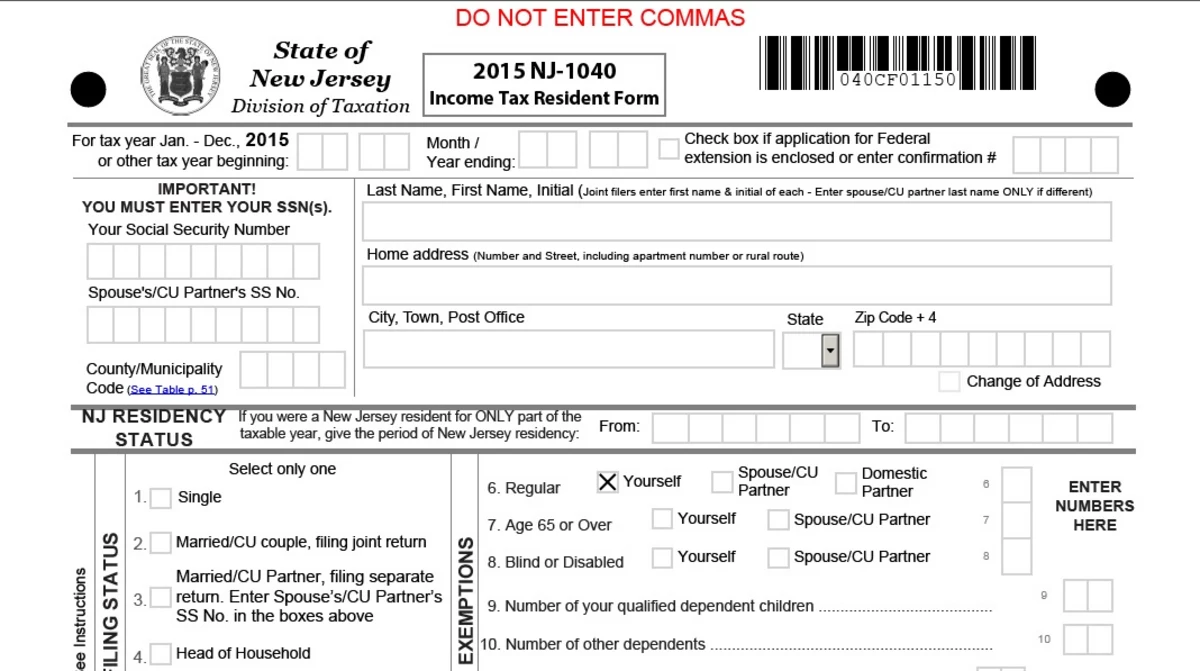

New Jersey Nonresident 2020 2023 Form Fill Out And Sign Printable PDF

Application For Tax Clearance New Jersey Free Download

Application For Tax Clearance New Jersey Free Download

New Jersey Tax Liens Explained Florida Tax Lien Tax Deed Research

For New Jersey City Tax free Development Comes At A Cost Al Jazeera

New Jersey Delaying Income Tax Refunds Until March

New Jersey Tax Free Clothing - Section 18 24 6 3 Exempt sales of clothing and footwear a Receipts from retail sales of clothing are exempt from tax imposed under the Sales and Use Tax Act