Nj Earned Income Tax Credit Income Limit Income Limits and Amount of EITC for additional tax years See the earned income and adjusted gross income AGI limits maximum credit for the current year

Claim and be allowed a 2023 federal Earned Income Tax Credit or be at least 18 years old and meet all the federal criteria for a credit except age limits Be a resident of this New Jersey EARNED INCOME TAX CREDIT EITC Rate Fully Refundable 40 as of September 2020 Eligibility Requirements All New Jersey taxpayers who qualify for the

Nj Earned Income Tax Credit Income Limit

Nj Earned Income Tax Credit Income Limit

https://uploads-ssl.webflow.com/56b26b90d28b886833e7a055/57ca19588bb9d6ee1a1ed827_pexels-photo-58728.jpeg

Earned Income Tax Credit EITC What It Is And Who Qualifies Quakerpedia

https://www.bankrate.com/2022/03/23160226/what-is-earned-income-tax-credit.png

See The EIC Earned Income Credit Table Income Tax Return Income

https://i.pinimg.com/originals/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.png

09 29 2020 TRENTON With the signing of the Fiscal Year 2021 Appropriations Act today the Murphy Administration extended a critical lifeline to an additional 60 000 New Jersey A law signed Tuesday expands New Jersey s Earned Income Tax Credit eligibility to those 18 or older and those 65 or older subject to income limits

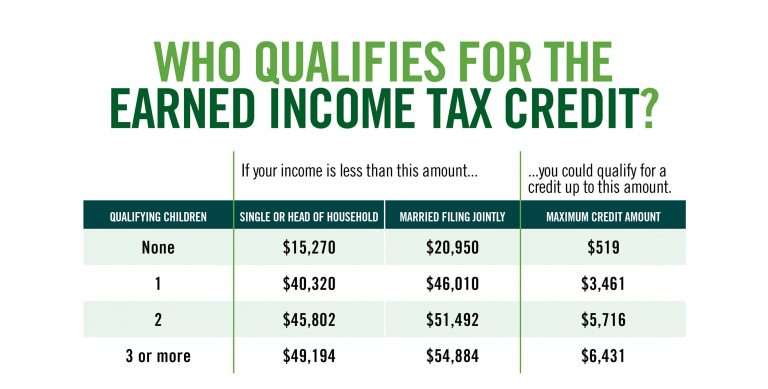

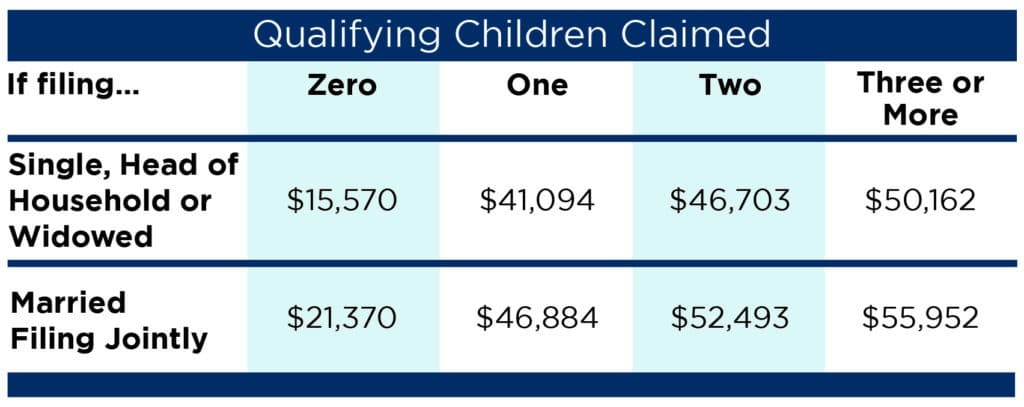

To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit A working family making less than 53 057 59 187 if married and filling jointly in 2022 may qualify for the Earned Income Tax Credit EITC The EITC is a federal and state

Download Nj Earned Income Tax Credit Income Limit

More picture related to Nj Earned Income Tax Credit Income Limit

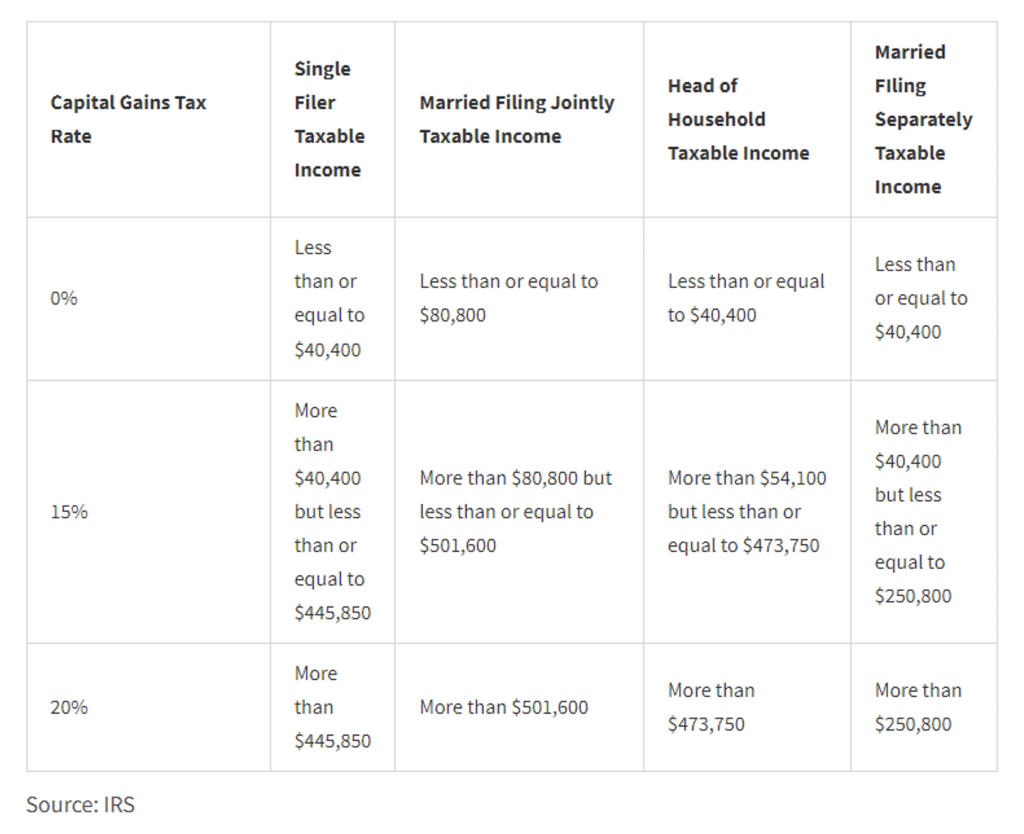

11 MMajor Tax Changes For 2022 Pearson Co CPAs

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.23.12-PM-1024x834.png

Earning Income Tax Credit Table

https://www.taxestalk.net/wp-content/uploads/earned-income-tax-credit-city-of-detroit-768x389.jpeg

Earned Income Credit Limitation Tax Reform Changes Ohio CPA

https://gbq.com/wp-content/uploads/2019/05/Qualifying-Children-Claimed-Chart-1024x407.jpg

Did you receive a letter from the IRS about the EITC Find out what to do Who Qualifies You may claim the EITC if your income is low to moderate The amount If you earned less than 63 698 if Married Filing Jointly or 56 838 if filing as an individual surviving spouse or Head of Household in tax year 2023 you may

For tax year 2021 New Jersey taxpayers could receive a refundable credit of up to 2 691 with qualifying dependents or 601 without dependents The maximum Nerdy takeaways The earned income credit is a refundable tax credit for low to middle income workers For tax returns filed in 2024 the tax credit ranges from

Earned Income Tax Credit EITC Who Qualifies

https://assets-global.website-files.com/600089199ba28edd49ed9587/63ab2cfeb6ed4e84980e9602_5Q05z7zzxkuPsQXDnaB9jShs6SVdcb0uB84DMBeLXFAIZJwwSAmHnQ4a7WbGqdLfxs9kSpNnGo8K3YMonR0wgBTu--Pgkhfuie7pFBG4XhGd3Kj-sMXIsb9rNoZWGXn0fc0IkJZa7T7C3Hhn3f492M_Gdep5jUnJluN29uavkjwe4XzK-GPA4B6nDNjE00CQKNhoDAt7LA.png

Earned Income Tax Credit Income Limits AND Q A YouTube

https://i.ytimg.com/vi/bTVjii0XK08/maxresdefault.jpg

https://www.eitc.irs.gov/eitc-central/income-limits-and-range-of-eitc

Income Limits and Amount of EITC for additional tax years See the earned income and adjusted gross income AGI limits maximum credit for the current year

https://www.nj.gov/treasury/taxation/pdf/eitcstatement.pdf

Claim and be allowed a 2023 federal Earned Income Tax Credit or be at least 18 years old and meet all the federal criteria for a credit except age limits Be a resident of this

Earned Income Tax Credit For Households With One Child 2023 Center

Earned Income Tax Credit EITC Who Qualifies

NJ Earned Income Tax Credit Could Climb As Part Of Deal To Hike Gas Tax

FAQ WA Tax Credit

What Is The Earned Income Tax Credit And Can You Qualify FleetStar

The Success Of The Earned Income Tax Credit Econofact

The Success Of The Earned Income Tax Credit Econofact

Tax Credit 2023 2023

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

T22 0250 Tax Benefit Of The Earned Income Tax Credit EITC Baseline

Nj Earned Income Tax Credit Income Limit - A working family making less than 53 057 59 187 if married and filling jointly in 2022 may qualify for the Earned Income Tax Credit EITC The EITC is a federal and state