New York Department Of Taxation S Homeowner Tax Rebate Credit Page 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed

REGISTER After you register If we determine you re eligible we ll send you a check for the homeowner tax rebate credit in the upcoming weeks Page last reviewed or updated August 17 2022 Property Tax Credit Lookup You can view and print the following information regarding the property tax credits we ve issued to you since 2018 description STAR HTRC or Property Tax Relief credit year check issue date property address property key amount Before you begin you ll need

New York Department Of Taxation S Homeowner Tax Rebate Credit Page

New York Department Of Taxation S Homeowner Tax Rebate Credit Page

https://yonkerstimes.com/wp-content/uploads/2022/06/FUVtPL9WIAM9l1Zggggg-1024x649.jpg

Some New Yorkers Will Get An Unexpected Payment When They Check Their

https://s.hdnux.com/photos/01/27/70/43/23038185/5/rawImage.jpg

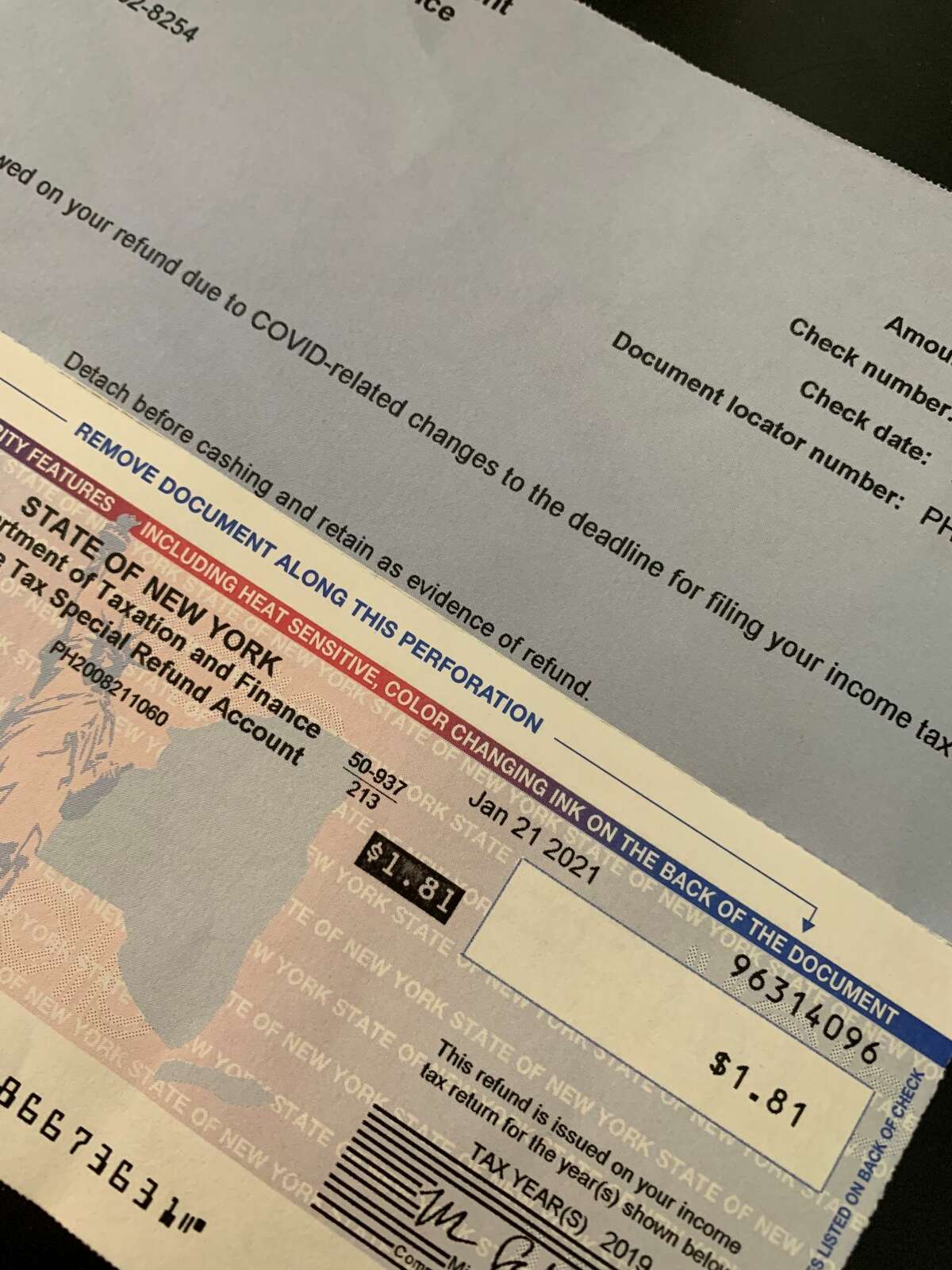

18 2M In Interest Payments Headed To New Yorkers For Delayed Refunds

https://s.hdnux.com/photos/01/16/31/17/20550616/6/1200x0.jpg

To find the amount of your credit use our Homeowner Tax Rebate Credit HTRC Check Lookup Find your credit amount Note By law the Tax Department cannot issue a homeowner tax rebate check for less than 100 How do I report this credit on my New York State income tax return Homeowner tax rebate credit HTRC STAR Credit Delivery Schedule lookup Look up your property tax credits How to report your STAR credit STAR exemption information The STAR exemption program is closed to new applicants However if you re receiving the exemption there are limited circumstances when you will need to reapply

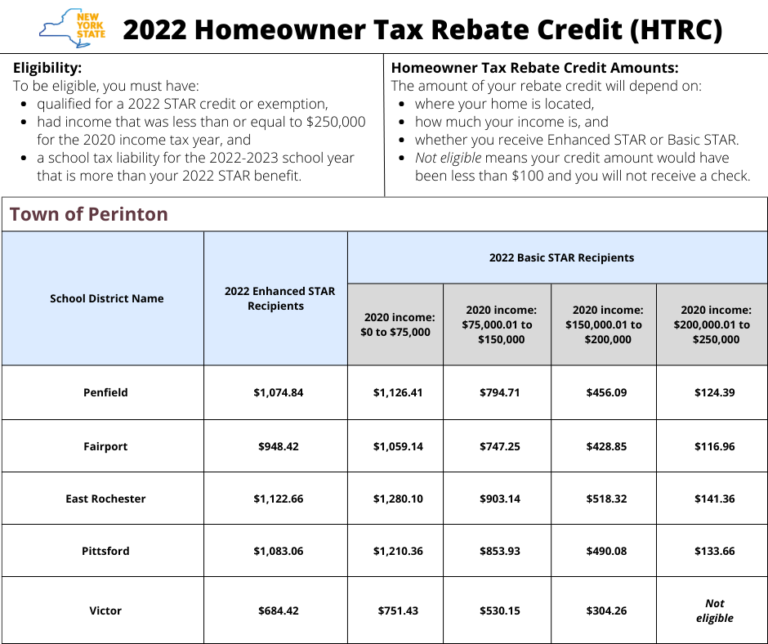

2022 Homeowner Tax Rebate Credit Amounts Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality If the check amount field for your school district is Not eligible your credit amount would have been less than 100 and you will not receive a check By law we cannot issue checks for the The fiscal year 2023 property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less Most recipients of the School Tax Relief STAR exemption or credit were automatically qualified and have already received their rebates

Download New York Department Of Taxation S Homeowner Tax Rebate Credit Page

More picture related to New York Department Of Taxation S Homeowner Tax Rebate Credit Page

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=1752&h=986&crop=1

Homeowner Tax Rebate Credit Coming Timeline For Getting Your Check

https://www.fingerlakes1.com/wp-content/uploads/2022/07/homeowner-tax-rebate-credit-coming-timeline-for-getting-your-check.jpg

Two Million Americans Could Get Automatic Checks Worth 970 Under State

https://www.the-sun.com/wp-content/uploads/sites/6/2022/01/NINTCHDBPICT000664164748.jpg

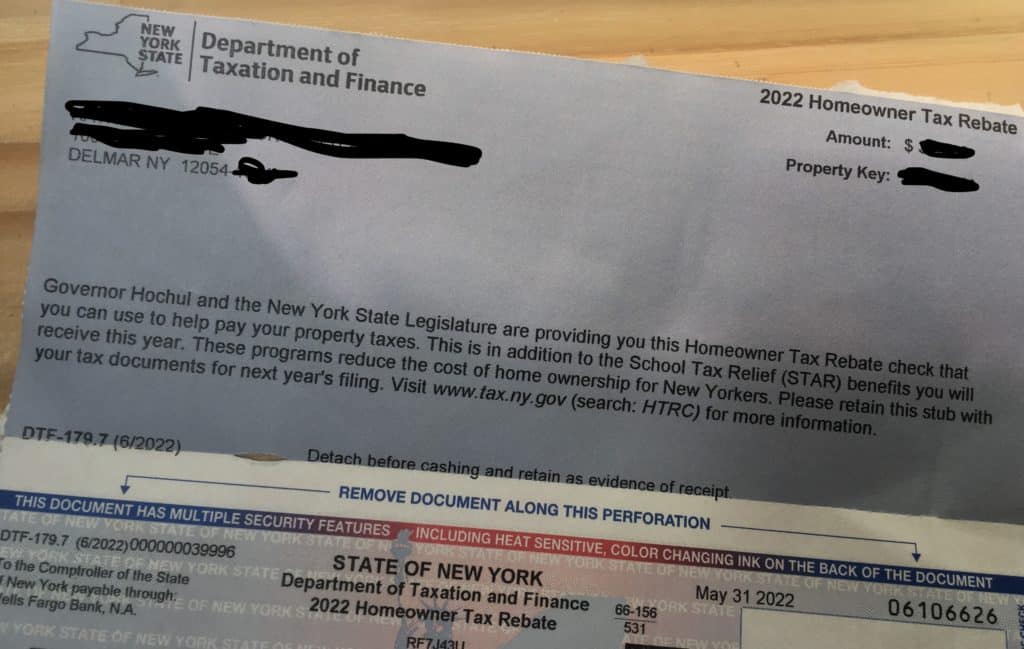

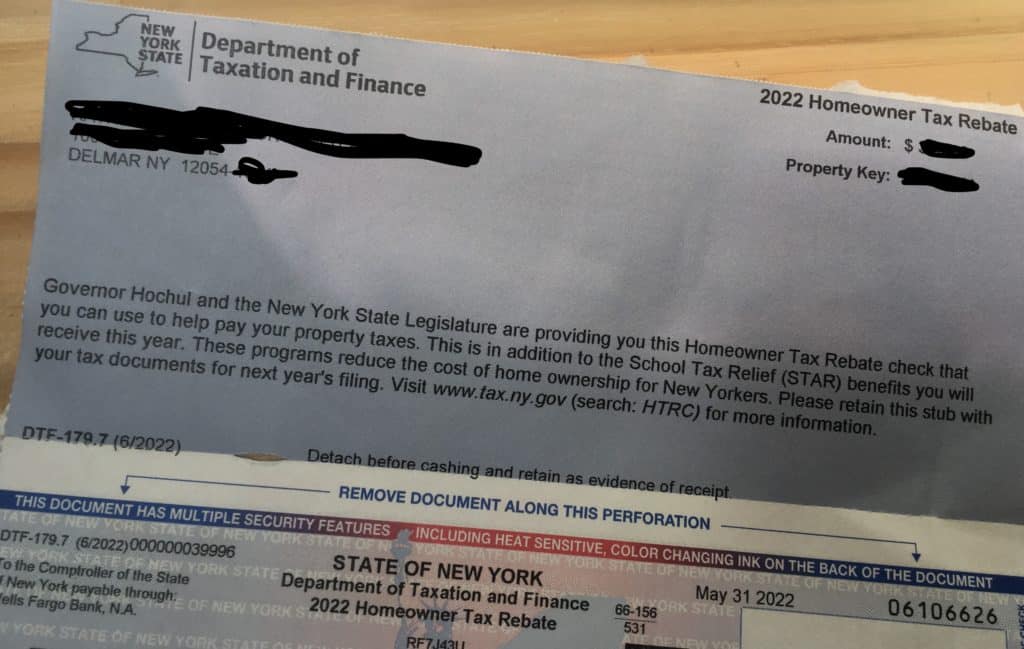

To learn more please visit our Homeowner tax rebate credit HTRC webpage which includes frequently asked questions and a lookup to determine the amount of the credit If you re not already subscribed stay up to date with our Tax Tips for Individuals and Tax Tips for Property Owners emails The New York State homeowner tax rebate credit HTRC is a one year program benefitting nearly three million eligible homeowners in 2022 Eligibility To be eligible you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and

NEW YORK New York City Mayor Eric Adams today signed legislation to provide a one time property tax rebate of up to 150 to hundreds of thousands of eligible New York homeowners The bill was passed by The New York Department of Taxation and Finance May 27 issued guidance on the homeowner tax rebate credit HTRC for property tax purposes The HTRC is a one year program providing direct tax relief to nearly 3 million eligible homeowners in 2022 The credit checks will be mailed in June

NY Homeowner Tax Rebate Checks Are In The Mail RBT CPAs LLP

https://www.rbtcpas.com/wp-content/uploads/2022/07/NY-Homeowner-Tax-Rebate-Checks-Are-in-the-Mail.jpg

Homeowners Tax Credit

https://activerain.com/image_store/uploads/9/1/9/7/5/ar125210717757919.jpg

https://www.tax.ny.gov/pit/property/htrc/lookup.htm

2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed

https://www.tax.ny.gov/pit/property/htrc-registration.htm

REGISTER After you register If we determine you re eligible we ll send you a check for the homeowner tax rebate credit in the upcoming weeks Page last reviewed or updated August 17 2022

New York Where s My Refund Tax Questions

NY Homeowner Tax Rebate Checks Are In The Mail RBT CPAs LLP

Direct Payments Worth Up To 1 050 Being Sent To Millions Of Americans

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

IPhone

New York State Homeowner Tax Rebate Credit HTRC Sciarabba Walker

New York State Homeowner Tax Rebate Credit HTRC Sciarabba Walker

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks

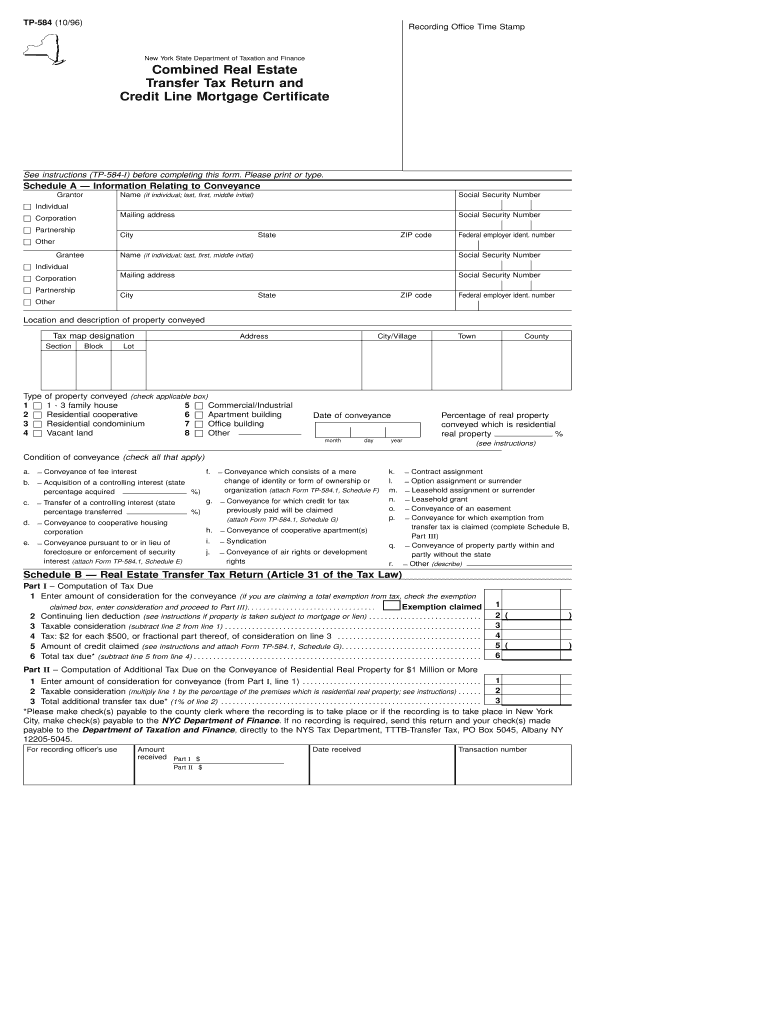

New York State Department Of Taxation And Finance TP 584 I Form Fill

Virginia Department Of Taxation Review Letter Sample 1

New York Department Of Taxation S Homeowner Tax Rebate Credit Page - 2022 Homeowner Tax Rebate Credit Amounts Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality If the check amount field for your school district is Not eligible your credit amount would have been less than 100 and you will not receive a check By law we cannot issue checks for the