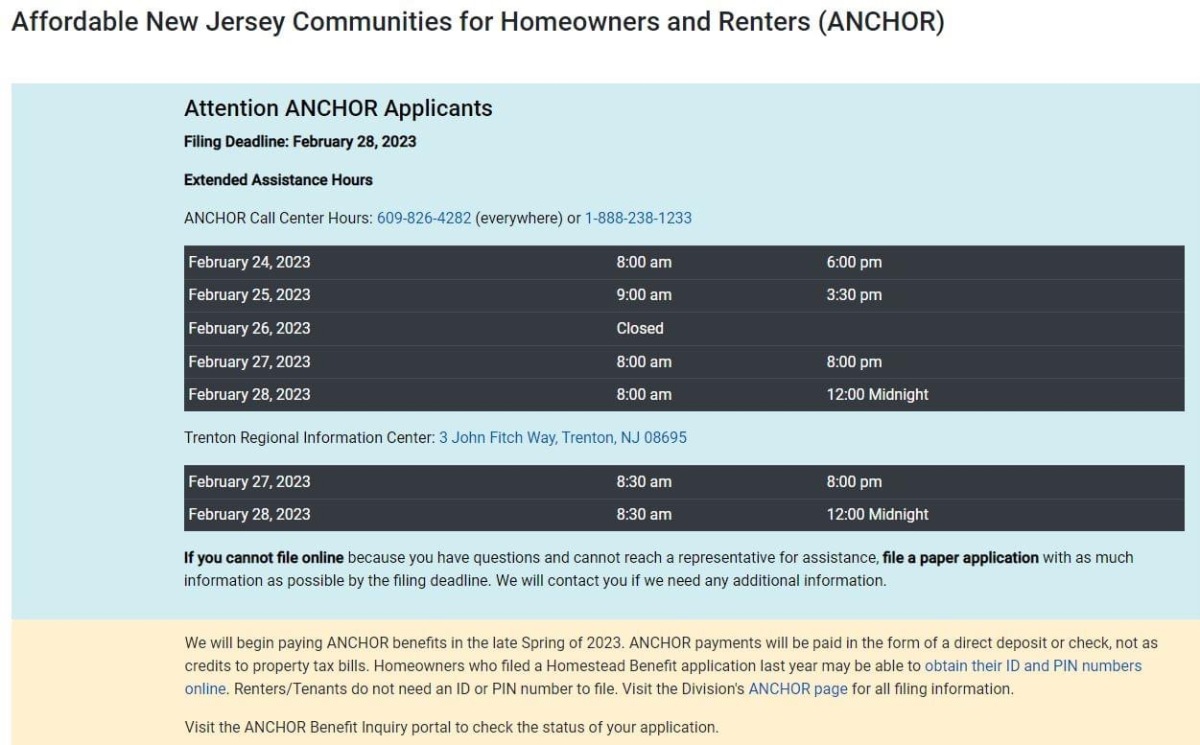

Nj Anchor Rebate Form Web We will file ANCHOR applications on behalf of most qualified residents who received an ANCHOR benefit earlier this year for tax year 2019 If you qualify you will receive an

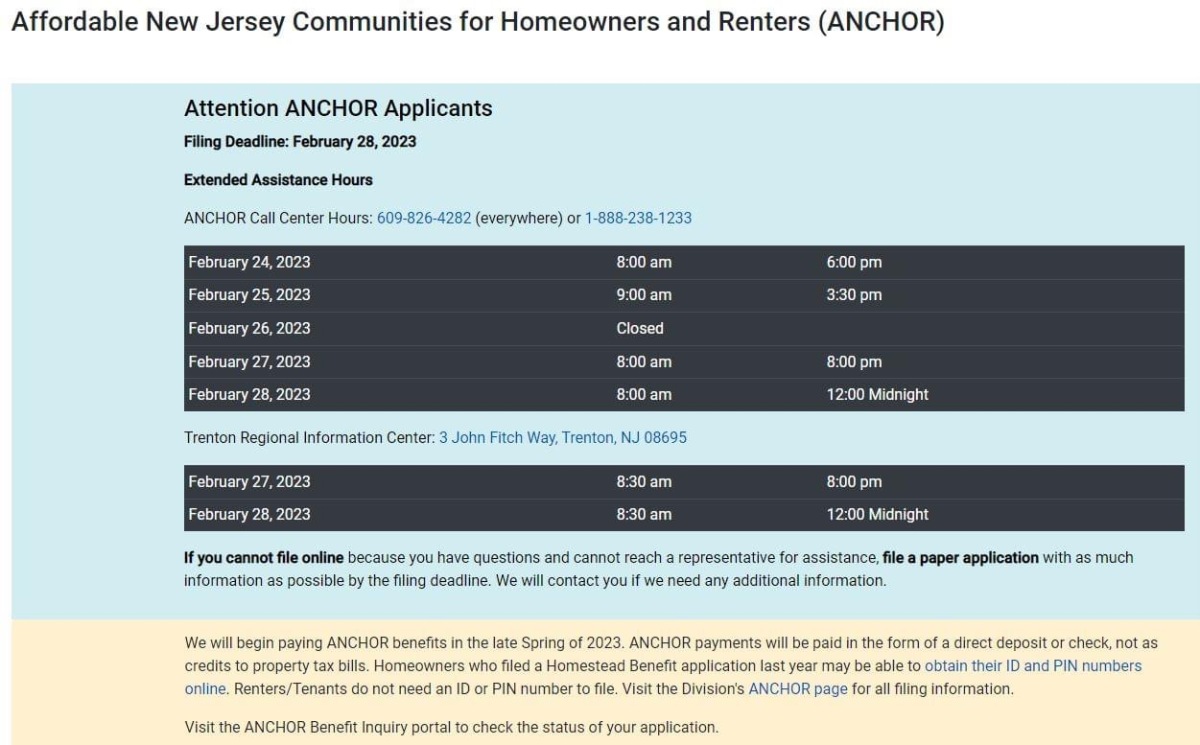

Web 1 General Information 2019 Form ANCHOR H ANCHOR Application for Homeowners Read all instructions carefully When to File File your application by February 28 2023 All Web When will I receive my ANCHOR Benefit Payments will be issued on a rolling basis Most applicants can expect to receive their payment approximately 90 days after filing the

Nj Anchor Rebate Form

Nj Anchor Rebate Form

https://jcenewscom.files.wordpress.com/2023/02/0b96e4fe-ba5d-4701-a1d4-57f0e219c3df.jpeg?w=1200

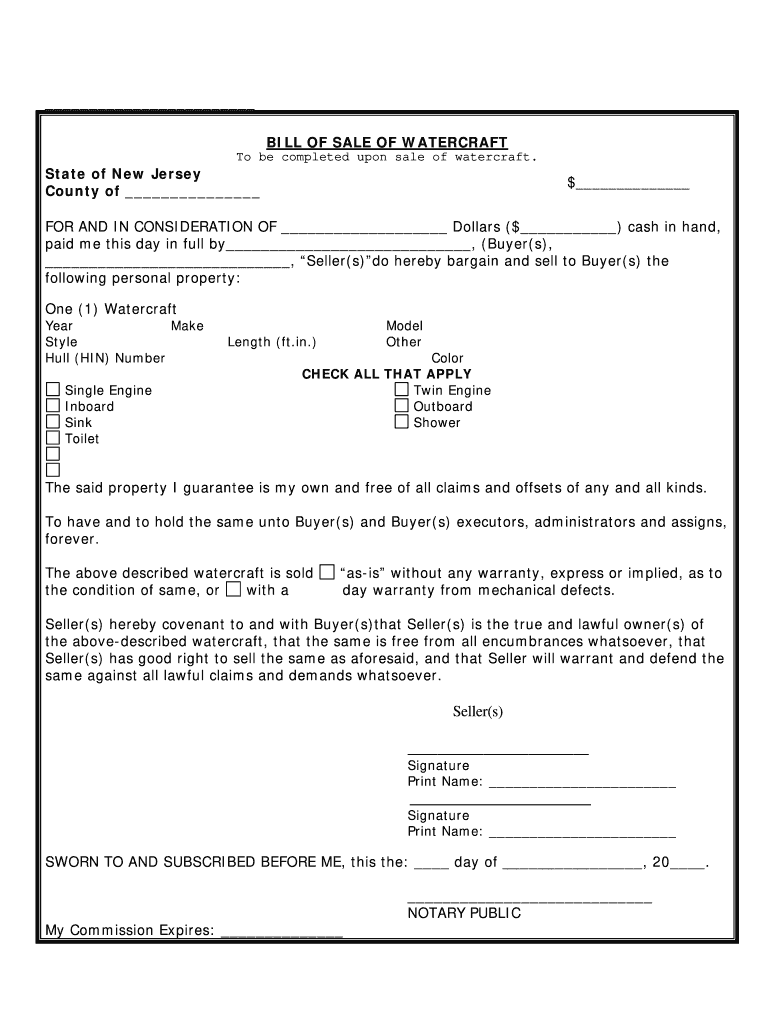

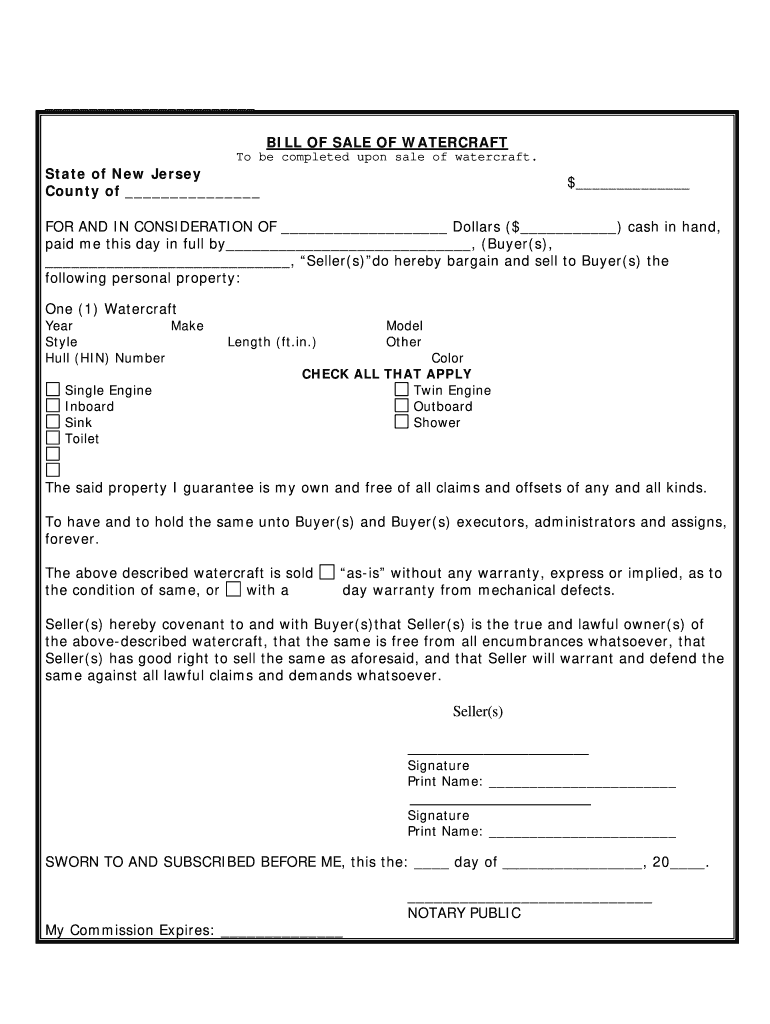

Nj Boat Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/2/362/2362906/large.png

NJ Tax Rebate The ANCHOR Program formerly Homestead Rebates

https://www.fanwoodnj.org/wp-content/uploads/2022/09/ANCHOR-rebate-graphic-800x450.jpg

Web We will file ANCHOR applications on behalf of most qualified residents who received an ANCHOR benefit earlier this year for tax year 2019 If you qualify you will receive an Web 16 sept 2022 nbsp 0183 32 The program called ANCHOR short for the Affordable New Jersey Communities for Homeowners and Renters replaces the Homestead Rebate There are no age restrictions It includes

Web 16 ao 251 t 2023 nbsp 0183 32 More than 870 000 homeowners with incomes up to 150 000 will be eligible to receive 1 500 in relief more than 290 000 homeowners with incomes over 150 000 Web 8 sept 2022 nbsp 0183 32 The program will provide credits of up to 1 500 to taxpayers with 2019 gross incomes up to 150 000 and 1 000 for those with gross incomes between 150 000

Download Nj Anchor Rebate Form

More picture related to Nj Anchor Rebate Form

How To Check Your Eligibility For The New Jersey ANCHOR Rebate

https://www.androidhire.com/wp-content/uploads/2023/04/cropped-image-15-1.png

State Extends Deadline For ANCHOR Tax Rebates Somers Point

https://somerspoint.com/wp-content/uploads/sites/4/2022/12/1.4-Anchor-Benefit.jpg

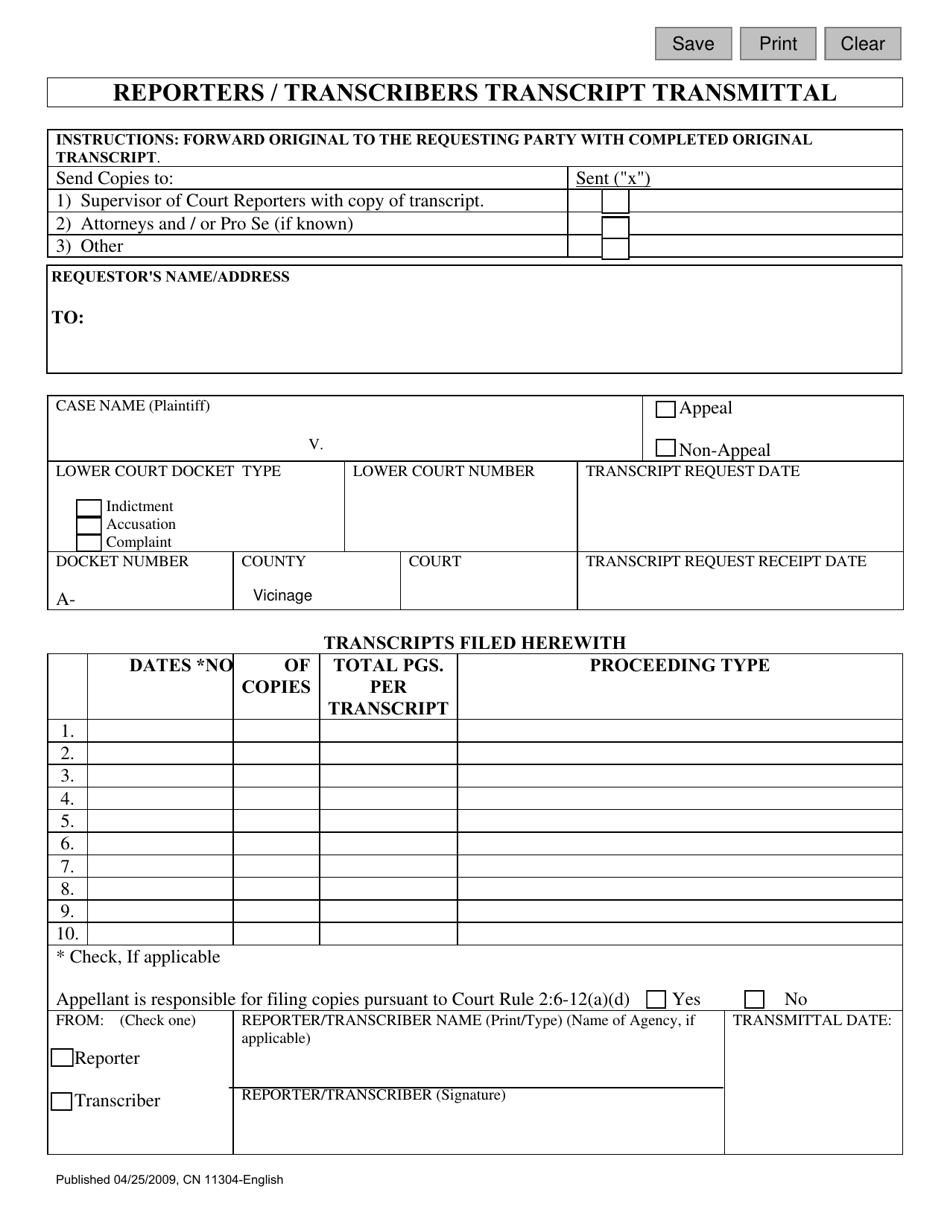

Form 11304 Download Fillable PDF Or Fill Online Reporters

https://data.templateroller.com/pdf_docs_html/2011/20112/2011288/form-11304-reporters-transcribers-transcript-transmittal-new-jersey_print_big.png

Web If you owned more than one property in New Jersey only file the application for the property that was your main home on October 1 2020 If you must file a paper application you Web 27 mars 2023 nbsp 0183 32 More than 1 7 million New Jersey residents applied for the ANCHOR rebate program including 1 25 million homeowners and over 514 000 renters The majority of payments will be issued before May 3 2023 with applications that need additional information potentially taking more time to finalize

Web Welcome to the ANCHOR filing system Please select the answer to the following question and choose continue On October 1 2020 were you a homeowner or a renter Web Line By Line Filing Instructions Use the instructions below to help you file your ANCHOR application over the telephone or online You can change all preprinted information with

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

https://www.nj.com/resizer/mG8HoEC03Z_laQKwr9yycp9fj8o=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/OCDIN5URIBBRVLQX5ZOGNBVHZI.jpg

Tenant Homestead Rebate Instructions

https://image.slidesharecdn.com/1293539/95/tenant-homestead-rebate-instructions-1-728.jpg?cb=1239784234

https://www.state.nj.us/treasury/taxation/anchor/home.shtml

Web We will file ANCHOR applications on behalf of most qualified residents who received an ANCHOR benefit earlier this year for tax year 2019 If you qualify you will receive an

https://www.nj.gov/treasury/taxation/pdf/anchor/anchor-h.pdf

Web 1 General Information 2019 Form ANCHOR H ANCHOR Application for Homeowners Read all instructions carefully When to File File your application by February 28 2023 All

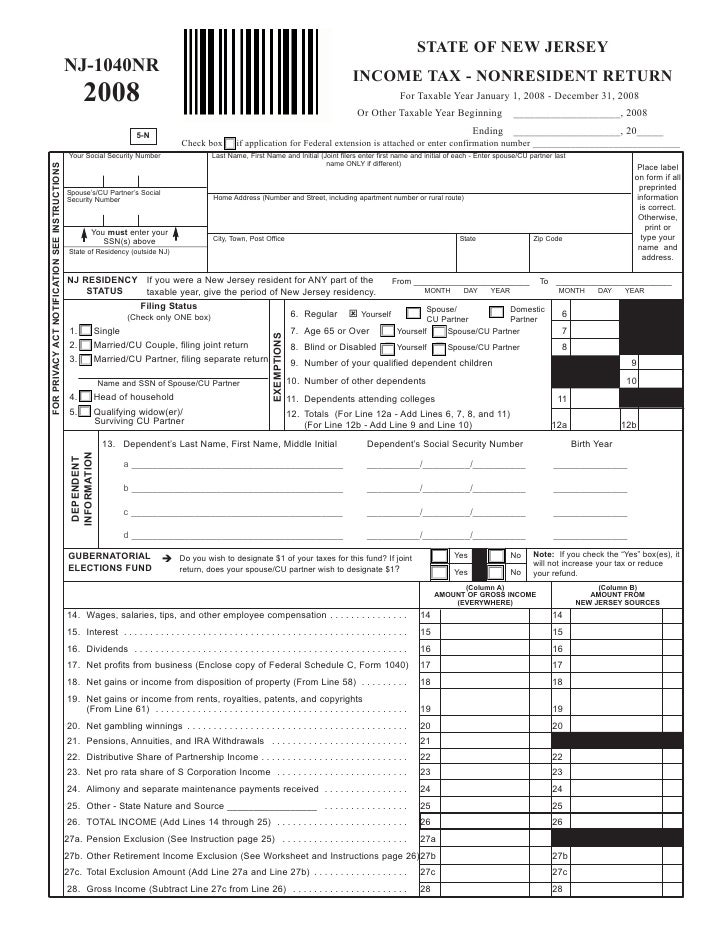

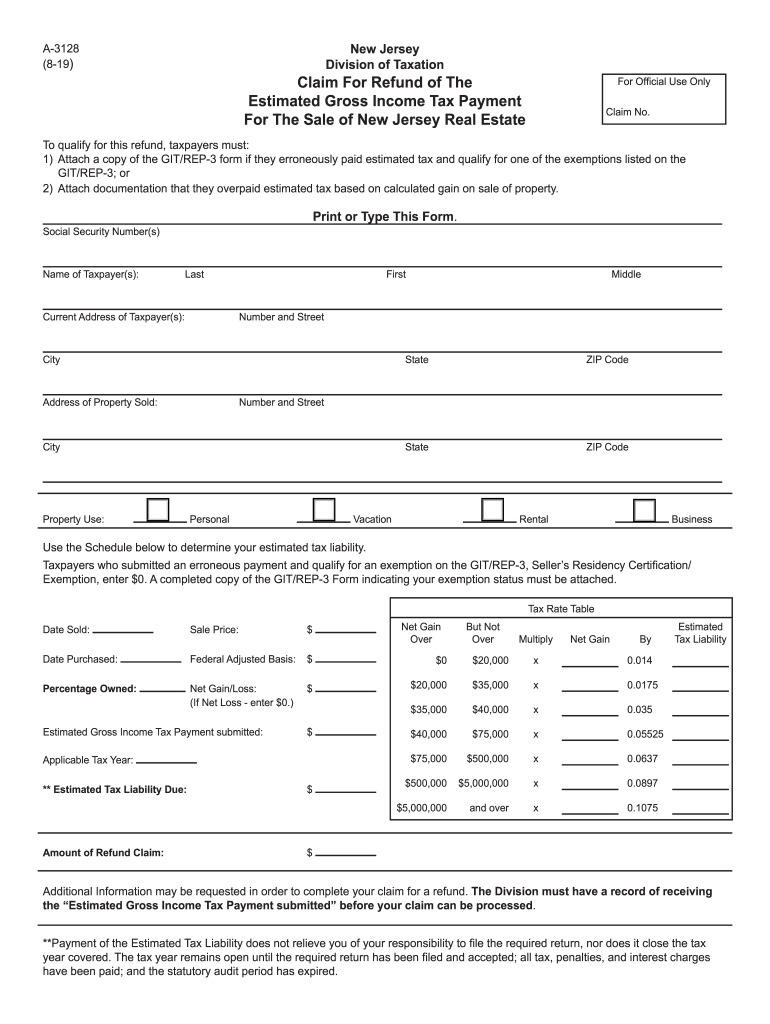

2019 Form NJ DoT A 3128 Fill Online Printable Fillable Blank PdfFiller

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

New Jersey Renters Rebate 2023 Printable Rebate Form

2018 New Jersey Homestead Rebate Application Fill Out Sign Online

Nj L8 Form Fill Out Sign Online DocHub

NJ Anchor Property Tax Rebate Deadline Is Today TomsRiver

NJ Anchor Property Tax Rebate Deadline Is Today TomsRiver

Questions Answered About NJ ANCHOR Rebate YouTube

NJ Tax Rebate Sayreville And South Amboy Residents Have Until Jan 31

Nj Claim Continued Form Fill Online Printable Fillable Blank

Nj Anchor Rebate Form - Web 30 ao 251 t 2023 nbsp 0183 32 As part of its efforts to send ANCHOR property tax payments to New Jersey residents by Nov 1 the state began mailing more than 2 million application packets this week The packets green for