New York Sales Tax Return Due Dates 2023 New York State and Local Annual Sales and Use Tax Return Due date Monday March 20 2023 This form can be completed electronically using your

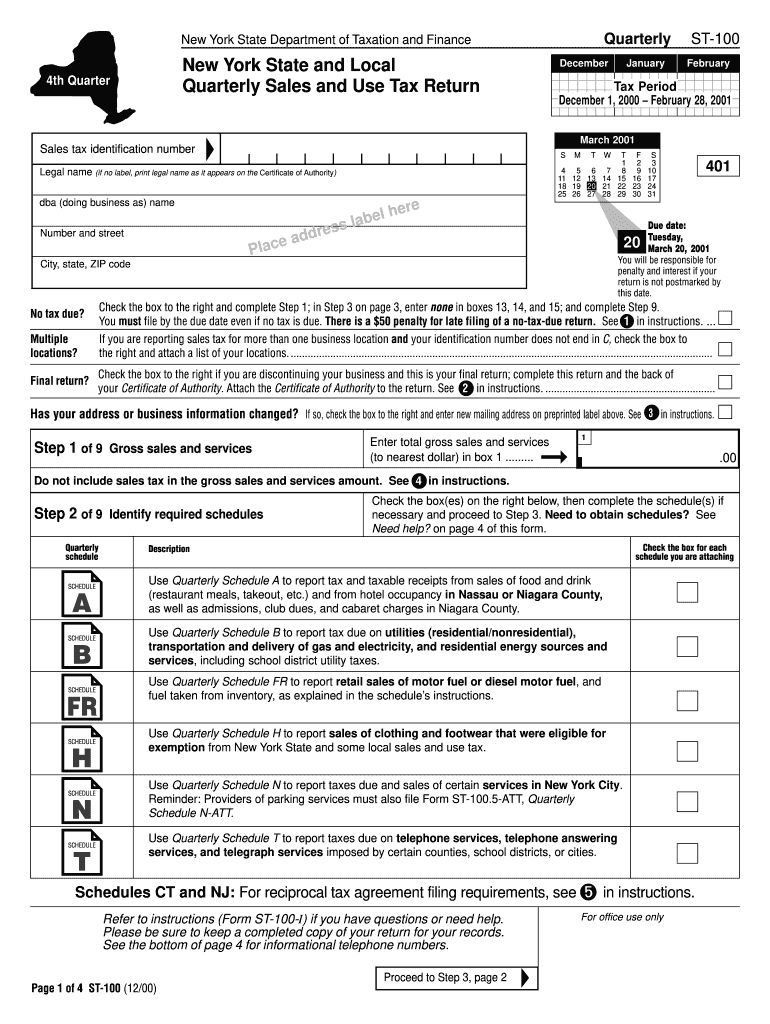

File sales tax returns If you re registered for sales tax purposes in New York State you must file sales and use tax returns quarterly part quarterly monthly or On this page we have compiled a calendar of all sales tax due dates for New York broken down by filing frequency The next upcoming due date for each filing schedule is marked

New York Sales Tax Return Due Dates 2023

New York Sales Tax Return Due Dates 2023

https://uploads-ssl.webflow.com/5e41d080471798e913648c3e/63b5e591f30ddf62c7b5d0c9_tax due date.jpg

New York Sales Tax For Your Auto Dealership

https://www.salestaxhelper.com/images/blog/shutterstock_1216440109.jpg

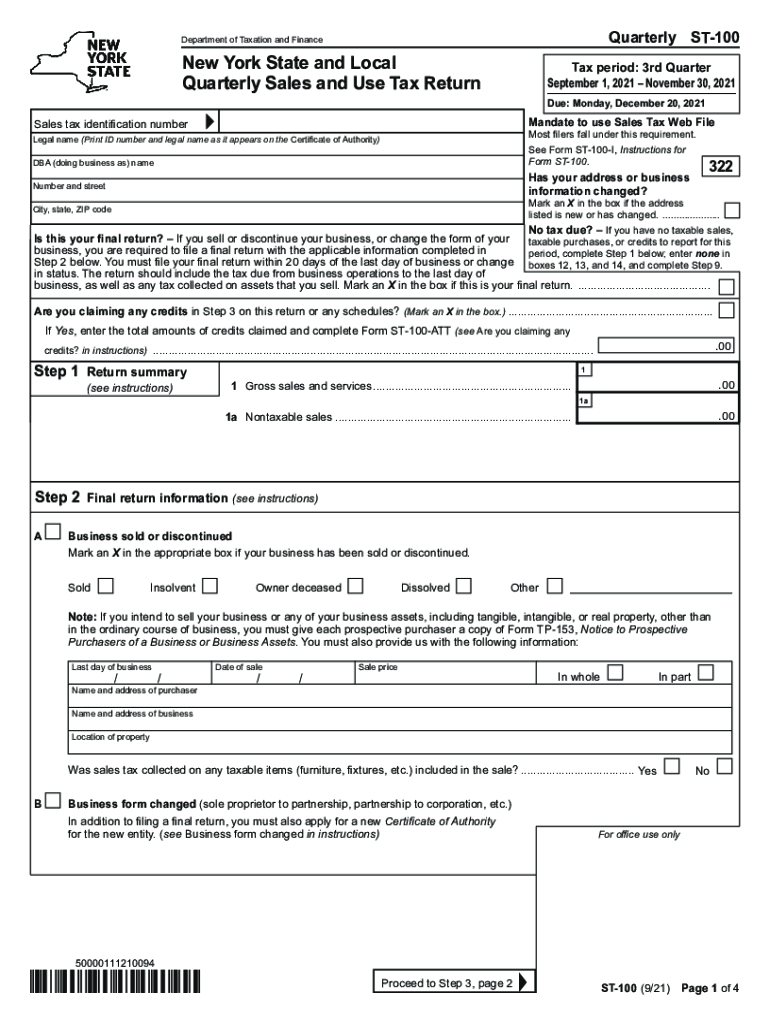

St 100 2021 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/577/778/577778985/large.png

Tax period March 1 2022 February 28 2023 Due Monday March 20 2023 Mandate to use Sales Tax Web File Most filers fall under this requirement See Form ST 101 I What are the New York sales tax due dates The due dates for filing sales tax returns in New York vary depending on the filing frequency For quarterly filers the due dates are January 31st April

Your New York Sales Tax Filing Frequency Due Dates Your business s sales tax return must be filed by the 20th of the month following reporting period for monthly filers for 12 rows2nd quarter June 1 2024 August 31 2024 Due date Friday September 20 2024 Quarterly Schedule B Taxes on Utilities and Heating Fuels Instructions for Form

Download New York Sales Tax Return Due Dates 2023

More picture related to New York Sales Tax Return Due Dates 2023

Due Dates In 2022 For 2021 Tax Reporting And 2022 Tax Estimates

https://www.tgccpa.com/wp-content/uploads/2021/12/AdobeStock_329684082-min-scaled-1.jpeg

The IRS Tax Refund Schedule 2023 Where s My Refund Irs Taxes

https://i.pinimg.com/736x/5f/5e/0f/5f5e0f1c9fdd61fa87df5215e135f24d.jpg

Form 20 F Due Date Form 20 F Pdf QFB66

https://i1.wp.com/facelesscompliance.com/wp-content/uploads/2020/05/Due-dates-2.jpg?fit=2476%2C1036&ssl=1

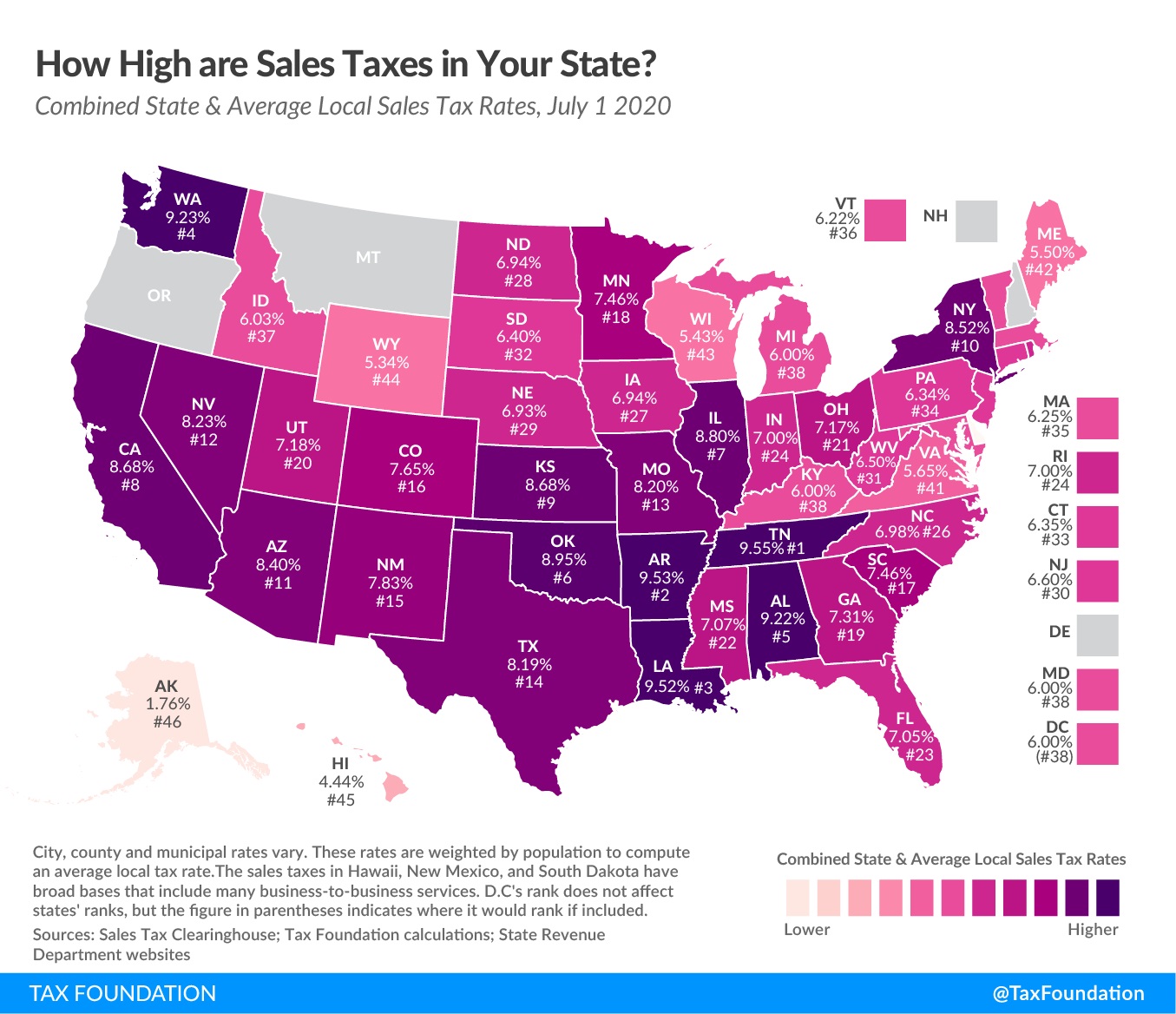

Discover our comprehensive New York 2023 sales tax guide for small businesses including filing tips deadlines and incentives Conquer sales tax today Reported on sales and use tax returns New reporting lines have been added to this quarter s returns and schedules to differentiate between transactions made within and

For quarterly filers sales tax returns are due on the 20th of the month following the end of the reporting quarter Q1 sales tax returns are due April 20 Yearly For yearly filers How to find your return due date The timing for filing a return depends on quarterly gross receipts and annual sales tax liability Most businesses are required to

Income Tax Return Filing For AY 2022 23 Know About Deadlines Click

http://blog.freetaxfiler.com/wp-content/uploads/2022/06/logo-dark.png

Nys Sales Tax Due Dates 2023 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/577/700/577700638/large.png

https://www.tax.ny.gov/forms/prvforms/sales_tax_2022_2023.htm

New York State and Local Annual Sales and Use Tax Return Due date Monday March 20 2023 This form can be completed electronically using your

https://www.tax.ny.gov/bus/st/filing_sales_tax_returns.htm

File sales tax returns If you re registered for sales tax purposes in New York State you must file sales and use tax returns quarterly part quarterly monthly or

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

Income Tax Return Filing For AY 2022 23 Know About Deadlines Click

New York Sales Tax Sales Tax New York NY Sales Tax Rate

Sales And Use Tax Return Form

Due Dates For Income Tax Returns Archives Ebizfiling

Economic Recovery And Relief 2023 Sales Tax Manhattan KS Official

Economic Recovery And Relief 2023 Sales Tax Manhattan KS Official

Printable Nys Sales Tax Form St 100

Paradigms And Demographics The State With The Greediest Politicians

NY Sales Tax Chart

New York Sales Tax Return Due Dates 2023 - Tax period March 1 2022 February 28 2023 Due Monday March 20 2023 Mandate to use Sales Tax Web File Most filers fall under this requirement See Form ST 101 I