Nj Age 65 State Tax Rebate Web 21 juin 2023 nbsp 0183 32 Under the program known as StayNJ any homeowner 65 or older with an annual income of 500 000 or less would be eligible for the tax cut starting in January 2026 This is really a chance to

Web You must have been age 65 or older as of De cember 31 2020 OR actually receiving federal Social Security disability benefit payments on or before December 31 2020 and on or before December 31 2021 You do notqualify if you or your spouse were receiving Web 1 juil 2023 nbsp 0183 32 According to the law eligible homeowners and renters 65 and older in the Garden State will get an immediate increase of 250 in the fiscal year that starts Saturday under an existing rebate

Nj Age 65 State Tax Rebate

Nj Age 65 State Tax Rebate

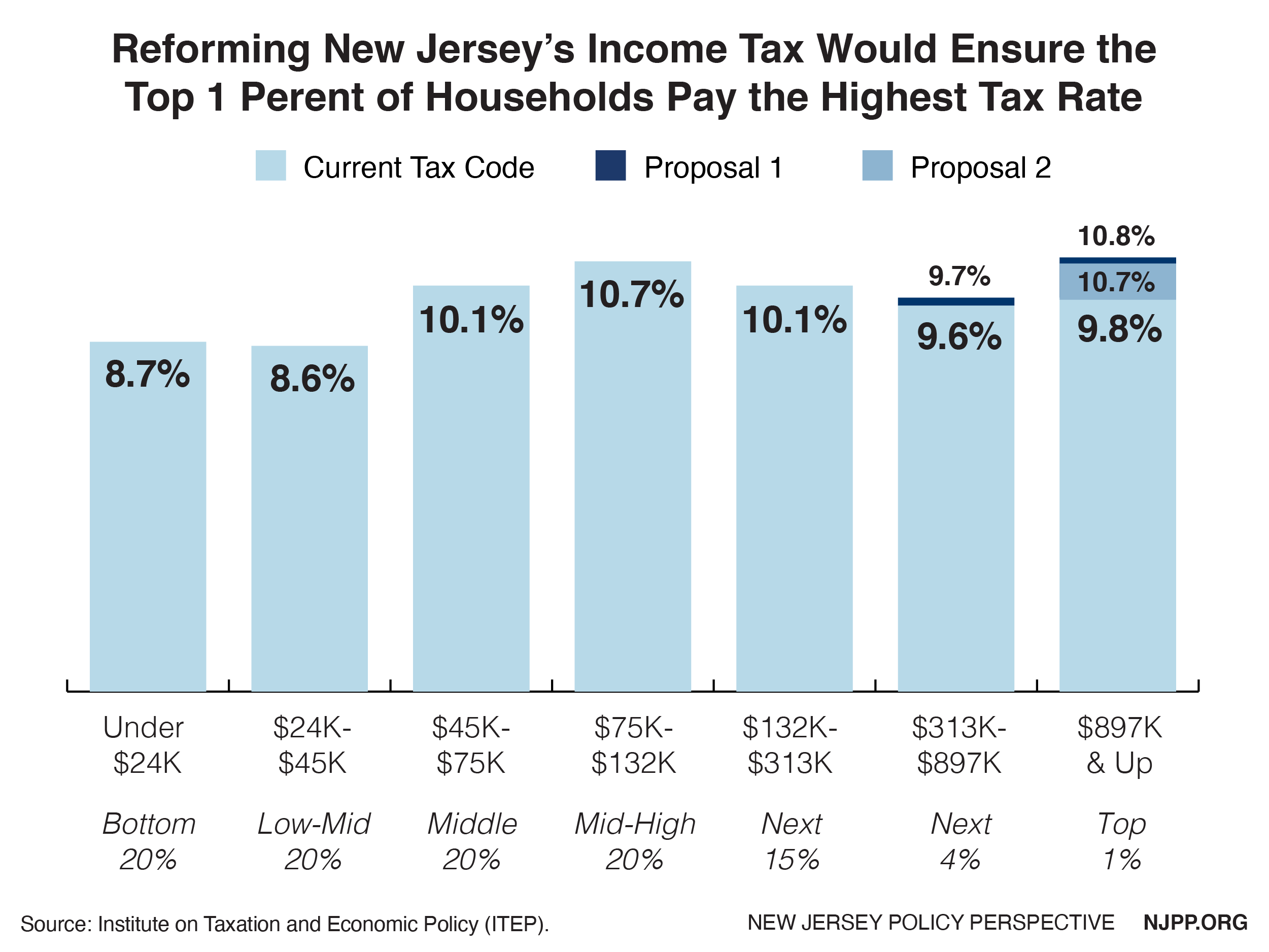

https://www.njpp.org/wp-content/uploads/2020/06/NJPP-Income-Tax-Report-New-Proposal-Who-Pays-Share-of-Income-Paid-in-Taxes-01.png

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Star Rebate Check Eligibility StarRebate

https://i0.wp.com/www.starrebate.net/wp-content/uploads/2022/10/new-york-state-star-rebate-checks-25-scaled.jpg

Web 1 f 233 vr 2023 nbsp 0183 32 Senior Freeze Eligibility The Senior Freeze Property Tax Reimbursement program reimburses eligible New Jersey residents who are senior citizens or disabled persons for property tax increases on their principal residence home Complete this Web 20 juil 2023 nbsp 0183 32 If your income was under 250 000 and you owned your home in 2019 or 150 000 and you rented you are allowed a tax rebate with ANCHOR Homeowners got about 1 500 and renters about 500

Web 19 oct 2021 nbsp 0183 32 If you are age 65 or older or disabled and have been a New Jersey resident for at least one year you may be eligible for an annual 250 property tax deduction You also may qualify if you are a surviving spouse or civil union partner Eligibility Web 22 juin 2023 nbsp 0183 32 Homeowners 65 and older who make 500 000 or less will qualify for up to 6 500 in property tax relief under this plan By Mike Catalini Published June 22 2023 Updated on June 23 2023 at

Download Nj Age 65 State Tax Rebate

More picture related to Nj Age 65 State Tax Rebate

Some Georgia Filers May Have To Pay Taxes On State Rebates Now Habersham

https://nowhabersham.nyc3.cdn.digitaloceanspaces.com/wp-content/uploads/2023/02/tax-return-768x439.png

Idaho State Tax Rebate 2023 Tax Rebate

https://www.tax-rebate.net/wp-content/uploads/2023/05/Idaho-State-Tax-Rebate-2023.jpg

Property Tax Rebate New York State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-York-Renters-Rebate-2023-768x685.jpg

Web 21 juin 2021 nbsp 0183 32 Sending over 760 000 families a rebate of up to 500 as part of the 2020 agreement to levy a higher income tax on people who earn more than 1 million a year the estimated cost to the state Web 21 juin 2023 nbsp 0183 32 Under the plan those 65 and older and making up to 500 000 a year would get up to 6 500 in property tax relief The plan doesn t go into effect until 2026 but would have a 250 benefit this

Web 14 juin 2023 nbsp 0183 32 The primary goal of the proposed new program is to beginning in 2025 cut property tax bills in half for many homeowners age 65 and older regardless of income Annual benefits of as much as Web 28 juin 2023 nbsp 0183 32 The program called StayNJ would afford a new property tax credit to residents 65 and older The credit which has a cap of 6 500 is intended to cut property tax bills in half for seniors with less than 500 000 in annual income

Illinois Tax Rebates Are Coming In Time For The Election The

https://static.independent.co.uk/2022/09/12/20/Illinois_Budget_Tax_Rebates_65831.jpg?quality=75&width=1200&auto=webp

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

https://i0.wp.com/www.gasrebates.net/wp-content/uploads/2023/03/gas-tax-rates-by-state-2020-state-fuel-excise-taxes-tax-foundation.png

https://www.nytimes.com/2023/06/21/nyregion/pr…

Web 21 juin 2023 nbsp 0183 32 Under the program known as StayNJ any homeowner 65 or older with an annual income of 500 000 or less would be eligible for the tax cut starting in January 2026 This is really a chance to

https://www.nj.gov/treasury/taxation/pdf/ptr/21-ptr1in.pdf

Web You must have been age 65 or older as of De cember 31 2020 OR actually receiving federal Social Security disability benefit payments on or before December 31 2020 and on or before December 31 2021 You do notqualify if you or your spouse were receiving

Smes Rebate Of State Central Taxes And Levies Mumbai ID 26286767133

Illinois Tax Rebates Are Coming In Time For The Election The

We ll Bet You Didn t Know That Every State In The Country Has A

Robin Hood In Reverse NJ Tax Cut Plan Is For The Rich Critics Say

UPDATE GOP Says State Can do Better Than Whitmer s Proposed 500 Tax

Breaking Down The Rebate Will The IRS Make People Pay Taxes On State

Breaking Down The Rebate Will The IRS Make People Pay Taxes On State

Smes Rebate Of State Central Taxes And Levies Mumbai ID 26286767133

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Hamden s Partnership For Young Children Posts Facebook

Nj Age 65 State Tax Rebate - Web 20 juil 2023 nbsp 0183 32 If your income was under 250 000 and you owned your home in 2019 or 150 000 and you rented you are allowed a tax rebate with ANCHOR Homeowners got about 1 500 and renters about 500