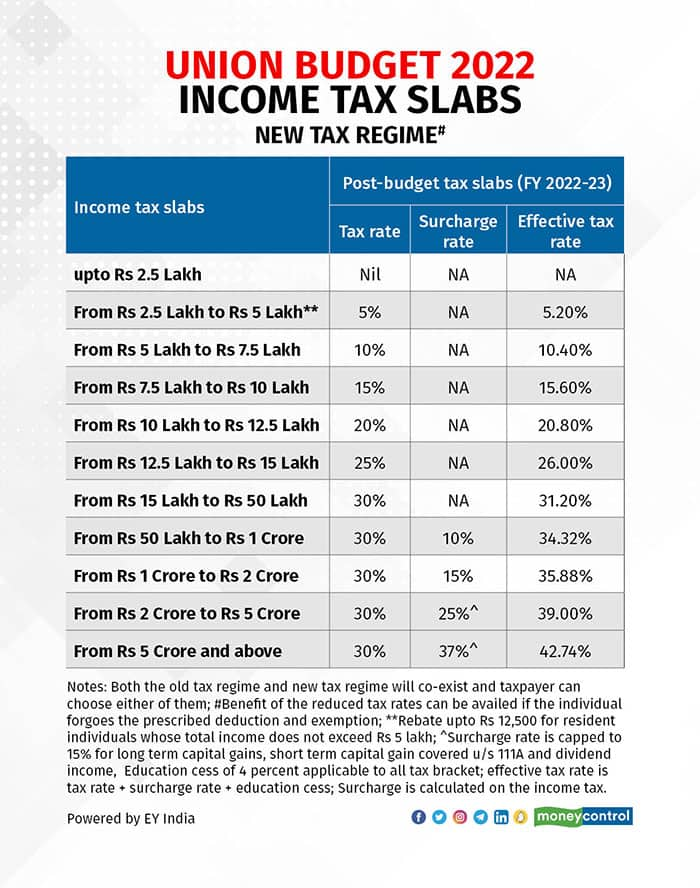

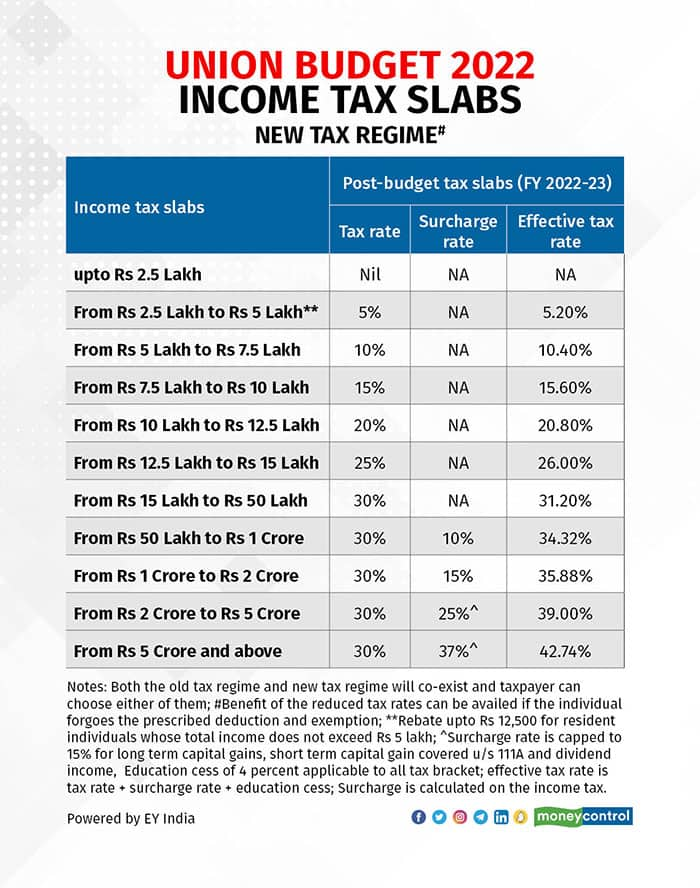

New Regime Tax Rebate Web 1 f 233 vr 2023 nbsp 0183 32 In her Union Budget speech Finance Minister Nirmala Sitharaman proposed to raise the income tax rebate limit from Rs 5 lakh to Rs 7 lakh in the new tax regime

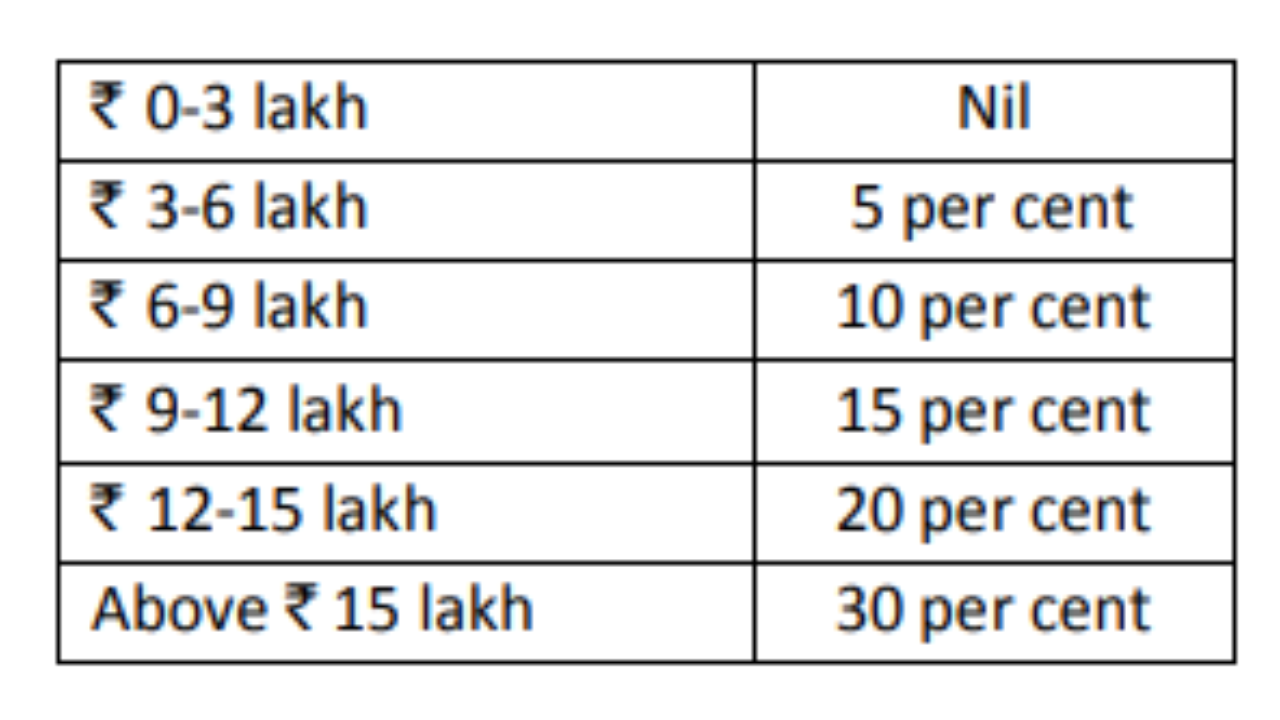

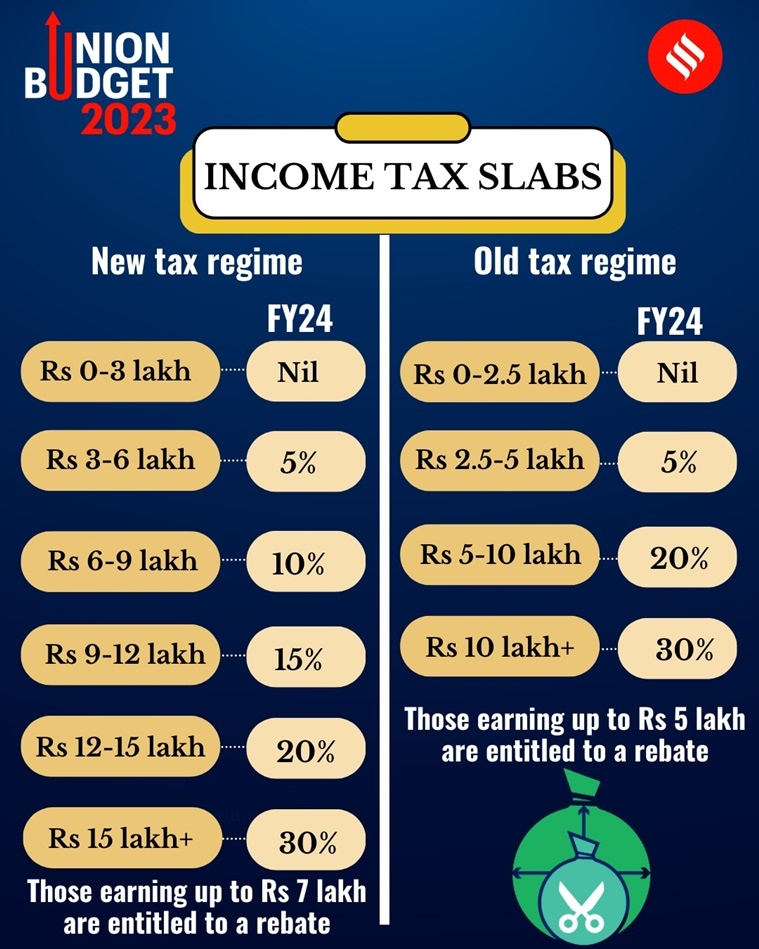

Web 14 f 233 vr 2023 nbsp 0183 32 The new income tax slabs slabs are Rs 3 lakh 6 lakh with 5 tax rate Rs 6 lakh 9 lakh with 10 etc But why is it being said that there is no income tax upto Rs 7 Web 16 mars 2017 nbsp 0183 32 Under the new income tax regime the amount of the rebate under Section 87A for FY 2023 24 AY 2024 25 has been modified A resident individual with taxable

New Regime Tax Rebate

New Regime Tax Rebate

https://i1.wp.com/blog.investyadnya.in/wp-content/uploads/2020/06/Which-is-better-new-tax-regime-vs-Old-tax-regime.png?fit=1024%2C683&ssl=1

How To Choose Between The New And Old Income Tax Regimes

https://images.moneycontrol.com/static-mcnews/2022/02/new-tax-regime-1.jpg

How To Choose Between The New And Old Income Tax Regimes Chandan

https://images.moneycontrol.com/static-mcnews/2022/02/New-vs-old-tax-regime-Make-a-wise-choice-R.jpg

Web 1 f 233 vr 2023 nbsp 0183 32 Sitharaman proposed to raise the rebate limit from Rs 5 lakh to Rs 7 lakh in the new tax regime Therefore if an individual has opted for the new tax regime he or Web 2 f 233 vr 2023 nbsp 0183 32 1 Rebate increased to Rs 7 lakh under the new tax regime The limit of total income for rebate under section 87A of the Income tax Act 1961 has been increased

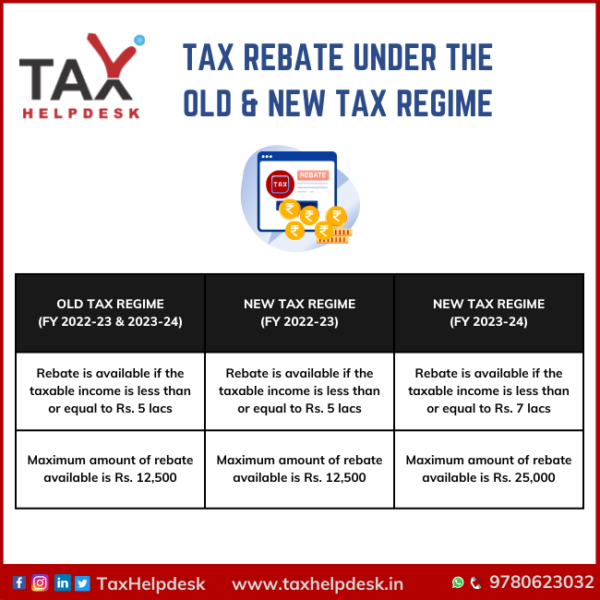

Web 4 ao 251 t 2023 nbsp 0183 32 Old Tax Regime New tax Regime until 31st March 2023 New Tax Regime From 1st April 2023 Income level for rebate eligibility 5 lakhs 5 lakhs 7 lakhs Web 16 ao 251 t 2023 nbsp 0183 32 Individuals with Net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u s 87A i e tax liability will be nil of such individual in both New

Download New Regime Tax Rebate

More picture related to New Regime Tax Rebate

Incometax Individual Income Taxes Urban Institute This Service

https://akm-img-a-in.tosshub.com/indiatoday/images/bodyeditor/202002/new_income_tax_slabs-1200x1149.jpg?RA2r0ErOqnEHAPszFYqp_R3A8vlGK5kS

New Income Tax Regime Changes In Tax Slabs And Rebate Limits See

https://static.tnn.in/photo/msid-101208384/101208384.jpg

Income Tax Calculator Fy 2023 24 Excel Free Download New Regime

https://i2.wp.com/www.askbanking.com/wp-content/uploads/2020/04/income-tax-slabs.jpg?fit=660%2C440&ssl=1

Web 2 f 233 vr 2023 nbsp 0183 32 As part of its Budget 2023 announcement Finance Minister Nirmala Sitharaman said that the tax rebate has been extended on income up to Rs 7 lakh in Web The limit of Tax Rebate under Section 87A under New Tax Regime in FY 2023 24 is Rs 25 000 if your taxable income is less than or equal to Rs 7 lakh In new tax regime you

Web 2 What are the changes in the new tax regime A full tax rebate of up to 7 Lakhs has been introduced Under the previous tax regime this threshold was set at 5 Lakhs This Web 3 f 233 vr 2023 nbsp 0183 32 Any individual opting for the new tax regime for any financial year till FY 2022 23 ending on March 31 2023 would be eligible for a tax rebate of Rs 12 500 if

Why The New Income Tax Regime Has Few Takers

https://images.moneycontrol.com/static-mcnews/2022/01/New-tax-regime-1.jpeg

Budget 2023 How You Can Get Rebate On Rs 7 5 Lakh Income Under New Tax

https://d1k6eu04h0vnbt.cloudfront.net/NEW-TAX-ENG-NEW_1675238464.jpg

https://indianexpress.com/article/explained/explained-economics/tax...

Web 1 f 233 vr 2023 nbsp 0183 32 In her Union Budget speech Finance Minister Nirmala Sitharaman proposed to raise the income tax rebate limit from Rs 5 lakh to Rs 7 lakh in the new tax regime

https://cleartax.in/s/new-tax-regime-frequently-asked-questions

Web 14 f 233 vr 2023 nbsp 0183 32 The new income tax slabs slabs are Rs 3 lakh 6 lakh with 5 tax rate Rs 6 lakh 9 lakh with 10 etc But why is it being said that there is no income tax upto Rs 7

2022 Deductions List Name List 2022

Why The New Income Tax Regime Has Few Takers

Opt New Tax Regime If Deduction Exemption Claims Less Than Rs 3 75

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Comparison Of New Income Tax Regime With Old Tax Regime The Economic

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

What Are The New Income Slabs Under The New Tax Regime

Tax Rebate Under The Old New Tax Regime

New Income Tax Regime Vs Old Key Things To Consider Budget 2023 Regimes

New Regime Tax Rebate - Web Le r 233 gime de TVA applicable n est pas fig 233 une entreprise peut 234 tre amen 233 e 224 changer de r 233 gime de TVA de plein droit lorsque l entreprise ne remplit plus les conditions pour