New Tax Laws For 2022 Key Points After another year of tax law changes there are significant updates for the 2022 filing season with the possibility of a smaller refund or bigger tax bill For some filers

Inflation Reduction Act changed a wide range of tax laws and provided funds to improve our services and technology to make tax filing faster and easier President Joe Biden signed into law Aug 16 a sweeping tax reconciliation bill with more than 450 billion in tax increases and 260 billion in energy tax incentives The legislation known as the Inflation Reduction Act H R 5376 passed the House on Aug 12 by a vote of 220 207 after passing the evenly divided Senate on Aug 7

New Tax Laws For 2022

New Tax Laws For 2022

https://i.ytimg.com/vi/-zYN-oRdQ4U/maxresdefault.jpg

27 Law Pictures Download Free Images On Unsplash

https://media.istockphoto.com/photos/new-tax-laws-for-2022-picture-id1342296394?b=1&k=20&m=1342296394&s=170667a&w=0&h=0keFvjn8ZVlEYGAb0c8PKndQPWjREMEBQxZBpy7nEHY=

Lawyer Reacts To New Gift And Estate Tax Laws For 2022 YouTube

https://i.ytimg.com/vi/lpNfjy-iaqY/maxresdefault.jpg

Here s what s new and some key items for taxpayers to consider before they file next year Reporting rules changed for Form 1099 K Taxpayers should receive Form 1099 K Payment Card and Third Party Network Transactions by January 31 2023 if they received third party payments in tax year 2022 for goods and services that exceeded 600 A special page updated and available on IRS gov outlines steps taxpayers can take now to make tax filing easier in 2022 Here are some key items for taxpayers to consider before they file next year

New tax law updates when they take effect Recovery Rebate Credit The credit has expired and cannot be claimed on the 2022 tax return Expired for tax year 2022 Earned Income Credit The credit will return to 2020 guidelines and limitations Takes effect for tax year 2022 A flurry of changes made by Congress in its budget and pandemic relief bill in December extended some temporary tax provisions for a year or more and made other temporary rules permanent

Download New Tax Laws For 2022

More picture related to New Tax Laws For 2022

7 Changes To Affect Tax Laws For 2021 AG FinTax

https://www.agfintax.com/wp-content/uploads/2021/06/shutterstock_608717837-scaled.jpg

New Business Laws For 2022 Naperville Law

https://www.napervillelaw.com/wp-content/uploads/2022/01/new-laws-2022-1080x675.jpg

ILoveQatar Qatar Announces New Tax Laws For 2019

https://d12eu00glpdtk2.cloudfront.net/public/videos/_760x500_clip_center-center_none/WhatsApp-Image-2018-12-13-at-21.45.37.jpeg

Tax Year 2022 For tax year 2022 the Child Tax Credit reverts back to the benefits available prior to the American Rescue Plan as follows Reverts back to up to 2 000 for 2022 2025 Each dependent child must be under age 17 Refundable up to 1 400 but no longer fully refundable The SECURE 2 0 Act of 2022 bolsters retirement savings with over 90 provisions with different effective dates Among the changes that take effect this year are the following People

First off the deadline to file individual tax returns is April 18 Other deadlines are January 17 2022 4th quarter 2021 estimated tax payment due March 15 2022 Partnership and S corporation returns for calendar year 2021 April 18 2022 1st quarter 2022 estimated tax payment due Tax deductions tax credit amounts and some tax laws have changed for the 2024 tax filing season

Build Back Better Act And Estate Planning

https://penbaylaw.com/wp-content/uploads/2021/10/New-Tax-Laws.jpg

2022 Tax Brackets Married Filing Jointly Irs Printable Form

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

https://www.cnbc.com/2022/12/02/the-biggest-tax...

Key Points After another year of tax law changes there are significant updates for the 2022 filing season with the possibility of a smaller refund or bigger tax bill For some filers

https://www.irs.gov/inflation-reduction-act-of-2022

Inflation Reduction Act changed a wide range of tax laws and provided funds to improve our services and technology to make tax filing faster and easier

New Tax Laws Cause Concern The Westfield News January 30 2019

Build Back Better Act And Estate Planning

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson

073 1099 Reporting New Laws For 2022 Pay Play Profit Podcast

TaxAudit Reviews The New Tax Laws For 2021

New Tax Laws Of 2016 What You Need To Know CBS Chicago

New Tax Laws Of 2016 What You Need To Know CBS Chicago

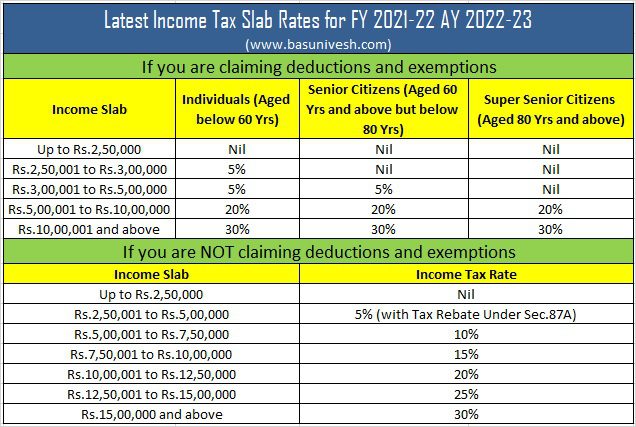

ITR Forms AY 2022 23 FY 2021 22 Which Form To Use BasuNivesh

Navigating Tax Law Changes In 2023 An Essential Guide For Bookkeepers

New Tax Laws For 2019 Explained 2019 Tax Reform 2019 Federal Income

New Tax Laws For 2022 - A flurry of changes made by Congress in its budget and pandemic relief bill in December extended some temporary tax provisions for a year or more and made other temporary rules permanent