New York State Real Estate Tax Credit The Real Property Tax Relief Credit NY IT 229 RPTR was implemented to provide relief to New York State NYS taxpayers who own qualified real property in the

For tax years beginning on or after January 1 2021 if you are eligible you may claim the real property tax relief credit on your residence If you do not use the full amount of the credit for the current tax year you may request a refund or credit the overpayment to the next year s tax liability For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that the net amount of loss reported on

New York State Real Estate Tax Credit

New York State Real Estate Tax Credit

https://licenselookup.org/images/2022-11/new-york-real-estate-agent-license-078bf91082.jpg

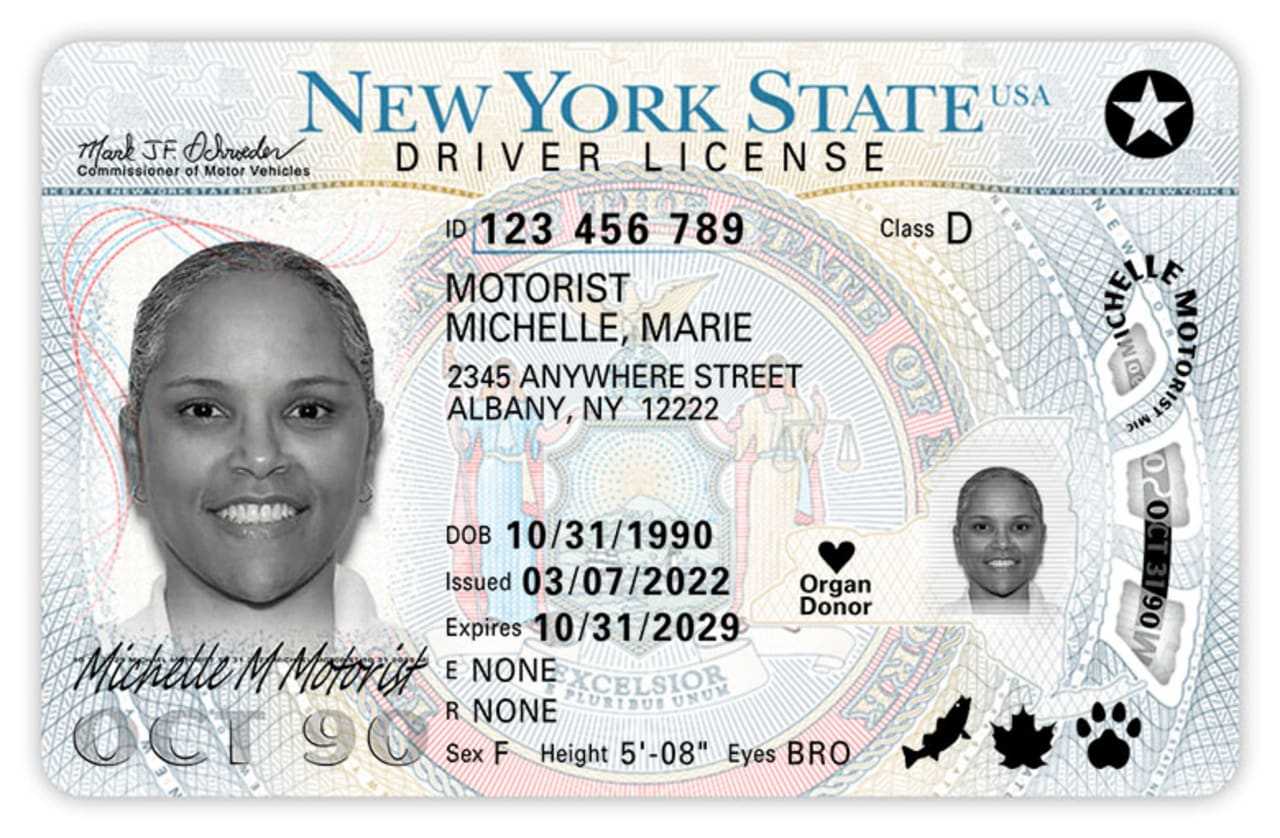

New York State REAL ID Deadline WHEC

https://www.whec.com/wp-content/uploads/2022/08/news10nbc_NewYorkStateREALIDdeadlinesyndImport044150.jpg

Tax Benefits Of Owning Commercial Real Estate Commercial Orange County

https://commercialorangecounty.com/wp-content/uploads/2023/02/3296f01ae9dcfd79269feaaf46230ed0.jpg

The new tax credit included in the state s 212 billion budget approved this week by the Legislature and Gov Andrew Cuomo will apply to eligible homeowners To qualify for the real property tax credit taxpayers must meet all of the following conditions Household gross income must be 18 000 or less Lived in the same New

Income tax credits will range between 250 and 350 All told the program will cost about 440 million 3 How will long will the program be in place The state budget enacts the circuit breaker for the New York homeowners should watch their mailboxes this month for a one time property tax credit thanks to a 2 2 billion tax relief program approved in New

Download New York State Real Estate Tax Credit

More picture related to New York State Real Estate Tax Credit

New York Real Estate Archives PropertyShark Real Estate Blog

https://www.propertyshark.com/Real-Estate-Reports/wp-content/uploads/sites/6/2020/03/shutterstock_459782230.jpg?resize=215

Top 3 Federal And State Real Estate Tax Credits

https://www.gma-cpa.com/hubfs/GMA Website Assets 2018/Website Graphics/Blog Graphics/Real estate investment that qualifies for tax credit.jpg

New York State Real Estate License Online Course INFOLEARNERS

https://infolearners.com/wp-content/uploads/2022/05/new-york-state-real-estate-license-online-course.jpg

The Real Property Tax Credit is intended to help New Yorkers who pay more than 6 of their income on property taxes which includes many homeowners on Long The real property tax credit may be available to New York State residents who have household gross incomes of 18 000 or less and pay either real property taxes or rent

Update on homeowner tax rebate credit checks Great news We ve mailed nearly two million homeowner tax rebate credit checks to eligible New York homeowners and The Enhanced Real Property Tax Credit is available to NYC residents who have a household gross income of less than 200 000 and pay either real property taxes or rent

The Real Estate Professional Rules What Counts As A Rental Activity

https://irstaxtrouble.com/wp-content/uploads/sites/5/2020/08/real-estate-tax-attorney-in-housto.jpg

Compromise Plan May Give Boston A 2 Percent Tax On Larger Real Estate

https://bostonglobe-prod.cdn.arcpublishing.com/resizer/IvEyeGkm1sz3MVCtIlJuZpTRSGo=/1024x0/arc-anglerfish-arc2-prod-bostonglobe.s3.amazonaws.com/public/4OC2J7USA4I6TGQJXV3PLWIYH4.jpg

https:// efprgroup.com /news/article-publication/...

The Real Property Tax Relief Credit NY IT 229 RPTR was implemented to provide relief to New York State NYS taxpayers who own qualified real property in the

https://www. tax.ny.gov /forms/current-forms/it/it229i.htm

For tax years beginning on or after January 1 2021 if you are eligible you may claim the real property tax relief credit on your residence If you do not use the full amount of the credit for the current tax year you may request a refund or credit the overpayment to the next year s tax liability

The Real Estate Professional Rules What Counts As A Rental Activity

New Extension For REAL ID Deadline Announced By DHS Stamford Daily Voice

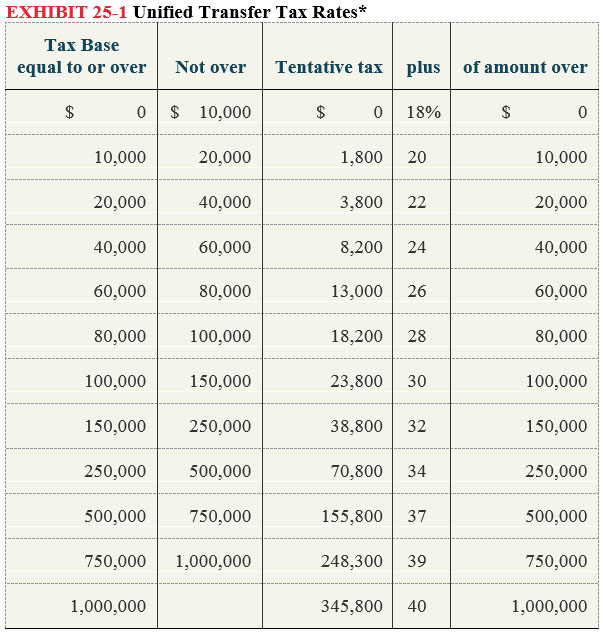

Unified Estate And Gift Tax Credit 2020 Blythe Strand

Real Estate Tax Impact For Expats

Birdie Robb

Birdie Robb

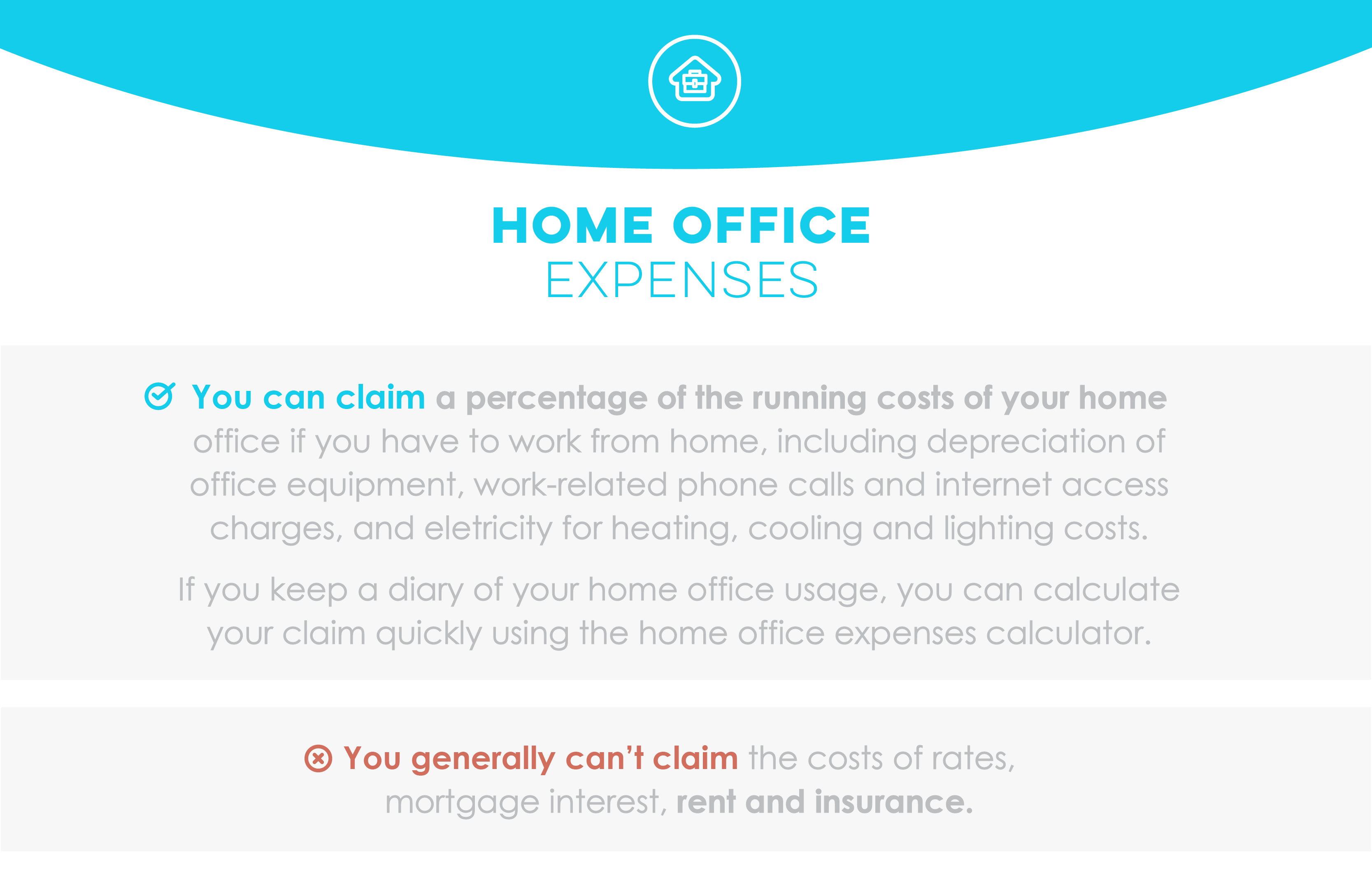

Top 12 Forgotten ATO Real Estate Tax Deductions PropertyMe

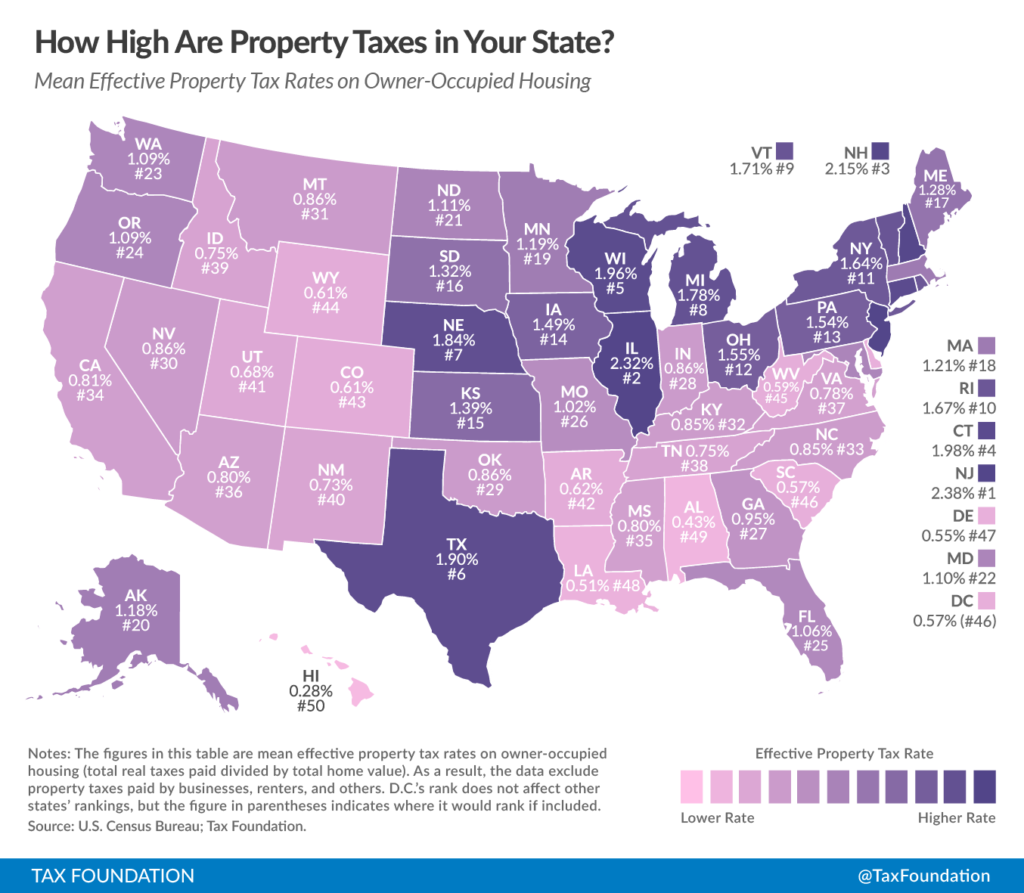

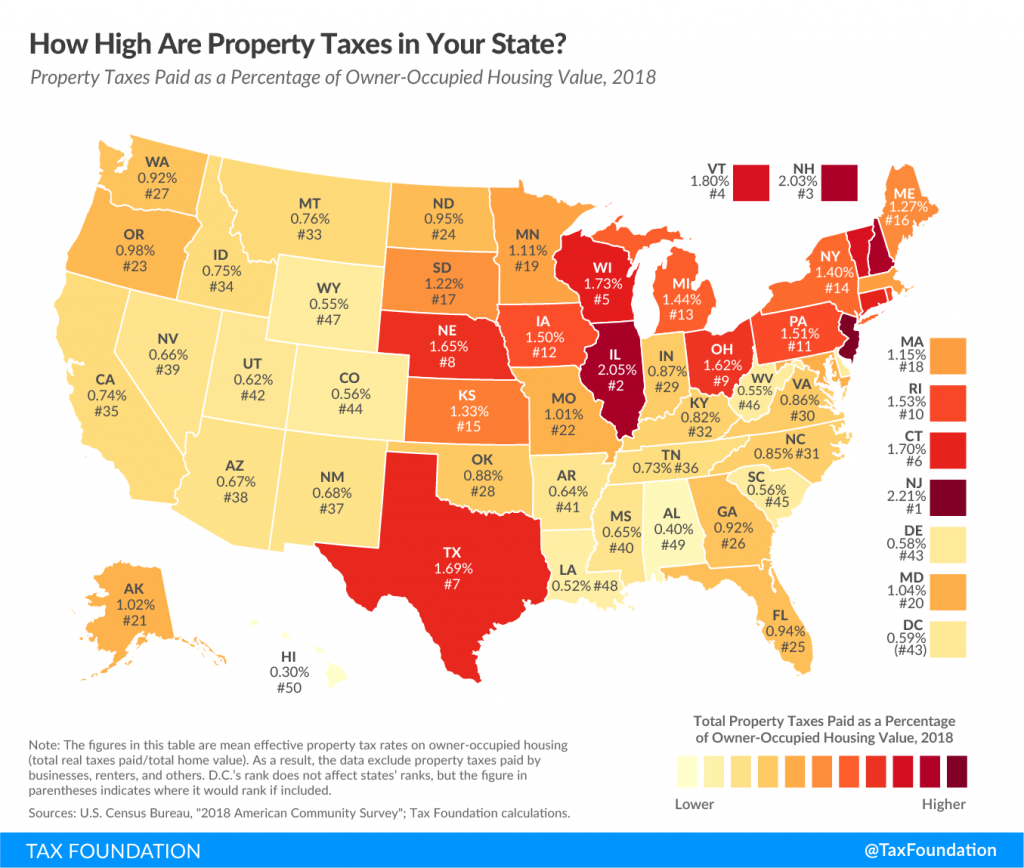

How High Are Property Taxes In Your State American Property Owners

Pin On New York Real Estate News

New York State Real Estate Tax Credit - The new credit is for tax year 2021 and 2022 and 2023 the credit is called the Real Property Tax Credit NY IT 229 This credit is for taxpayers who pay more than