New Mexico Real Estate Tax Rebate For The Elderly Web 2 juil 2018 nbsp 0183 32 The tax rebate provided for in this section shall not exceed two hundred fifty dollars 250 per return and if a return is filed separately that could have been filed jointly the tax rebate shall not exceed one hundred twenty five dollars 125

Web 8 mars 2022 nbsp 0183 32 A one time refundable income tax rebate of 500 for married couples filing joint returns with incomes under 150 000 and 250 for single filers with income under Web 31 mai 2022 nbsp 0183 32 New Mexico seniors with a modified gross income of 22 000 or lower may qualify for the personal in come tax low income comprehensive tax rebate and the

New Mexico Real Estate Tax Rebate For The Elderly

New Mexico Real Estate Tax Rebate For The Elderly

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA19S9Gk.img?w=1280&h=720&m=4&q=79

Eligible Recipients To Get Tax Rebates Up To 1 000 Payments In New

https://www.pelhamplus.com/wp-content/uploads/2023/05/Newsweek-750x430.jpg

500 New Mexico Tax Rebate Checks Why Some May Not Get It

https://www.valuewalk.com/wp-content/uploads/2023/04/Tax-Rebates-from-Minnesota.jpeg

Web 6 juil 2022 nbsp 0183 32 All New Mexico residents who filed a 2021 state Personal Income Tax return and who are not dependents on others returns are eligible for the rebates distributed in Web 1 ao 251 t 2022 nbsp 0183 32 SANTA FE This week about 525 000 taxpayers will receive the final round of this summer s rebates approved by Gov Michelle Lujan Grisham through direct

Web The rebates will be sent automatically to New Mexico residents who have filed a 2021 Personal Income Tax PIT return and are not declared as a dependent on another Web New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers The PIT RC Rebate and Credit Schedule is a separate schedule to

Download New Mexico Real Estate Tax Rebate For The Elderly

More picture related to New Mexico Real Estate Tax Rebate For The Elderly

Abington School Board Approves Senior Citizen Real Estate Tax Rebate

https://storage.googleapis.com/burbcommunity-glensidelocal/2023/06/untitled-1080-×-630-px-12-1024x597.jpg

Up To 1 000 New Mexico Tax Rebate 2022 Deadline To Claim Is

https://southarkansassun.com/wp-content/uploads/2023/05/16493351457608.jpg

/do0bihdskp9dy.cloudfront.net/04-06-2023/t_c2c311e4895b47979b2546a66824b032_name_file_1280x720_2000_v3_1_.jpg)

Chesterfield County Leaders Approve Next Year s Budget And Real Estate

https://gray-wwbt-prod.cdn.arcpublishing.com/resizer/4wi1O_DZBrNGMrAnlnNzUIGtn7M=/1200x600/smart/filters:quality(85)/do0bihdskp9dy.cloudfront.net/04-06-2023/t_c2c311e4895b47979b2546a66824b032_name_file_1280x720_2000_v3_1_.jpg

Web 2 juil 2014 nbsp 0183 32 Section 7 2 14 3 NMSA 1978 The rebate is based on modified gross income on a sliding scale from 0 to 24 000 and results in a rebate of a percentage of the Web 500 for single filers 1 000 for couples filing jointly heads of household Gov Michelle Lujan Grisham today announced that the state will begin sending out the newest round of

Web 1 Any resident 65 or older meeting the requirements for the tax rebate who resides in a long term residential care facility nursing home which is subject to taxation under the Web As a New Mexico resident at least 65 years old you may claim special in come tax and property tax benefits This brochure tells you first what all seniors may claim on New

Gov Shapiro Attends Senior Center Ribbon Cutting In Roslyn Abington

https://patch.com/img/cdn20/users/22896833/20230515/121617/styles/patch_image/public/shapiro___15121531809.jpg

Deadline To Claim 2022 New Mexico Tax Rebate Approaching

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1bDgup.img?w=2000&h=1000&m=4&q=75

https://law.justia.com/codes/new-mexico/2021/chapter-7/article-2/...

Web 2 juil 2018 nbsp 0183 32 The tax rebate provided for in this section shall not exceed two hundred fifty dollars 250 per return and if a return is filed separately that could have been filed jointly the tax rebate shall not exceed one hundred twenty five dollars 125

https://www.governor.state.nm.us/2022/03/08/governor-enacts-tax-cuts...

Web 8 mars 2022 nbsp 0183 32 A one time refundable income tax rebate of 500 for married couples filing joint returns with incomes under 150 000 and 250 for single filers with income under

Chesterfield County Leaders Approve Next Year s Budget And Real Estate

Gov Shapiro Attends Senior Center Ribbon Cutting In Roslyn Abington

Simply New Mexico Real Estate Services LLC Santa Fe NM

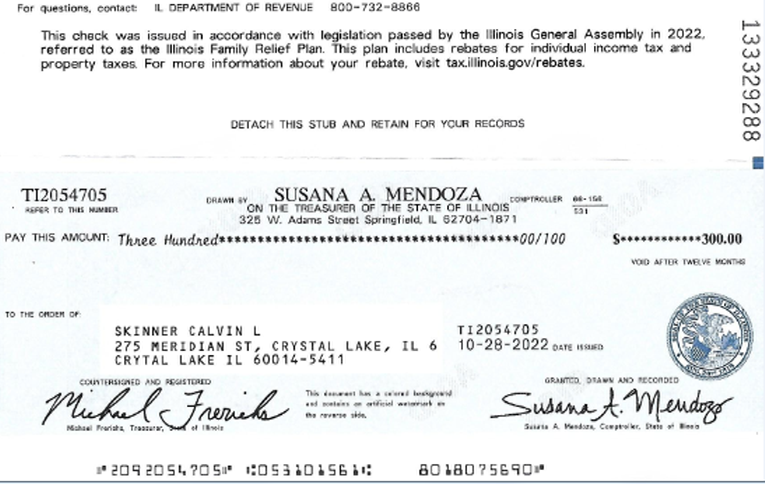

300 Check Allegedly A Real Estate Tax Rebate Arrives Eight Days

More Pa Seniors Would Qualify For The Property Tax Rent Rebate

Homestead Real Estate Tax Rebate Now Available For Warrington Residents

Homestead Real Estate Tax Rebate Now Available For Warrington Residents

View New Mexico Real Estate Listings

A New Mexico Real Estate Investment May Pay Off

Richmond Tax Rebate The Biggest Winners Axios Richmond

New Mexico Real Estate Tax Rebate For The Elderly - Web The rebates will be sent automatically to New Mexico residents who have filed a 2021 Personal Income Tax PIT return and are not declared as a dependent on another