New Mexico Low Income Comprehensive Tax Rebate Table Web Low Income Comprehensive Tax Rebate LINE 14 To qualify for this rebate all of the following must be true You have a modified gross income of 36 000 or less You were

Web 36 000 or less may qualify for the low income comprehensive tax rebate Section II 16 000 or less who are age 65 or older may qualify for the property tax rebate Section Web 36 000 or less Low Income Comprehensive Tax Rebate Section II 16 000 or less Property Tax Rebate if you are 65 or older Section III 30 160 or less New Mexico

New Mexico Low Income Comprehensive Tax Rebate Table

New Mexico Low Income Comprehensive Tax Rebate Table

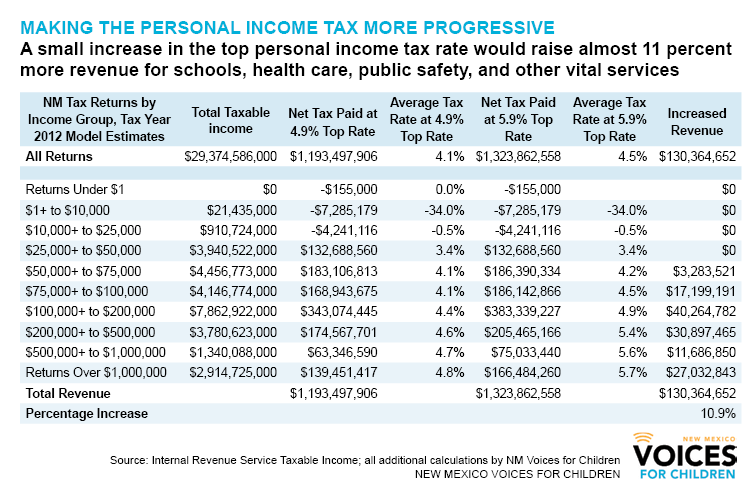

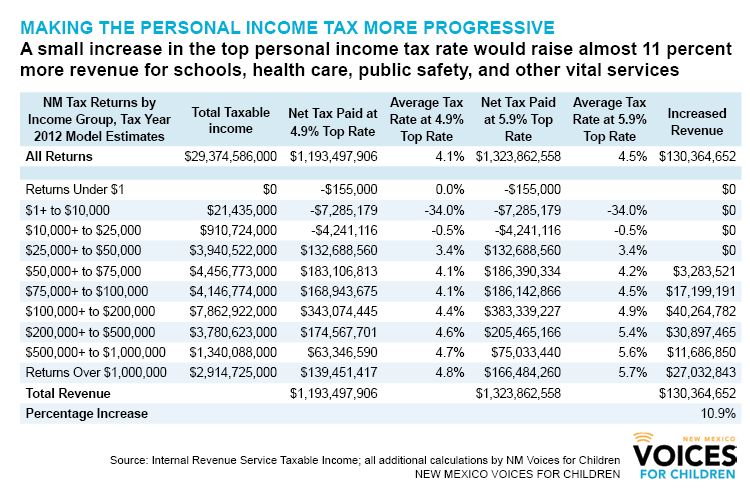

https://www.nmvoices.org/wp-content/uploads/2015/01/PIT-graphic-1-new.png

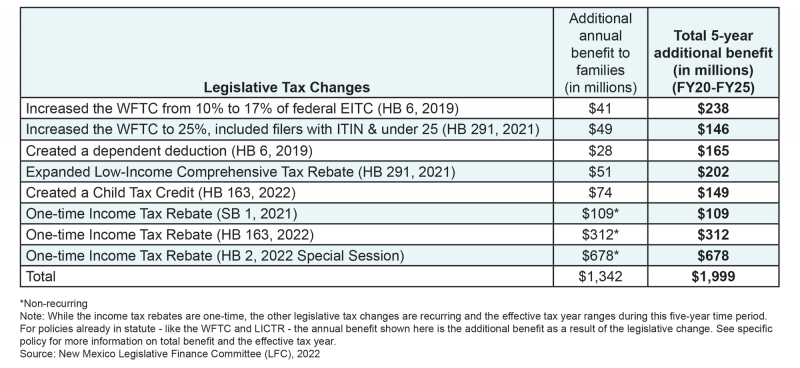

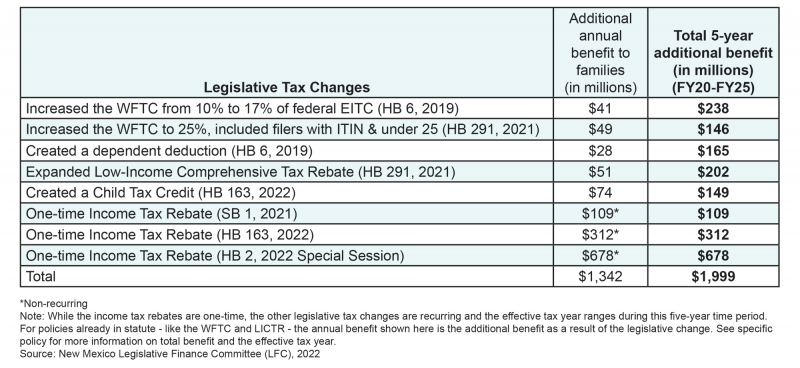

New Mexico Is Putting Families First In Tax Policy New Mexico Voices

https://www.nmvoices.org/wp-content/uploads/2022/06/NM-Tax-Policy-Wins-for-Families_factsheet_table1-1-800x368.png

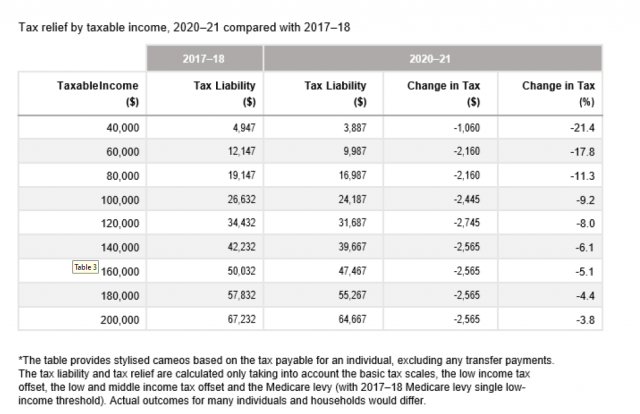

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Web Besides access to the new rebate low income New Mexicans may also be eligible for refundable tax credits and rebates like the Low Income Comprehensive Tax Rebate Web If your modified gross income is You may qualify for 22 000 or less Low Income Comprehensive Tax Rebate Section II 16 000 or less Property Tax Rebate if you

Web Low Income Comprehensive Tax Rebate thanks to changes signed into law by Gov Lujan Grisham Under the provisions of House Bill 291 the Working Families Tax Credit will be Web 11 avr 2023 nbsp 0183 32 As approved the bill increases the child tax credit for the lowest three income levels from 175 to 600 150 to 400 and 125 to 200 The bill also adds

Download New Mexico Low Income Comprehensive Tax Rebate Table

More picture related to New Mexico Low Income Comprehensive Tax Rebate Table

Increase The Threshold For Qualifying For Tax Forgiveness PennLive

https://www.pennlive.com/resizer/m4KwUD7bWaXPCpyOB7MZ4BmTwYs=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/U5MVCZVZI5COTCDGVU3MWDQABQ.png

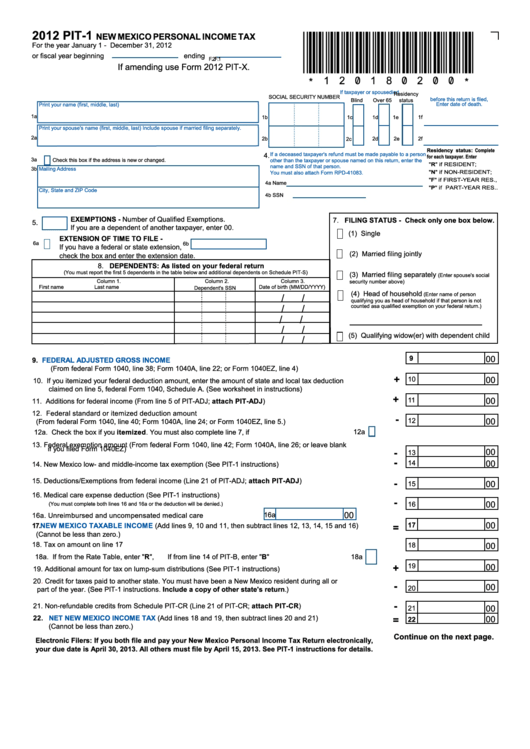

New Mexico Tax Forms And Instructions For 2020 Form PIT 1

https://www.incometaxpro.net/images/forms/2020/new-mexico-tax-forms.png

Budget 2020 Individuals Tax Accounting Adelaide

https://www.taxaccountingadelaide.com/wp-content/uploads/2020/10/00-640x414.png

Web 6 avr 2021 nbsp 0183 32 The Low Income Comprehensive Tax Rebate or LICTR under the new law will now be worth up to 730 depending on income and family size up from a maximum Web 14 mars 2022 nbsp 0183 32 retirement income in 2022 and gradually rising to 30 000 of retirement income in tax years 2024 through 2026 A new refundable child tax credit ranging from

Web The Low Income Comprehensive Income Tax Rebate is now available to taxpayers with up to 36 000 in modified gross income The average rebate is expected to rise from Web 505 670 5406 March 5 2021 Guidance on 600 Income Tax Rebates Certain taxpayers who qualify for the New Mexico Working Families Tax Credit will also be eligible for the

Download 1040Ez 2020 Tax Table Table Gallery

https://lh5.googleusercontent.com/proxy/IyTOge_aHqsRs6h-IMVGBkaS1wXpPkhhHzVmb143wbZGwRllXIjTh4ZUdqkZ4cZkjF8la5DbA0aKOauwOnshdjVqH22DraZCSuurZ9Cvy41TtMuYMkBIfb34Qv3O-JI5bgBUJMzrKY0FgoZkKDK_uGYf0vxU_VmlR9aGM54=w1200-h630-p-k-no-nu

A Guide To New Mexico s Tax System New Mexico Voices For Children

https://www.nmvoices.org/wp-content/uploads/2020/03/Tax-guide-2021-figure4.png

https://taxsim.nber.org/historical_state_tax_forms/NM/2021/…

Web Low Income Comprehensive Tax Rebate LINE 14 To qualify for this rebate all of the following must be true You have a modified gross income of 36 000 or less You were

http://realfile.tax.newmexico.gov/2022pit-rc.pdf

Web 36 000 or less may qualify for the low income comprehensive tax rebate Section II 16 000 or less who are age 65 or older may qualify for the property tax rebate Section

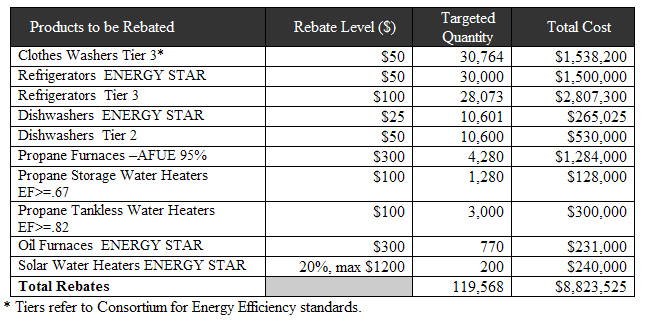

Michigan Appliance Rebate Program GreeningDetroit

Download 1040Ez 2020 Tax Table Table Gallery

Budget Highlights For 2021 22 Nexia SAB T

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

Form Pit 1 New Mexico Personal Income Tax form Pit Adj New Mexico

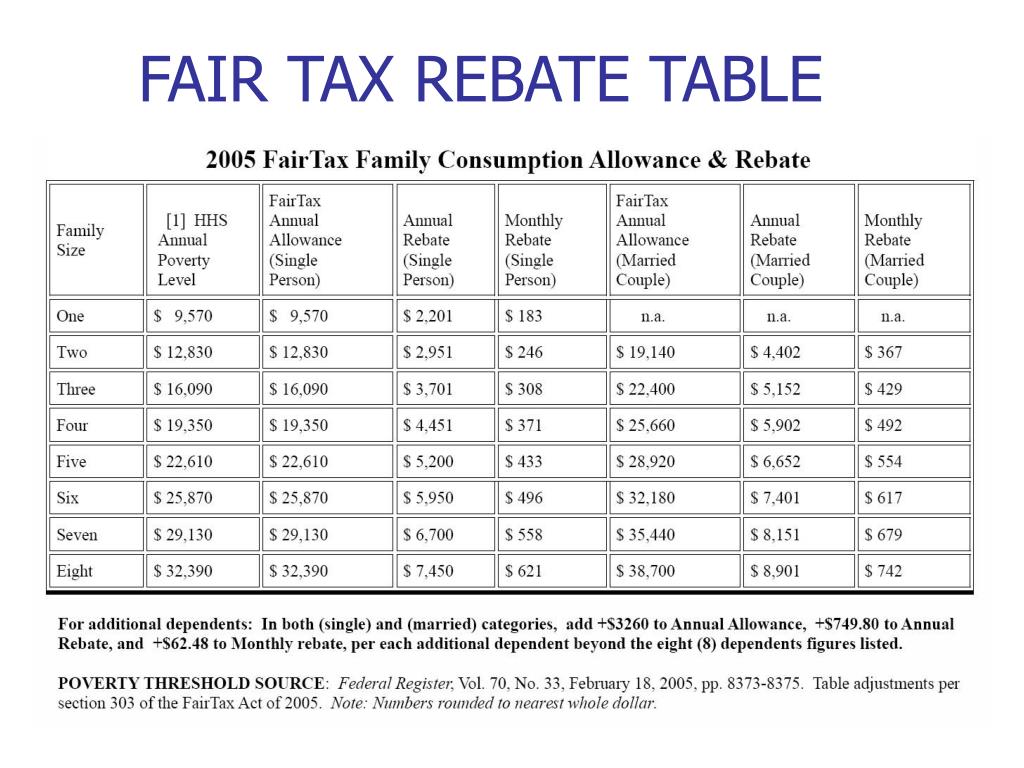

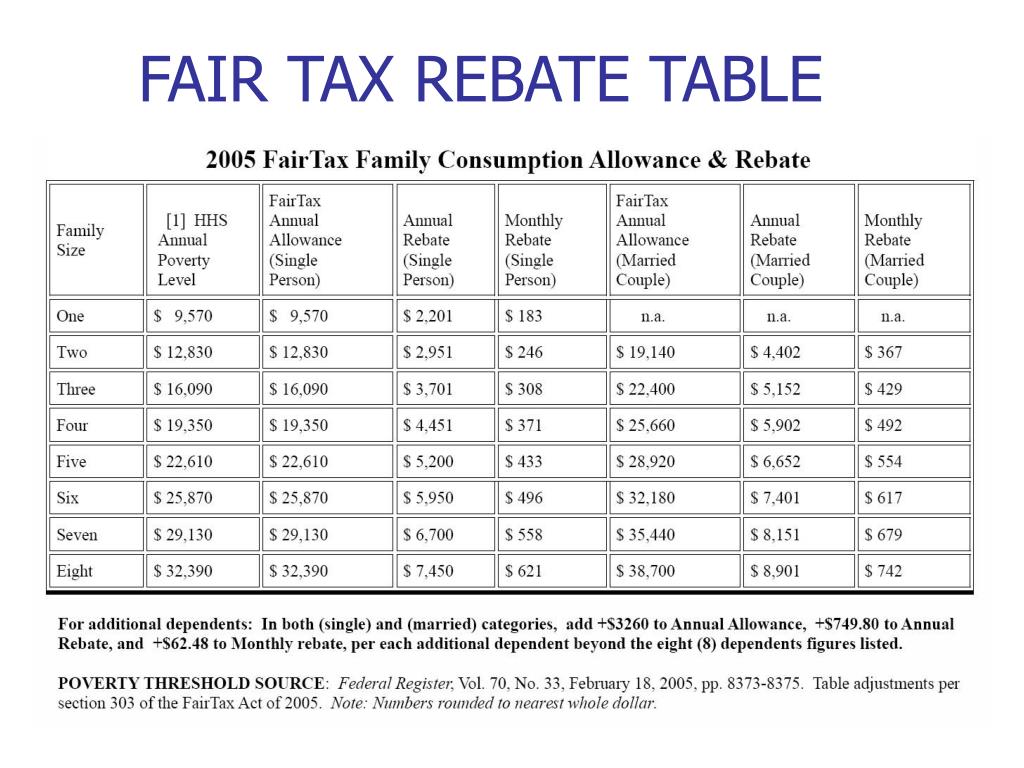

PPT The FairTax Plan HR 25 S25 PowerPoint Presentation Free Download

PPT The FairTax Plan HR 25 S25 PowerPoint Presentation Free Download

ISelect What You Need To Know Tax Rebates On Health Insurance And

FPUC Commercial Natural Gas

Awesome Reclassification Note In Financial Statements Nfra Report On

New Mexico Low Income Comprehensive Tax Rebate Table - Web 2 juil 2014 nbsp 0183 32 Low income comprehensive tax rebate 187 LawServer New Mexico Statutes gt Chapter 7 gt Article 2 gt 167 7 2 14 New Mexico Statutes 7 2 14 Low income