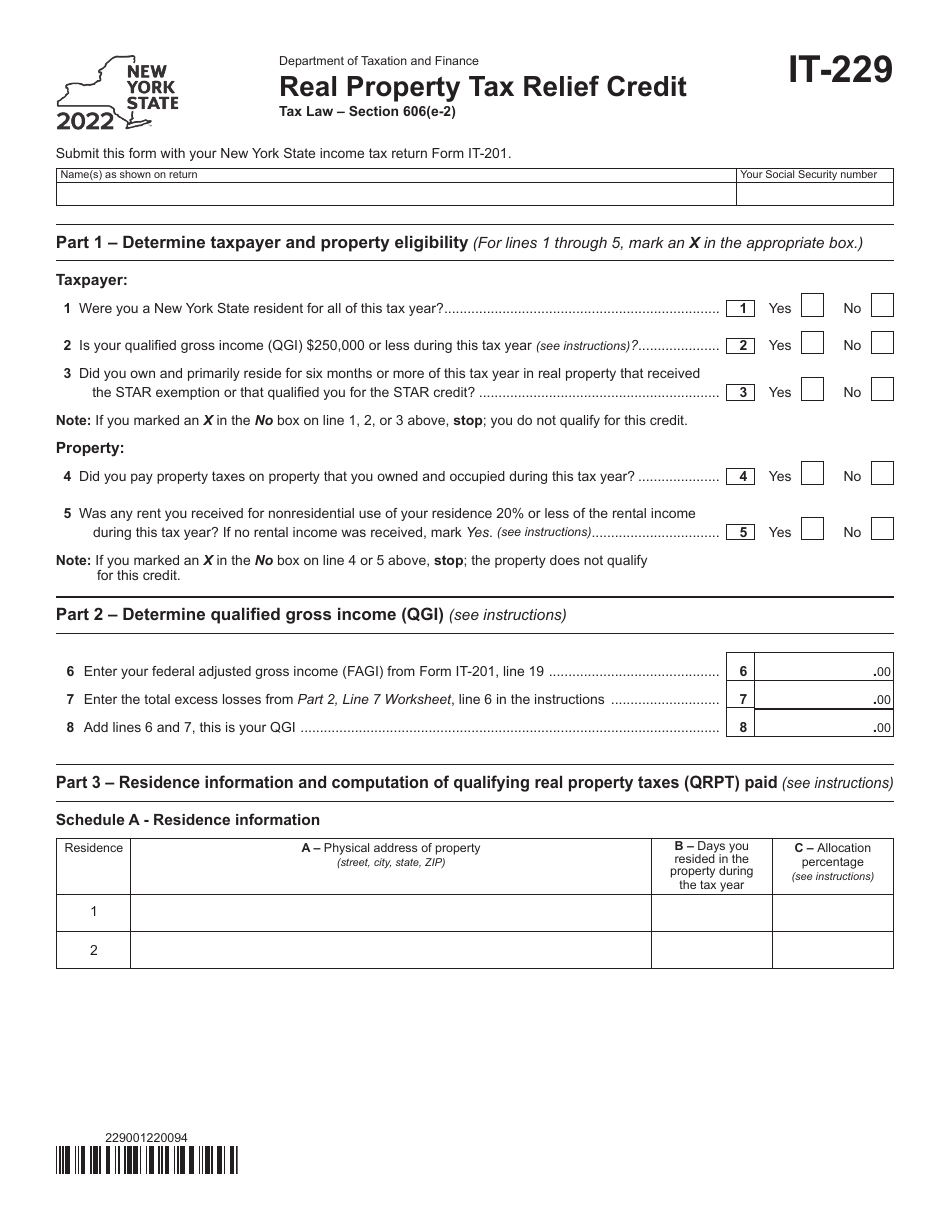

New York Real Property Tax Relief Credit For tax years beginning on or after January 1 2021 if you are eligible you may claim the real property tax relief credit on your residence If you do not use the full amount of the credit for the current tax year you may request a refund or credit the overpayment to the next year s tax liability

You are entitled to this refundable credit if your household gross income is 18 000 or less you occupied the same New York residence for six months or more you were a New York State resident for the entire tax year you could not be claimed as a dependent on another taxpayer s federal income tax return The Real Property Tax Relief Credit NY IT 229 RPTR was implemented to provide relief to New York State NYS taxpayers who own qualified real property in the state The Credit takes effect for tax years beginning on or after January 1 2021 and is also available for 2022 23 school tax assessments

New York Real Property Tax Relief Credit

New York Real Property Tax Relief Credit

https://imageio.forbes.com/specials-images/imageserve/63daa78412863dfa679afec2/0x0.jpg?format=jpg&width=1200

Real Estate Tax Relief Program Official Website Of Arlington County

https://www.arlingtonva.us/files/sharedassets/public/housing/images/homeownership/realestaterelief-thumb.jpg?w=1200

BREA Received Multiple Complaints Over Real Property Tax Bills Eye

https://ewnews.com/wp-content/uploads/2022/01/shutterstock_630862376-scaled.jpg

ALBANY New York has created a new property tax credit for homeowners who make less than 250 000 a year with about a quarter of the state s estimated 4 5 million owner occupied homes To qualify for the real property tax credit taxpayers must meet all of the following conditions Household gross income must be 18 000 or less Lived in the same New York residence for at least six months You were a New York resident the entire tax year

Electronic filing is the fastest safest way to file but if you must file a paper Claim for Real Property Tax Credit use our enhanced fill in Form IT 214 with 2D barcodes Benefits include no more handwriting type your entries directly into our form automatic calculation of your refund or tax due amount the form does the math The real property tax credit may be available to New York State residents who have household gross incomes of 18 000 or less and pay either real property taxes or rent for their residences The amount of the credit for each household will vary depending on income and real property taxes paid see table to the right In addition to

Download New York Real Property Tax Relief Credit

More picture related to New York Real Property Tax Relief Credit

4 Property Tax Relief Options Keep Asking

https://cdn.keepasking.com/keepasking/wp-content/uploads/2021/02/4-property-tax-relief-options-scaled.jpg

Property Tax Relief LinkedIn

https://media.licdn.com/dms/image/C4D1BAQEAHYYE6AxTTw/company-background_10000/0/1519799470721?e=1690952400&v=beta&t=iNKJPTul0tNFIiaW-HxpUmFJe7t1hHrm5BOPfod5lRE

LEM MEMO Remember The Property Tax Relief Credit For NYS New York

https://www.nystap.org/wordpress/wp-content/uploads/2022/02/image001.png

The credit provides direct property tax relief in the form of checks to eligible homeowners The amount of the credit will depend on your home s location your income and whether you receive Basic or Enhanced STAR School Tax Relief Am I eligible To be eligible you must have qualified for a 2022 STAR credit or exemption The newly approved 212 billion state budget includes relief for qualifying homeowners in New York who pay among the highest tax levies in the country But not everyone will qualify for the relief as part of the state budget which is

[desc-10] [desc-11]

Property Tax Reduction Consultants Which Types Of Property Tax Relief

https://2.bp.blogspot.com/-GJ9QVVvt9gY/WoczuVPhn7I/AAAAAAAABUk/FP-Ts5X5GHUKlMg2A_HITxAfJZ-vdfK0ACLcBGAs/s1600/shutterstock_104946530.jpg

2019 2024 Form NY NYC 208 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/607/821/607821949/large.png

https://www.tax.ny.gov/forms/current-forms/it/it229i.htm

For tax years beginning on or after January 1 2021 if you are eligible you may claim the real property tax relief credit on your residence If you do not use the full amount of the credit for the current tax year you may request a refund or credit the overpayment to the next year s tax liability

https://www.tax.ny.gov/pit/credits/real_property_tax_credit.htm

You are entitled to this refundable credit if your household gross income is 18 000 or less you occupied the same New York residence for six months or more you were a New York State resident for the entire tax year you could not be claimed as a dependent on another taxpayer s federal income tax return

N Y Has New Property Tax Relief What About N J NJMoneyHelp

Property Tax Reduction Consultants Which Types Of Property Tax Relief

2016 2017 Real Property Tax Relief Program Updates

Real Property Tax In The Philippines All Properties

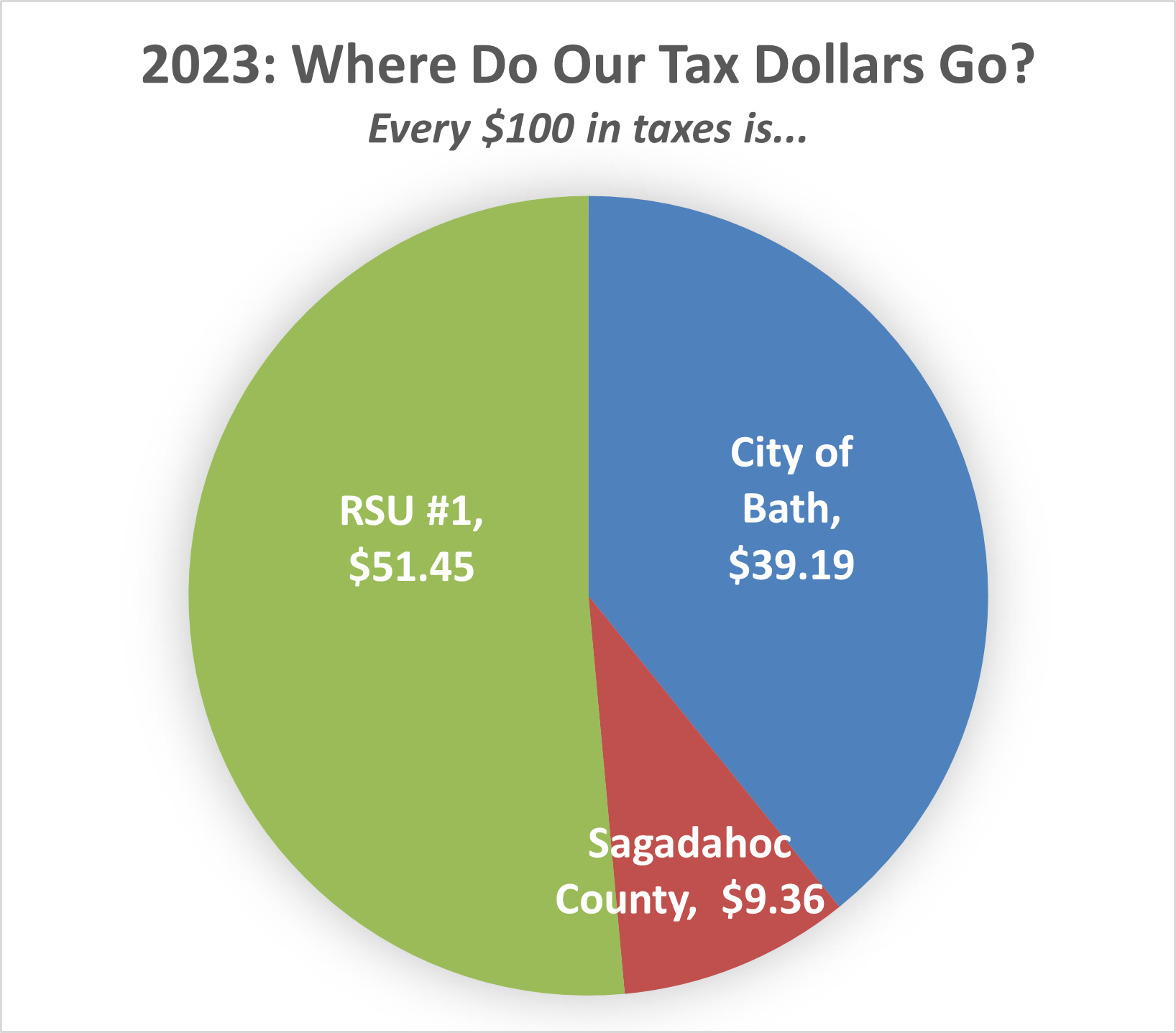

City Of Bath Maine Official Website Assessor s Office

Financial Transparency Portal Story

Financial Transparency Portal Story

Form IT 229 Download Fillable PDF Or Fill Online Real Property Tax

Real Property Transfer Tax Return New York City Free Download

.jpg)

DeKalb County Property Tax Information

New York Real Property Tax Relief Credit - [desc-14]