New York Real Estate Tax Rebate Web 27 janv 2023 nbsp 0183 32 The amount of the credit is the product of the amount of real property tax which exceeds 6 of the taxpayer s qualified gross income QGI and a specified rate

Web 24 ao 251 t 2022 nbsp 0183 32 NEW YORK New York City Mayor Eric Adams today signed legislation to provide a one time property tax rebate of up to 150 to hundreds of thousands of eligible Web 5 juil 2023 nbsp 0183 32 Property tax relief credit Note The information below is for the property tax relief credit which ended in 2019 If you re looking for information about the 2022

New York Real Estate Tax Rebate

New York Real Estate Tax Rebate

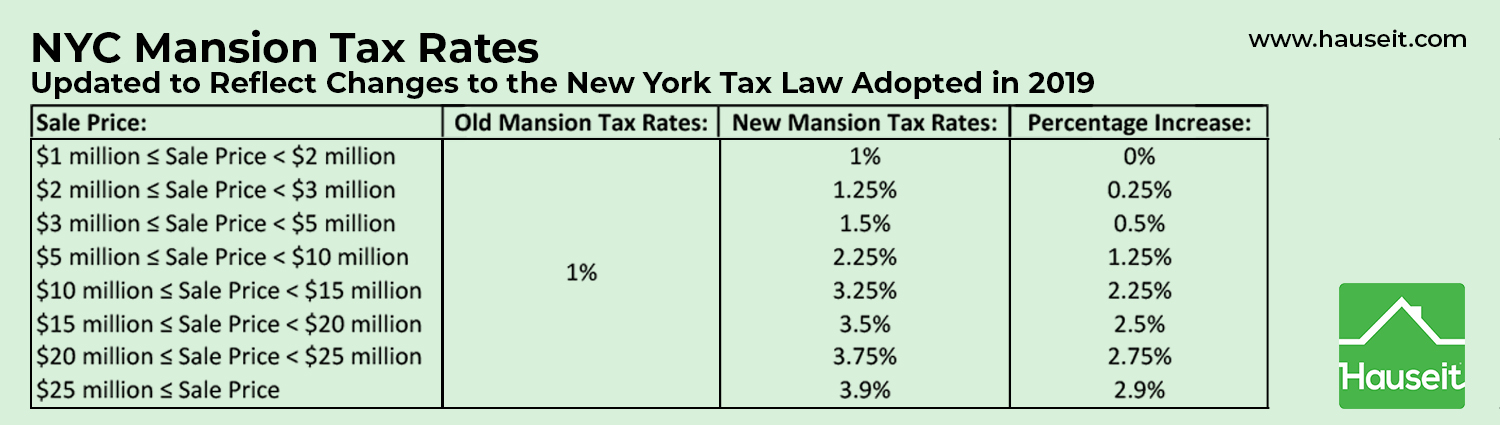

https://www.hauseit.com/wp-content/uploads/2019/04/Updated-NYC-Mansion-Tax-Rates-2019.jpg

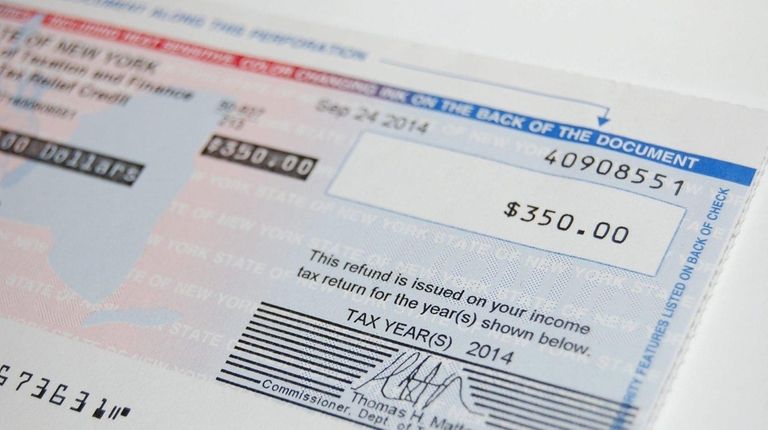

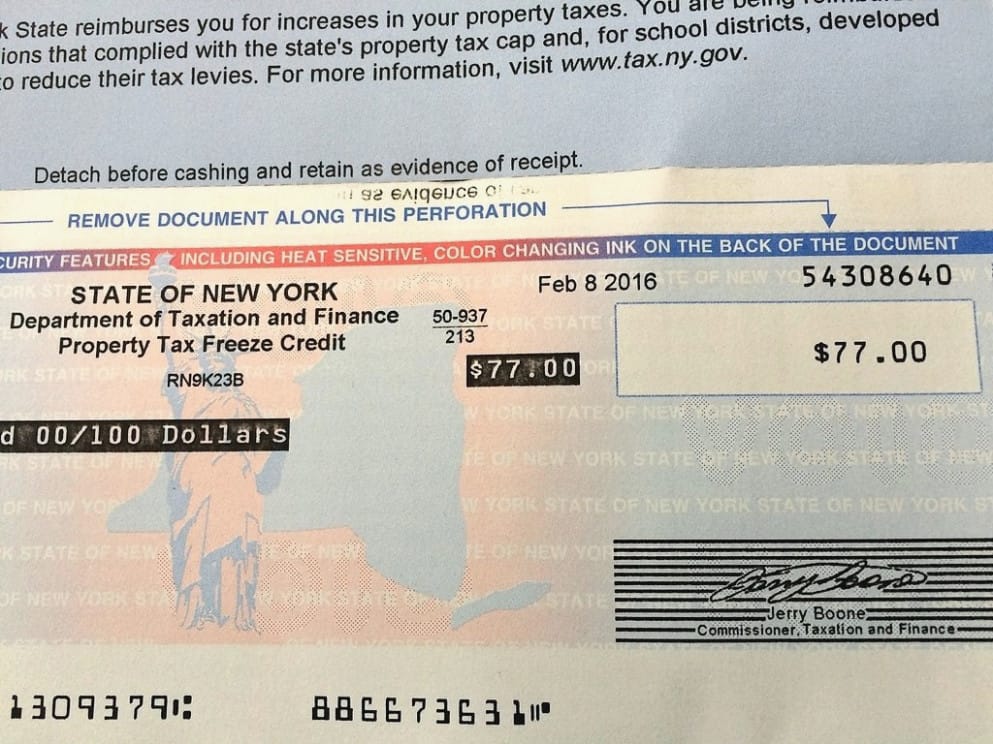

Tax Rebate Checks Come Early This Year Yonkers Times

https://yonkerstimes.com/wp-content/uploads/2018/09/check-2-2.jpg

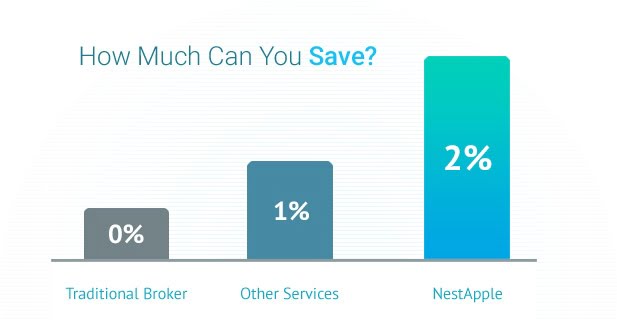

New York Real Estate Buyer s Rebate Up To 2 Cash Back

https://www.nestapple.com/wp-content/uploads/2020/02/howMuchCanYouSave.jpg

Web 24 ao 251 t 2022 nbsp 0183 32 The bill Intro 600 passed by the New York City Council earlier this month will implement a state authorizing law which will allow the city to provide a rebate of real property Web 14 mars 2023 nbsp 0183 32 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program providing direct property tax relief to eligible

Web 7 nov 2022 nbsp 0183 32 The property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less How to Web 12 oct 2022 nbsp 0183 32 Bloomberg Starting this week qualifying New York state residents will receive an extra tax credit check in the mail worth an average of 270 Eligible recipients

Download New York Real Estate Tax Rebate

More picture related to New York Real Estate Tax Rebate

Property Tax Rebate New York State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-York-Renters-Rebate-2023-768x685.jpg

Form Et 90 New York State Estate Tax Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/361/3614/361431/page_1_thumb_big.png

New York City Real Estate Tax Rebate Real Estate Spots

https://cdn.newsday.com/polopoly_fs/1.11211356.1449701630!/httpImage/image.jpeg_gen/derivatives/landscape_768/image.jpeg

Web 13 juin 2022 nbsp 0183 32 A 101 billion budget deal between Mayor Eric Adams and City Council members includes 90 million for a property tax rebate for roughly 600 000 eligible city Web 9 juin 2022 nbsp 0183 32 ALBANY New York state homeowners with household incomes of 250 000 or less are starting to receive new tax rebate checks worth hundreds of dollars The

Web 9 avr 2022 nbsp 0183 32 Accelerates a 1 2 Billion Dollar Middle Class Tax Cut and Provides a Homeowner Tax Rebate Credit for Almost 2 5 Million New Yorkers Provides Up to 250 Web 13 juin 2022 nbsp 0183 32 June 13 2022 at 2 01 PM 183 2 min read monkeybusinessimages iStock About 3 million New Yorkers are eligible for a homeowner tax rebate that will be hitting

New York Issued 2 1 Million Property Tax Rebate Checks In Late Summer

https://i.pinimg.com/originals/6c/a6/59/6ca659553b2f8bf64a3594bc439c0fad.png

LIers With Children Can Get 350 Tax Credit Newsday

https://cdn.newsday.com/polopoly_fs/1.11302750.1452269577!/httpImage/image.jpeg_gen/derivatives/landscape_768/image.jpeg

https://www.tax.ny.gov/pit/credits/real-property-tax-relief-credit.htm

Web 27 janv 2023 nbsp 0183 32 The amount of the credit is the product of the amount of real property tax which exceeds 6 of the taxpayer s qualified gross income QGI and a specified rate

https://www.nyc.gov/office-of-the-mayor/news/616-22/mayor-adams-signs...

Web 24 ao 251 t 2022 nbsp 0183 32 NEW YORK New York City Mayor Eric Adams today signed legislation to provide a one time property tax rebate of up to 150 to hundreds of thousands of eligible

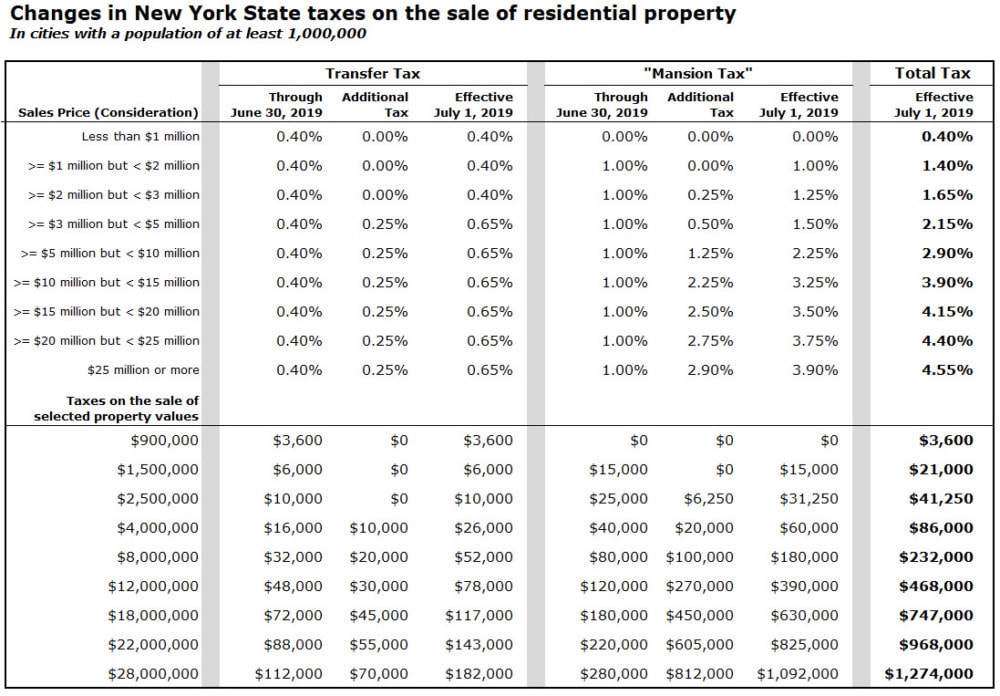

NYC NYS Seller Transfer Tax Of 1 4 To 2 075 Hauseit

New York Issued 2 1 Million Property Tax Rebate Checks In Late Summer

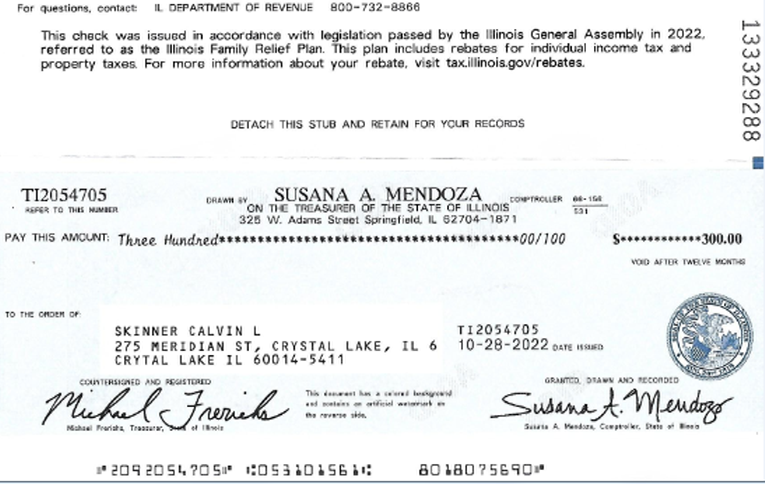

300 Check Allegedly A Real Estate Tax Rebate Arrives Eight Days

July 1 2019 New York State And New York City Real Estate Transfer

New York State Homeowner Tax Rebate Credit HTRC Sciarabba Walker

Form Tt 385 New York State Estate Tax Return Printable Pdf Download

Form Tt 385 New York State Estate Tax Return Printable Pdf Download

Comptroller NY Tax Dept Approved More Than 31 000 Questionable Tax

Did You Get Your Tax Rebate Check Yet Here s How Many Still Haven t

Transfer Taxes In New York Explained ELIKA New York

New York Real Estate Tax Rebate - Web 18 janv 2022 nbsp 0183 32 The tax rebates are considered a tax credit which will apply to the 2022 tax year But waiting for the tax credit to be implemented when you fill out your tax forms in