New Residential Rental Property Rebate Web 30 oct 2020 nbsp 0183 32 This guide provides information for landlords of new residential rental properties on how to apply for the GST HST new residential rental property rebate It

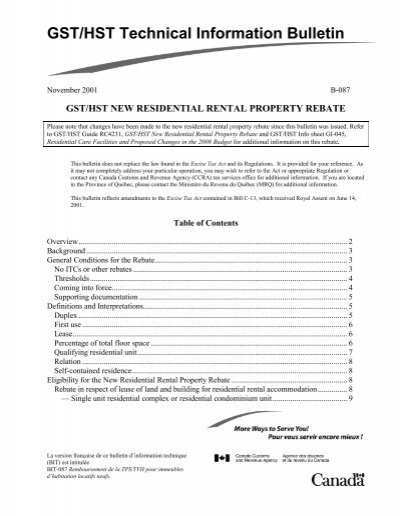

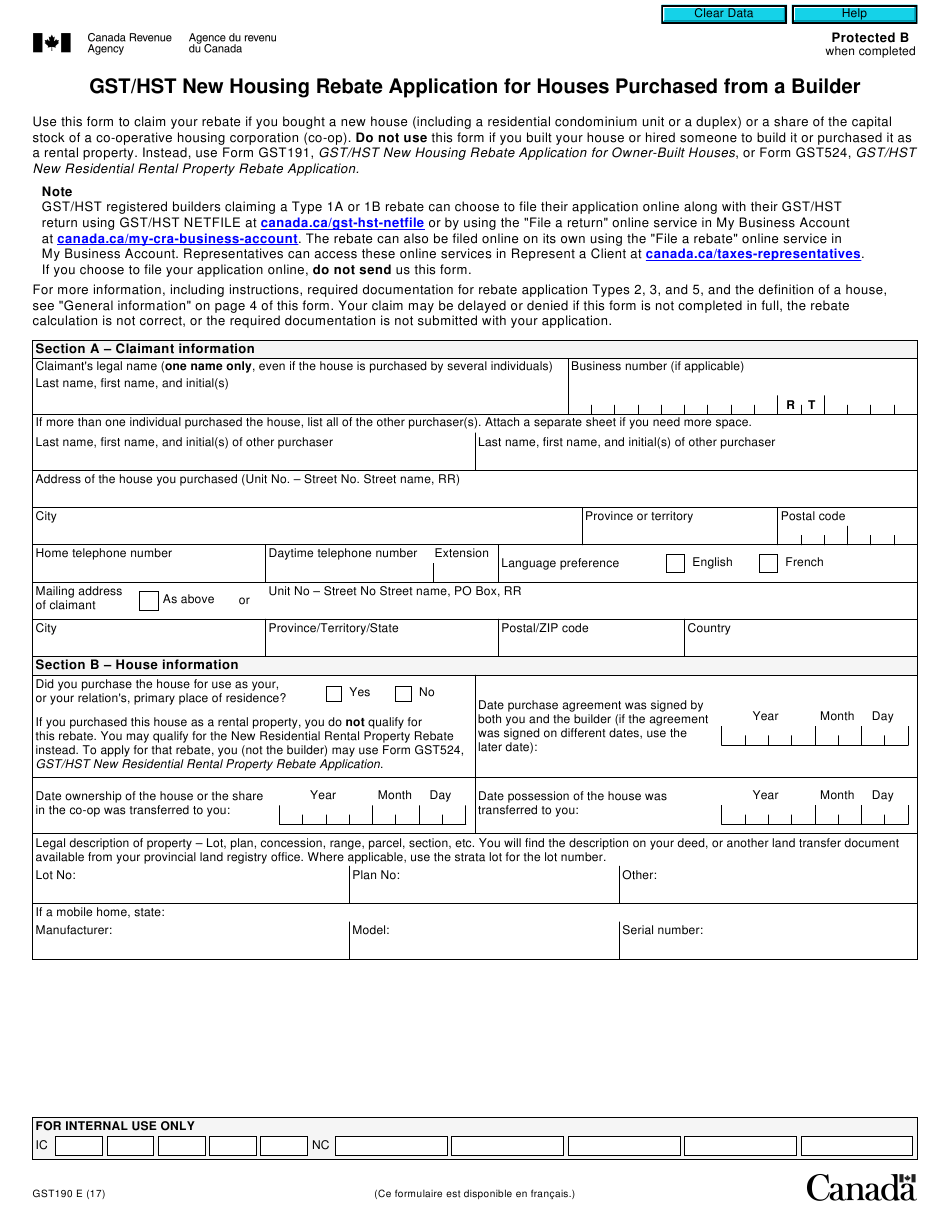

Web 14 juin 2001 nbsp 0183 32 Eligibility for the New Residential Rental Property Rebate Rebate in respect of lease of land and building for residential rental accommodation Single unit Web 3 d 233 c 2020 nbsp 0183 32 All applicants must complete Form GST524 GST HST New Residential Rental Property Rebate Application Depending on the specific situation under which

New Residential Rental Property Rebate

New Residential Rental Property Rebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2022/10/guide-rc4231-gst-hst-new-residential-rental-property-rebate-property-6.png?fit=791%2C1024&ssl=1

Gst Hst New Residential Rental Property Rebate Application Guide

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/gst-hst-new-residential-rental-property-rebate-application-guide.jpg?fit=358%2C506&ssl=1

Gst hst New Residential Rental Property Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2022/10/form-gst524-download-fillable-pdf-or-fill-online-gst-hst-new-13.png?fit=950%2C1229&ssl=1

Web The NRRP rebate applies to your new home or condo if it is bought constructed or renovated as a rental property The rental property must be bought or constructed for Web 21 juil 2020 nbsp 0183 32 If you ve recently undergone substantial renovations built or hired someone to build an addition built or hired someone to build a new home or purchased a new residential rental property you can receive

Web New Residential Rental Property QST Rebate This form is for use by any person hereinafter the claimant that is claiming a Qu 233 bec sales tax QST rebate for the Web To qualify for the New Residential Rental Property Rebate you or your corporation will need to rent out the property for at least one year In this article we break down how

Download New Residential Rental Property Rebate

More picture related to New Residential Rental Property Rebate

GST HST New Residential Rental Property Rebate Agence Du

https://www.yumpu.com/en/image/facebook/7898976.jpg

Calam o Hst Rebate On New Residential Rental Property In Ontario

https://p.calameoassets.com/180330173708-8cfcc8d7db36f5b9ce1c9ef69c5570c6/p1.jpg

You May Be Eligible To Cl

https://img.yumpu.com/5553203/7/500x640/gst-hst-new-residential-rental-property-rebate.jpg

Web New Residential Rental Property GST Rebate Application Supplement Multiple Units FP 525 V New Residential Rental Property QST Rebate VD 370 67 V QST and GST Web Requirements for the New Residential Rental Rebate First the property must be considered to be a purchase of a newly constructed home from a builder or a

Web Which rental properties qualify for the GST HST new residential rental property rebate In order to be eligible for the rebate you must purchase and pay the GST HST on a Web new residential rental property rebate fill out parts A B C and F of this form do not fill out parts D and E Then fill out the appropriate provincial rebate schedule and send it to

Missouri Rent Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Missouri-Renters-Rebate-2023.jpg

Rental Property GST Rebate For New Residential Homes Condo Millionaire

http://static1.squarespace.com/static/621d9692ec1be8680a5926c5/621e379deb4b915868e49b86/63a26b6cd673c5048b06d060/1672927175407/INSTAGRAM+-+Multiple+Pages.png?format=1500w

https://www.canada.ca/en/revenue-agency/services/forms-publications...

Web 30 oct 2020 nbsp 0183 32 This guide provides information for landlords of new residential rental properties on how to apply for the GST HST new residential rental property rebate It

https://www.canada.ca/en/revenue-agency/services/forms-publications/...

Web 14 juin 2001 nbsp 0183 32 Eligibility for the New Residential Rental Property Rebate Rebate in respect of lease of land and building for residential rental accommodation Single unit

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

Missouri Rent Rebate 2023 Printable Rebate Form

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

New Residential Rental Rebate

TrevorKLaw GST HST Rebates For New House Or Condo Purchases

Property Tax Rebate New York State Printable Rebate Form

Property Tax Rebate New York State Printable Rebate Form

GST HST New Residential Rental Property Rebate

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

GST HST New Housing Rebate In Ontario GTA Homes

New Residential Rental Property Rebate - Web 21 juil 2020 nbsp 0183 32 If you ve recently undergone substantial renovations built or hired someone to build an addition built or hired someone to build a new home or purchased a new residential rental property you can receive