New York Estate Tax Exemption 2023 Cliff If you pass away in 2023 and the value of your estate exceeds the 6 580 000 basic exclusion amount by more than 5 you will lose the exclusion benefit and your entire estate will be subject to New York estate tax starting at the first dollar

The current New York estate tax exemption amount is 6 940 000 in 2024 up from 6 580 000 in 2023 Under current law this number will remain until January 1 2025 at which point it will rise again with inflation Who does the Cliff affect Everyone with a NYS taxable estate in varying degrees The New York State estate tax exemption amount for 2023 is 6 580 000 an increase from last year in the amount of 470 000 However those individuals close to this amount should be cautious as they could be at risk of falling off the New York State Estate Tax Cliff

New York Estate Tax Exemption 2023 Cliff

New York Estate Tax Exemption 2023 Cliff

https://www.ejrosenlaw.com/wp-content/uploads/2022/01/New-York-Estate-Tax-1536x1017.jpeg

It May Be Time To Start Worrying About The Estate Tax The New York Times

https://static01.nyt.com/images/2021/03/14/business/14Tax-Estate-illo/14Tax-Estate-illo-superJumbo.jpg?quality=75&auto=webp

How The New New York State Estate Tax Exemption Works

http://dmaccountingfirm.com/wp-content/uploads/2014/05/104392892.jpg

New York has a cliff that impacts very wealthy estates If the estate exceeds the 6 94 million exemption by less than 5 it only pays taxes on the amount that goes over the threshold If the total value is more than 105 of exemptible amount taxes are paid on the entire estate The cliff refers to a unique estate tax rule in New York If an estate s taxable value exceeds 105 of the exclusion amount the exclusion is entirely forfeited An estate that falls off the cliff is taxed from the first dollar without any exclusion benefit

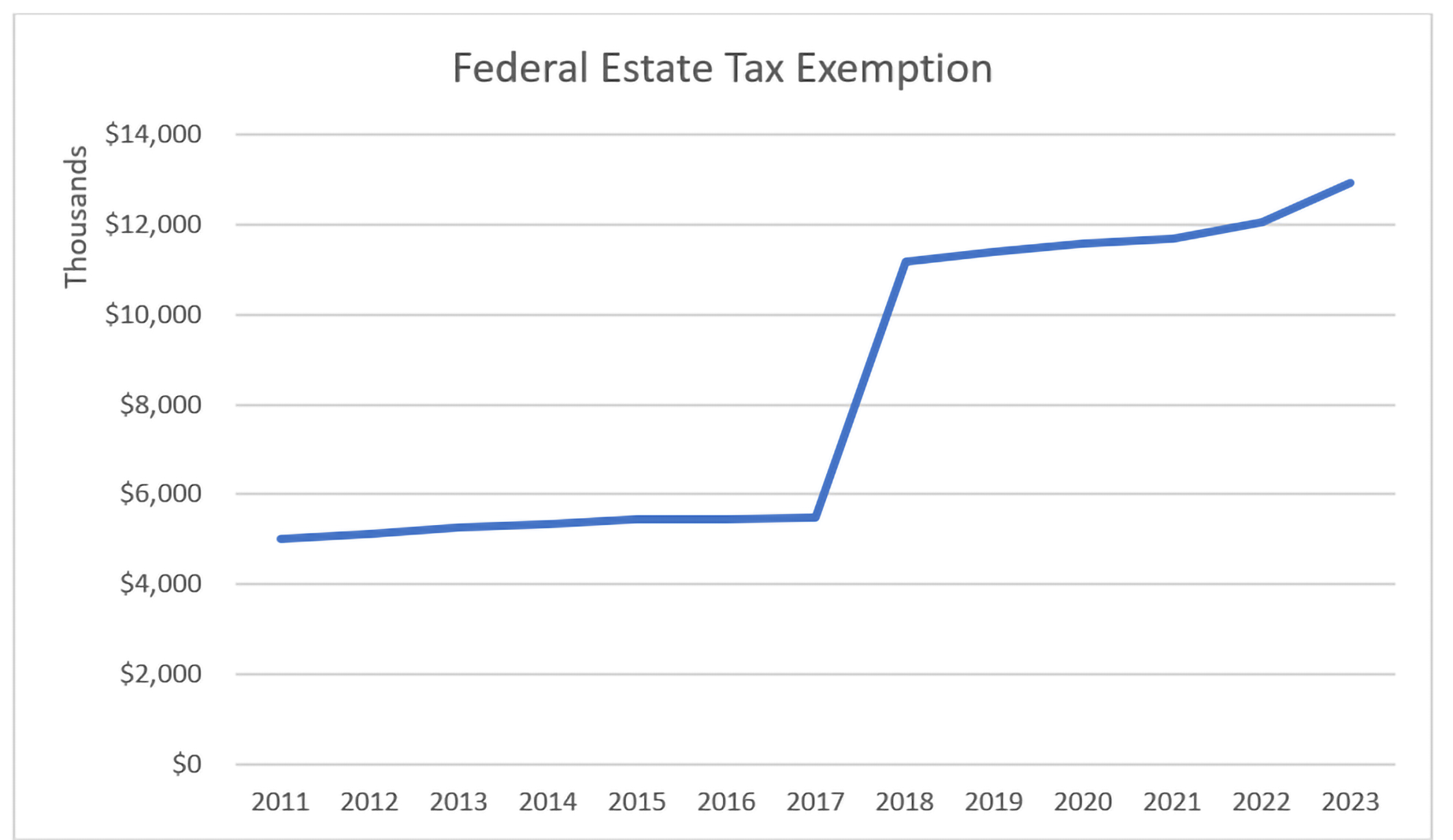

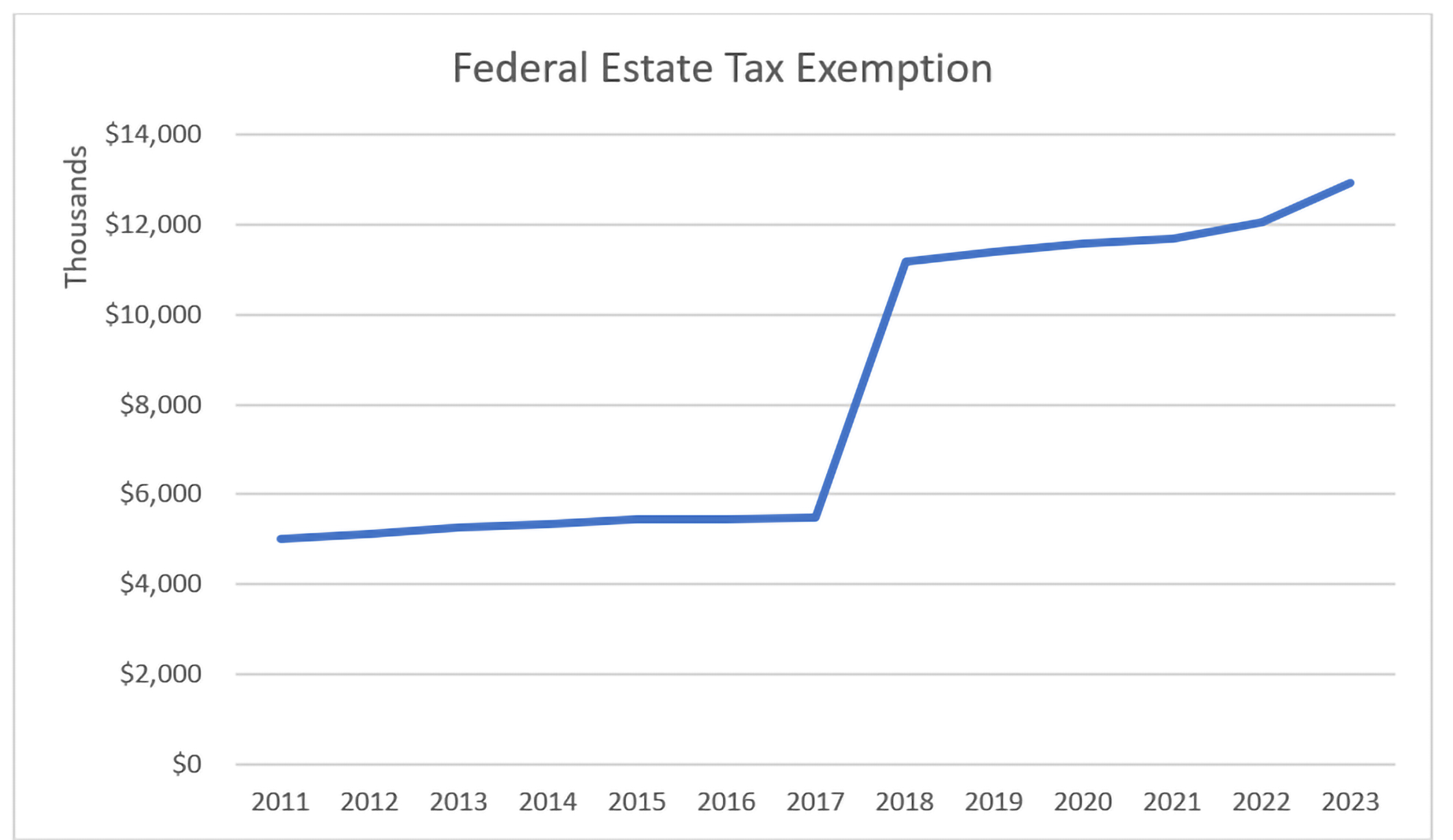

The estate of a New York State resident must file a New York State estate tax return if the following exceeds the basic exclusion amount the amount of the resident s federal gross estate plus the amount of any includible gifts The current New York estate tax exclusion amount as of 2024 is 6 940 000 indexed for inflation each year Before new legislation was passed in 2014 the New York exclusion amount was 1 000 000 and the estate

Download New York Estate Tax Exemption 2023 Cliff

More picture related to New York Estate Tax Exemption 2023 Cliff

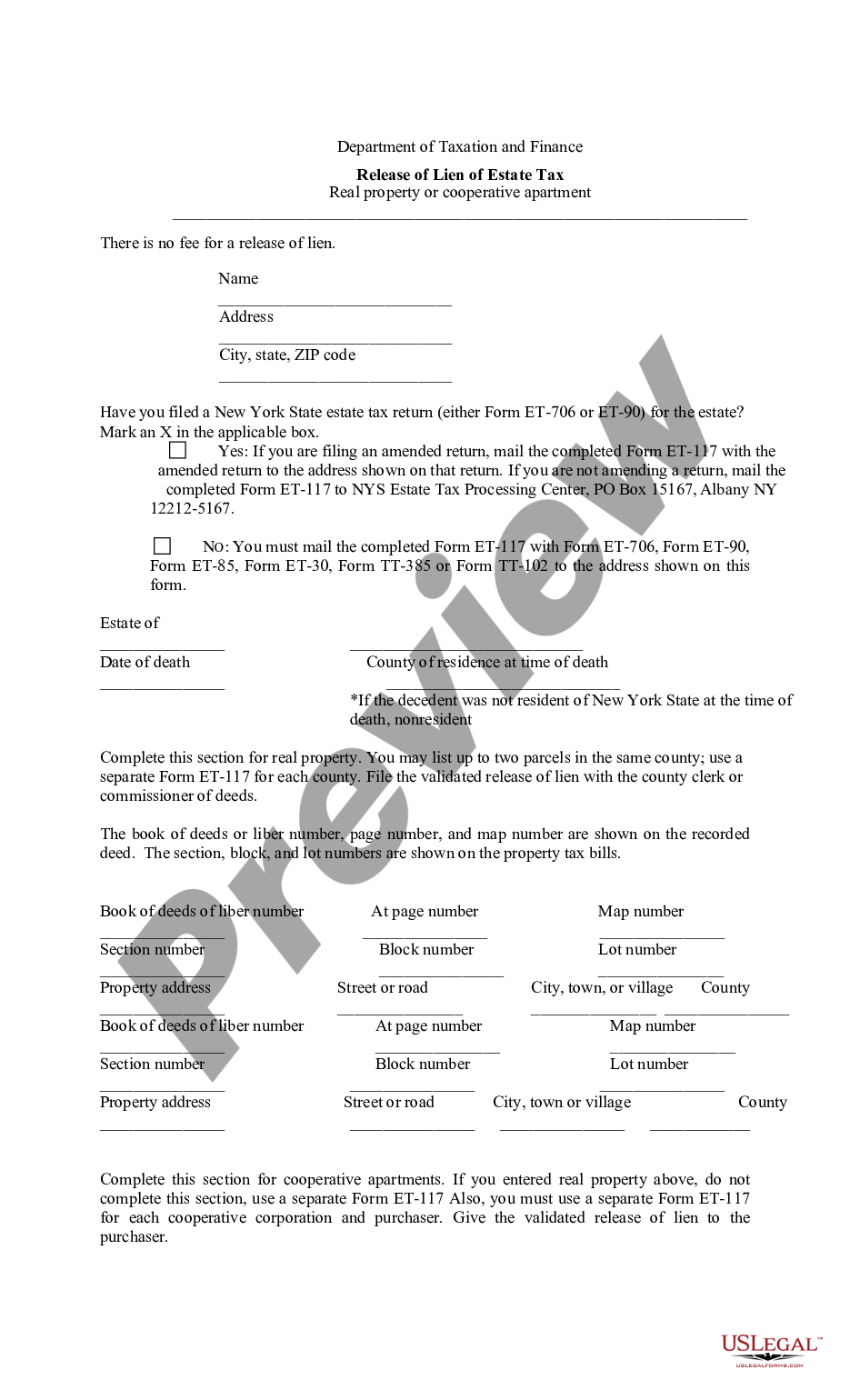

New York Estate Tax Liens And Form ET 117

https://media.licdn.com/dms/image/D4E12AQG_OM3lEKFObQ/article-cover_image-shrink_720_1280/0/1692910472681?e=2147483647&v=beta&t=xZkYHeFz1SvfC3NIy_13mCOQzSwK63VdbQov9_Glx2A

Estate Tax Exemption Changes Coming In 2026 Estate Planning

https://i0.wp.com/legacygroupny.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-03-at-11.32.59-PM.png?w=758&ssl=1

New York Estate Tax Win Opens Floodgates For Millions In Refunds And

https://imageio.forbes.com/specials-images/imageserve/897714566/0x0.jpg?format=jpg&width=1200

It s important to note that the design of New York s estate tax features what has been called a cliff provision which means that if an estate s value exceeds the threshold e g 6 94 million by more than 5 e g 7 287 000 the entire estate is subject to taxation not just the portion exceeding the threshold New York s estate tax cliff can lead to heirs in the state paying estate tax at a rate that surpasses 100 The existing per person New York state estate tax exemption is 6 11 million

In New York the estate tax exemption the amount of your estate that is free from taxation stands at 6 11 million as of 2022 This figure may seem generous but here s the catch if your estate s value exceeds the exemption by more than 5 the entire estate becomes subject to taxation not just the amount over the threshold New York has an estate tax cliff which can result in heirs paying New York estate tax at a rate exceeding 100 The current per person NYS estate tax exemption is 6 11 million which is

What Is The New York Estate Tax Exemption For 2022 The Right Answer

https://www.travelizta.com/wp-content/uploads/2022/09/what-is-the-new-york-estate-tax-exemption-for-2022-780x470.jpg

Outsmart The New York Estate Tax Cliff Proven Strategies To Preserve

https://www.nycprobate.com/probate-blog/wp-content/uploads/2023/05/estate_tax_cliff.jpg

https://vjrussolaw.com/what-is-the-new-york-state-estate-tax-cliff

If you pass away in 2023 and the value of your estate exceeds the 6 580 000 basic exclusion amount by more than 5 you will lose the exclusion benefit and your entire estate will be subject to New York estate tax starting at the first dollar

https://www.wealthspire.com/blog/new-york-estate-tax-cliff

The current New York estate tax exemption amount is 6 940 000 in 2024 up from 6 580 000 in 2023 Under current law this number will remain until January 1 2025 at which point it will rise again with inflation Who does the Cliff affect Everyone with a NYS taxable estate in varying degrees

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

What Is The New York Estate Tax Exemption For 2022 The Right Answer

What Is New York s Estate Tax Cliff 2021 Round Table Wealth

Alternative Minimum Tax What s It Like Today CPA Trendlines

How To Avoid The New York Estate Cliff Tax

Estate Tax Exemption Increased For 2023 Anchin Block Anchin LLP

Estate Tax Exemption Increased For 2023 Anchin Block Anchin LLP

Should The Massachusetts Estate Tax Exemption Be Raised From The

New York Estate Tax Withholding For Remote Employees US Legal Forms

New York Estate Tax And Its Dreaded Cliff The Estate Legacy And

New York Estate Tax Exemption 2023 Cliff - The current New York estate tax exclusion amount as of 2024 is 6 940 000 indexed for inflation each year Before new legislation was passed in 2014 the New York exclusion amount was 1 000 000 and the estate