Ni Tax Return Sign into or set up a personal tax account to check and manage HMRC records including Income Tax change of address Self Assessment and company car tax

These notes will help you to fill in your paper tax return You can also complete it online which has several benefits You can find more information about Self National Insurance is a tax on earnings and self employed profits You normally start paying when you turn 16 and earn over a certain amount Your National Insurance contributions NICs decide Jobseeker s

Ni Tax Return

Ni Tax Return

https://moneyunshackled.com/wp-content/uploads/408-Big-NI-Tax-Rise-Rant-How-Much-Poorer-Will-You-Be-scaled.jpg

Pay Your Personal Tax Return By The End Of January Alterledger

https://www.alterledger.com/wp-content/uploads/2022/01/Pay-your-tax-by-end-of-Jan.gif

National Tax Preparation Company Dearborn MI

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100069332370607

If you want to make voluntary contributions for the tax year 2016 to 2017 or 2017 to 2018 the deadline has been extended You have until 5 April 2025 to pay You can sometimes All the information to claim back a national insurance refund is on Gov UK There are different procedures depending on the Class of NICs and the reason that you are

If you re self employed this guide explains how much tax and National Insurance you ll need to pay Plus help with Self Assessment tax returns A Self Assessment tax return can be daunting If you understand the form it s a lot easier than it looks Learn how to file it correctly and avoid paying penalties

Download Ni Tax Return

More picture related to Ni Tax Return

Dividend And NI Tax Rises Is An SPV Still The Right Choice For

https://a.storyblok.com/f/107107/1200x628/524bc2e9d2/pv-blog-graphic_tax-rise-spv-1200x628px-blo.png/m/3840x0

TAX

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=637237501533919

NI Tax Hike Jump Will Cost Firms More Than ALL New Taxes In Past Decade

https://i.dailymail.co.uk/1s/2022/02/20/23/54438651-0-image-a-7_1645398430102.jpg

Self assessment tax returns must be submitted each year by the self employed and people who owe tax on income they ve received Find out how to complete a tax return for the 2023 24 tax year and If you re aged between 45 and 73 ish buying extra national insurance years could massively boost your state pension If it works for you the returns can be huge Learn

HMRC will let you know how much National Insurance is due after you ve filed your Self Assessment tax return There are different National Insurance rules if you re a You can Tax calculators and tax tools to check your income and salary after deductions such as UK tax national insurance pensions and student loans Updated for

Tax Return Employment Self Employment Dividend Rental Property

https://i.pinimg.com/originals/d3/7f/83/d37f830fdf0e55518f62e71ed96aa8bd.png

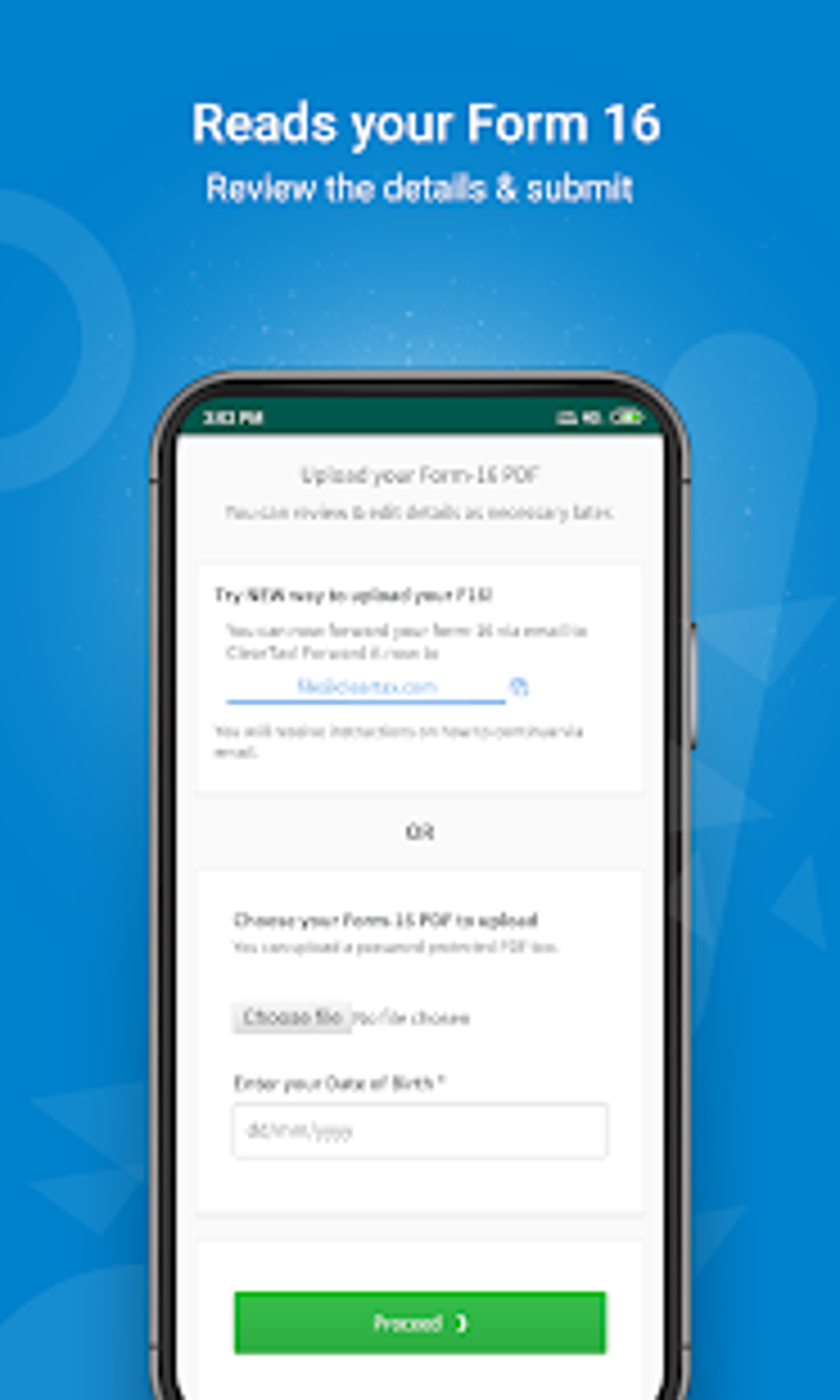

Android File FREE Income Tax Return ClearTax ITR E filing

https://images.sftcdn.net/images/t_app-cover-l,f_auto/p/7db9b7c2-9ff1-41ac-bbee-27dcf1be0514/1391937416/file-free-income-tax-return-cleartax-itr-e-filing-screenshot.png

https://www.gov.uk/personal-tax-account

Sign into or set up a personal tax account to check and manage HMRC records including Income Tax change of address Self Assessment and company car tax

https://www.gov.uk/government/publications/self...

These notes will help you to fill in your paper tax return You can also complete it online which has several benefits You can find more information about Self

4 Smart Investments Using Your Tax Return

Tax Return Employment Self Employment Dividend Rental Property

WHAT HAPPENS IF YOU DON T FILE AN INCOME TAX RETURN The Global Hues

Tax Return Deadline Extension

IRS Commissioner Says Tax Return Backlog Will Clear By End Of 2022

How To Read And Understand A Tax Return C2P Central

How To Read And Understand A Tax Return C2P Central

Extended Tax Returns Are Due By October 15th Last Chance To Avoid

NI AND TAX CALCULATOR

When Should I File My UK Self Assessment Tax Return For 2022 23 Gold

Ni Tax Return - If you re self employed this guide explains how much tax and National Insurance you ll need to pay Plus help with Self Assessment tax returns