New York City Income Tax Filing Requirements Generally you must file a New York State income tax return if you are a New York State resident and are required to file a federal return You may also have to file a New

Nonresidents of New York City are not liable for New York City personal income tax The rules regarding New York City domicile are also the same as for New York State New York City residents must pay a personal income tax which is administered and collected by the New York State Department of Taxation and Finance Non Resident Employees of the

New York City Income Tax Filing Requirements

New York City Income Tax Filing Requirements

https://www.sportofmoney.com/wp-content/uploads/2022/10/2021-NYS-and-NYC-Income-Tax-Rates.png

Who Is Subject To New York City Income Tax The Right Answer 2022

https://www.travelizta.com/wp-content/uploads/2022/09/who-is-subject-to-new-york-city-income-tax.jpg

duedate The Treasury Department And Internal Revenue Service Announced

https://i.pinimg.com/originals/a2/73/56/a2735670b53e972ede62eec6cbfc48e6.jpg

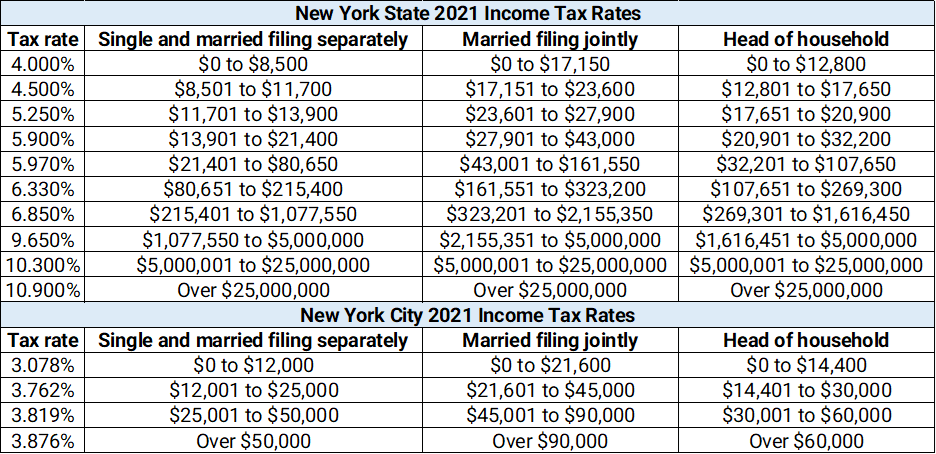

The city income tax rates vary from year to year The tax rate you ll pay depends on your income level and filing status It s based on your New York State taxable income There are no city specific deductions But Anyone who lives or works in New York City can use an NYC Free Tax Prep site In general individuals must have earned 59 000 or less and families with dependents must

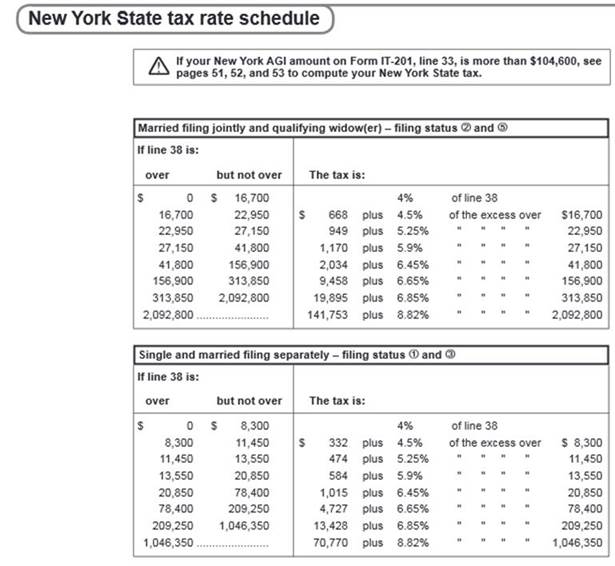

In this post we ll look at the New York City tax rate schedule imposed on New York City residents We ll then review the NYC tax forms required to file New York City taxes According to Form IT 203 I you must file a New York part year or nonresident return if You have any income from a New York source and your New York AGI exceeds your New York State

Download New York City Income Tax Filing Requirements

More picture related to New York City Income Tax Filing Requirements

What Is New York City Tax TaxesTalk 2023

https://www.taxestalk.net/wp-content/uploads/farewell-new-york-new-york-retire29.jpeg

Income Tax Rate In New York City INCOMEARTA

https://i2.wp.com/www.empirecenter.org/wp-content/uploads/2018/10/Screen-Shot-2018-10-15-at-12.34.58-PM-7300971.png

I T Return Filing Interest Penalties On The Cards If Failed To File

https://images.moneycontrol.com/static-mcnews/2022/07/Penalties-2-belate-returns-ITR-.jpg

If you became an employee of the City of New York on or after January 4 1973 and if while so employed you were a nonresident of the City during any part of 2021 you are subject to In New York City low and middle income taxpayers qualify to get their taxes prepared and filed for free The services are offered through many libraries community centers and local nonprofits that are certified by the

If you live or work in New York City you ll need to pay income tax Your New York City tax rate will be 4 to 10 9 for tax year 2022 depending on your filing status and taxable income The New York City income tax rates are 3 078 3 762 3 819 and 3 876 depending on which income bracket you are in Where you fall within these brackets depends on your filing

IRS Issues New Warning Ahead Of Tax Deadline You Could Lose Your Tax

https://ijr.com/wp-content/uploads/2023/03/GettyImages-1137415864.jpg

Federal Income Tax Deadline Moved To July 15 Cleveland

https://www.cleveland.com/resizer/4xotllvRMMDFrvjZUriCQfQC1rw=/1280x0/smart/arc-anglerfish-arc2-prod-advancelocal.s3.amazonaws.com/public/DZ3DCHUDXBBZZE4LLJII35DUKU.jpg

https://www.tax.ny.gov › pit › file › do_i_need_to_file.htm

Generally you must file a New York State income tax return if you are a New York State resident and are required to file a federal return You may also have to file a New

https://www.tax.ny.gov › pit › file › nonresident-faqs.htm

Nonresidents of New York City are not liable for New York City personal income tax The rules regarding New York City domicile are also the same as for New York State

Company Income Tax Returns Services In Pan India ID 23705598055

IRS Issues New Warning Ahead Of Tax Deadline You Could Lose Your Tax

Federal Income Tax Filing Threshold 2023 Printable Forms Free Online

State Income Tax Filing Deadline Is Monday

Income Tax Filing Requirements For Retirees In Good Health Central

Income Tax In New York INVOMERT

Income Tax In New York INVOMERT

Child Tax Credit

CA Income Tax Consultant In Pan India Company Rs 1000 session Infine

Income Tax Return Filing Service In Mumbai ID 23872724248

New York City Income Tax Filing Requirements - The city income tax rates vary from year to year The tax rate you ll pay depends on your income level and filing status It s based on your New York State taxable income There are no city specific deductions But