Nj Maximum Property Tax Deduction Most older homeowners would see their property tax bills cut in half with a maximum benefit of 6 500 The agreement still must be approved as part of a proposed 53 billion budget which is

The property tax deduction reduces your taxable income You can deduct your property taxes paid or 15 000 whichever is less For Tax Years 2017 and earlier the maximum Filing Topics Property Tax Deduction Credit Eligibility Answer Based on the information provided you are eligible to claim a property tax deduction or credit for Tax Year 2023

Nj Maximum Property Tax Deduction

Nj Maximum Property Tax Deduction

https://i.pinimg.com/originals/8e/f4/2c/8ef42c9ab3dffc9b087a7a496909a1de.png

NJ Property Taxes Have Been Rising At A Slower Pace NJ Spotlight News

https://www.njspotlightnews.org/wp-content/uploads/sites/123/2022/02/Property-tax-graph-pic--900x506.jpg

Do You Qualify For A Vehicle Sales Tax Deduction

https://www.toptaxdefenders.com/hs-fs/hubfs/Depositphotos_138271860_s-2019.jpg?width=1500&name=Depositphotos_138271860_s-2019.jpg

Residents of New Jersey that pay property tax on the home they own or rent may qualify for a refundable tax credit or a deduction on their return You may claim only one of the Many New Jersey homeowners are entitled to a rebate or credit that s a percentage of the first 10 000 in property tax that they paid last year The percentage depends on the

The SALT limitations limit the amount of state and local taxes that can be deducted to 10 000 per year 5 000 for those who file married filing separately This includes property taxes Despite the new name ANCHOR is really an expansion of the Homestead Benefit program which provides property tax relief to homeowners who earn up to 75 000 per year as well as seniors and

Download Nj Maximum Property Tax Deduction

More picture related to Nj Maximum Property Tax Deduction

Prepaying Property Taxes For A Larger Deduction NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2019/04/home-1349925_1920.jpg

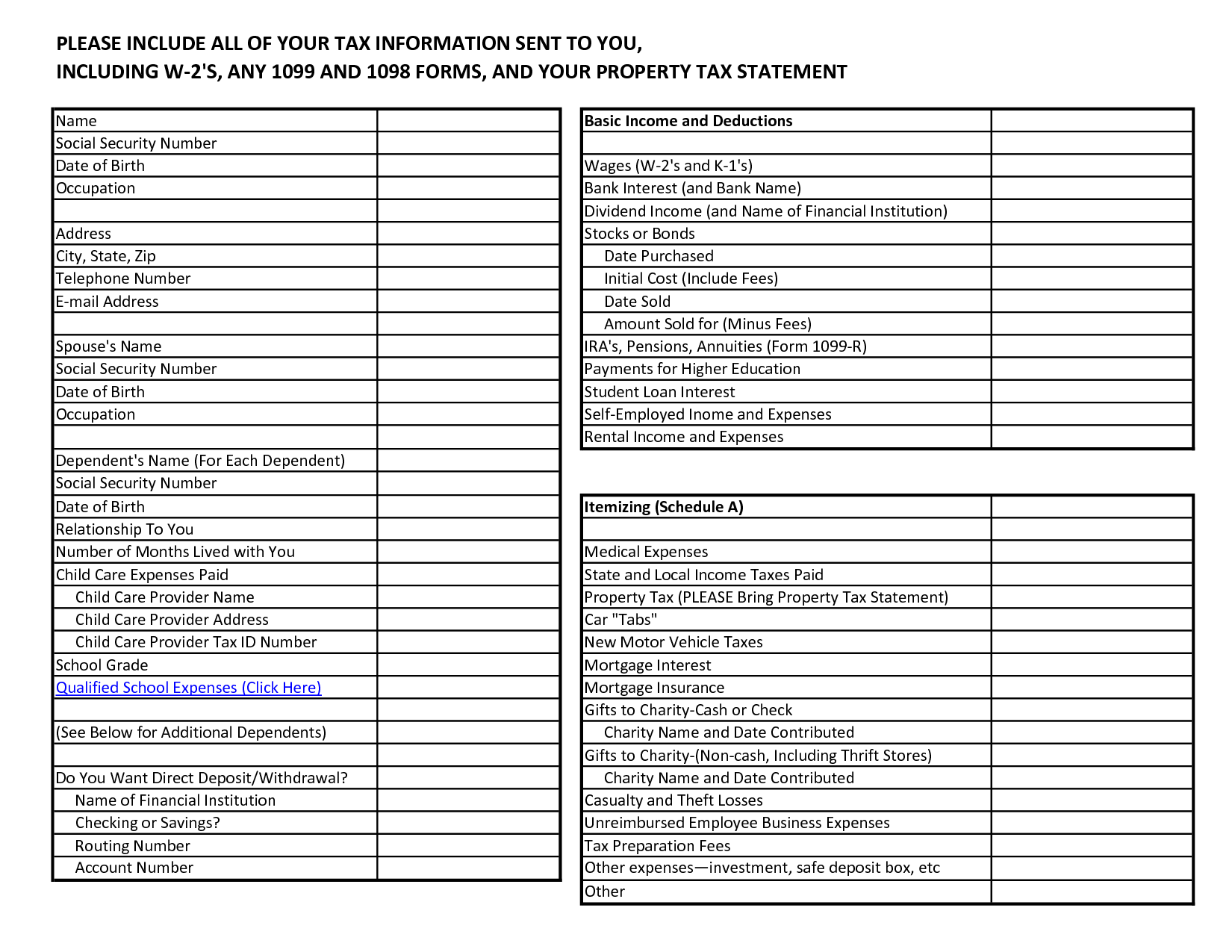

10 Home Based Business Tax Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/01/business-tax-deductions-worksheet_472298.png

About That Property Tax Deduction For Vets NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2017/08/kconnors-1024x685.jpg

While still subject to further changes the legislation scheduled for a vote by the end of the week would increase the amount allowed to be deducted up to 80 000 A key provision of the envisioned program is the funding of tax credits that would be used to cut property taxes in half for many homeowners ages 65 and older up

Property taxes are top of mind for many New Jersey homeowners The state has the highest property taxes in the nation with an average property tax bill of more than Spearheaded by Assembly Speaker Craig Coughlin the initiative called StayNJ will provide tax credits worth 50 of property tax bills up to 6 500 for

NJ Property Tax Deduction For Veterans Highlighted By Campaign

https://www.mycentraljersey.com/gcdn/presto/2020/11/11/PNJM/8156bda5-2d72-4fab-a635-9a9ffe2cbe94-111120_Paterson_VetsTZ_323.JPG?crop=3749,2109,x0,y191&width=3200&height=1801&format=pjpg&auto=webp

Property Tax Deduction When Filing Separate Returns NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2019/04/house-2483336_1920-768x537.jpg

https://www. nytimes.com /2023/06/21/nyre…

Most older homeowners would see their property tax bills cut in half with a maximum benefit of 6 500 The agreement still must be approved as part of a proposed 53 billion budget which is

https://www. nj.gov /treasury/taxation/njit35.shtml

The property tax deduction reduces your taxable income You can deduct your property taxes paid or 15 000 whichever is less For Tax Years 2017 and earlier the maximum

Tax Benefits On Home Loan Know More At Taxhelpdesk

NJ Property Tax Deduction For Veterans Highlighted By Campaign

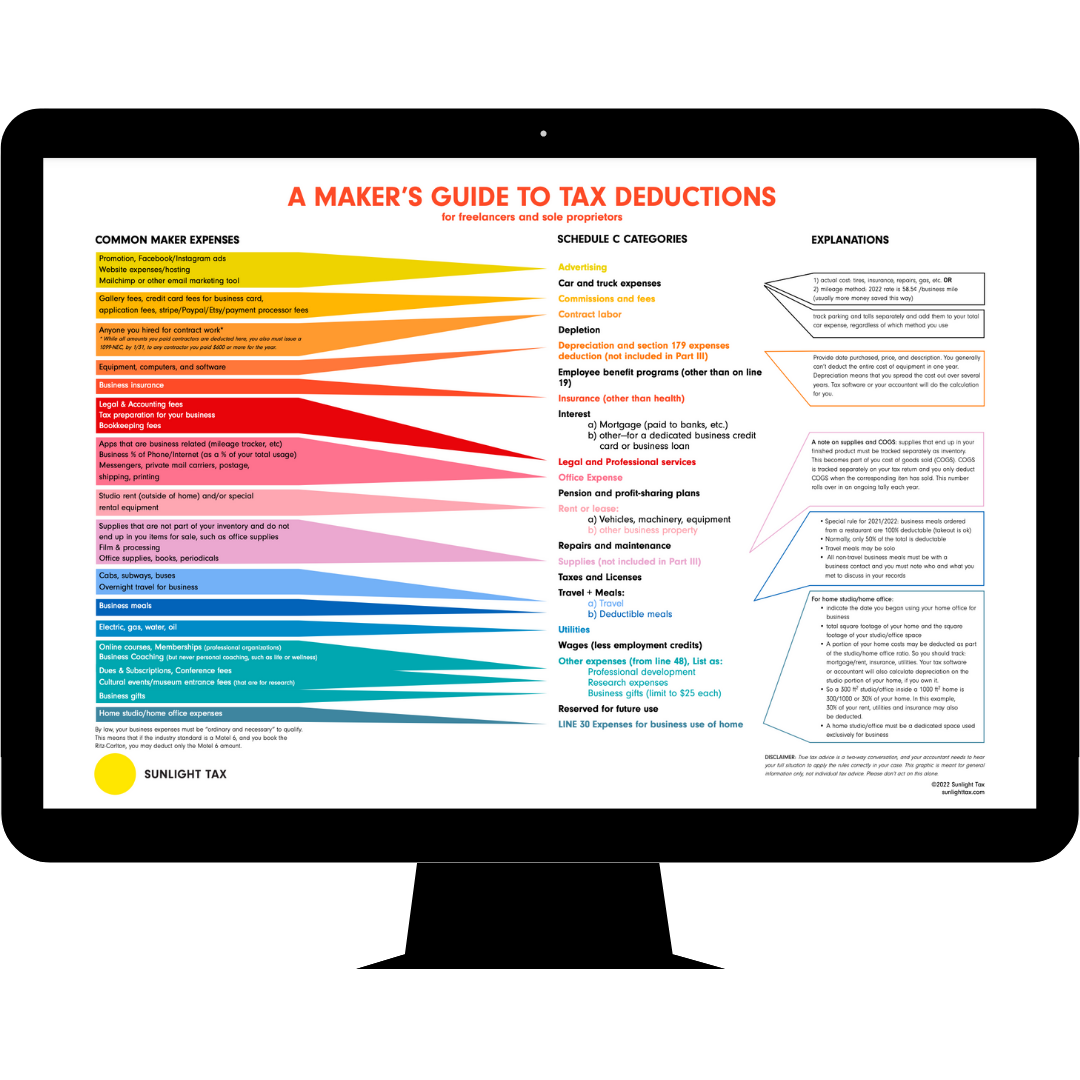

Tax Deduction Planner Graphic By Watercolortheme Creative Fabrica

House Poised To Restore Your Property Tax Deduction Nj

Tax Deductions Guide Sunlight Tax

Property Tax Deduction Exemption In Income Tax Paytm Blog

Property Tax Deduction Exemption In Income Tax Paytm Blog

How 2017 Property Tax Deductions Work NJMoneyHelp

Property Tax In Kakinada Online Payment Rates

Section 80C Deductions List To Save Income Tax FinCalC Blog

Nj Maximum Property Tax Deduction - Annual Property Tax Deduction for Senior Citizens Disabled Persons Annual deduction of up to 250 from property taxes for homeowners 65 or older or disabled who meet certain