Nh Property Tax Rebate Web An eligible applicant for the Low and Moderate Income Homeowners Property Tax Relief is a person who is Single with adjusted gross income equal to or less than 37 000 or

Web Form DP 8 fillable Low and Moderate Income Homeowners Property Tax Relief Form DP 8 print Low and Moderate Income Homeowners Property Tax Relief Note 2022 Web 7 mai 2021 nbsp 0183 32 income homeowners the opportunity to apply for property tax relief NHDRA is accepting applications for its Low and Moderate Income Homeowners Property Tax

Nh Property Tax Rebate

Nh Property Tax Rebate

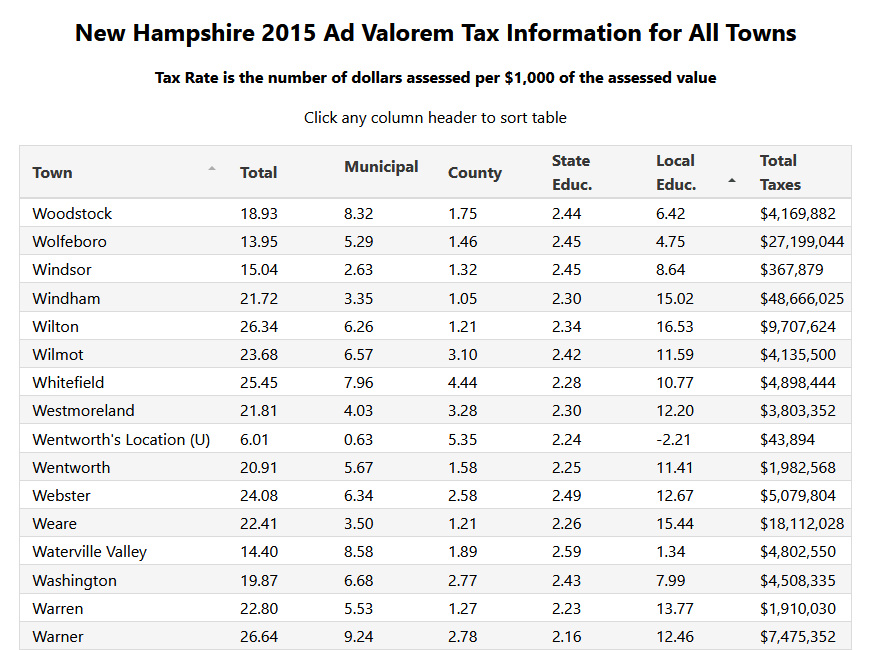

https://joeshimkus.com/Images/NH-Tax-Rates-2015.png

New Hampshire Mini Split Rebates Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-Hampshire-Renters-Rebate-2023-768x684.jpg

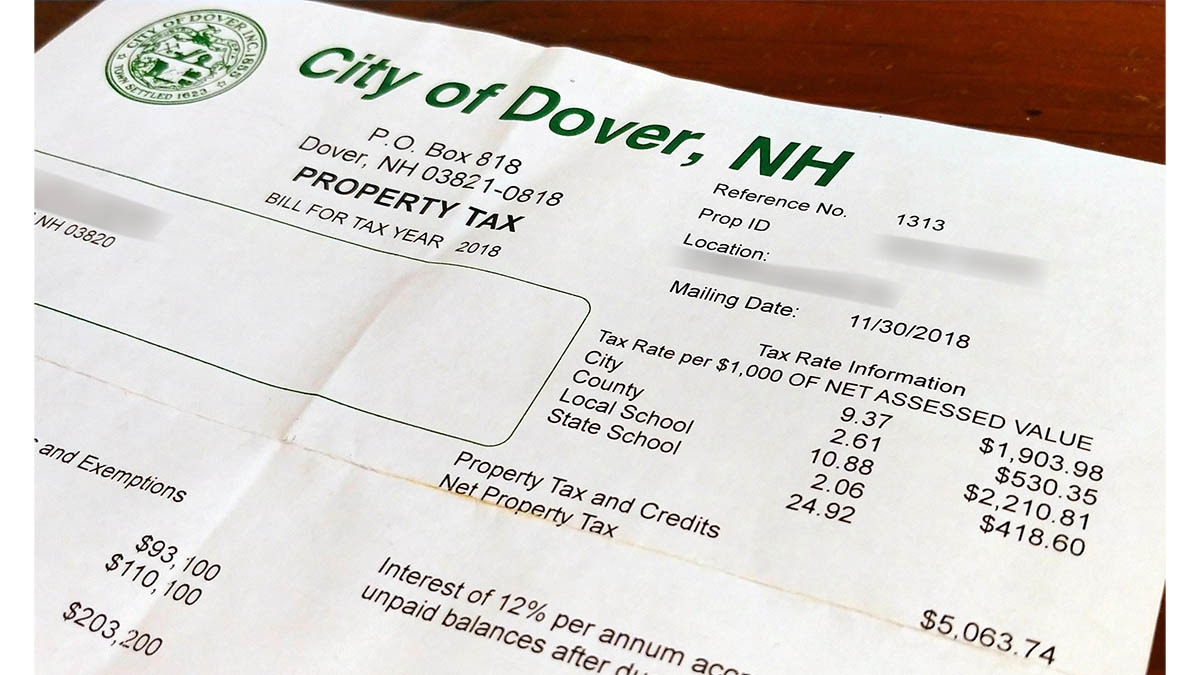

New Hampshire S Education Property Tax Rebate Doesn T Amount To Much

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/new-hampshire-s-education-property-tax-rebate-doesn-t-amount-to-much.jpg?fit=1500%2C1125&ssl=1

Web You may qualify for a rebate up to 250 through the NH Dept of Revenue Program You must apply between May 1 and June 30 New Hampshire s Low and Moderate Income Web 7 mai 2021 nbsp 0183 32 The New Hampshire Department of Revenue Administration is offering property tax relief for qualifying low and moderate income homeowners Single people who earn less than 20 000 are eligible to

Web Property owners who resided in their home as of April 1st in the year for which the claim is made and had total household incomes of 37 000 or less if single and 47 000 or less if Web Latest Hampshire Property Tax Rebates 2022 While COVID 19 restrictions limit the avilability of free help with property fiscal special present is help obtainable Most

Download Nh Property Tax Rebate

More picture related to Nh Property Tax Rebate

Nh Property Tax Rebate PropertyRebate

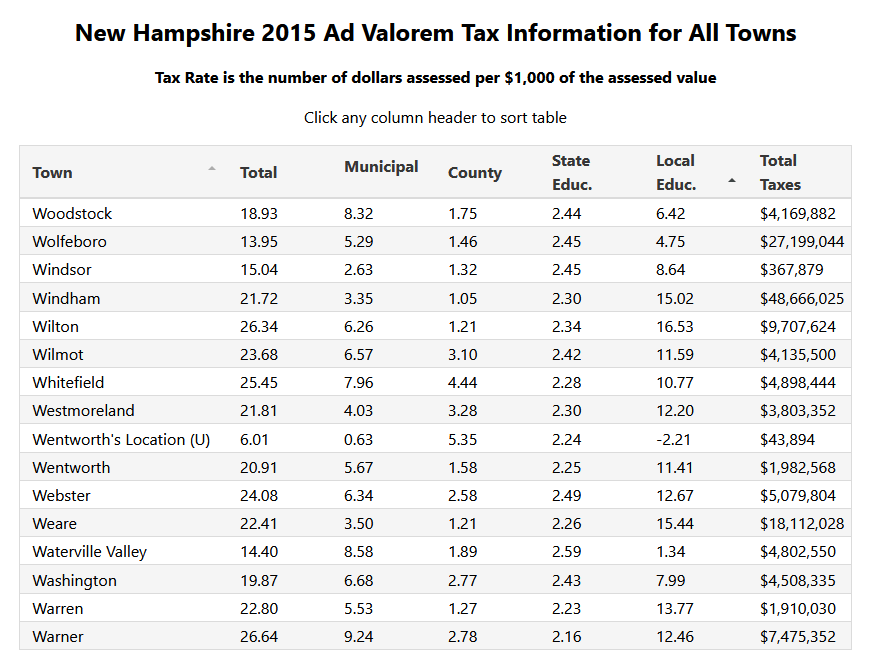

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/2018-nh-property-tax-rates-catherine-zerba-realty-group-llc.jpg

Del Hauser

https://suburbs101.com/wp-content/uploads/2022/02/Property-Taxes-1.jpg

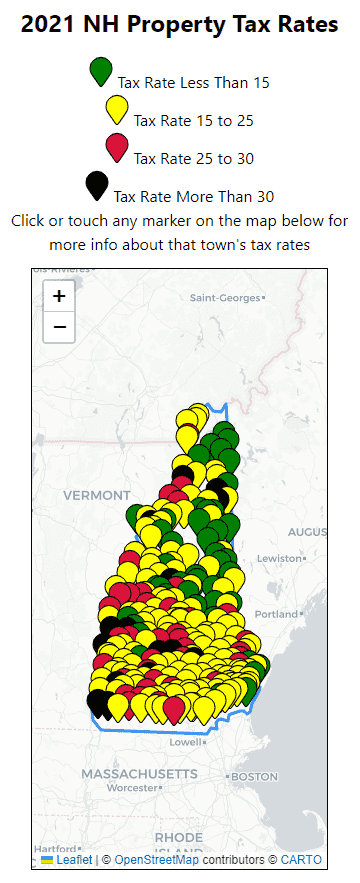

Nh Towns With Lowest Property Taxes Property Walls

https://i.pinimg.com/originals/22/98/08/229808d3f56dfd2e446345acfc505bc3.jpg

Web Property Tax Rebate To Qualify To be eligible for 2021 New Hampshire property tax bill which is filed include Allow or June of 2022 Income Qualifications Simple AGI of Web 24 juin 2023 nbsp 0183 32 Nh Property Taxes Rebate 2023 A Property Tax Rebate is available to property owners in Pennsylvania The program is a way to reduce your property tax

Web The Exemptions and Tax Credits Granted Report summarizes the total exemptions and tax credits granted by each municipality in 2022 2022 Exemptions and Tax Credits Granted Web You must own a homestead subject to the state education property tax have resided in such homestead on April 1 of the year for which the claim for relief is made have a total

Letha Hailey

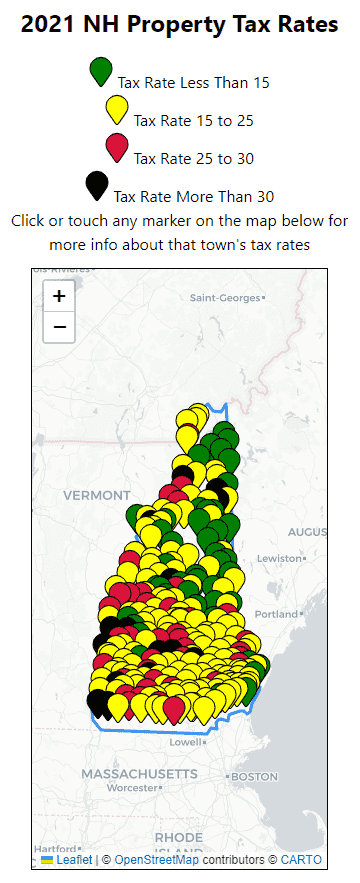

https://joeshimkus.com/Images/NH-Tax-Rates-2021.png

New Hampshire Property Tax Rates 2023 Town By Town List Suburbs 101

https://suburbs101.com/wp-content/uploads/2022/02/Property-Taxes-2.jpg

https://www.revenue.nh.gov/assistance/low-moderate.htm

Web An eligible applicant for the Low and Moderate Income Homeowners Property Tax Relief is a person who is Single with adjusted gross income equal to or less than 37 000 or

https://www.revenue.nh.gov/forms/low-moderate.htm

Web Form DP 8 fillable Low and Moderate Income Homeowners Property Tax Relief Form DP 8 print Low and Moderate Income Homeowners Property Tax Relief Note 2022

Property Tax Rebate New York State Printable Rebate Form

Letha Hailey

How To Get Property Tax Rebate PropertyRebate

Proposal To Update Ailing PA Rent Property Tax Rebate Program Would

Nh Property Tax Rates Per Town Keila Danner

New Hampshire Solar Incentives Tax Credits Rebates 2023 What You

New Hampshire Solar Incentives Tax Credits Rebates 2023 What You

Goffstown Hillsborough County NH Undeveloped Land For Sale Property

NH Property Tax Relief Program Deadline Extended To November NH

Tax Rebate On Rental Property PropertyRebate

Nh Property Tax Rebate - Web Property owners who resided in their home as of April 1st in the year for which the claim is made and had total household incomes of 37 000 or less if single and 47 000 or less if