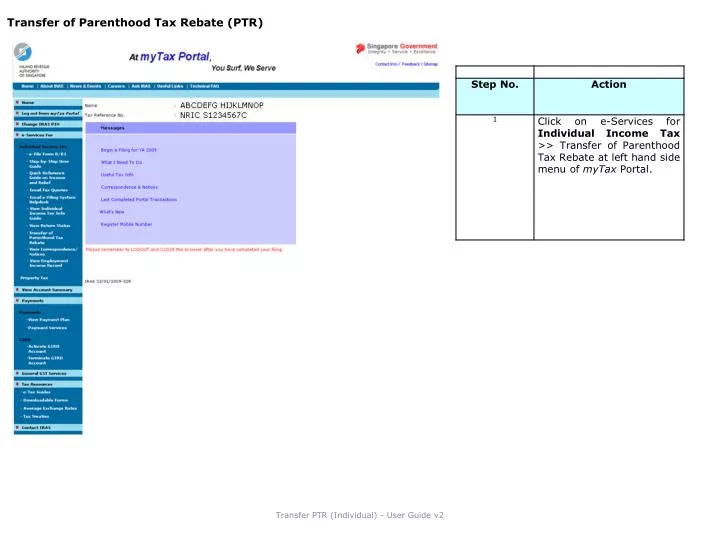

New Parenthood Tax Rebate Web 27 sept 2022 nbsp 0183 32 Discover the conditions and benefits of the Parenthood Tax Rebate PTR in Singapore Learn how to qualify and claim up to 20 000 per child

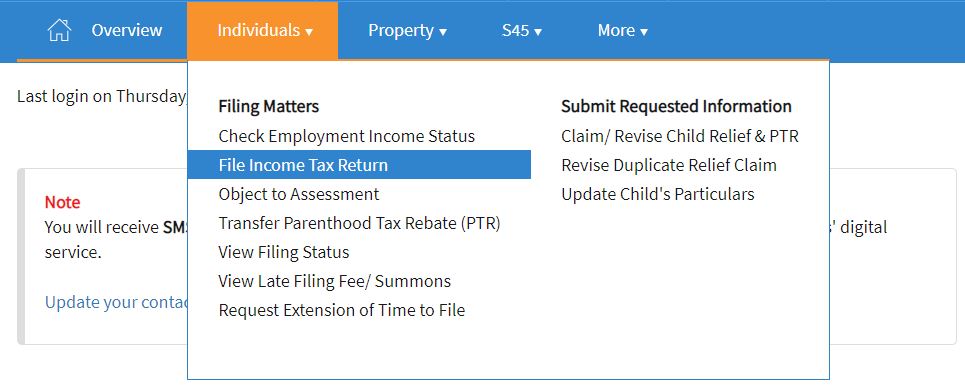

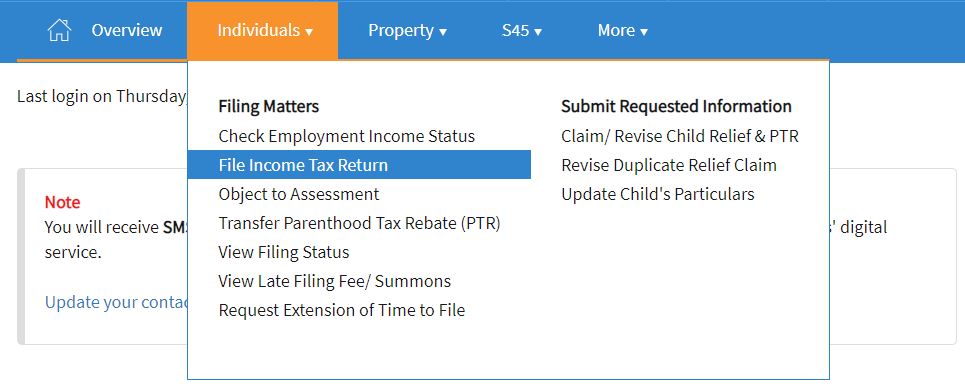

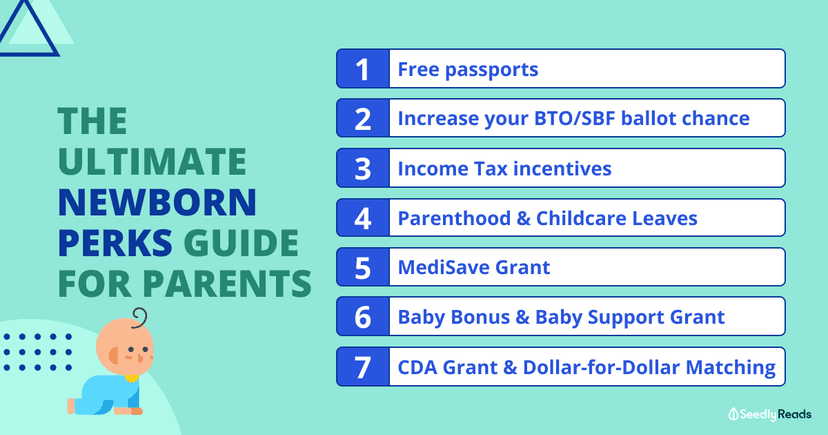

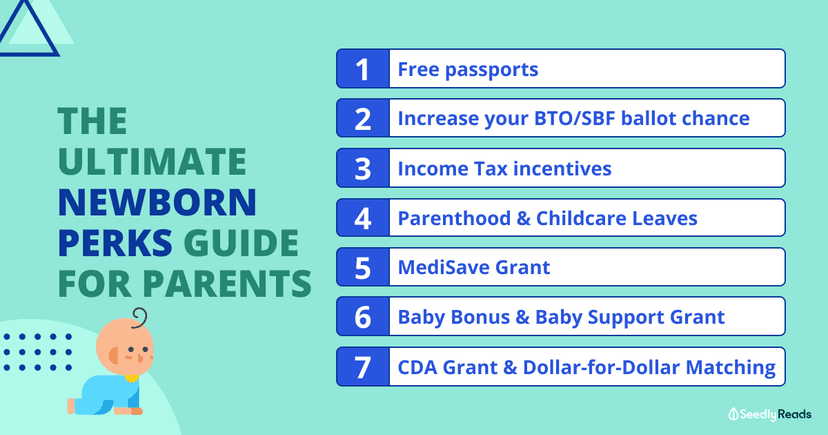

Web 3 f 233 vr 2022 nbsp 0183 32 February 3 2022 0 This article was submitted by a Financial Horse Contributor Good news for expecting parents there are a range of special baby bonuses government top ups tax reliefs that you may be eligible for What is a Child Development Account CDA Web 29 juil 2021 nbsp 0183 32 What exactly is the Parenthood Tax Rebate PTR The PTR is a government tax relief scheme given to Singapore tax residents to encourage them to have more children It can be claimed in the year following your child s birth If your child was born or adopted after 2008 and meets the qualifying conditions you can make a PTR claim too

New Parenthood Tax Rebate

New Parenthood Tax Rebate

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

Parenthood Tax Rebate Guide For Singapore Parents

https://raisingangels.sg/wp-content/uploads/2021/11/PTR2.jpg

Parenthood Tax Rebate Guide For Singapore Parents

https://www.raisingangels.sg/wp-content/uploads/2021/11/Untitled-design-7-1-768x644.png

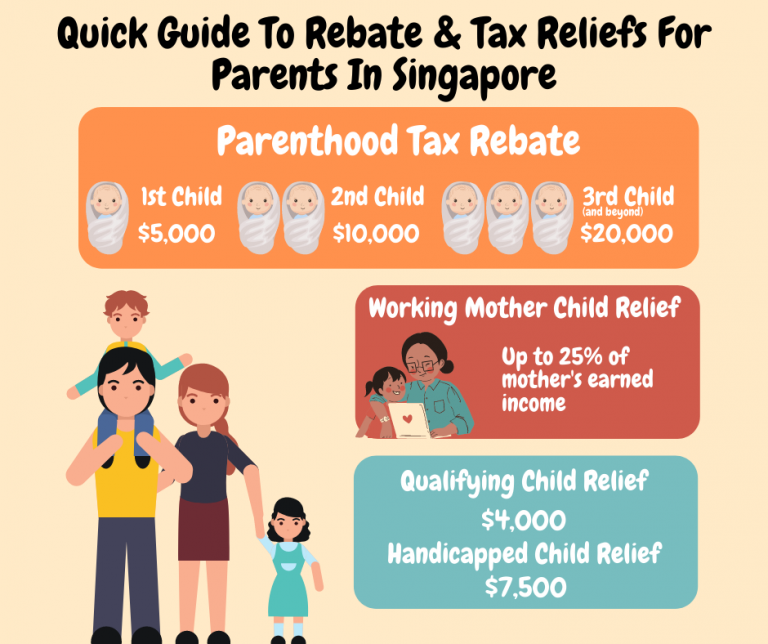

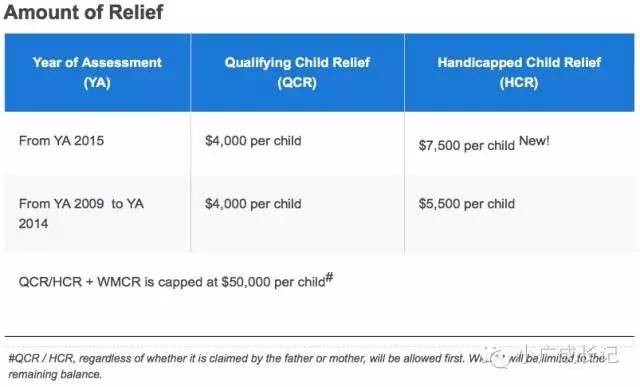

Web Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 per child for your third and subsequent child The child must be a Singapore Citizen at the time of birth or within 12 months thereafter Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can receive a rebate for

Web Check your Eligibility for Parenthood Tax Rebate PTR only applies to children born to the family adopted by family on or after 1 Jan 2008 Is your child a Singapore citizen at the time of birth or within 12 months thereafter c A Singapore citizen at the time of legal adoption Click here to find out how to claim PTR Web 4 mai 2022 nbsp 0183 32 Note that pending new legislation the child tax credit in 2022 which you will file with your 2023 tax return will revert back to 2 000 for each dependent age 17 and under Who Qualifies for the Child Tax

Download New Parenthood Tax Rebate

More picture related to New Parenthood Tax Rebate

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2016/04/table.jpg?fit=654%2C320&ssl=1

Parenthood Tax Rebate Rocks SimplyJesMe

https://4.bp.blogspot.com/-9c515_YMS7A/Wy8VH0SC9tI/AAAAAAAAEFk/GVdpND0QU6MV0-ks1zhFYidSsBlitIwdACLcBGAs/s640/1.JPG

https://www.xinjiapo.news/image/a767a095880f5a7e35fa41114c0aff7d173d1296.jpeg

Web 9 sept 2023 nbsp 0183 32 The proposed budget would temporarily increase the Virginia standard deduction for the 2024 and 2025 tax years For joint filers the standard deduction in the Commonwealth would go to 17 000 Web 2 mars 2016 nbsp 0183 32 If you are a new parent you will be entitled to 5 000 parenthood tax rebate for your first kid This rebate can be shared between parents and utilised slowly over the next few years The parenthood tax rebate increases to 10 000 for your second child and 20 000 for your subsequent children You will manually input how much you want to

Web As first time parents the Singapore government has conferred you a slew of tax incentives such as Qualifying Child Relief Working Mother Child Relief Parenthood Tax Rebate etc To save you the hassle this article targets to be a comprehensive guide on the various tax reliefs unique only to working parents Web 2 avr 2023 nbsp 0183 32 Le versement est effectu 233 durant le 7 233 me mois de grossesse 1 019 40 Si vous attendez des jumeaux ou des tripl 233 s vous percevrez la prime de naissance pour chaque enfant 224 na 238 tre Montant de la prime 224 l adoption 2 038 85 224 compter du mois d arriv 233 e de l enfant 224 votre foyer

IRAS Parenthood Tax Rebate PTR Can Be Shared Between Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=2781915438586529

Parenthood Tax Rebate Rocks SimplyJesMe

https://3.bp.blogspot.com/-Syz5S6irE9M/Wy8XE1JT6pI/AAAAAAAAEF4/1ukNNmDZBQUHQDKYgePlDTz8iHdwzSaWQCLcBGAs/s1600/2.JPG

https://parentology.sg/complete-guide-to-the-parenthood-tax-rebate-ptr

Web 27 sept 2022 nbsp 0183 32 Discover the conditions and benefits of the Parenthood Tax Rebate PTR in Singapore Learn how to qualify and claim up to 20 000 per child

https://financialhorse.com/baby-bonus-child-development-account-cda...

Web 3 f 233 vr 2022 nbsp 0183 32 February 3 2022 0 This article was submitted by a Financial Horse Contributor Good news for expecting parents there are a range of special baby bonuses government top ups tax reliefs that you may be eligible for What is a Child Development Account CDA

IRAS Tax Savings For Married Couples And Families

IRAS Parenthood Tax Rebate PTR Can Be Shared Between Facebook

All About The Parenthood Tax Rebate In Singapore

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

PPT Transfer Of Parenthood Tax Rebate PTR PowerPoint Presentation

Baby Bonus Parenthood Tax Rebate More Perks For Making Babies

Baby Bonus Parenthood Tax Rebate More Perks For Making Babies

IRAS The Parenthood Tax Rebate And Qualifying Child Facebook

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

New Parenthood Tax Rebate - Web 4 mai 2022 nbsp 0183 32 Note that pending new legislation the child tax credit in 2022 which you will file with your 2023 tax return will revert back to 2 000 for each dependent age 17 and under Who Qualifies for the Child Tax