New Mexico Child Tax Credit 2023 Verkko New Mexico should increase the Child Tax Credit to up to 600 for families most in need and index the credit for inflation Policies like the Child Tax Credit CTC that boost

Verkko Relief payments or 500 or 1 000 for New Mexicans who do not qualify for the rebates above A total of 15 million was appropriated for the payments which were distributed based on an application process Verkko 7 huhtik 2023 nbsp 0183 32 The expanded child tax credit provides for more than 100 million in tax relief for an estimated 214 000 families who will be able to claim a larger credit of up

New Mexico Child Tax Credit 2023

New Mexico Child Tax Credit 2023

https://i.ytimg.com/vi/jZkTfYSsaw8/maxresdefault.jpg

.png)

Monday Map Average Child Tax Credit Received Per Tax Return Tax

https://files.taxfoundation.org/legacy/docs/Child-Credit-Received-(Large).png

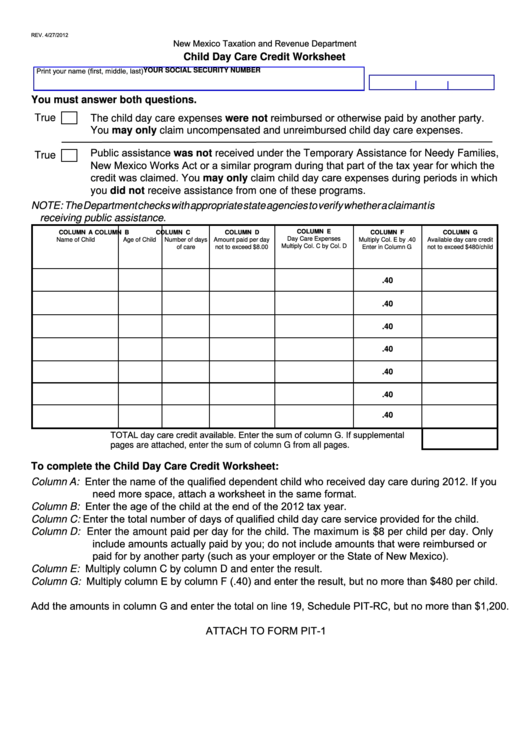

Child Day Care Credit Worksheet Form New Mexico Taxation And Revenue

https://data.formsbank.com/pdf_docs_html/319/3196/319696/page_1_thumb_big.png

Verkko 12 maalisk 2022 nbsp 0183 32 According to a fact sheet distributed by the governor s office House Bill 163 creates a new refundable child tax credit of up to 175 per child and Verkko 11 huhtik 2023 nbsp 0183 32 The amendment is effective April 1 2023 Child income tax credit As approved the bill increases the child tax credit for the lowest three income levels

Verkko 14 marrask 2023 nbsp 0183 32 For 2024 the credit is worth up to 7 830 up from 7 430 for 2023 with three qualifying children 6 960 up from 6 604 with two qualifying children Verkko New Mexico Passes Its Own Child Tax Credit National Interest March 2022 New Mexico joined many other states in enacting a new state Child Tax Credit CTC

Download New Mexico Child Tax Credit 2023

More picture related to New Mexico Child Tax Credit 2023

Maximum Amount Of Child Tax Credit 2023 Texas Breaking News

https://texasbreaking.com/wp-content/uploads/2023/02/child-tax-credit-in-2023-check-eligibility-how-to-claim.jpg

T14 0047 Eliminate Income Threshold For The Refundable Child Tax

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/T14-0047.gif?itok=5kNtR7oI

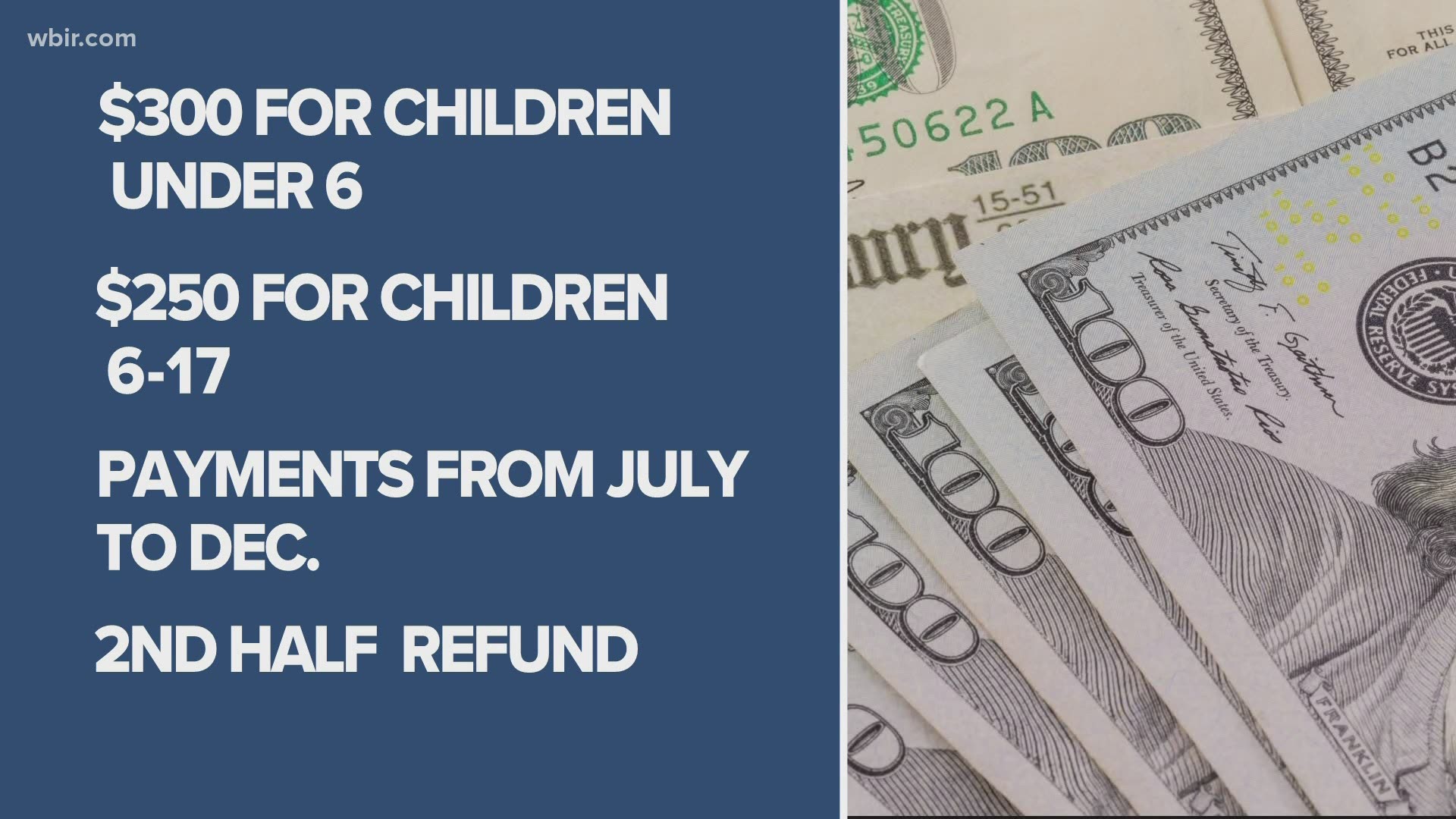

Child Tax Credit You Can Opt out Of Monthly Payment Soon Wnep

https://media.tegna-media.com/assets/WBIR/images/b623d726-e494-4ce3-9e5e-7a9b8470caf3/b623d726-e494-4ce3-9e5e-7a9b8470caf3_1920x1080.jpg

Verkko 14 maalisk 2022 nbsp 0183 32 A new refundable child tax credit ranging from 25 to 175 per child depending on income beginning in the 2023 tax year and continuing through Verkko Latest Legislative Action On April 7 2023 New Mexico Governor Michelle Lujan Grisham signed House Bill 147 which increased the state CTC value to up to 600

Verkko 17 tammik 2023 nbsp 0183 32 New Mexico recently enacted a new state level CTC that will provide benefits Increasing the Child Tax Credit to every single child throughout the state 1 Verkko 7 huhtik 2023 nbsp 0183 32 The child tax credit provides more than 100 million in tax relief for around 214 000 New Mexico families Those families will be able to claim a larger

T14 0048 Eliminate Income Threshold For The Refundable Child Tax

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/T14-0048.gif?itok=p2LRkHoI

Child Credit Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/100/58/100058528/large.png

https://www.nmvoices.org/wp-content/uploads/2023/02/CT…

Verkko New Mexico should increase the Child Tax Credit to up to 600 for families most in need and index the credit for inflation Policies like the Child Tax Credit CTC that boost

.png?w=186)

https://www.tax.newmexico.gov/rebates

Verkko Relief payments or 500 or 1 000 for New Mexicans who do not qualify for the rebates above A total of 15 million was appropriated for the payments which were distributed based on an application process

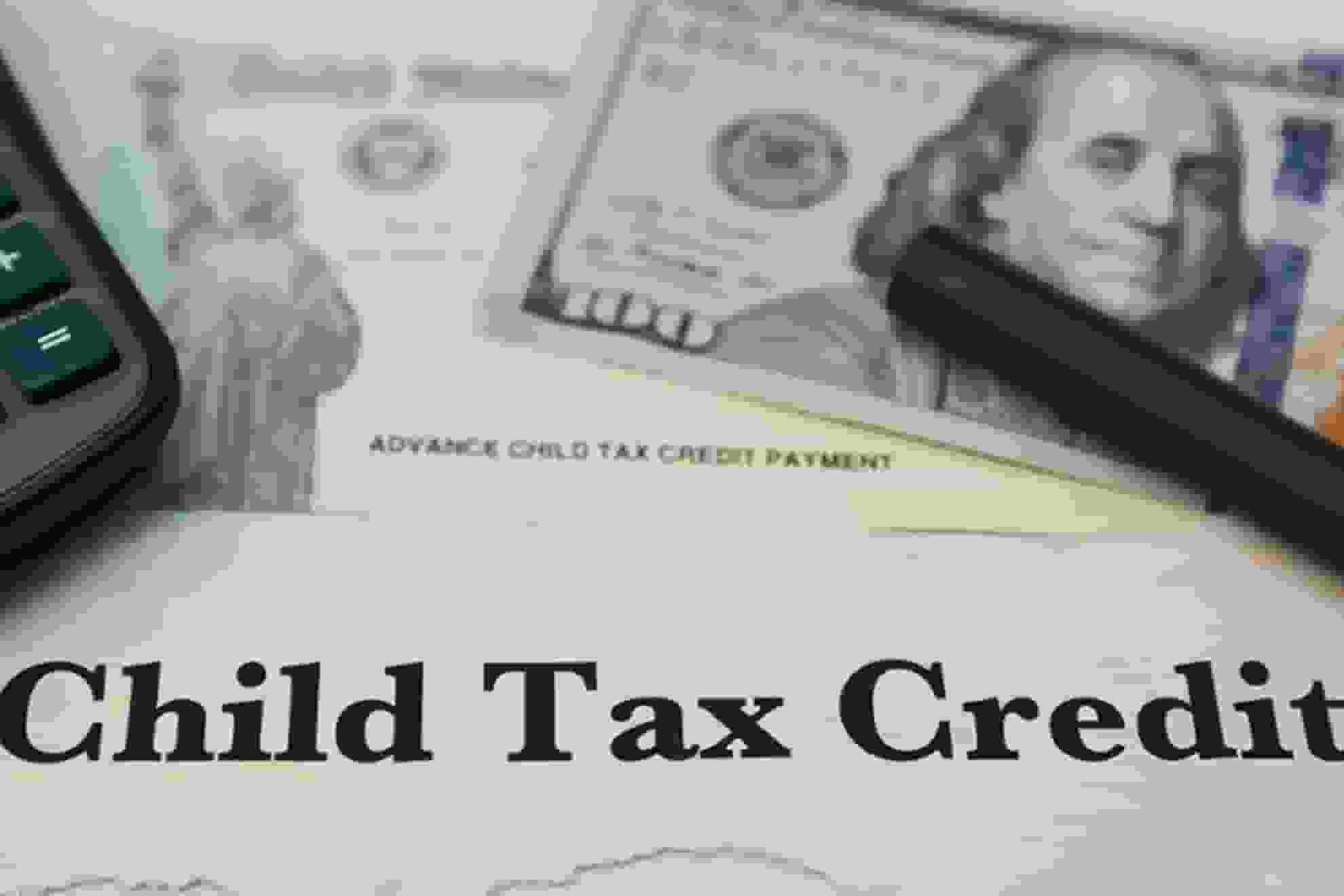

Advance Child Tax Credit Payments Start Today Cook Co News

T14 0048 Eliminate Income Threshold For The Refundable Child Tax

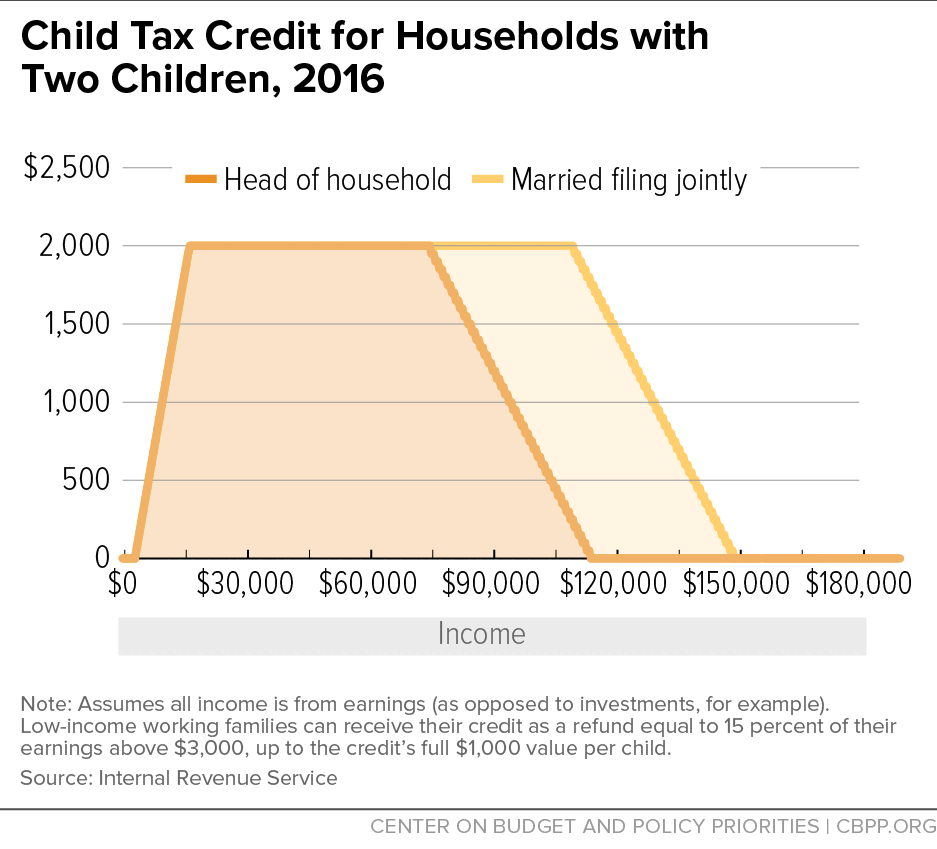

Chart Book The Earned Income Tax Credit And Child Tax Credit Center

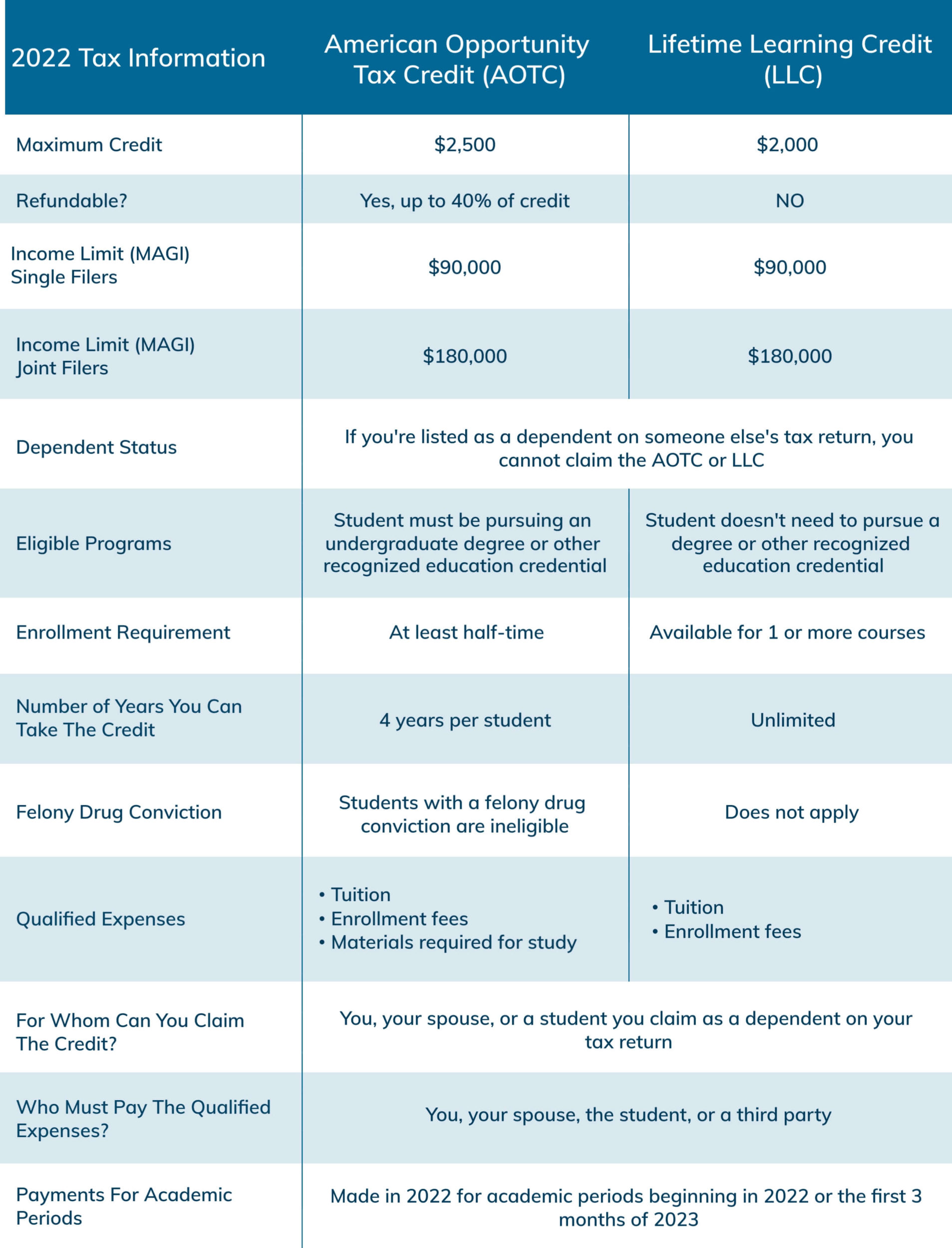

2022 Education Tax Credits Are You Eligible

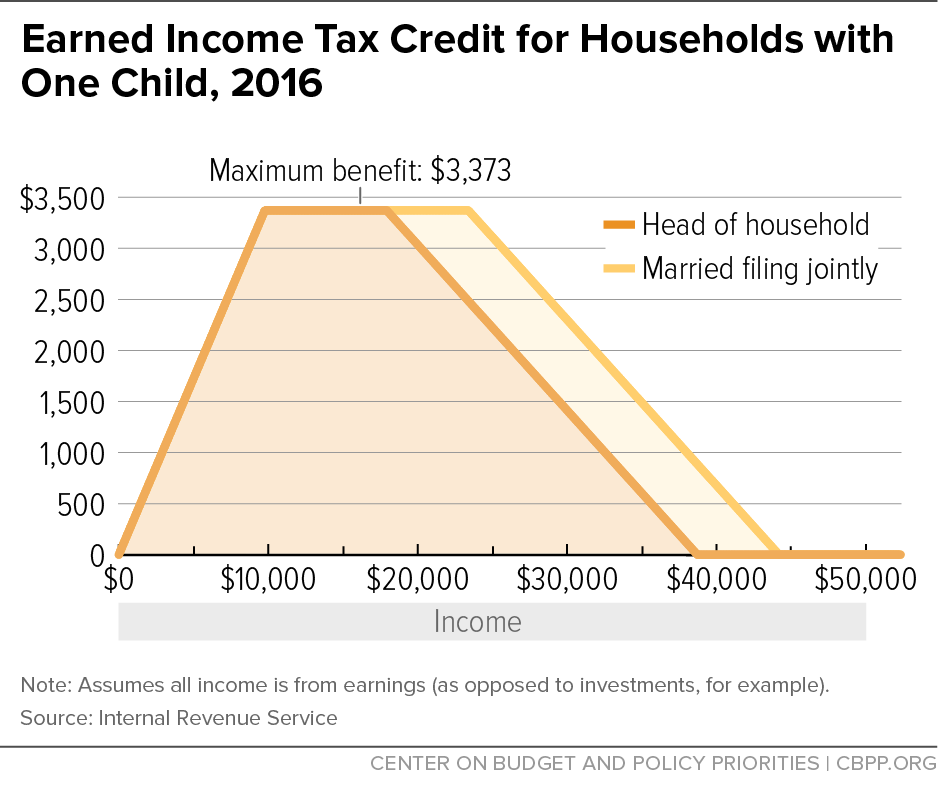

Earned Income Tax Credit For Households With One Child 2016 Center

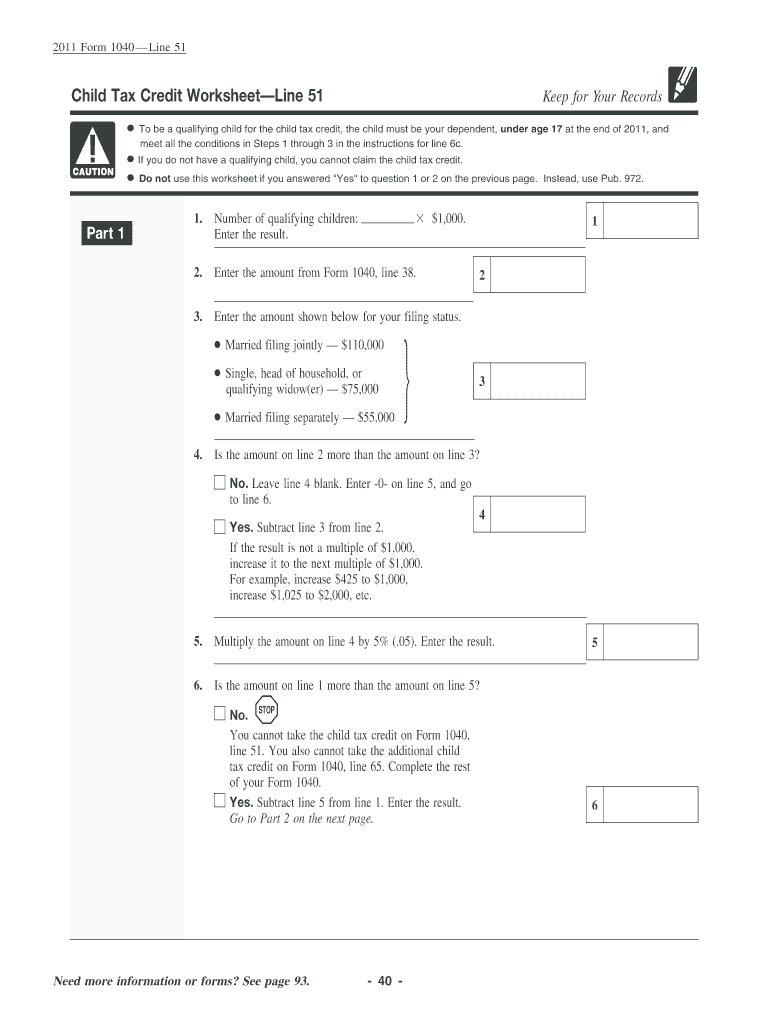

Child Tax Credit Form Free Download

Child Tax Credit Form Free Download

Is The 2020 Child Tax Credit A Refundable Credit Leia Aqui Is The IRS

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some

What Is The Difference Between Child Tax Credit And Child Care Tax

New Mexico Child Tax Credit 2023 - Verkko 10 huhtik 2023 nbsp 0183 32 Governor Approves Tax Rebate And Expanded Child Tax Credit From New Mexico On Friday Gov Grisham signed into law some of her key tax priorities