New York State Real Property Tax Exemption 139 rowsFind the forms and instructions for various property tax exemptions in New

All real property in New York is subject to taxation unless specific legal provisions grant it exempt status whereas personal property is not subject to taxation Real property Source Annual Financial Data reported to OSC FY 2016 data excludes New York City Property tax revenue includes real property taxes and assessments and other real

New York State Real Property Tax Exemption

New York State Real Property Tax Exemption

https://www.military.net/wp-content/uploads/2023/09/state-property-tax-exemptions-veterans-2048x1152.jpg

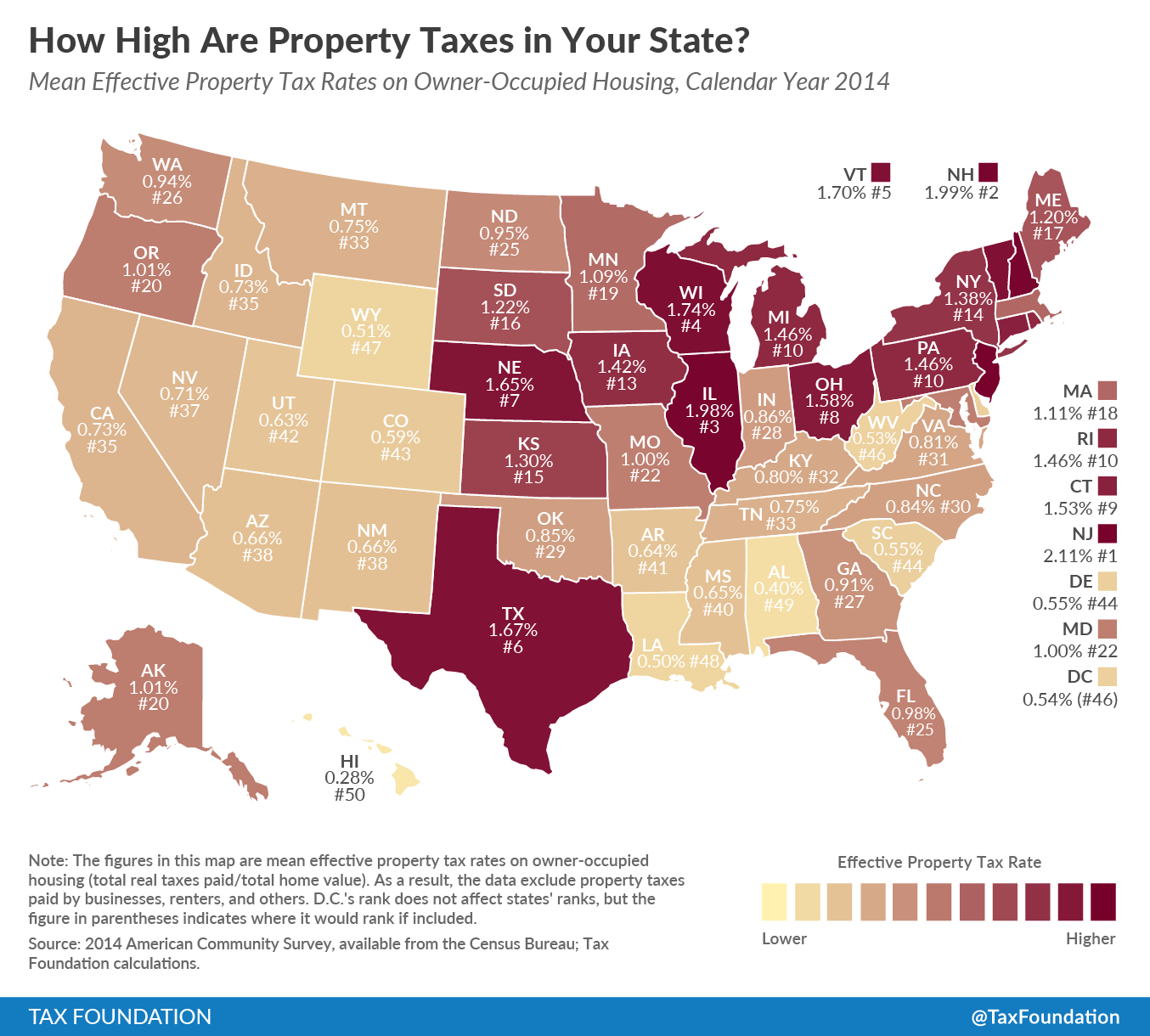

How High Are Property Taxes In Your State 2016 Tax Foundation

https://files.taxfoundation.org/20170113143210/Property-01.png

State Lodging Tax Exempt Forms ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/ny-hotel-tax-exempt-fill-online-printable-fillable-blank-pdffiller-8.png

Learn about the types amounts and impacts of property tax exemptions in New York State which exclude some property from the tax base Find out how exemptions vary by This bill allows municipalities to increase the maximum income eligible for New York s real property tax exemption to 50 000 for people age 65 and over and people with disabilities Before today the maximum

Property taxes are also a major source of revenue for local governments in New York New York Tax Laws Property taxes in New York are levied by the municipal government and are based on the property s 1 Newly constructed primary residential property purchased by one or more persons each of whom is a first time homebuyer and has not been married to a homeowner in the

Download New York State Real Property Tax Exemption

More picture related to New York State Real Property Tax Exemption

Hecht Group How To Pay Your Minnesota Property Taxes Online

https://img.hechtgroup.com/1663161982846.Document

BREA Received Multiple Complaints Over Real Property Tax Bills Eye

https://ewnews.com/wp-content/uploads/2022/01/shutterstock_630862376-scaled.jpg

To What Extent Does Your State Rely On Property Taxes Tax Foundation

https://files.taxfoundation.org/20170413133826/Property-01.png

Learn about the different types of tax exemptions available in the Town of Babylon such as STAR AGED VETERANS and more Find out the eligibility Learn how to apply for a reduction on property taxes for qualifying senior citizens in New York State Find out the income limits eligibility requirements

This section provides tax exemptions for eligible multiple dwellings or homeownership projects that meet certain affordability and income criteria It also The state of New York a department or agency thereof Exemption from taxation of real property used in manufacture of steel in cities of fifty thousand or more persons

New Extension For REAL ID Deadline Announced By DHS Stamford Daily Voice

https://cdn.dailyvoice.com/image/upload/c_fill,dpr_2,f_auto,q_auto:eco,w_640/New_York_REAL_ID_license_kycutk

Ohio Real Property Tax Exemption Denials For SNFs ALs ROLF LAW

https://blog.rolflaw.com/assets/blog/ohio-real-property-tax-exemption-denials-snfs-als/_socialTransform/Tax-Exemption_2022-02-02-180434_pstf.jpg

https://www.tax.ny.gov/forms/orpts/exemption.htm

139 rowsFind the forms and instructions for various property tax exemptions in New

https://www.tax.ny.gov/.../exempt/exemptrpt2020.pdf

All real property in New York is subject to taxation unless specific legal provisions grant it exempt status whereas personal property is not subject to taxation Real property

Birdie Robb

New Extension For REAL ID Deadline Announced By DHS Stamford Daily Voice

Assessor New York s Property Tax Exemptions Create A Giant Mess Your

Property Tax 101 Real Estate Tax Cycle The Shoppers Weekly

Tanauan E Services

.jpg)

DeKalb County Property Tax Information

.jpg)

DeKalb County Property Tax Information

To Gauge Whether Your State S Property Tax Structure Has

Real Property Tax In The Philippines All Properties

18 States With Full Property Tax Exemption For 100 Disabled Veterans

New York State Real Property Tax Exemption - Local governments and school districts in New York State can opt to grant a reduction on the amount of property taxes paid by qualifying senior citizens This is accomplished by