New York State Real Estate Transfer Tax Return 16 rowsCombined Real Estate Transfer Tax Return Credit Line Mortgage Certificate and

Form TP 584 must be used to comply with the filing requirements of the real estate transfer tax Tax Law Article 31 the tax on mortgages Tax Law Article 11 as it applies to the Credit Line You must pay the Real Property Transfer Tax RPTT on sales grants assignments transfers or surrenders of real property in New York City You must also pay RPTT for the sale or

New York State Real Estate Transfer Tax Return

New York State Real Estate Transfer Tax Return

https://www.marcumllp.com/wp-content/uploads/insights-leaseholds-nys-real-estate-transfer-taxes-960x600.jpg

San Francisco Real Estate Transfer Tax Patrick Lowell

https://www.patricklowell.com/wp-content/uploads/1real-property-transfer-tax-1-800x532.jpg

Free New York Residential Real Estate Purchase And Sale Agreement PDF

https://i2.wp.com/eforms.com/images/2018/08/New-York-Residential-Purchase-Agreement.png?fit=1600,2070&ssl=1

The New York State Real Estate Transfer Tax RETT is imposed on real property conveyances at a rate of 2 per 500 of consideration For certain qualified transfers to Real Estate Investment Trusts REITs the tax is In New York the seller of the property is typically the individual responsible for paying the real estate transfer tax The tax is 2 for each 500

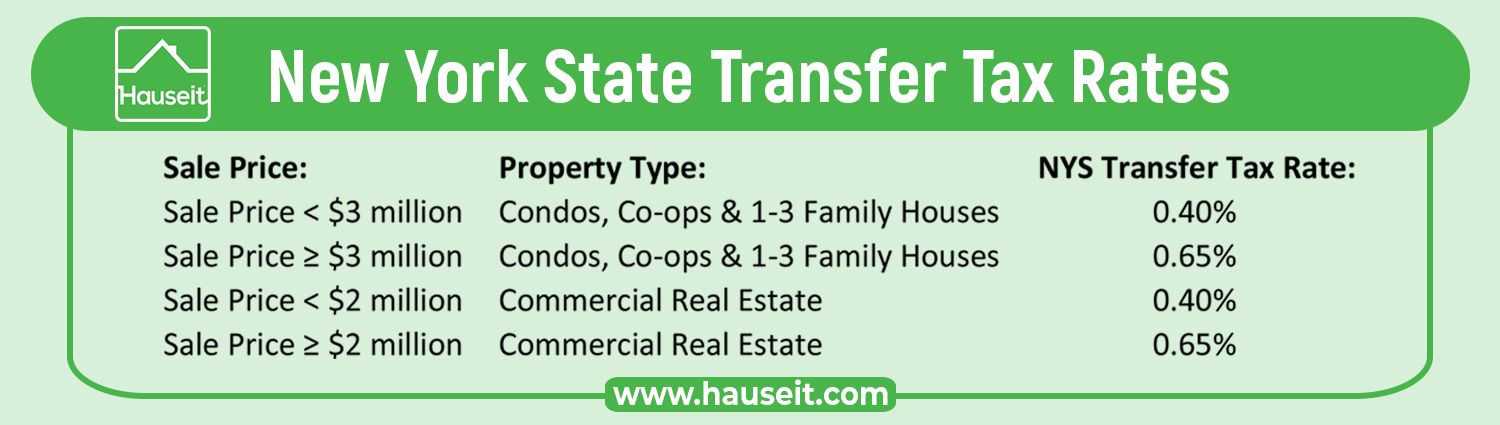

New York State s transfer tax is 4 for properties sold under 2 million which increases to 65 if the price exceeds that amount The city s taxes are significantly higher than the states A sale price of 500 000 equates to a Use Form IT 2663 Nonresident Real Property Estimated Income Tax Payment Form to compute the gain or loss and pay the estimated personal income tax due from the sale or transfer of

Download New York State Real Estate Transfer Tax Return

More picture related to New York State Real Estate Transfer Tax Return

Purchase CEMA Savings Calculator For NYC Interactive Hauseit NYC

https://www.hauseit.com/wp-content/uploads/2019/05/NYS-Real-Property-Transfer-Tax-Rates.jpg

Real Property Transfer Tax Return New York Free Download

https://www.formsbirds.com/formimg/estate-tax/18249/real-property-transfer-tax-return-new-york-l5.png

TP 584 Combined Real Estate Transfer Tax Return Credit Line Mortgage

http://www.formsbirds.com/formimg/estate-tax/18235/tp-584-combined-real-estate-transfer-tax-return-credit-line-mortgage-and-exemption-certificate-l6.png

Article 31 of the Tax Law imposes a real estate transfer tax on each conveyance of real property or interest in real property when the consideration exceeds 500 The tax is computed at a The NYC transfer tax also known as the NYC Real Property Transfer Tax RPTT is a tax that applies to all transfers of real property and cooperative shares over

CPAs will now need to be aware of four components of the New York transfer tax when clients buy and sell property in New York City the previous base tax the new additional If you are a New York State resident transferor s seller s listed in Schedule A of Form TP 584 or an attachment to Form TP 584 you must sign the certification below If one or more

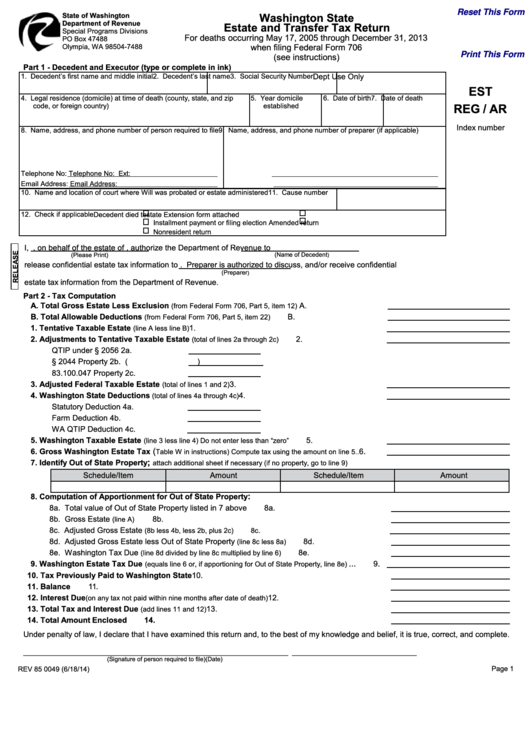

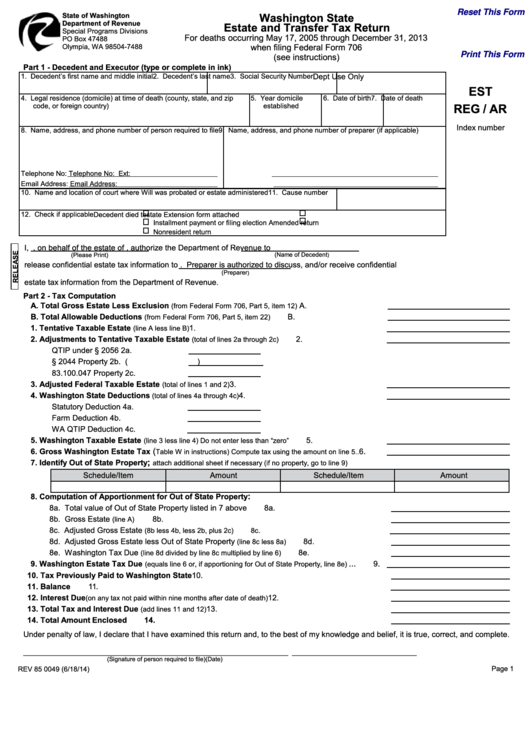

Fillable Washington State Estate And Transfer Tax Return Form Printable

https://data.formsbank.com/pdf_docs_html/203/2031/203121/page_1_thumb_big.png

Real Estate Transfer Tax What Are They Where Does The Money Go

https://assets.site-static.com/userFiles/2282/image/uploads/agent-1/Transfertax_v2.png

https://www.tax.ny.gov/forms/real_prop_tran_cur_forms.htm

16 rowsCombined Real Estate Transfer Tax Return Credit Line Mortgage Certificate and

https://www.tax.ny.gov/pdf/current_forms/property/...

Form TP 584 must be used to comply with the filing requirements of the real estate transfer tax Tax Law Article 31 the tax on mortgages Tax Law Article 11 as it applies to the Credit Line

Free New York Real Estate Purchase Agreement Template PDF WORD

Fillable Washington State Estate And Transfer Tax Return Form Printable

Land Transfer Taxes 101 Susan Bandler Toronto Real Estate

New York Real Estate Archives PropertyShark Real Estate Blog

NY Real Estate Transfer Tax Changes To Liability Provisions

Real Property Transfer Tax Return New York City Free Download

Real Property Transfer Tax Return New York City Free Download

Real Property Transfer Tax Return Free Download

New York State Real Estate License Online Course INFOLEARNERS

What Do I Need To Know About Property Transfer Tax Silver Law

New York State Real Estate Transfer Tax Return - New York State s transfer tax is 4 for properties sold under 2 million which increases to 65 if the price exceeds that amount The city s taxes are significantly higher than the states A sale price of 500 000 equates to a