Nj Homestead Rebate 2024 Application New Jersey s ANCHOR tax rebate program was a hallmark of the 2023 budget and the Department of the Treasury is already looking ahead to 2024 As of last month more than 1 638 million

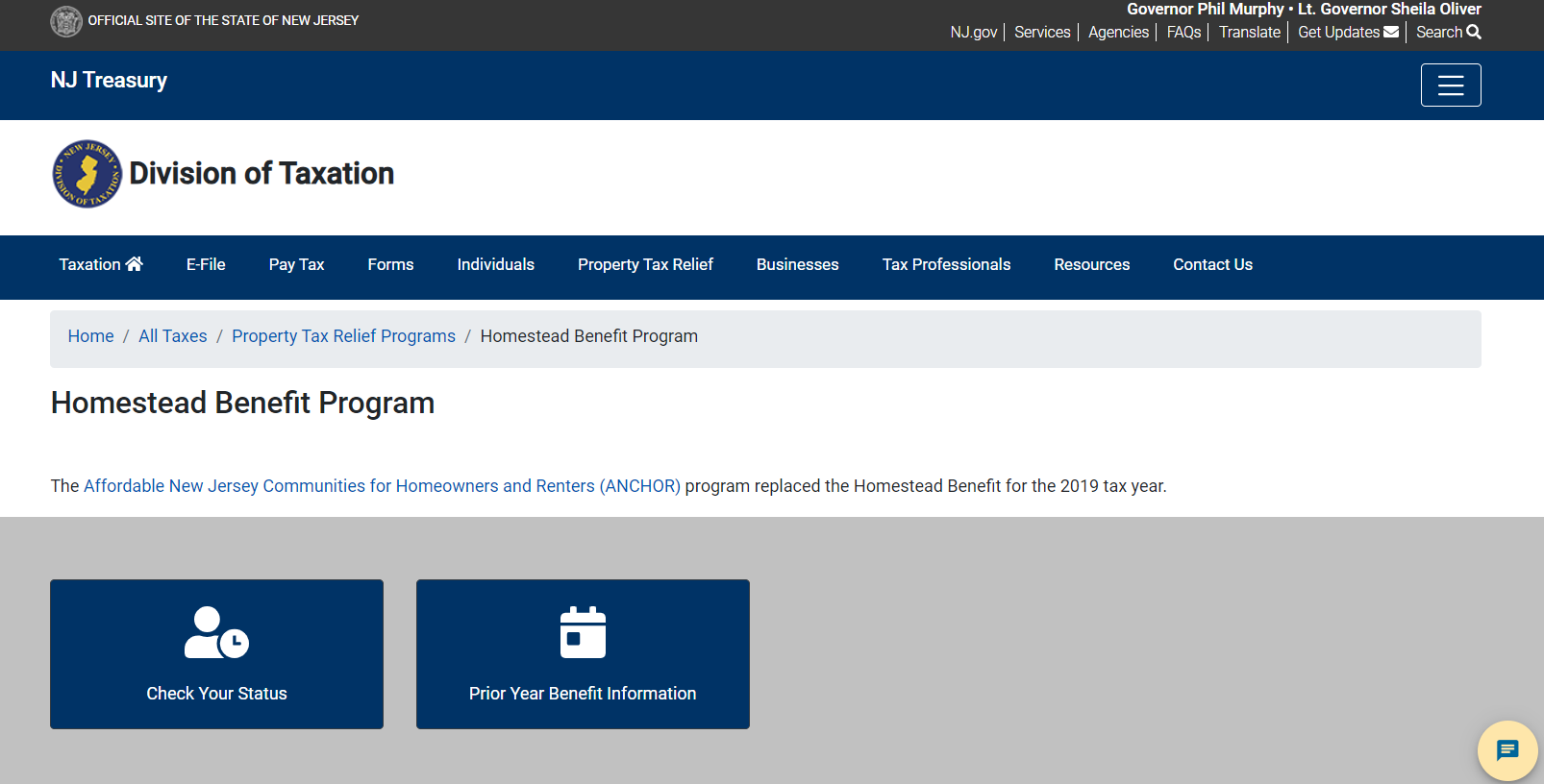

About the Stay NJ Property Tax Credit Program Governor Phil Murphy signed the Stay NJ Act P L 2023 CH 75 into law in July of 2023 authorizing the creation of the Stay NJ Task Force 2024 a report containing recommendations about how to restructure and consolidate the various property tax relief programs into one streamlined Your application is in processing we have no record of processing your application the date we issued a benefit including if it was applied to your property tax bill for tax year 2018 To use this service you will need your valid Social Security Number SSN Individual Taxpayer Identification Number ITIN and ZIP code

Nj Homestead Rebate 2024 Application

Nj Homestead Rebate 2024 Application

https://printablerebateform.net/wp-content/uploads/2023/02/New-Jersey-Renters-Rebate-2023.jpg

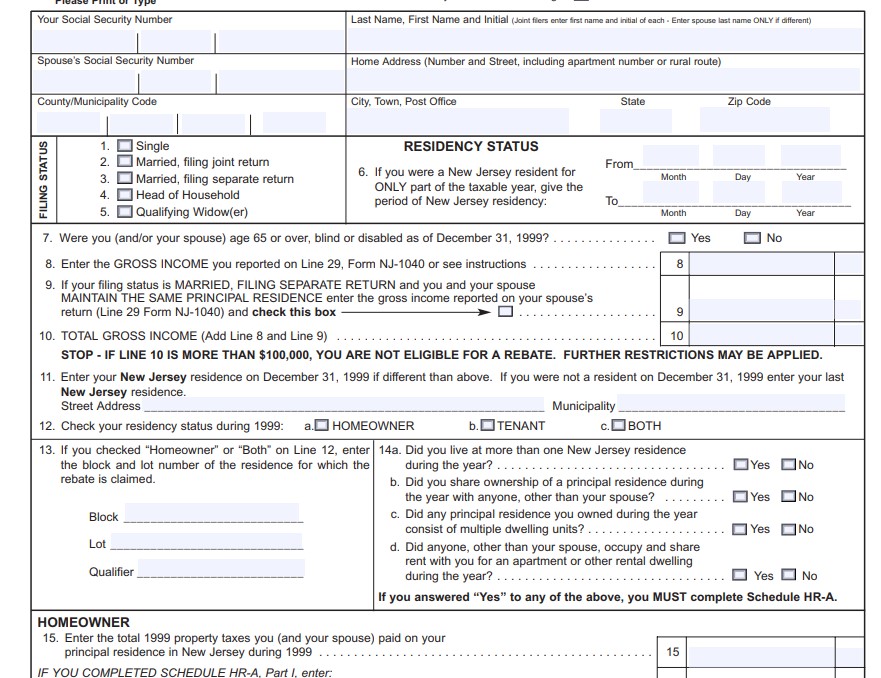

Nj Homestead Rebate 2022 Renters RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/property-tax-rebates-check-if-you-are-eligible-for-anchor-program-3.jpg

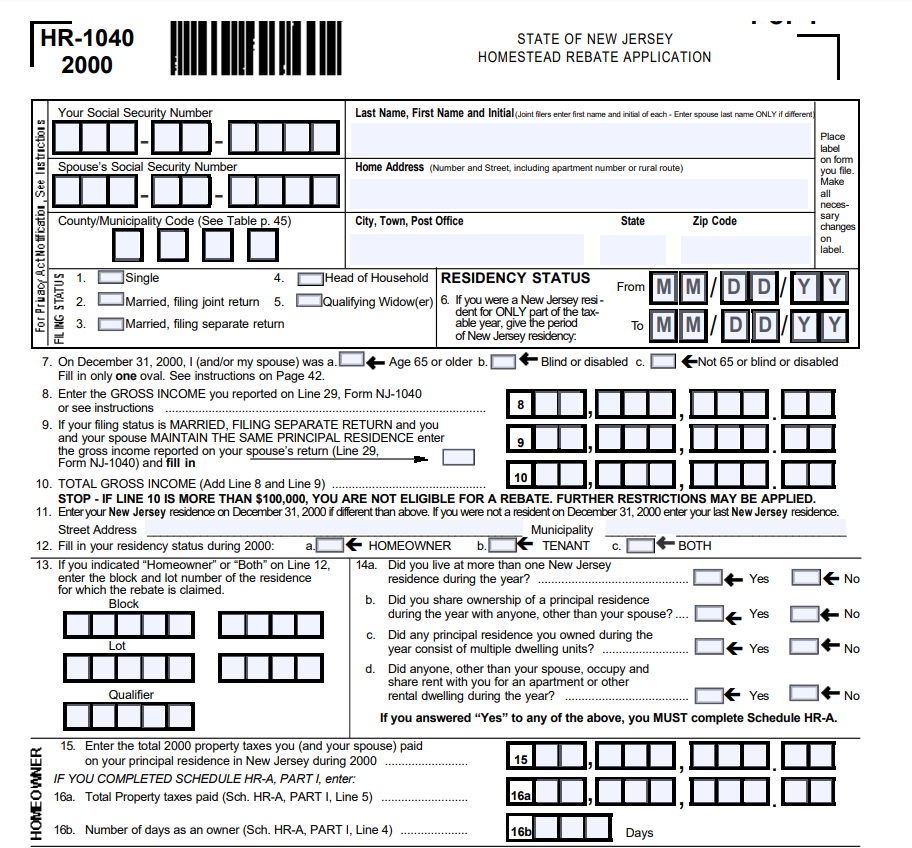

NJ Homestead Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/File-NJ-Homestead-Rebate-Form-Online.png

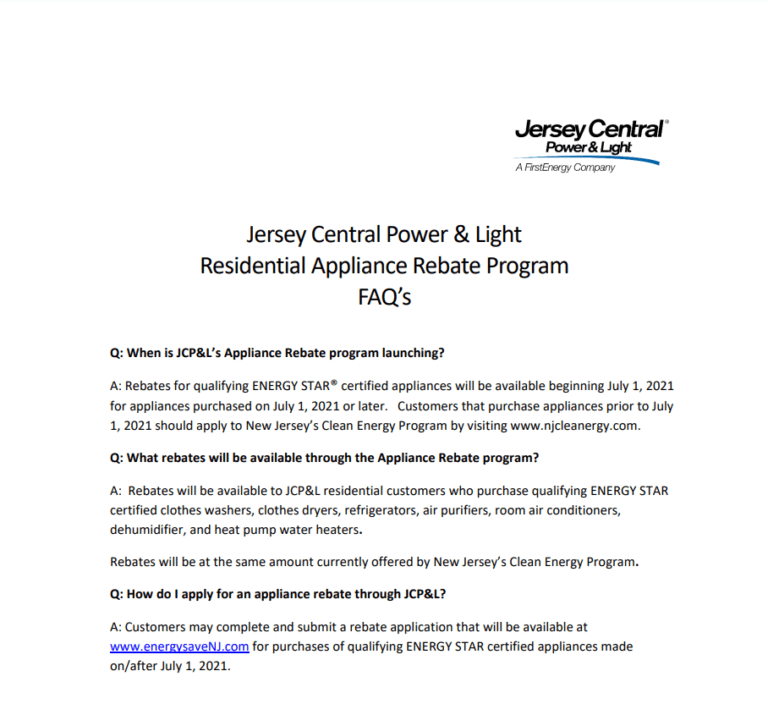

TRENTON Governor Phil Murphy signed the Fiscal Year 2024 Appropriations Act into Law on Friday building on the historic progress made over the last five years with new investments centered around increasing affordability promoting fiscal responsibility and creating world class opportunities for everyone to succeed Under the ANCHOR Property Tax Relief Program homeowners making up to 250 000 per year are eligible to receive an average 700 rebate in FY2023 to offset property tax costs lowering the effective average property tax cost back to 2016 levels for many households that were previously ineligible for property tax relief

The program is expected to have an average payout of 971 called ANCHOR short for the Affordable New Jersey Communities for Homeowners and Renters replaces the Homestead Rebate A key provision of the envisioned program is the funding of tax credits that would be used to cut property taxes in half for many homeowners ages 65 and older up to a maximum of 6 500 annually Right now senior homeowners making up to 500 000 annually would be eligible for the promised benefits

Download Nj Homestead Rebate 2024 Application

More picture related to Nj Homestead Rebate 2024 Application

What Happens To The Homestead Rebate And My Tax Return NJMoneyHelp

http://njmoneyhelp.com/wp-content/uploads/2019/03/Homestead-968x643.jpg

I Missed The Homestead Rebate Deadline What Now Nj PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/i-missed-the-homestead-rebate-deadline-what-now-nj.jpg?w=1280&ssl=1

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

https://www.nj.com/resizer/mG8HoEC03Z_laQKwr9yycp9fj8o=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/OCDIN5URIBBRVLQX5ZOGNBVHZI.jpg

If you own a home primary residence but were a temporary resident of an Assisted Living Facility ALF and did not change your primary domicile you are eligible to apply for the benefit on the home you owned on October 1 2020 as long as you meet all other program requirements Some 1 7 million NJ homeowners and renters applied for the Anchor property tax relief program The administration says it can reach more residents in 2024 New Jersey residents are just beginning to receive the first payments under the state s new Anchor property tax relief program but attention is already shifting to finding ways to improve

Under current law the program would fund direct credits that could cut property tax bills in half for homeowners ages 65 and older making up to 500 000 annually with a maximum planned annual credit of 6 500 The program will provide credits of up to 1 500 to taxpayers with 2019 gross incomes up to 150 000 and 1 000 for those with gross incomes between 150 000 and 250 000 Tenants also can

What Happened To My Homestead Rebate Nj

https://www.nj.com/resizer/lnFRLLMV-oHSml1s4d1b8o7uJnc=/800x0/smart/image.nj.com/home/njo-media/width600/img/business_impact/photo/old-man-3617304-1920jpg-452fcfe731a60d12.jpg

Do I Qualify For The Homestead Rebate Or The Senior Freeze Nj

https://www.nj.com/resizer/kcwBZVqWIdjRli1vdeiFYH-bjfA=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/MUCSCZHD3ZAV7A3WHFDQHKXNII.jpg

https://www.msn.com/en-us/money/realestate/this-is-who-can-qualify-for-nj-anchor-rebates-in-2024/ar-AA1emGXe

New Jersey s ANCHOR tax rebate program was a hallmark of the 2023 budget and the Department of the Treasury is already looking ahead to 2024 As of last month more than 1 638 million

https://www.nj.gov/treasury/staynj/

About the Stay NJ Property Tax Credit Program Governor Phil Murphy signed the Stay NJ Act P L 2023 CH 75 into law in July of 2023 authorizing the creation of the Stay NJ Task Force 2024 a report containing recommendations about how to restructure and consolidate the various property tax relief programs into one streamlined

File NJ Homestead Rebate Form Online PrintableRebateForm

What Happened To My Homestead Rebate Nj

Is The Homestead Rebate For Homeowners Running Late Nj

What Happens To The Homestead Rebate And My Tax Return NJMoneyHelp PropertyRebate

State Freezes Payments For Homestead Rebate Program Video NJ Spotlight News

When Will I Be Eligible For The Homestead Rebate Nj

When Will I Be Eligible For The Homestead Rebate Nj

Am I Entitled To The Homestead Rebate NJMoneyHelp

NJ Property Tax Relief Program Updates Access Wealth

NJ Homestead PrintableRebateForm

Nj Homestead Rebate 2024 Application - TRENTON Governor Phil Murphy signed the Fiscal Year 2024 Appropriations Act into Law on Friday building on the historic progress made over the last five years with new investments centered around increasing affordability promoting fiscal responsibility and creating world class opportunities for everyone to succeed