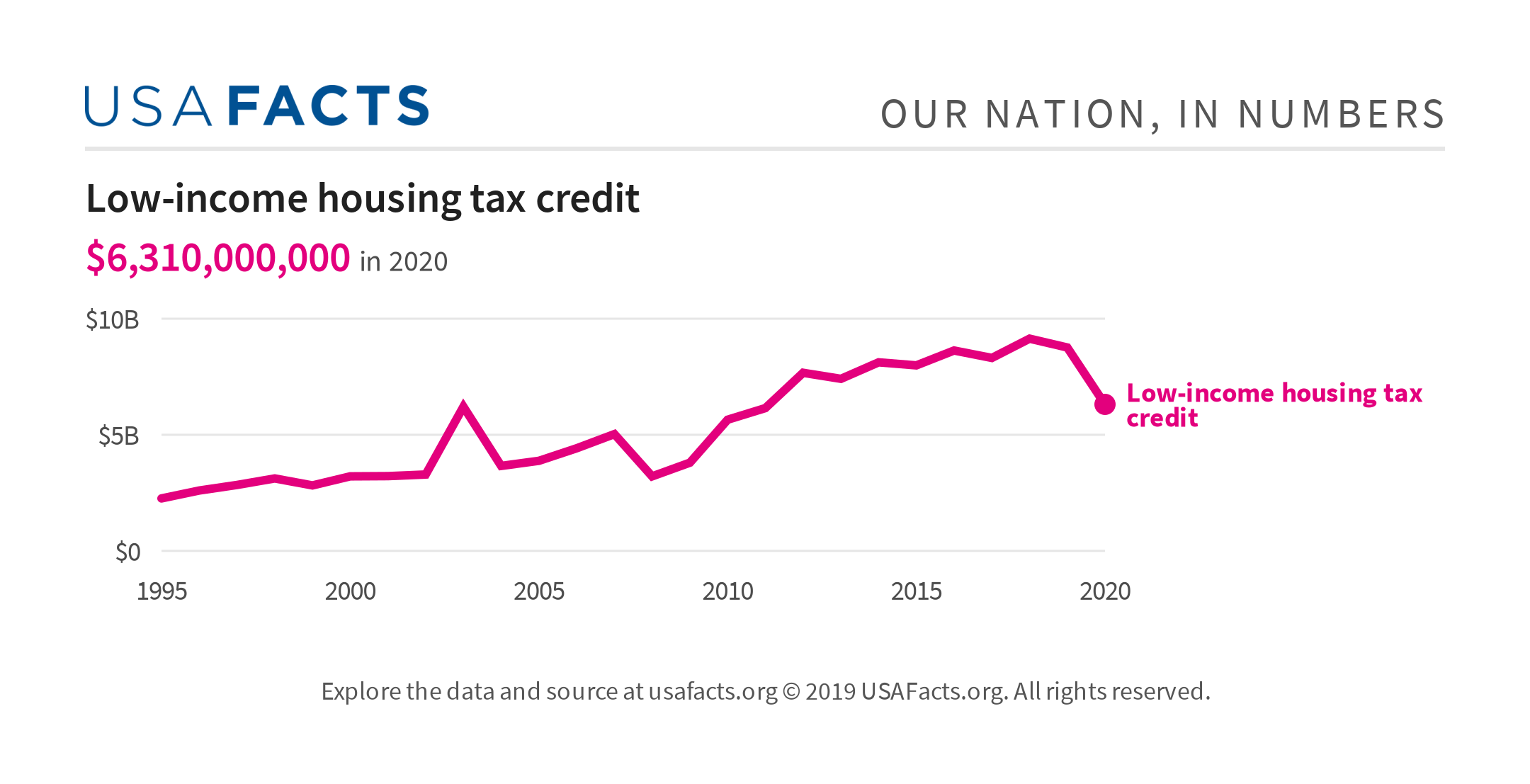

New Mexico Low Income Housing Tax Credit The development must be maintained as low income housing for at least 30 years Obtaining Tax Credits In 2023 each state has an annual tax credit authority equal to 2 75 per state resident New Mexico s annual authority is estimated at 5 818 662 in 2023 with a population estimate of 2 115 877

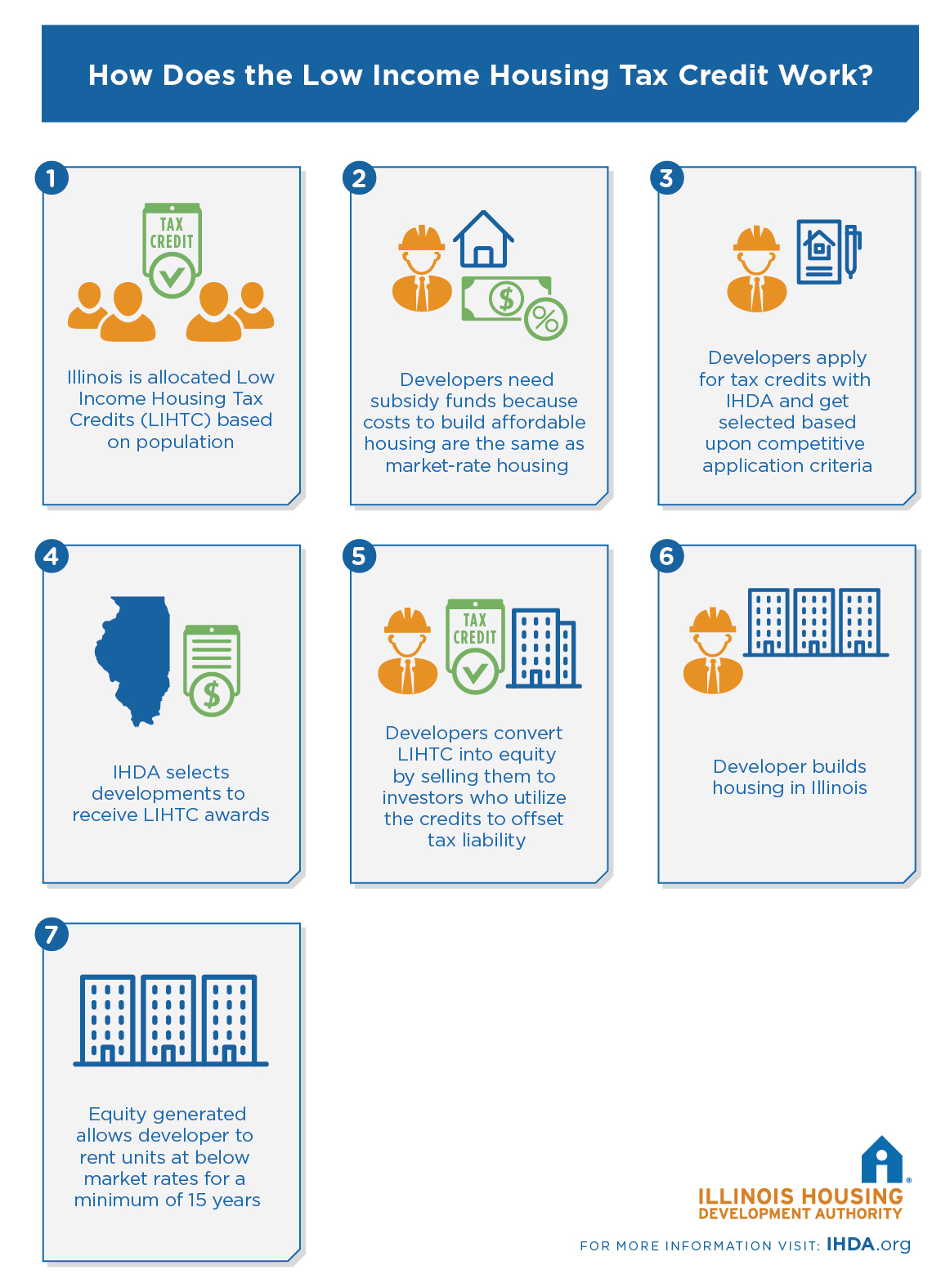

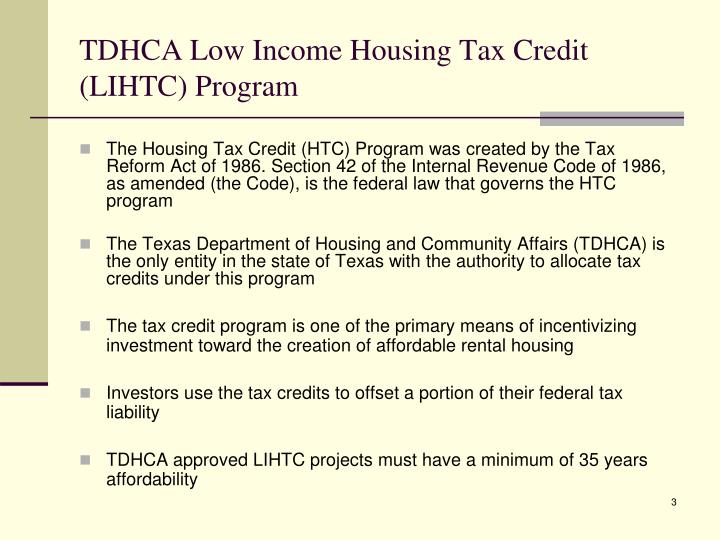

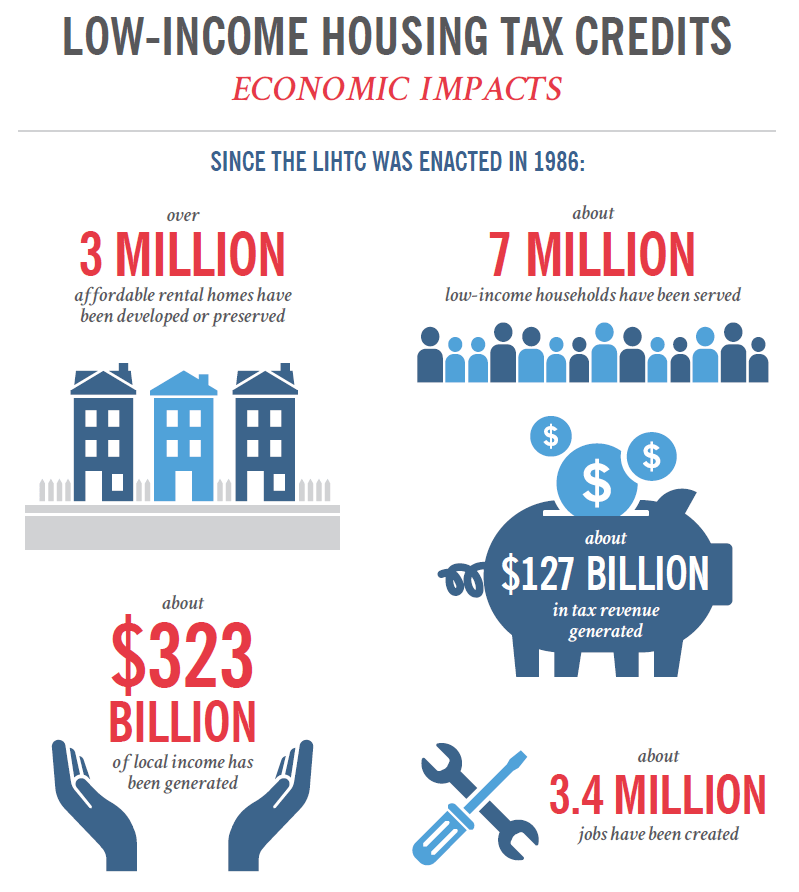

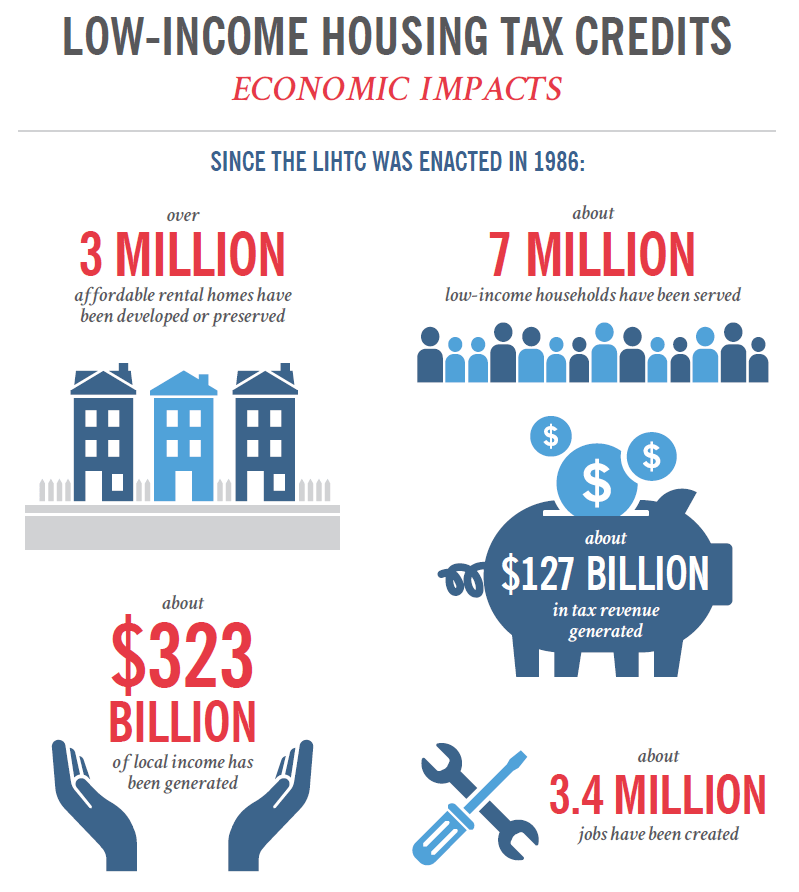

However on December 27 2020 the Consolidated Appropriations Act 2021 H R 133 was signed into law establishing a minimum credit of 4 percent for Low Income Housing Tax Credit LIHTC projects The 4 percent LIHTC will provide approximately 30 percent equity for a new or existing project Low Income Housing Tax Credits LIHTC The Program Tax credits provide direct federal income tax savings to individuals or corporations that invest funds in rental housing developments with apartments set aside for low income households

New Mexico Low Income Housing Tax Credit

New Mexico Low Income Housing Tax Credit

https://www.ihda.org/wp-content/uploads/2015/08/IHDA-Low-Income-Tax-Credit-02-3.jpg

What Is Low Income Housing Tax Credit Hanfincal

https://hanfincal.com/wp-content/uploads/2022/01/what-is-low-income-housing-tax-credit-hanfincal.jpg

Low income Housing Tax Credit USAFacts

https://usafacts.org/embed/chartsocialimage/70967.png

New Mexico Affordable Housing Tax Credit A state tax credit for up to 50 percent of the value of donations cash land buildings or services for affordable housing projects approved by the MFA or for donations made directly to the NM Affordable Housing Charitable Trust The Low Income Housing Tax Credit LIHTC is a public private partnership that leverages federal dollars with private investment to produce affordable rental housing and stimulate new economic development in many communities

Low Income Housing Tax Credit program LIHTC finances the construction rehabilitation and preservation of housing affordable to lower income households The LIHTC program encourages private investment by providing a tax credit a dollar for dollar reduction in federal taxes owed on other income PURPOSE Provides tax credits to eligible individuals and businesses that provide donations to eligible affordable housing projects approved by MFA or to the charitable trust administered by MFA Credits on income taxes gross receipts taxes GRT and compensating taxes excluding local option GRT imposed by a municipality or county or

Download New Mexico Low Income Housing Tax Credit

More picture related to New Mexico Low Income Housing Tax Credit

The Low Income Housing Tax Credit LIHTC Program

https://s2.studylib.net/store/data/005485763_1-e73d45d1f40c3c658f73a64e52040d93.png

PPT Low Income Housing Tax Credit Program And Selection Criteria

https://image3.slideserve.com/6388222/tdhca-low-income-housing-tax-credit-lihtc-program-n.jpg

How To Get Low Income Housing Tax Credit PROFRTY

https://i.pinimg.com/originals/b3/3b/43/b33b434f8e16d153c32315f4b9925161.jpg

Established through state legislation in 2005 the New Mexico Affordable Housing Tax Credit Program provides state tax credits to any individual tribal government housing authority corporation limited liability company partnership joint venture syndicate association or nonprofit organization that provide donations to Affordable Housing The New Mexico Mortgage Finance Authority MFA as the designated Housing Credit Agency for the state of New Mexico is responsible for administering the Low Income Housing Tax Credit Program and allocating tax credits

Statewide the Housing Credit has provided more than 27 500 affordable homes for low income families seniors veterans and people with disabilities See the state fact sheet to learn more about the Housing Credit s impact Download State Fact Sheet Low Income Housing Tax Credit Impact In New Mexico s 3rd District The ACTION Campaign represents over 2 400 organizations and businesses working to address our nation s severe shortage of afordable rental housing by supporting the Low Income Housing Tax Credit

Building The Case Low Income Housing Tax Credits And Health

https://bipartisanpolicy.org/wp-content/uploads/2019/03/Low-Income-Housing-Tax-Credit-Economic-Impacts.png

.png)

2021 Low Income Housing Tax Credit Training Building The Engine Of

https://ci3.googleusercontent.com/proxy/1ww4alI5szG1rUYlHhQM_mbfgj83r3PdbB1mDWHSnO-drF6HYHYUUBNgQRwX1VRFX2NqDnuUh1_I-TozUYPHy-t5xEuJdHwjHFqEMFiKYz5775Vfjsr0c-YyWHubjqRKxHzylaVY0Zz4z3KLnWhVHrQWnFXQ1izh2YSh1i2XhbjB8weKfdQ=s0-d-e1-ft#https://members-cedam.wildapricot.org/resources/Pictures/Low income housing tax credit training (1).png

https://housingnm.org/developers/lihtc

The development must be maintained as low income housing for at least 30 years Obtaining Tax Credits In 2023 each state has an annual tax credit authority equal to 2 75 per state resident New Mexico s annual authority is estimated at 5 818 662 in 2023 with a population estimate of 2 115 877

https://housingnm.org/developers/lihtc/4-pct-program

However on December 27 2020 the Consolidated Appropriations Act 2021 H R 133 was signed into law establishing a minimum credit of 4 percent for Low Income Housing Tax Credit LIHTC projects The 4 percent LIHTC will provide approximately 30 percent equity for a new or existing project

Low Income Housing Tax Credit Enterprise Community Partners

Building The Case Low Income Housing Tax Credits And Health

PPT The Low Income Housing Tax Credit Program PowerPoint Presentation

How To Get Low Income Housing Fast Potentially 30 Days Or Less

PPT Low Income Housing Tax Credit LIHTC Program PowerPoint

Low Income Housing Tax Credits 101 300 8

Low Income Housing Tax Credits 101 300 8

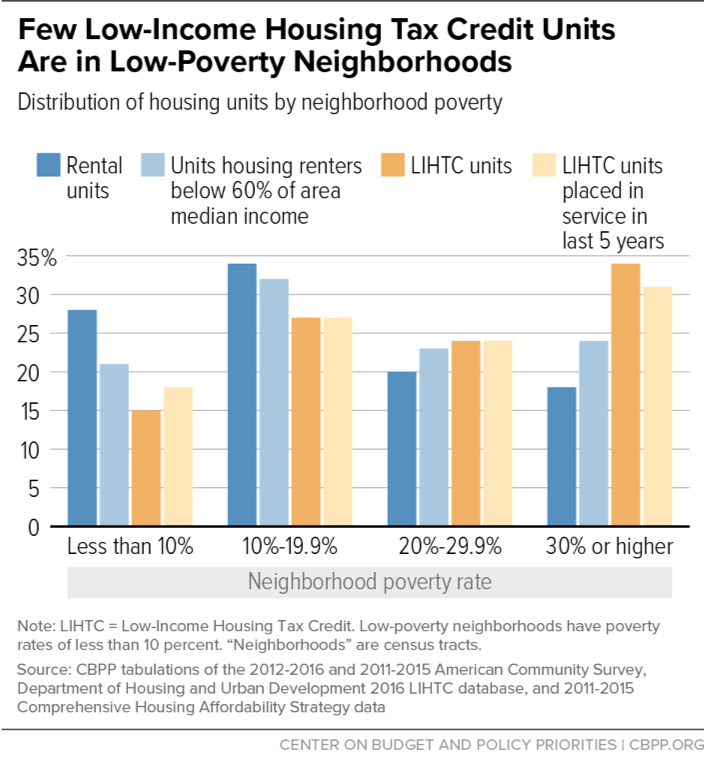

Few Low Income Housing Tax Credit Units Are In Low Poverty

How To Get Low Income Housing Tax Credit PROFRTY

WVHDF IMPACT Low Income Housing Tax Credit Program YouTube

New Mexico Low Income Housing Tax Credit - Low Income Housing Tax Credit program LIHTC finances the construction rehabilitation and preservation of housing affordable to lower income households The LIHTC program encourages private investment by providing a tax credit a dollar for dollar reduction in federal taxes owed on other income