New Mexico Property Tax Exemptions On March 16 2023 the New Mexico Legislature passed sweeping legislation which significantly increased the homestead exemption for New Mexicans from 60 000 00

Property Tax Division The Property Tax Division helps local governments in the administration and collection of ad valorem taxes in the State of New Mexico Property taxes contribute a large portion Property Tax Exemptions Under the New Mexico property tax law NMSA 1978 chapter 7 there are two categories of individual property taxation exemptions and several

New Mexico Property Tax Exemptions

New Mexico Property Tax Exemptions

https://okcredit-blog-images-prod.storage.googleapis.com/2021/02/taxexemption1.jpg

New Mexico Taxation And Revenue Santa Fe NM

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100069117193952

New Jersey Real Property Tax Exemption Overview WCRE

https://wolfcre.com/wp-content/uploads/2022/08/New-Jersey-Real-Property-Tax-Exemption-Overview-scaled.jpg

All NM Taxes Frequently Asked Questions What is an exemption Exemptions from gross receipts are receipts that are not taxable and do not have to The exemption allowed shall be in the following amounts for the specified property tax years 1 for the property tax years 1989 and 1990 the exemption shall be eight

Under New Mexico property tax law NMSA 1978 chapter 7 there are two categories of individual property taxation exemptions and several categories of institutional and Government Elected Officials Assessor Exemptions Under New Mexico Property Tax Law NMSA 1978 Chapter 7 there are two categories of individual property taxation

Download New Mexico Property Tax Exemptions

More picture related to New Mexico Property Tax Exemptions

Qualifying Trusts For Property Tax Homestead Exemption Sprouse

https://www.sprouselaw.com/wp-content/uploads/2022/05/BAC-Tax-Home-Exemption-2022.5.png

Free New Mexico Property Disclosure Statement PDF

https://esign.com/wp-content/uploads/New-Mexico-Sellers-Property-Disclosure.png

Understanding Mexican Property Taxes Tao Mexico T

https://assets-global.website-files.com/5c0984fd72fcb42ce3a007f4/61462af28a2c097d34a5c849_xMcbiJzednuc3qvoC2R_LeZBffhZ6lPCFObr_oqZNVlAWCdL2BI7TKukpZRiZgaokrezDxDxxBiIxE16G25CmyESp7iiP4fIYKYrPvfOpS9JOHCVoAT96L1HXgntR7y2yZ5g6Wdv%3Ds0.png

1 Head of Family Exemption Apply for 2 000 reduction in taxable value of property 2 Value Freeze Program The property owner must have a modified gross income of Property Tax Facts The Department of Finance and Administration provides sound fiscal advice and problem solving support to the Governor provide budget direction and fiscal

Property Tax Rebate for Persons 65 or Older This is a rebate that New Mexico offers for property tax billed or rent paid during the tax year on your principal place of residence in GENERAL INFORMATION PROPERTY VALUATION FOR TAX ASSESSMENT PROPERTY TAX CALENDER AGRICULTURAL PROPERTY APPRAISAL

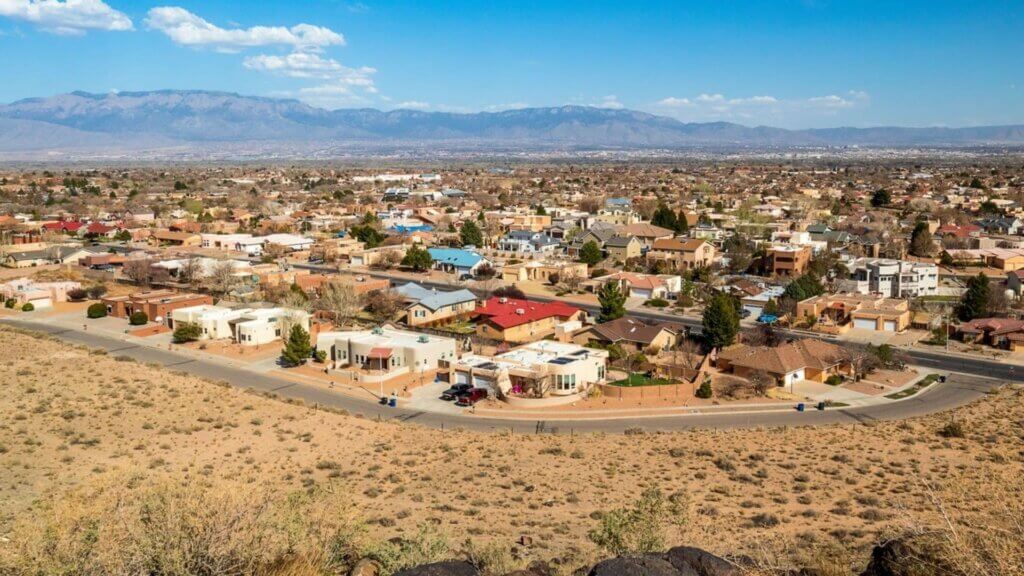

How To Calculate New Mexico Property Tax 2024 PayRent

https://www.payrent.com/wp-content/uploads/2023/11/New-mexico-landmark-1024x768.jpg

Property Tax Exemptions Brunswick ME

https://www.brunswickme.org/ImageRepository/Document?documentID=6109

https:// nmfinanciallaw.com /blog/homestead...

On March 16 2023 the New Mexico Legislature passed sweeping legislation which significantly increased the homestead exemption for New Mexicans from 60 000 00

https://www. tax.newmexico.gov /About-Us/P…

Property Tax Division The Property Tax Division helps local governments in the administration and collection of ad valorem taxes in the State of New Mexico Property taxes contribute a large portion

Top 8 Veteran Benefits In New Mexico The Ultimate Guide

How To Calculate New Mexico Property Tax 2024 PayRent

Bernalillo County Property Tax 2024

Bankruptcy Exemptions In Arizona Part Four AZ Debt Relief Group

Tax Exemptions Know Your Taxes

Minnesota Education New Mexico U S State Tax PNG 600x600px

Minnesota Education New Mexico U S State Tax PNG 600x600px

Understanding Tax Exemptions And Incentives For Property Owners In

PropertyTax Exemptions In Jamestown At 37 Percent Higher Than 30

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

New Mexico Property Tax Exemptions - The state s average effective property tax rate is 0 73 The median annual property tax paid by homeowners in New Mexico is 1 557 about 1 200 less than the national