New Vehicle Sales Tax Deduction 2022 Verkko 22 tammik 2023 nbsp 0183 32 You can enter the sales tax you paid for the car you purchased in 2022 by going to Federal gt Deductions and Credits gt Estimates and Other Taxes Paid gt

Verkko 11 jouluk 2022 nbsp 0183 32 There are two ways to get a tax deduction The first is to get a standard deduction which is a single fixed amount The second is to itemize Verkko 3 helmik 2023 nbsp 0183 32 One of the many deductions that people miss is the sales tax that was paid on a new or used car This is a tricky deduction however You can claim sales

New Vehicle Sales Tax Deduction 2022

New Vehicle Sales Tax Deduction 2022

https://mediacloud.kiplinger.com/image/private/s--X-WVjvBW--/f_auto,t_content-image-full-desktop@1/v1636590821/Tax_Form_And_Calculator.jpg

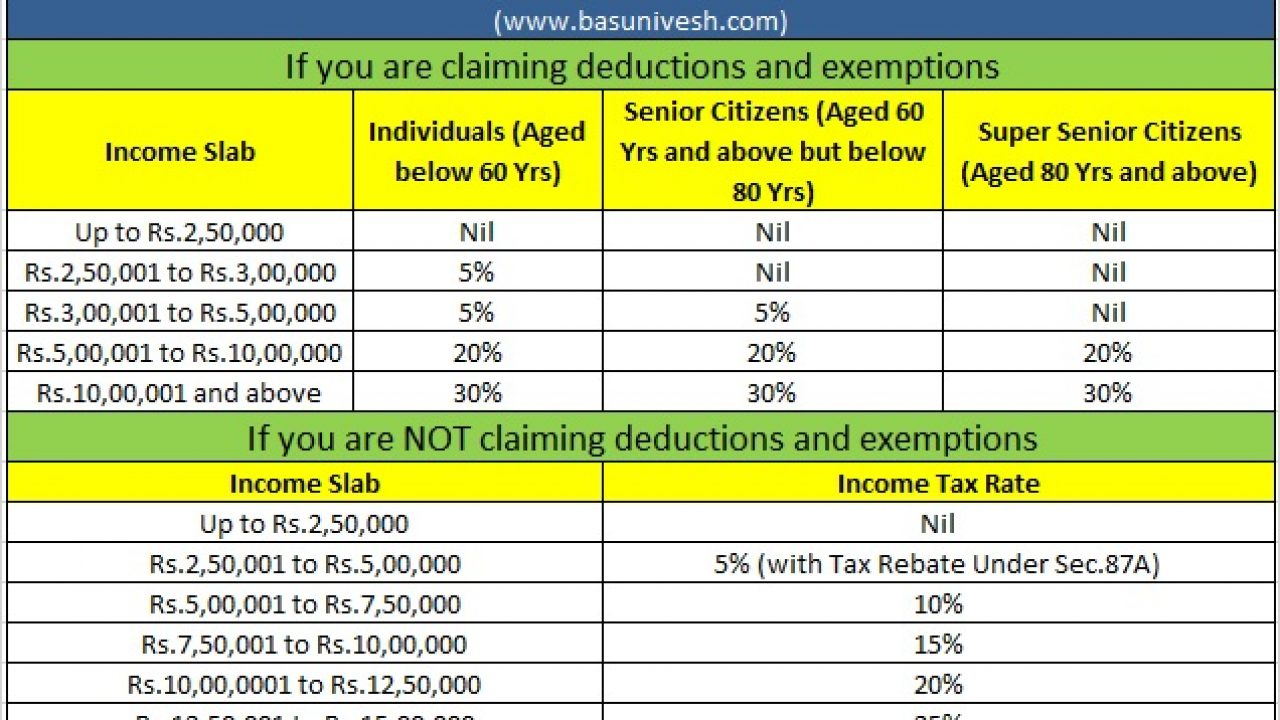

Standard Deduction Income Tax Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-13.jpg

Vehicle Sales Tax Deductions Explained Picnic

https://www.picnictax.com/wp-content/uploads/2022/02/shutterstock_1214543995-768x512.jpg

Verkko 21 tuntia sitten nbsp 0183 32 Looking at the average annual tax revenue per motor vehicle in major EU markets it largely differed in 2022 Spain 1 148 collected the least tax per Verkko To deduct vehicle sales tax you can either Save all sales receipts and deduct actual sales taxes paid throughout the year or Use the IRS sales tax tables to figure your deduction These tables calculate the

Verkko 16 toukok 2022 nbsp 0183 32 Section 179 allows businesses to deduct the full purchase price of qualifying equipment such as a vehicle bought or financed and put into service sometime during the same tax year The Verkko To enter personal property tax or sales tax paid on a new vehicle From within your TaxAct return Online or Desktop click Federal on smaller devices click in the top

Download New Vehicle Sales Tax Deduction 2022

More picture related to New Vehicle Sales Tax Deduction 2022

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

https://blog.carvana.com/wp-content/uploads/2020/02/022120-How-to-qualify-for-the-vehicle-sales-tax-deduction_Blog4.png

Tax Deductions Guide For 2022 For An Employer For Maximum Savings

https://www.deskera.com/blog/content/images/2022/03/Untitled-design--4-.png

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

Verkko 29 maalisk 2023 nbsp 0183 32 While new cars aren t fully tax deductible you ability write switched some concerning the charge Learn how and what extra car expenses you can Verkko Sales tax deduction Frequently asked questions The final verdict Personal Use Non Deductible Expenses When purchasing a car solely for personal use the cost of the

Verkko 1 jouluk 2022 nbsp 0183 32 This deduction only applies to sales taxes paid on new cars and trucks not used ones that weigh less than 8 500 pounds plus motorcycles and Verkko March 30th 2022 Why use LendingTree Buying a car for personal or business use may have tax deductible benefits The IRS allows taxpayers to deduct either local and

Tax Rates Absolute Accounting Services

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

What Is The Vehicle Sales Tax Deduction

https://blog.relaycars.com/wp-content/uploads/2022/03/Are-There-Tax-Credits-for-Vehicles-768x432.jpg

https://ttlc.intuit.com/community/tax-credits-deductions/discussion/if...

Verkko 22 tammik 2023 nbsp 0183 32 You can enter the sales tax you paid for the car you purchased in 2022 by going to Federal gt Deductions and Credits gt Estimates and Other Taxes Paid gt

https://www.jdpower.com/cars/shopping-guides/how-to-qualify-for-the...

Verkko 11 jouluk 2022 nbsp 0183 32 There are two ways to get a tax deduction The first is to get a standard deduction which is a single fixed amount The second is to itemize

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

Tax Rates Absolute Accounting Services

What Is The Vehicle Sales Tax Deduction

Tax Deduction Everything You Should Know About TDS And VDS

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

Deduct The Batmobile Vehicle Tax Deduction For Real Estate Agents

Deduct The Batmobile Vehicle Tax Deduction For Real Estate Agents

Car Tax Deduction

2022 Tax Brackets MeghanBrannan

2022 Deductions List Name List 2022

New Vehicle Sales Tax Deduction 2022 - Verkko To enter personal property tax or sales tax paid on a new vehicle From within your TaxAct return Online or Desktop click Federal on smaller devices click in the top