New Solar Incentives 2023 If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

WASHINGTON June 28 2023 Today the U S Environmental Protection Agency EPA launched a 7 billion grant competition through President Biden s Investing in America agenda to increase access to affordable resilient and clean solar energy for millions of low income households Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the

New Solar Incentives 2023

New Solar Incentives 2023

https://images.dealer.com/ddc/vehicles/2023/Ford/Explorer/SUV/perspective/front-left/2023_24.png

New Year s Eve 2023 Countdown Projectorgram

https://projectorgram.com/wp-content/uploads/Still-NYE-2023.jpg

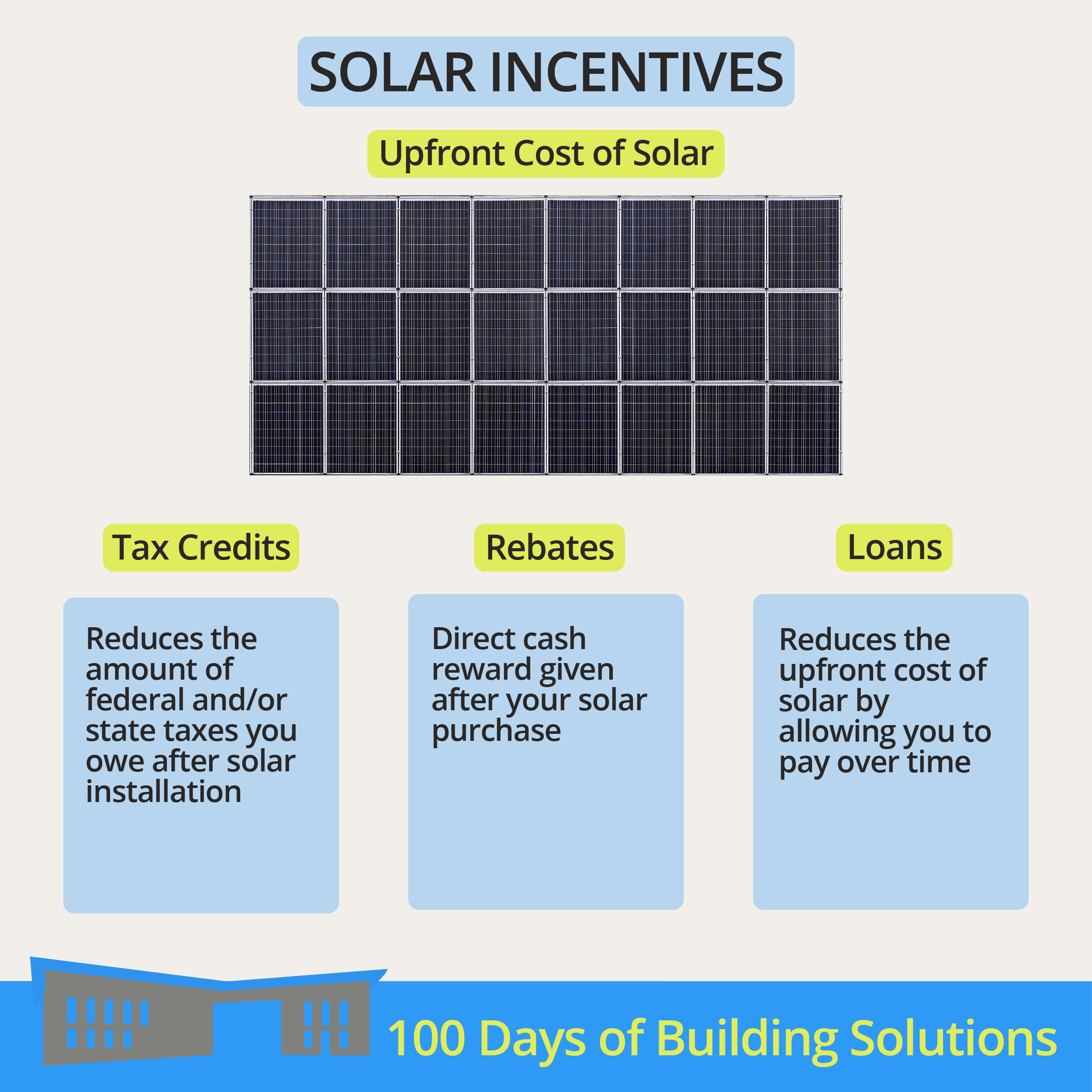

Top Solar Incentives And Rebates Available In 2023

https://thesolarlabs.com/ros/content/images/size/w1000/2023/01/featured-image-solar.jpg

The ITC increased in amount and its timeline has been extended Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 The federal solar Investment Tax Credit ITC offers a direct reduction in taxes owed as an incentive for installing a new solar energy system Per the Inflation Reduction Act the ITC

The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe New data from the Internal Revenue Service show that more than 3 4 million American families have already claimed more than 8 billion in residential clean energy and home energy efficiency credits against their 2023 federal income taxes the first year that the IRA s full adjustments to the value and scope of these tax credits were in effect

Download New Solar Incentives 2023

More picture related to New Solar Incentives 2023

What Is Behind The Dramatic Shift In NJ Solar Incentives Geoscape Solar

https://geoscapesolar.com/wp-content/uploads/2021/09/Moreys-scaled-1.jpeg

Display 2023 2024

https://501438041880-zoomcatalog-assets.s3.amazonaws.com/22325/35c0a1fb3f9c498793c4e66c8609ea3e/preview.jpg

What Are Solar Incentive Programs R W Kern Center

https://sites.hampshire.edu/rwkerncenter/files/2021/02/solar-incentives.png

The IRS issued statistics on the Inflation Reduction Act clean energy tax credits for tax year 2023 Taxpayers have claimed more than 6 billion in credits for residential clean energy investments which include solar electricity generation solar water heating and battery storage and more than 2 billion for energy efficient home At 30 the tax credit is worth 7 500 for a 25 000 solar system effectively knocking the price down to 17 500 The credit was previously at 26 for systems installed in 2022 and scheduled to step down to 22 in 2023 before going away entirely in 2024

In 2023 3 4 million American families saved 8 4 billion on clean energy and energy efficiency investmentsWASHINGTON Today in advance of the two year anniversary of the Inflation Reduction Act the U S Department of the Treasury Treasury released new data from the IRS and new analysis by the Office of Economic Policy August 7 2024 at 9 01 a m EDT American taxpayers claimed more than 8 billion in credits on their 2023 returns more than twice government projections for making climate friendly

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

2023 Emerging Leadership Conference

https://emergingconference.com/2023/wp-content/uploads/2021/09/logo.png

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

https://www.epa.gov/newsreleases/biden-harris...

WASHINGTON June 28 2023 Today the U S Environmental Protection Agency EPA launched a 7 billion grant competition through President Biden s Investing in America agenda to increase access to affordable resilient and clean solar energy for millions of low income households

Solar Incentives What You Need To Know Wolf Track Energy

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Solar Incentives Available To Homeowners Initiatives To Increase Further

2023 Sports Inclusion Conference

2023 Honda Passport Incentives Specials Offers In Hot Springs AR

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Solar Federation Natural Science Solar Federation

Homeowner s Guide To NYC Solar Incentives Brooklyn SolarWorks

2023 Residential Clean Energy Credit Guide ReVision Energy

New Solar Incentives 2023 - This page covers what you should know about solar panel incentives by state the federal tax credit and how to apply for solar energy incentives Can solar panels save you money