New York State Property Tax Relief Verkko 28 marrask 2023 nbsp 0183 32 For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that the net amount of loss reported on Federal Schedule C D E or F doesn t exceed 3 000 the net amount of any other separate category of loss doesn t exceed 3 000 and

Verkko The homeowner tax rebate credit is a one year program providing direct property tax relief to about 2 5 million eligible homeowners in 2022 If you qualify you don t need to do anything we ll automatically send you a check for the amount of your credit Verkko 8 huhtik 2021 nbsp 0183 32 NEWS New York has a new property tax credit Here s how to tell if you qualify Jon Campbell New York State Team ALBANY New York has created a new property tax credit for

New York State Property Tax Relief

New York State Property Tax Relief

https://townline.org/wp-content/uploads/2022/08/tax_relief-1030x686.jpg

N Y Has New Property Tax Relief What About N J Nj

https://www.nj.com/resizer/wwT_I0C8rksX3t7VxgBVokQTM8k=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/RF6P5SE4G5ESJPZS4E3LINQMIU.jpg

4 Property Tax Relief Options Keep Asking

https://cdn.keepasking.com/keepasking/wp-content/uploads/2021/02/4-property-tax-relief-options-scaled.jpg

Verkko 30 lokak 2023 nbsp 0183 32 The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in one of two ways STAR credit If you are registered for the STAR credit the Tax Department will issue your STAR benefit via Verkko 29 elok 2023 nbsp 0183 32 Property Tax Credit Lookup You can view and print the following information regarding your 2017 through 2023 property tax credits that have been issued your prior year New York State income tax return Form IT 201 IT 201 X IT 203 or IT 203X filed for a prior tax year from 2017 to 2021 and the Total payments

Verkko 21 syysk 2022 nbsp 0183 32 Note this article was updated 9 21 22 and now includes a reference link regarding the 2022 23 school tax assessments The Real Property Tax Relief Credit NY IT 229 RPTR was implemented to provide relief to New York State NYS taxpayers who own qualified real property in the state The Credit takes effect for tax years Verkko 30 lokak 2023 nbsp 0183 32 Learn about the homeowner tax rebate credit The homeowner tax rebate credit is a one year program providing direct property tax relief to nearly three million eligible homeowners in 2022 Learn whether you re eligible Have questions Read our frequently asked questions See homeowner tax rebate credit

Download New York State Property Tax Relief

More picture related to New York State Property Tax Relief

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

https://rfa.sc.gov/sites/default/files/styles/card_regular/public/2020-08/shutterstock_1091472533.jpg?itok=pJHg7Z0v

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

https://rfa.sc.gov/sites/default/files/styles/card_regular/public/2020-08/shutterstock_1139203982.jpg?itok=_XW5NOtG

Alaska Property Taxes Ranked Alaska Policy Forum

https://alaskapolicyforum.org/wp-content/uploads/Property-taxes_22.jpg

Verkko 23 kes 228 k 2022 nbsp 0183 32 New York homeowners should watch their mailboxes this month for a one time property tax credit thanks to a 2 2 billion tax relief program approved in New York s budget Verkko 8 huhtik 2021 nbsp 0183 32 1 Who will benefit The program will apply to taxpayers who make less than 250 000 based on the proportion of their income spent on property taxes In other words credits are based on the amount of property taxes paid in excess of 6 percent of an eligible taxpayer s federal adjusted gross income

Verkko 9 huhtik 2022 nbsp 0183 32 The State Budget also creates a new property tax relief credit the Homeowner Tax Rebate Credit for eligible low and middle income households as well as eligible senior households Verkko Real Property Tax Relief Credit Tax Law Section 606 e 2 IT 229 Submit this form with your New York State income tax return Form IT 201 Name s as shown on return Your Social Security number Part 1 Determine taxpayer and property eligibility For lines 1 through 5 mark an X in the appropriate box Taxpayer

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

Property Tax Bill Examples

https://www.tax.state.ny.us/images/orpts/proptaxbills/upstate-2.jpg

https://www.tax.ny.gov/pit/property/property-tax-relief.htm

Verkko 28 marrask 2023 nbsp 0183 32 For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that the net amount of loss reported on Federal Schedule C D E or F doesn t exceed 3 000 the net amount of any other separate category of loss doesn t exceed 3 000 and

https://www.tax.ny.gov/pit/property/homeowner-tax-rebate-credit.htm

Verkko The homeowner tax rebate credit is a one year program providing direct property tax relief to about 2 5 million eligible homeowners in 2022 If you qualify you don t need to do anything we ll automatically send you a check for the amount of your credit

Credit Versus Exemption In Homestead Property Tax Relief ITR Foundation

How High Are Property Taxes In Your State American Property Owners

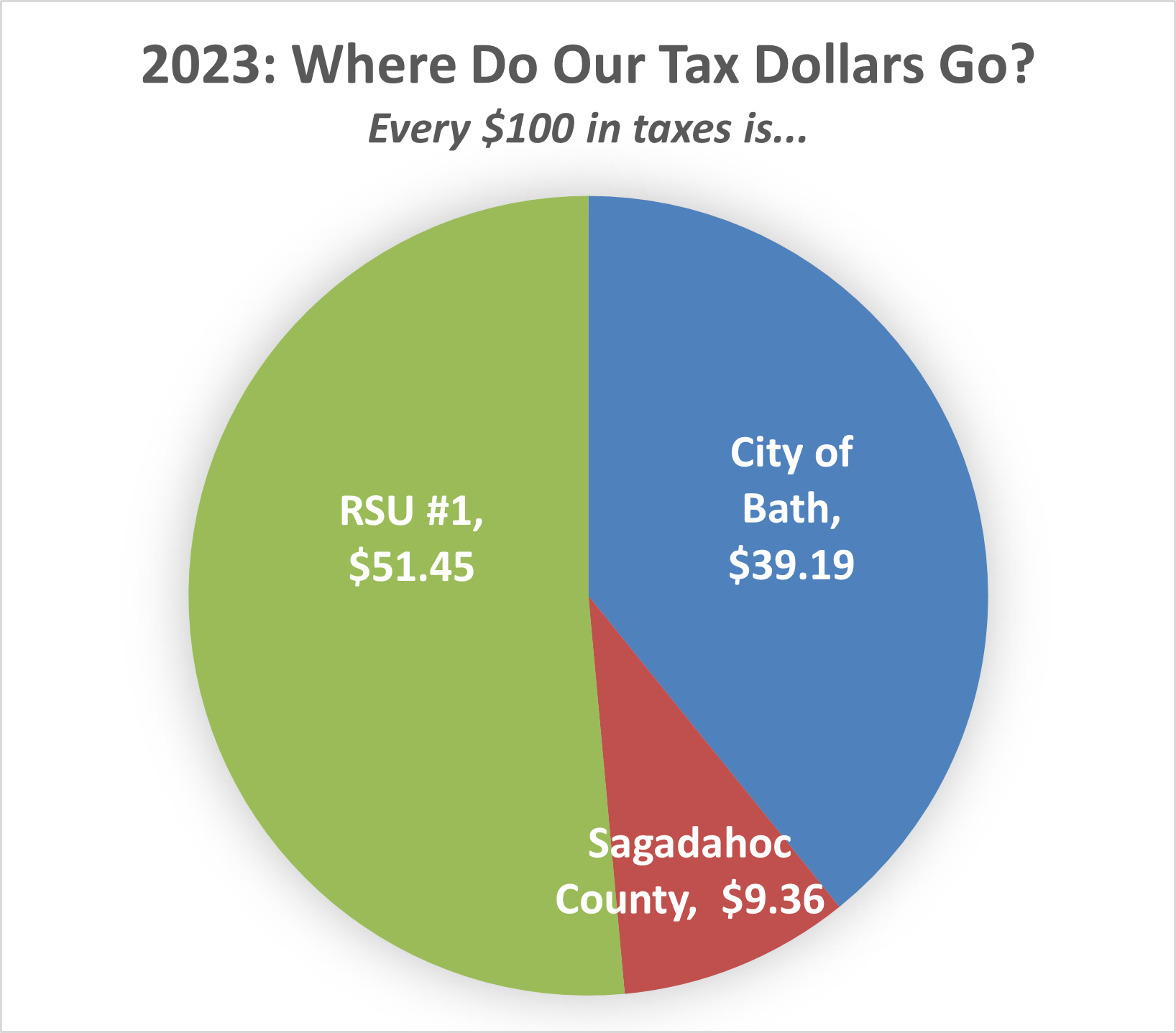

City Of Bath Maine Official Website Assessor s Office

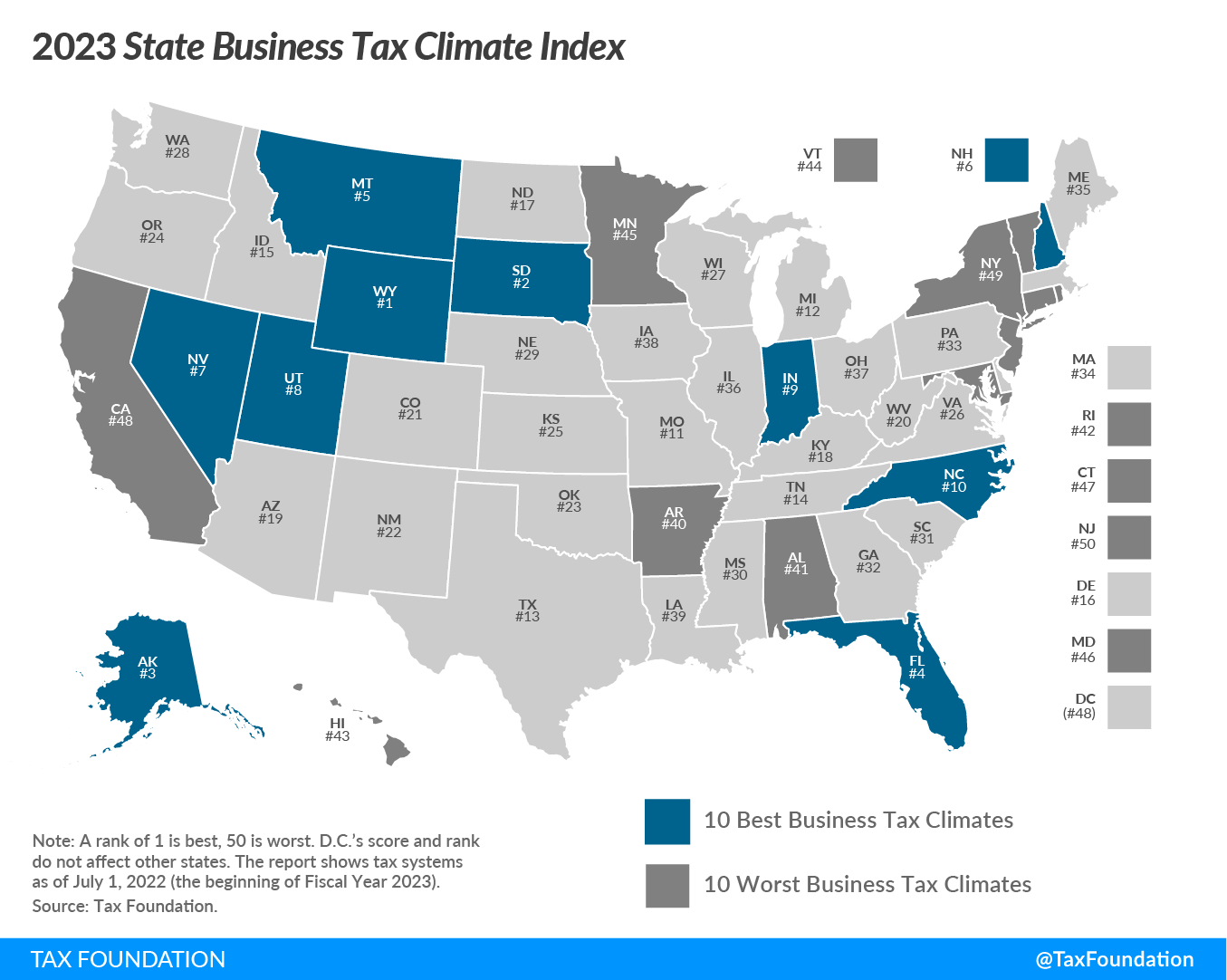

2023 State Business Tax Climate Index Tax Unfiltered

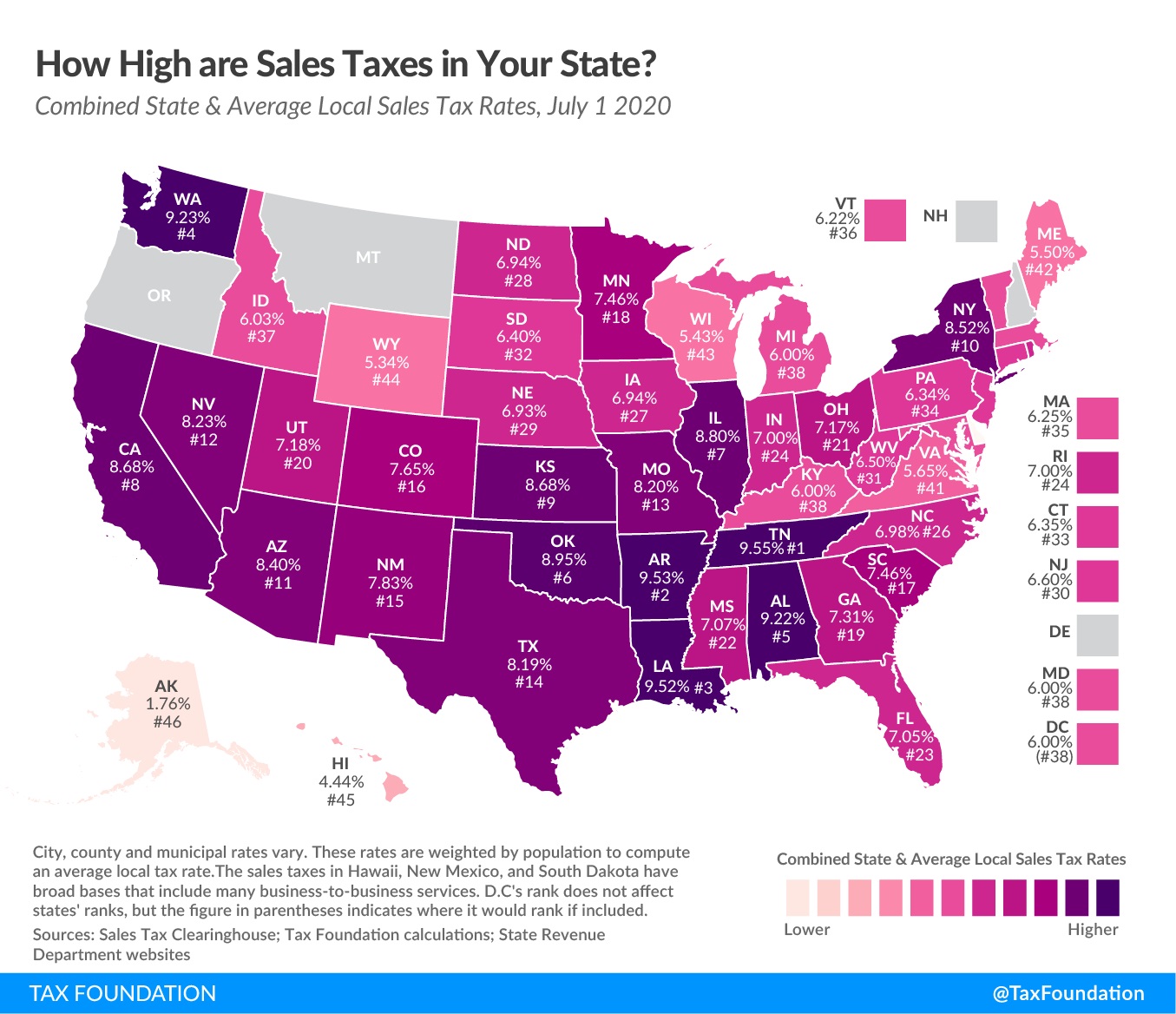

How Do Pa s Property Taxes Stack Up Nationally This Map Will Tell You

Taxpayers Mad About High Property Appraisals But Officials Argue Tax

Taxpayers Mad About High Property Appraisals But Officials Argue Tax

Property Tax Relief Homestead And Farmstead Exclusion Application

Upstate NY Has Some Of The Highest Property Tax Rates In The Nation

Paradigms And Demographics The State With The Greediest Politicians

New York State Property Tax Relief - Verkko 29 elok 2023 nbsp 0183 32 Property Tax Credit Lookup You can view and print the following information regarding your 2017 through 2023 property tax credits that have been issued your prior year New York State income tax return Form IT 201 IT 201 X IT 203 or IT 203X filed for a prior tax year from 2017 to 2021 and the Total payments